Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do all cells, and show exact equations with cell numbers for each. look at both pictures provided is all one question D Question 3:

please do all cells, and show exact equations with cell numbers for each. look at both pictures provided is all one question

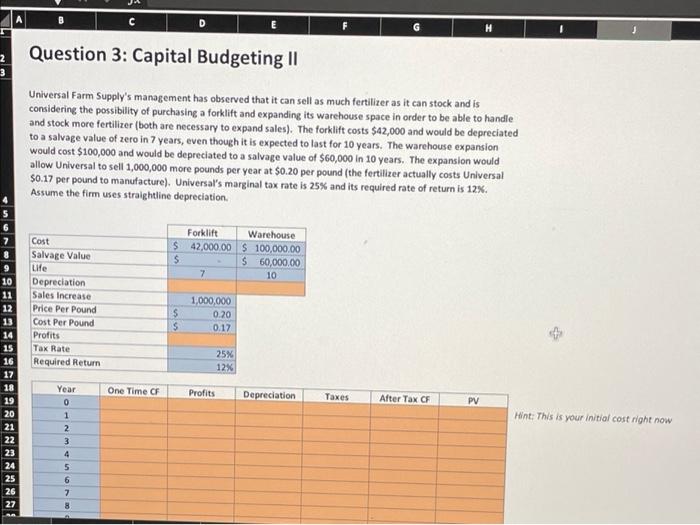

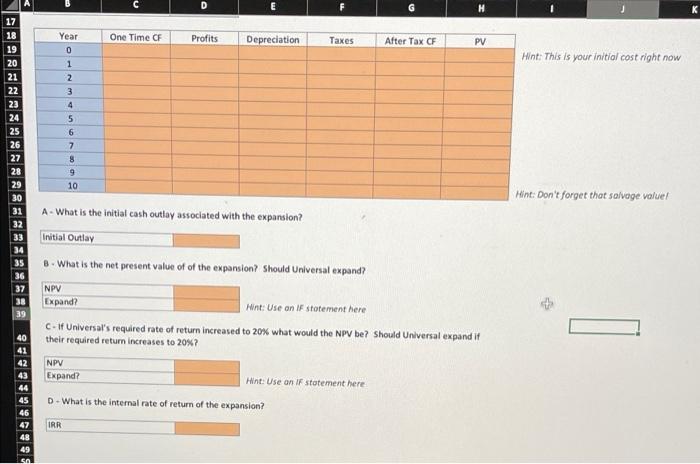

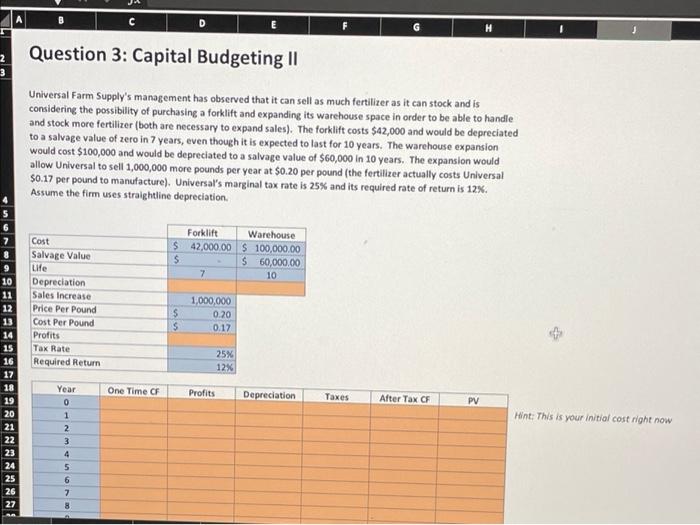

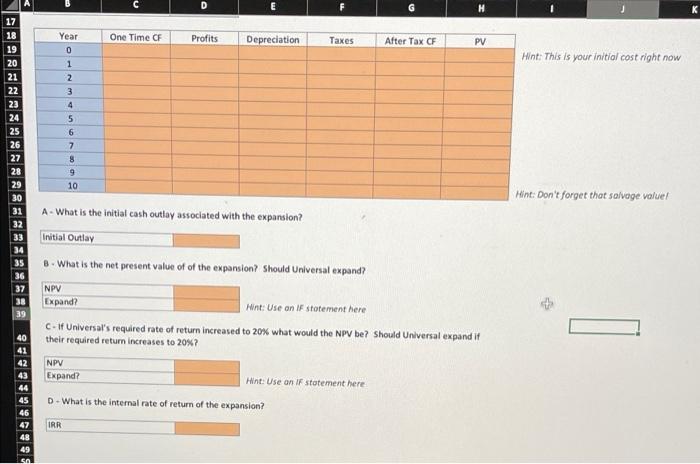

D Question 3: Capital Budgeting II 2 3 Universal Farm Supply's management has observed that it can sell as much fertilizer as it can stock and is considering the possibility of purchasing a forklift and expanding its warehouse space in order to be able to handle and stock more fertilizer (both are necessary to expand sales). The forklift costs $42,000 and would be depreciated to a salvage value of zero in 7 years, even though it is expected to last for 10 years. The warehouse expansion would cost $100,000 and would be depreciated to a salvage value of $60,000 in 10 years. The expansion would allow Universal to sell 1,000,000 more pounds per year at $0.20 per pound (the fertilizer actually costs Universal $0.17 per pound to manufacture). Universal's marginal tax rate is 25% and its required rate of return is 12%. Assume the firm uses straightline depreciation. S $ Forklift Warehouse 42,000.00 $ 100,000.00 $ 60,000.00 7 10 Cost Salvage Value Life Depreciation Sales Increase Price Per Pound Cost Per Pound Profits Tax Rate Required Return S $ 1,000,000 0.20 0.17 25% 12% 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 One Time CF Profits Depreciation Taxes After Tax CF PV Year 0 1 2 3 Hint: This is your initial cost right now 4 5 6 26 7 8 D 17 One Time CF Profits Depreciation Taxes After Tax CF PV Hint: This is your initial cost right now 18 19 20 21 22 23 24 25 26 27 28 29 30 Year 0 1 2 3 4 5 6 7 8 9 10 Hint: Don't forget that salvage value A- What is the initial cash outlay associated with the expansion? Initial Outlay 36 37 38 39 8. What is the net present value of of the expansion? Should Universal expand? NPV Expand? Hint: Use on I statement here C-If Universal's required rate of return increased to 20% what would the NPV be? Should Universal expand it their required return increases to 20%? 40 41 42 43 44 45 46 47 NPV Expand? Hint: Use an IF statement here D. What is the internal rate of return of the expansion? IRR sa

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started