please do all of the red and all 5 in the last picture

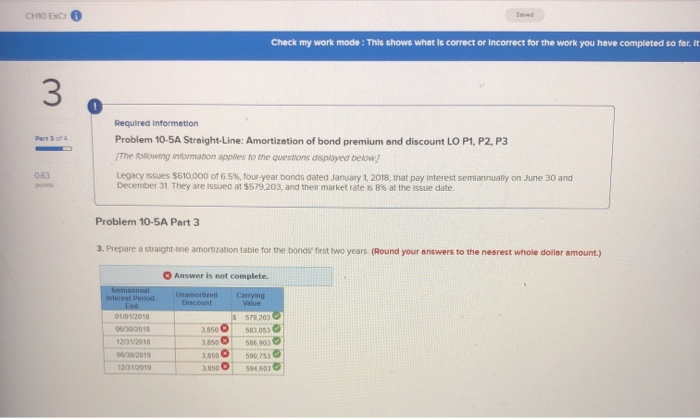

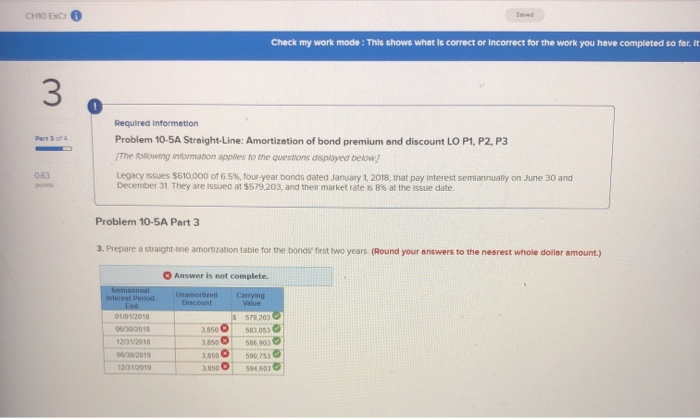

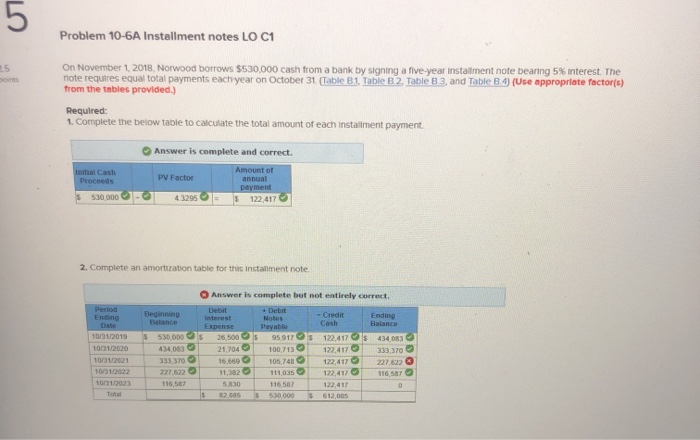

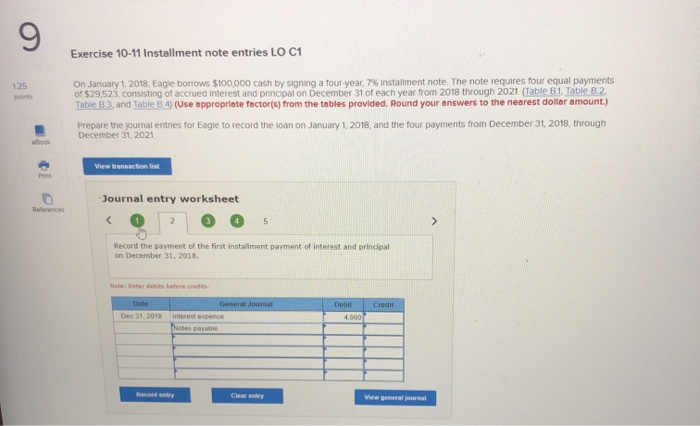

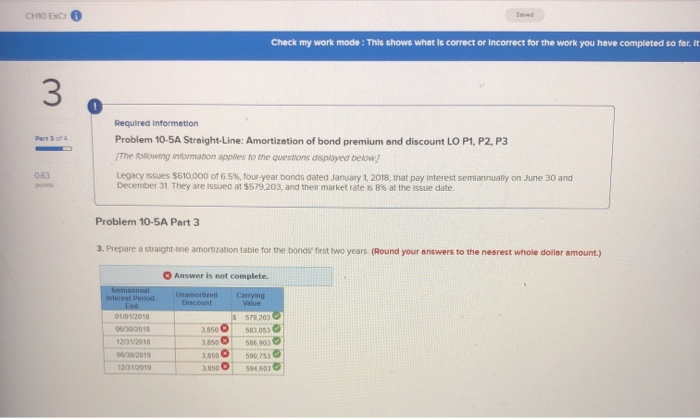

CHIO EXCO Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It Part 4 Required Information Problem 10-5A Straight-Line: Amortization of bond premium and discount LO P1, P2, P3 The following information applies to the questions displayed below] Legacy issues 5610,000 of 6.5%, four-year bonds dated January 1, 2018, that pay interest semiannually on June 30 and December 31 They are issued at $579,203 and their market rates at the issue date. 0.53 Problem 10-5A Part 3 3. Prepare a straight-une amortization table for the bonds first two years. (Round your answers to the nearest whole dollar amount.) Answer is not complete. Un mond Interest Period Carrying $ 579203 DU01/2018 01/2018 12/31/2018 05 2019 27/11/2010 586 901 Problem 10-6A Installment notes LO C1 On November 1, 2018 Norwood borrows $530,000 cash from a bank by signing a five-year installment note bearing 5% interest. The note requires equal total payments each year on October 31 (Table B.1. Table B2 Table B3, and Table B(Use appropriate factor(s) from the tables provided) Required: 1. Complete the below table to calculate the total amount of each installment payment Answer is complete and correct. Initial Cash Proceeds PV Factor $ 530 000 - 43295 $ 122,417 2. Complete an amortization table for this installment note Answer is complete but not entirely correct Period Ending Beginning + Debit Notes Interest - Credit $ 's $ 26,500 21.104 122.4175 122,417 434 083 383 370 10312019 10/31/2020 10312021 1012022 530.000 4340 333 370 221 622 116,587 16.669 95 917 100713 10574 111035 116.587 10000 116 587 11,382 5330 2005 S Exercise 10-11 Installment note entries LO C1 125 On January 1, 2018, Eagle borrows $100,000 cash by signing a four-year, 7% installment note. The note requires four equal payments of $29,523, consisting of accrued interest and principal on December 31 of each year from 2018 through 2021 (Table B1, Table B2 Table B 3, and Table 8.4) (Use appropriate factor(s) from the tables provided. Round your answers to the nearest dollar amount.) Prepare the journal entries for Eagle to record the loan on January 1, 2018, and the four payments from December 31, 2018, through December 31, 2021 View transaction list Roces Journal entry worksheet 2 * * Record the payment of the first installment payment of interest and principal on December 31, 2018. No t balore credits Date Debit Dec 31, 2018 interest expen Record entry Clearly View general ournal