Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do all parts and neat easy to read. will upvote Exercise 14-8 (Static) Investor; straight-line method [LO14-2] Universal Foods issued 10% bonds, dated January

please do all parts and neat easy to read. will upvote

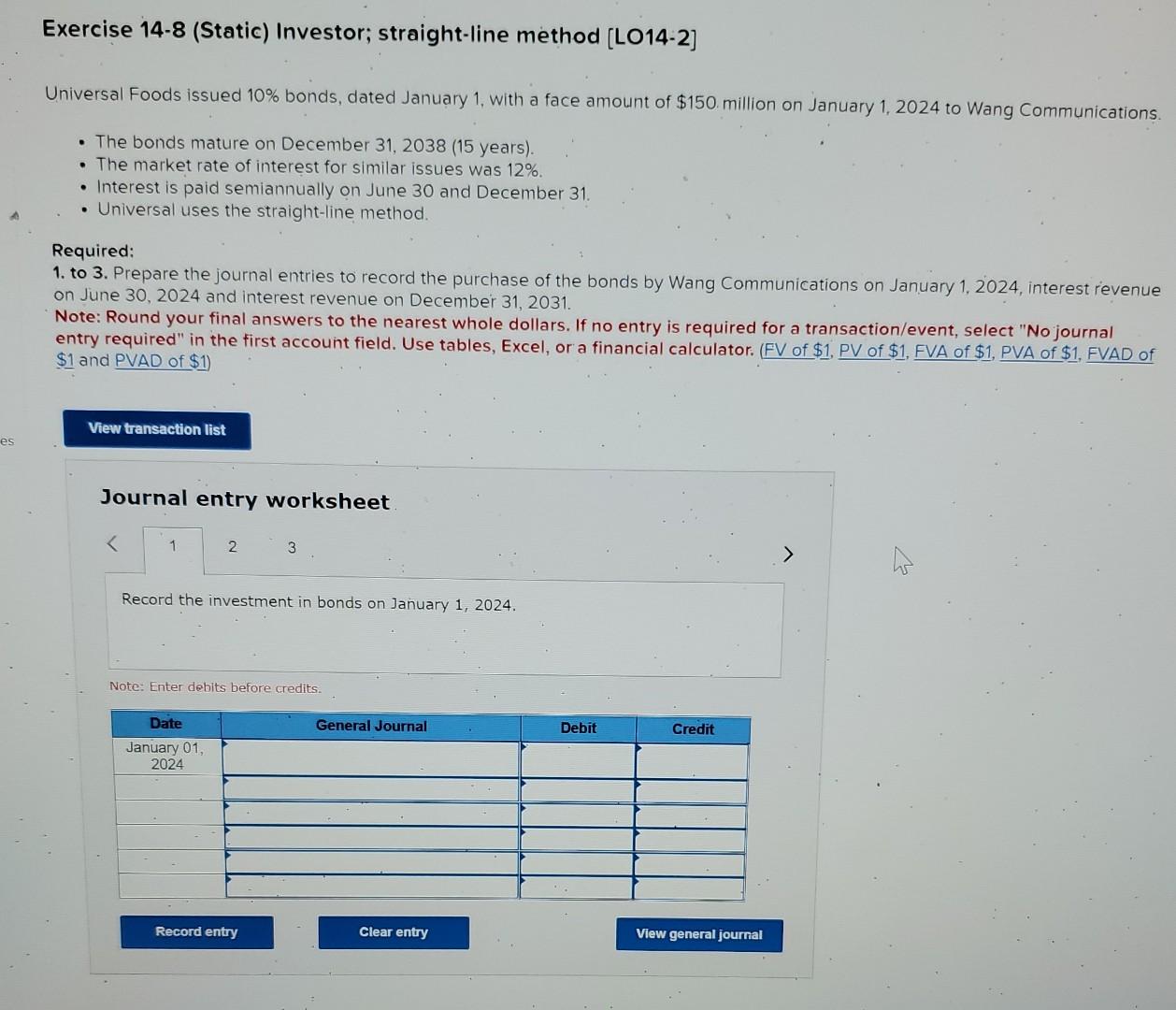

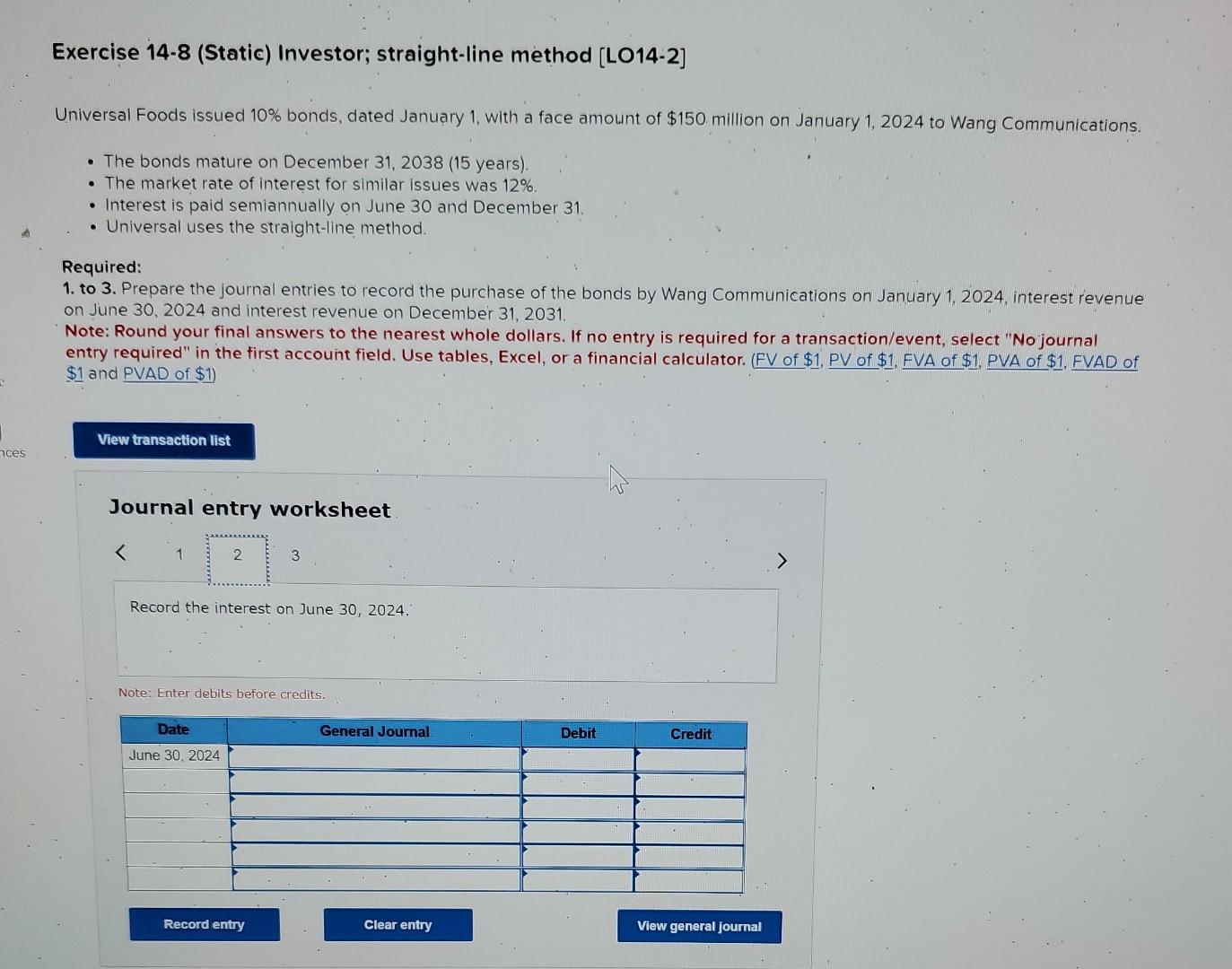

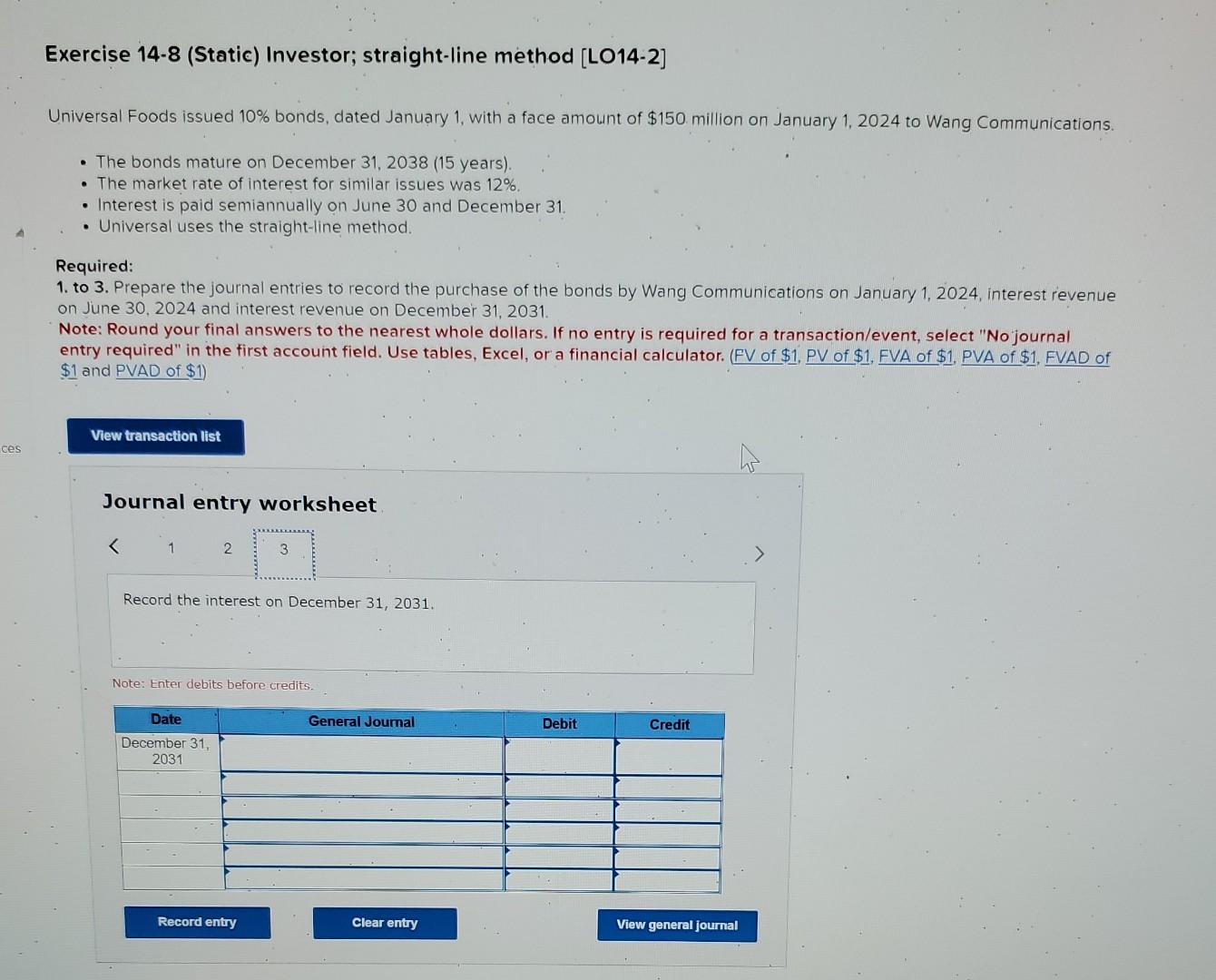

Exercise 14-8 (Static) Investor; straight-line method [LO14-2] Universal Foods issued 10% bonds, dated January 1, with a face amount of $150 million on January 1,2024 to Wang Communications. - The bonds mature on December 31, 2038 (15 years). - The market rate of interest for similar issues was 12%. - Interest is paid semiannually on June 30 and December 31. - Universal uses the straight-line method. Required: 1. to 3. Prepare the journal entries to record the purchase of the bonds by Wang Communications on January 1,2024 , interest revenue on June 30, 2024 and interest revenue on December 31, 2031. Note: Round your final answers to the nearest whole dollars. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Use tables, Excel, or a financial calculator. (FV of \$1, PV of $1, FVA of \$1, PVA of \$1, FVAD of $1 and PVAD of \$1) Journal entry worksheet 3 Record the investment in bonds on January 1,2024. Note: Enter debits before credits. Exercise 14-8 (Static) Investor; straight-line method [LO14-2] Universal Foods issued 10% bonds, dated January 1, with a face amount of $150 million on January 1,2024 to Wang Communications. - The bonds mature on December 31, 2038 (15 years). - The market rate of interest for similar issues was 12%. - Interest is paid semiannually on June 30 and December 31 . - Universal uses the straight-line method. Required: 1. to 3. Prepare the journal entries to record the purchase of the bonds by Wang Communications on January 1,2024 , interest revenue on June 30,2024 and interest revenue on December 31,2031. Note: Round your final answers to the nearest whole dollars. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Use tables, Excel, or a financial calculator. (FV of $1,PV of $1,FVA of $1,PVA of $1, FVAD of $1 and PVAD of $1 ) Journal entry worksheet Exercise 148 (Static) Investor; straight-line method [LO14-2] Universal Foods issued 10% bonds, dated January 1, with a face amount of $150 million on January 1,2024 to Wang Communications. - The bonds mature on December 31,2038 (15 years). - The market rate of interest for similar issues was 12%. - Interest is paid semiannually on June 30 and December 31 . - Universal uses the straight-line method. Required: 1. to 3. Prepare the journal entries to record the purchase of the bonds by Wang Communications on January 1,2024 , interest revenue on June 30, 2024 and interest revenue on December 31, 2031. Note: Round your final answers to the nearest whole dollars. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Use tables, Excel, or a financial calculator. (FV of $1,PV of $1, FVA of $1,PVA of $1, FVAD of $1 and PVAD of $1 ) Journal entry worksheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started