Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do all parts in 25 minutes please urgently and give only final answer no need to explain... I'll give you up thumb definitely Question

please do all parts in 25 minutes please urgently and give only final answer no need to explain... I'll give you up thumb definitely

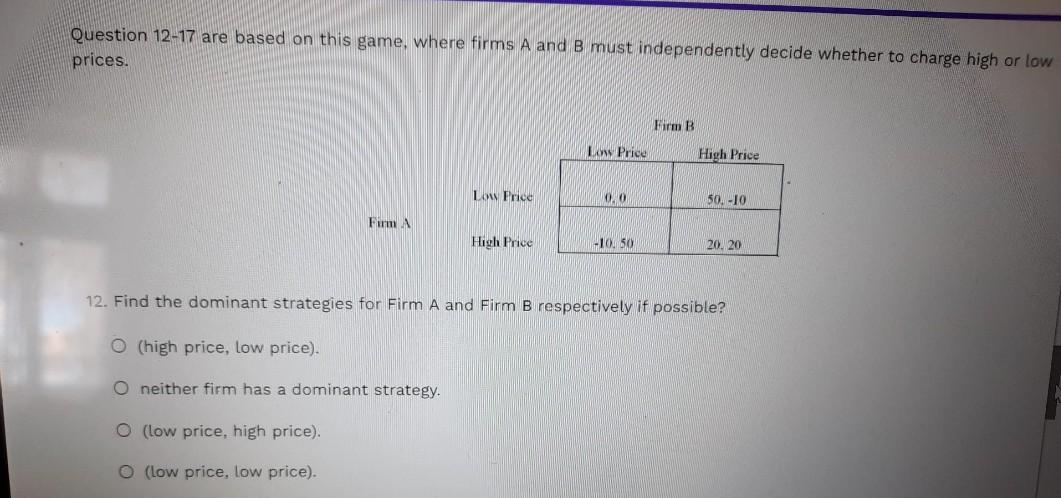

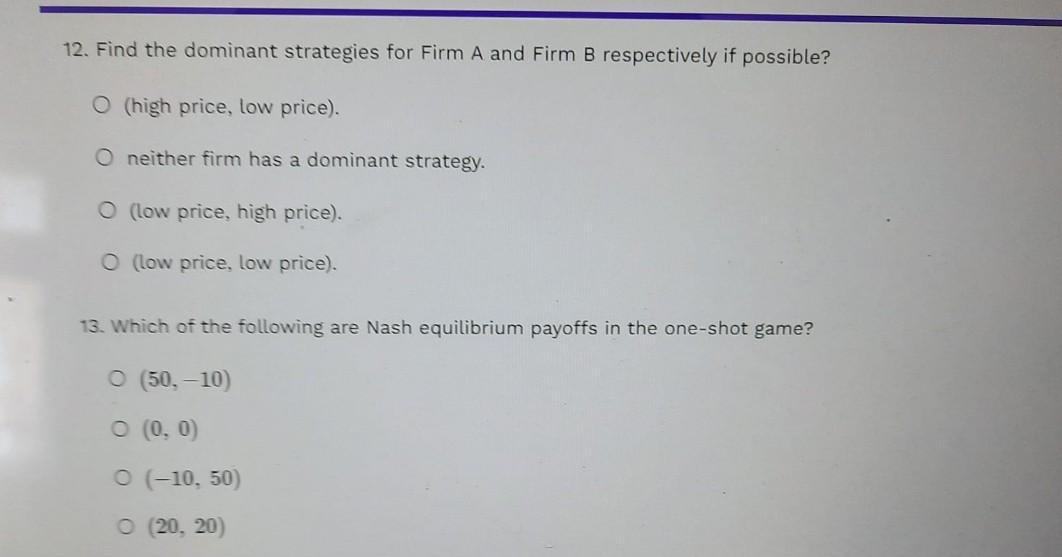

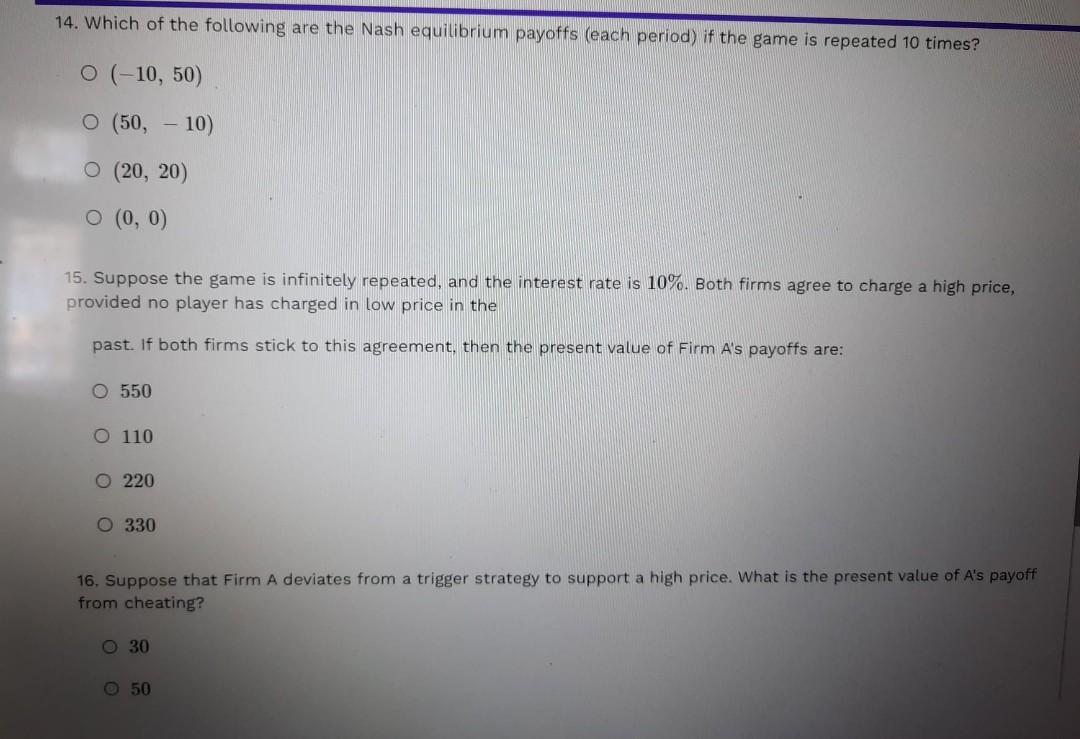

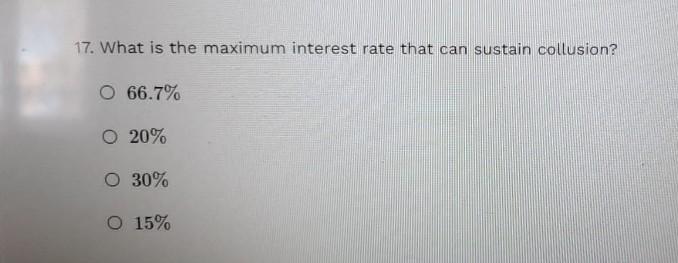

Question 12-17 are based on this game, where firms A and B must independently decide whether to charge high or low prices. Farm B L Price High Price Low Price 00 50.-10 Firm High Price -1050 20.20 12. Find the dominant strategies for Firm A and Firm B respectively if possible? (high price, low price). neither firm has a dominant strategy. O (low price, high price). 0 (low price, low price). 12. Find the dominant strategies for Firm A and Firm B respectively if possible? (high price, low price). O neither firm has a dominant strategy. (low price, high price). (low price, low price). 13. Which of the following are Nash equilibrium payoffs in the one-shot game? O (50,-10 O (0,0) O (-10, 50) O (20, 20) 14. Which of the following are the Nash equilibrium payoffs (each period) if the game is repeated 10 times? O (-10, 50) O (50, 10) - O (20, 20) O (0,0) 15. Suppose the game is infinitely repeated, and the interest rate is 10%. Both firms agree to charge a high price, provided no player has charged in low price in the past. If both firms stick to this agreement, then the present value of Firm A's payoffs are: O 550 O 110 O 220 O 330 16. Suppose that Firm A deviates from a trigger strategy to support a high price. What is the present value of A's payoff from cheating? 30 50 17. What is the maximum interest rate that can sustain collusion? O 66.7% O 20% O 30% O 15% Question 12-17 are based on this game, where firms A and B must independently decide whether to charge high or low prices. Farm B L Price High Price Low Price 00 50.-10 Firm High Price -1050 20.20 12. Find the dominant strategies for Firm A and Firm B respectively if possible? (high price, low price). neither firm has a dominant strategy. O (low price, high price). 0 (low price, low price). 12. Find the dominant strategies for Firm A and Firm B respectively if possible? (high price, low price). O neither firm has a dominant strategy. (low price, high price). (low price, low price). 13. Which of the following are Nash equilibrium payoffs in the one-shot game? O (50,-10 O (0,0) O (-10, 50) O (20, 20) 14. Which of the following are the Nash equilibrium payoffs (each period) if the game is repeated 10 times? O (-10, 50) O (50, 10) - O (20, 20) O (0,0) 15. Suppose the game is infinitely repeated, and the interest rate is 10%. Both firms agree to charge a high price, provided no player has charged in low price in the past. If both firms stick to this agreement, then the present value of Firm A's payoffs are: O 550 O 110 O 220 O 330 16. Suppose that Firm A deviates from a trigger strategy to support a high price. What is the present value of A's payoff from cheating? 30 50 17. What is the maximum interest rate that can sustain collusion? O 66.7% O 20% O 30% O 15%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started