Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do all parts in 3 hours please urgently... I'll give you up thumb definitely Use the scenario below to answer Questions 3 and 4.

please do all parts in 3 hours please urgently... I'll give you up thumb definitely

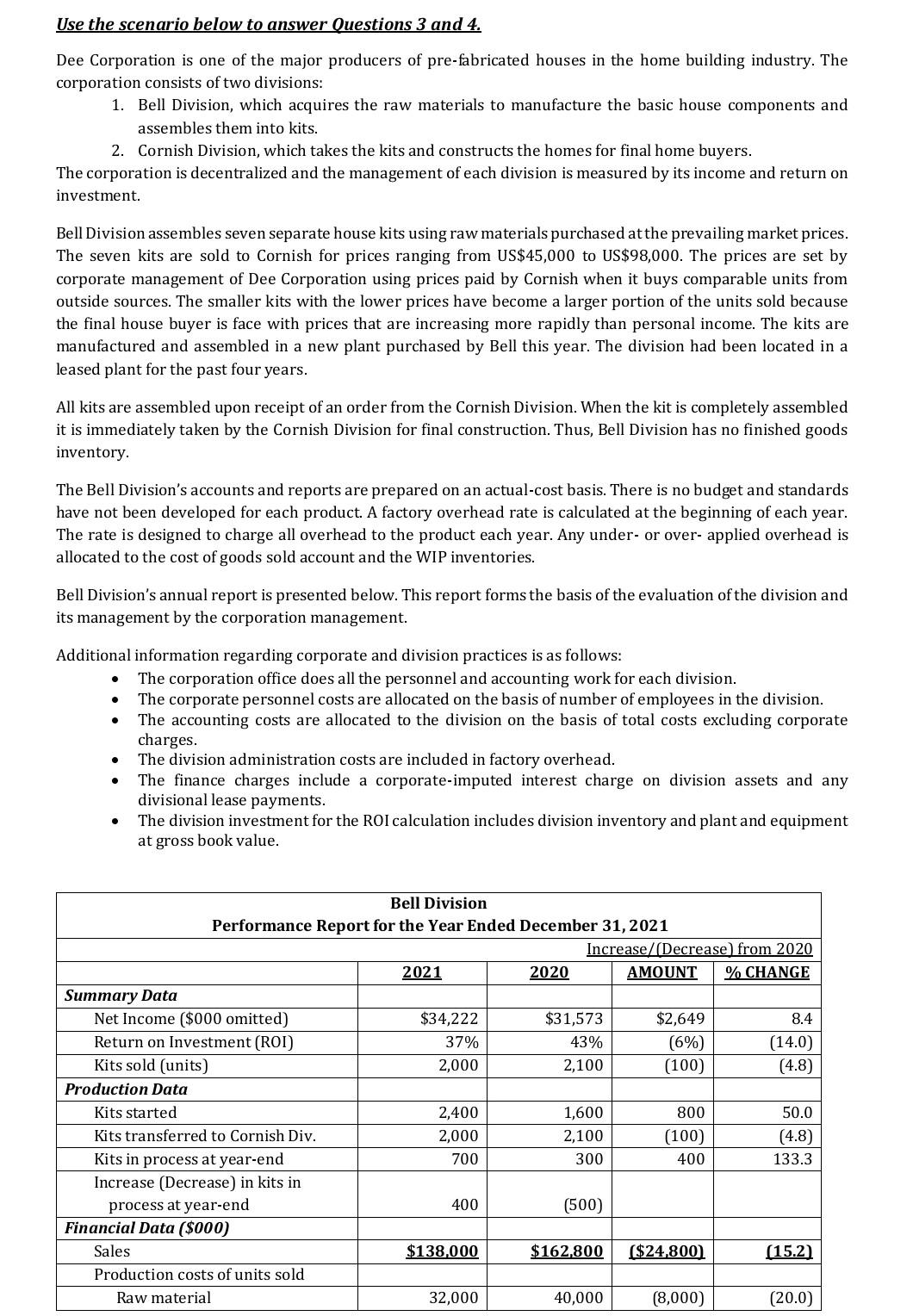

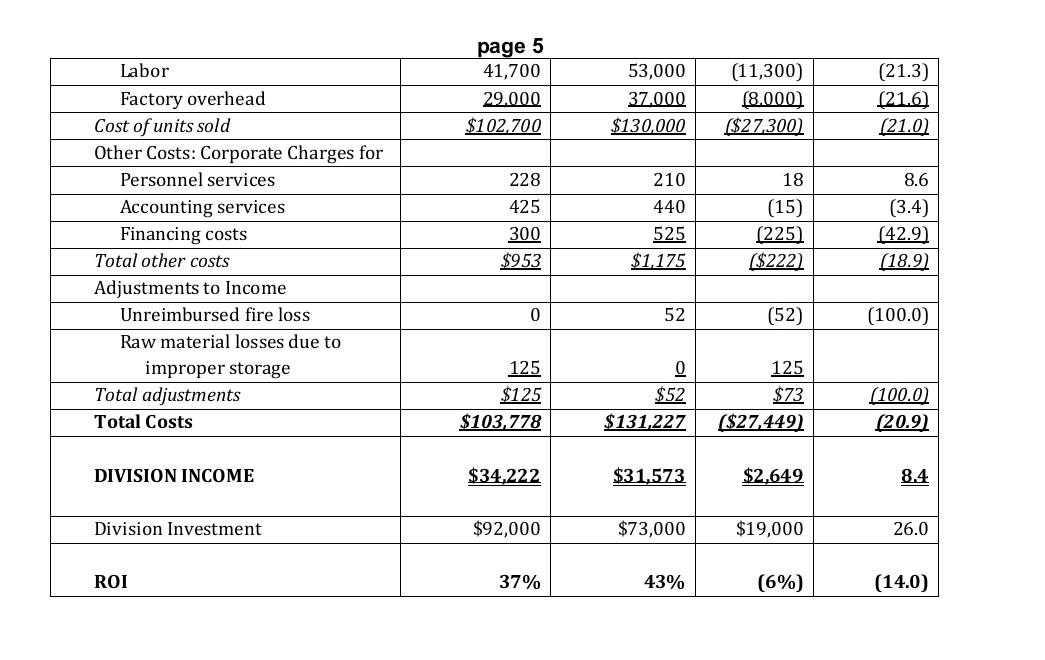

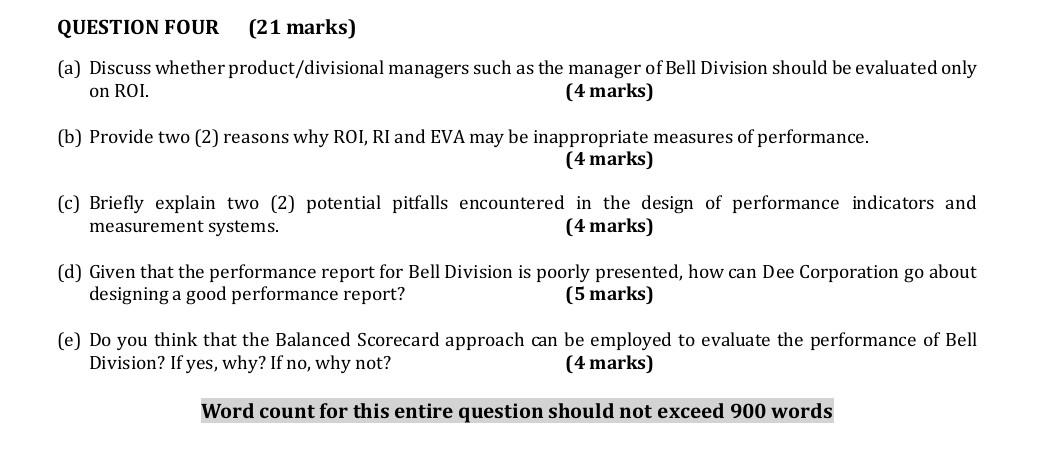

Use the scenario below to answer Questions 3 and 4. Dee Corporation is one of the major producers of pre-fabricated houses in the home building industry. The corporation consists of two divisions: 1. Bell Division, which acquires the raw materials to manufacture the basic house components and assembles them into kits. 2. Cornish Division, which takes the kits and constructs the homes for final home buyers. The corporation is decentralized and the management of each division is measured by its income and return on investment. Bell Division assembles seven separate house kits using raw materials purchased at the prevailing market prices. The seven kits are sold to Cornish for prices ranging from US$45,000 to US$98,000. The prices are set by corporate management of Dee Corporation using prices paid by Cornish when it buys comparable units from outside sources. The smaller kits with the lower prices have become a larger portion of the units sold because the final house buyer is face with prices that are increasing more rapidly than personal income. The kits are manufactured and assembled in a new plant purchased by Bell this year. The division had been located in a leased plant for the past four years. All kits are assembled upon receipt of an order from the Cornish Division. When the kit is completely assembled it is immediately taken by the Cornish Division for final construction. Thus, Bell Division has no finished goods inventory. The Bell Division's accounts and reports are prepared on an actual-cost basis. There is no budget and standards have not been developed for each product. A factory overhead rate is calculated at the beginning of each year. The rate is designed to charge all overhead to the product each year. Any under- or over- applied overhead is allocated to the cost of goods sold account and the WIP inventories. Bell Division's annual report is presented below. This report forms the basis of the evaluation of the division and its management by the corporation management. Additional information regarding corporate and division practices is as follows: The corporation office does all the personnel and accounting work for each division. The corporate personnel costs are allocated on the basis of number of employees in the division. The accounting costs are allocated to the division on the basis of total costs excluding corporate charges. The division administration costs are included in factory overhead. The finance charges include a corporate-imputed interest charge on division assets and any divisional lease payments. The division investment for the ROI calculation includes division inventory and plant and equipment at gross book value. . . 37% Bell Division Performance Report for the Year Ended December 31, 2021 Increase/Decrease from 2020 2021 2020 AMOUNT % CHANGE Summary Data Net Income ($000 omitted) $34,222 $31,573 $2,649 8.4 Return on Investment (ROI) 43% (6%) (14.0) Kits sold (units) 2,000 2,100 (100) (4.8) Production Data Kits started 2,400 1,600 800 50.0 Kits transferred to Cornish Div. 2,000 2,100 (100) (4.8) Kits in process at year-end 700 300 400 133.3 Increase (Decrease) in kits in process at year-end 400 (500) Financial Data ($000) Sales $138.000 $162,800 ($24,800) (15.2 Production costs of units sold Raw material 32,000 40,000 (8,000) (20.0) page 5 41,700 29.000 $102.700 53,000 37.000 $130,000 (11,300) (8.000) ($27,300) (21.3) (21.6) (21.0) Labor Factory overhead Cost of units sold Other Costs: Corporate Charges for Personnel services Accounting services Financing costs Total other costs Adjustments to Income Unreimbursed fire loss Raw material losses due to improper storage Total adjustments Total Costs 228 425 300 $953 210 440 525 $1,175 18 (15) (225) ($222) 8.6 (3.4) (42.9 (18.9 0 52 (52) (100.0) 125 $125 $103,778 0 $52 $131,227 125 $73 ($27,449) (100.0 (20.9) DIVISION INCOME $34,222 $31.573 $2,649 8.4 Division Investment $92,000 $73,000 $19,000 26.0 ROI 37% 43% (6%) (14.0) QUESTION FOUR (21 marks) (a) Discuss whether product/divisional managers such as the manager of Bell Division should be evaluated only on ROI. (4 marks) (b) Provide two (2) reasons why ROI, RI and EVA may be inappropriate measures of performance. (4 marks) (c) Briefly explain two (2) potential pitfalls encountered in the design of performance indicators and measurement systems. (4 marks) (d) Given that the performance report for Bell Division is poorly presented, how can Dee Corporation go about designing a good performance report? (5 marks) (e) Do you think that the Balanced Scorecard approach can be employed to evaluate the performance of Bell Division? If yes, why? If no, why not? (4 marks) Word count for this entire question should not exceed 900 wordsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started