Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do all parts in 50 minutes please urgently... I'll give you up thumb definitely Question 3: AMF Ltd is to be incorporated on 1st

please do all parts in 50 minutes please urgently... I'll give you up thumb definitely

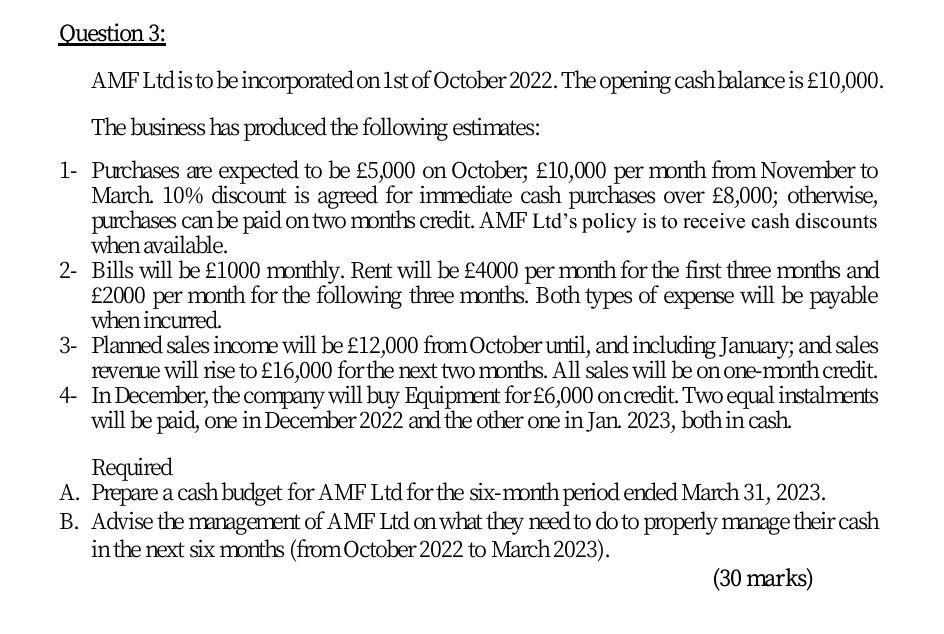

Question 3: AMF Ltd is to be incorporated on 1st of October 2022. The opening cash balance is 10,000. The business has produced the following estimates: 1- Purchases are expected to be 5,000 on October, 10,000 per month from November to March 10% discount is agreed for immediate cash purchases over 8,000; otherwise, purchases can be paid on two months credit. AMF Ltd's policy is to receive cash discounts when available. 2- Bills will be 1000 monthly. Rent will be 4000 per month for the first three months and 2000 per month for the following three months. Both types of expense will be payable when incurred. 3- Planned sales income will be 12,000 from October until, and including January; and sales revenue will rise to 16,000 for the next two months. All sales will be on one-month credit. 4- In December, the company will buy Equipment for6,000 on credit. Two equal instalments will be paid, one in December 2022 and the other one in Jan. 2023, both in cash. Required A. Prepare a cash budget for AMF Ltd for the six-month period ended March 31, 2023. B. Advise the management of AMF Ltd on what they need to do to properly manage their cash in the next six months (from October 2022 to March 2023). (30 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started