Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do all parts . Thankyou Prepare entries to record the following non-strategic investment transactions of Arrowhead Investment Corporation. (If no entry is required for

please do all parts . Thankyou

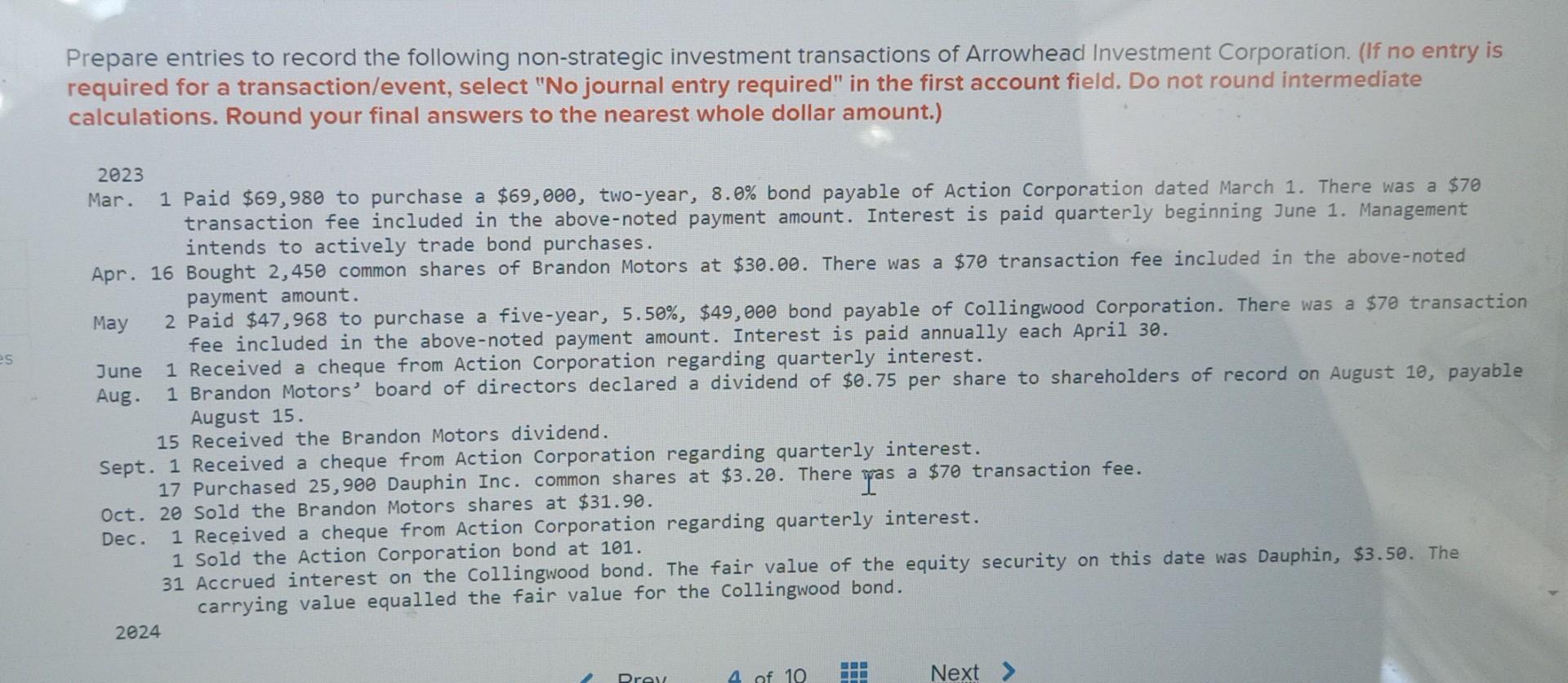

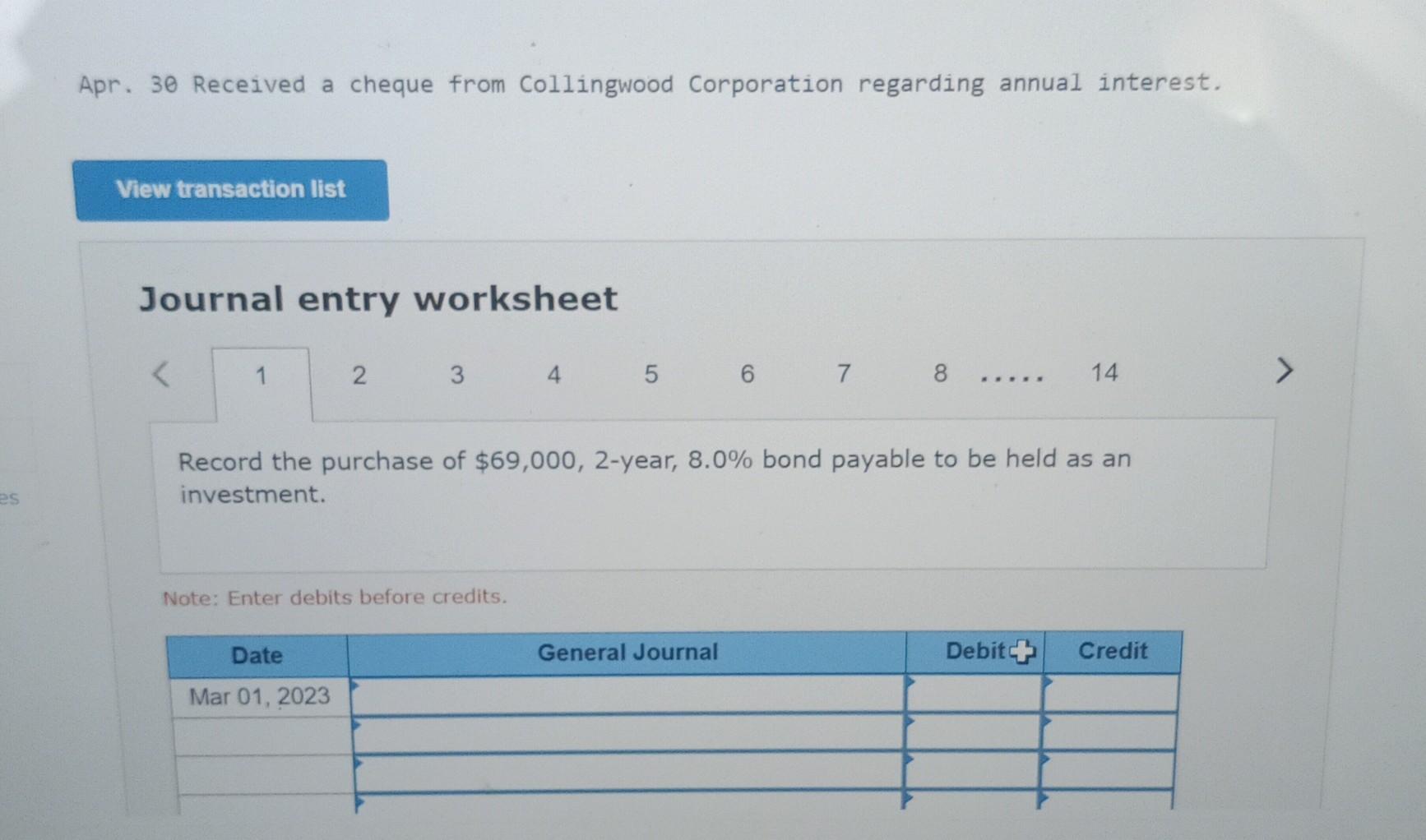

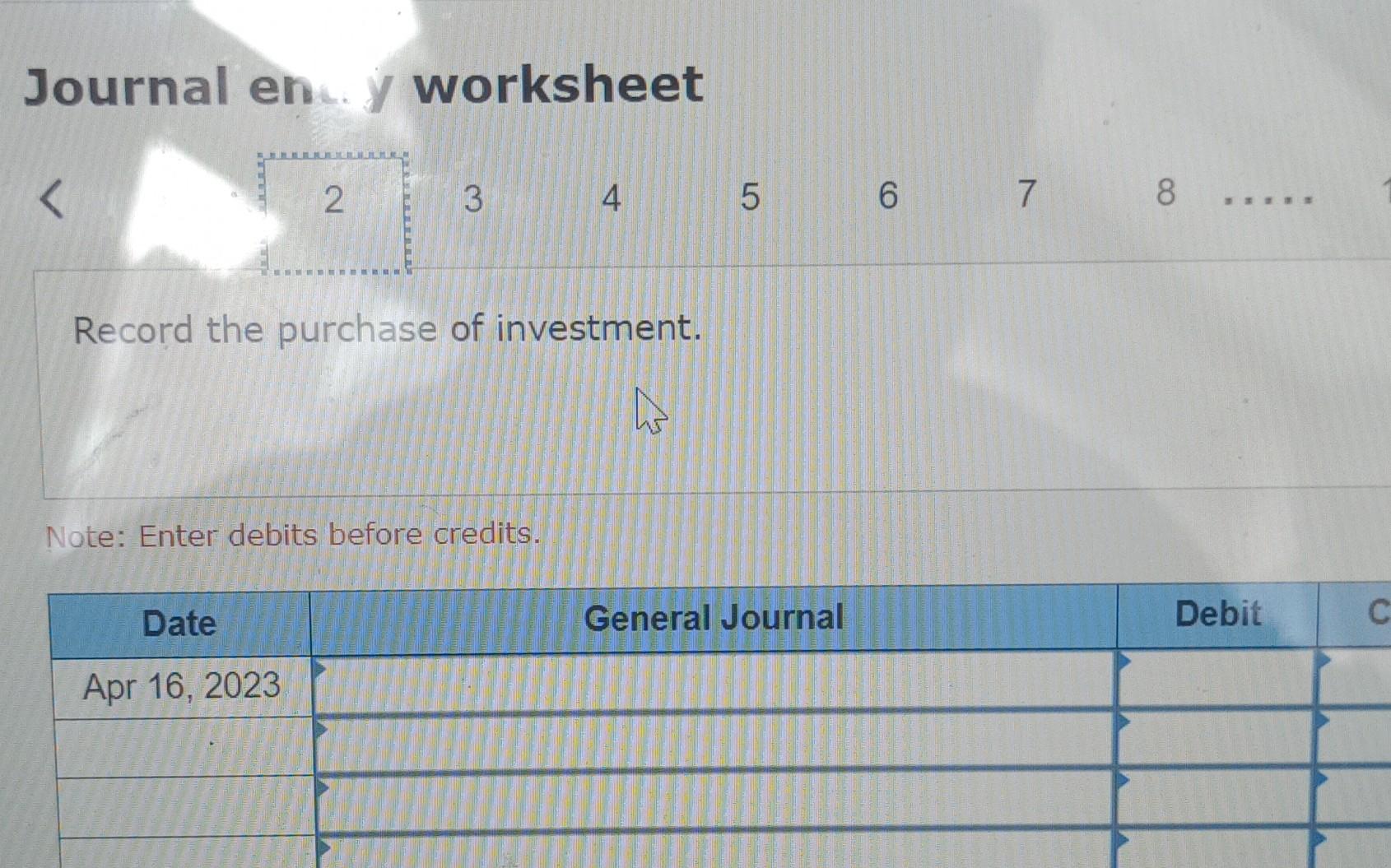

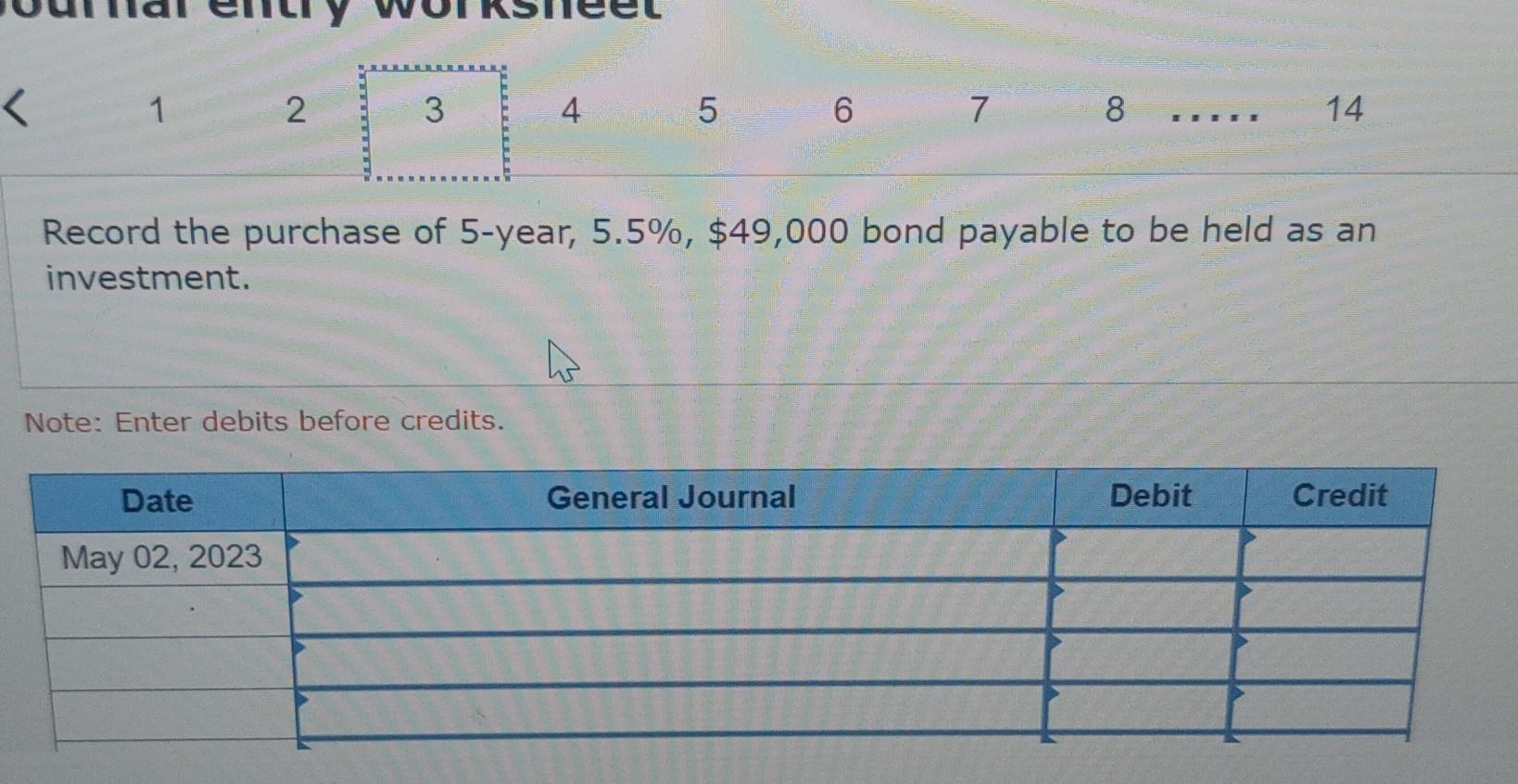

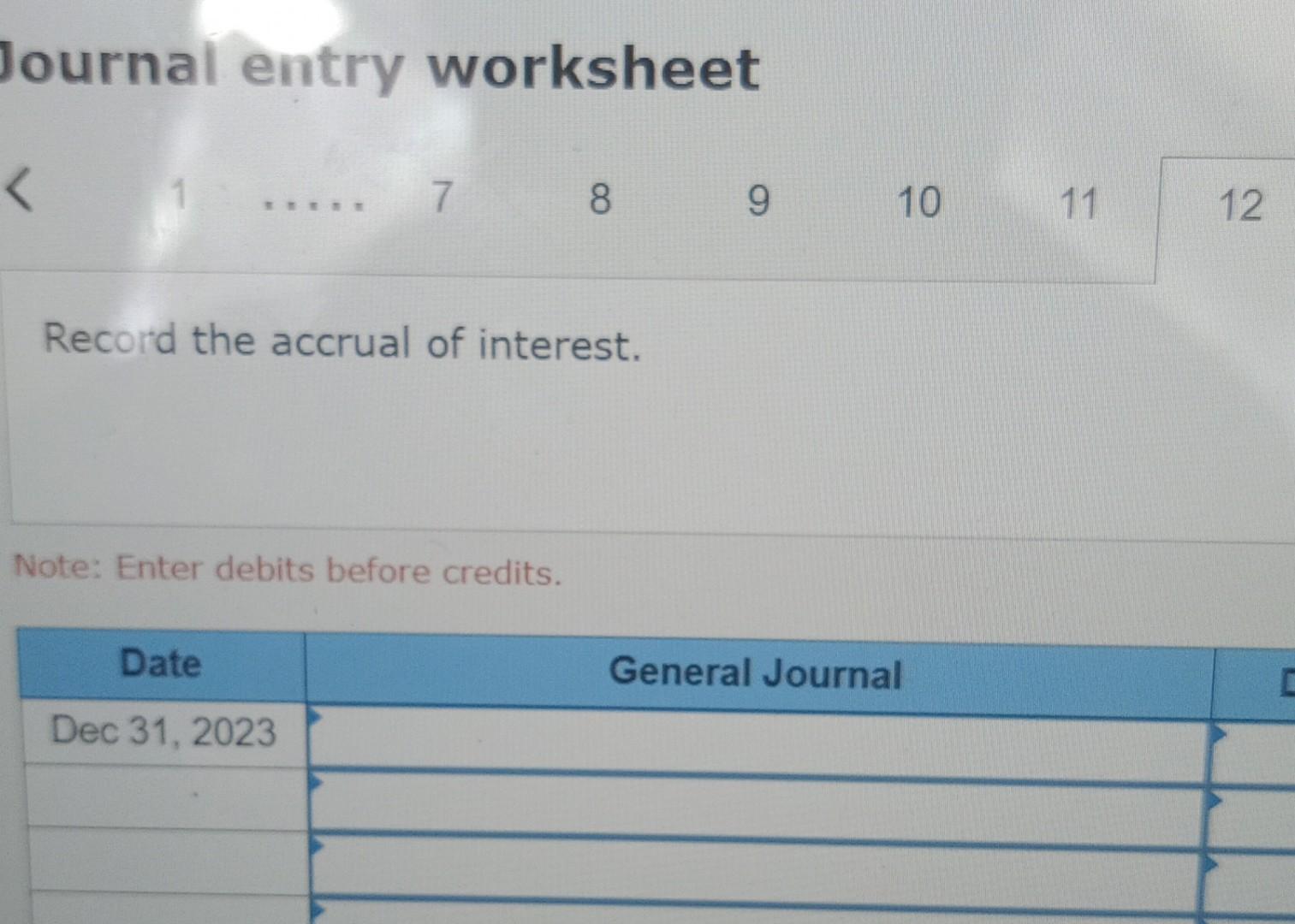

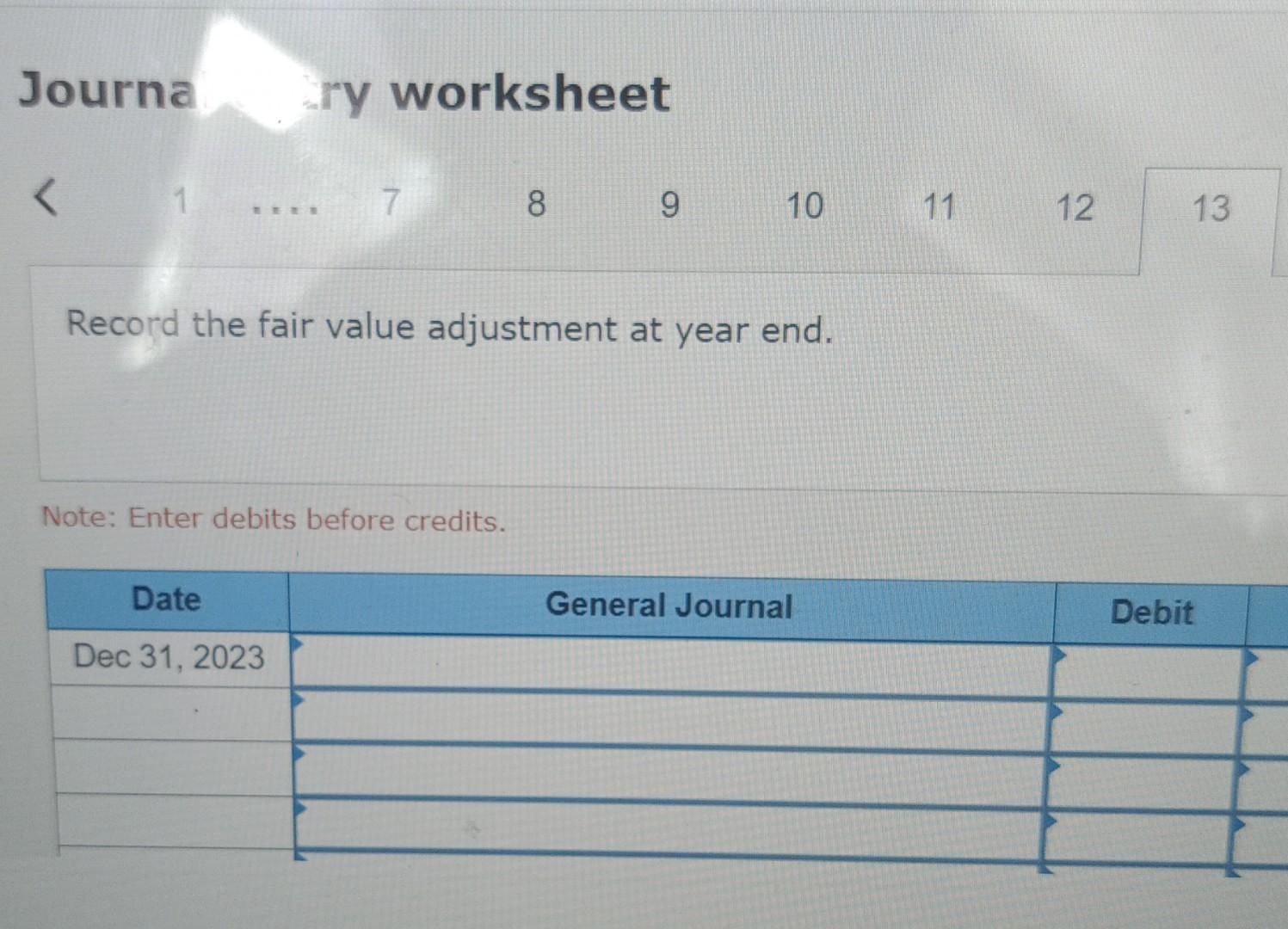

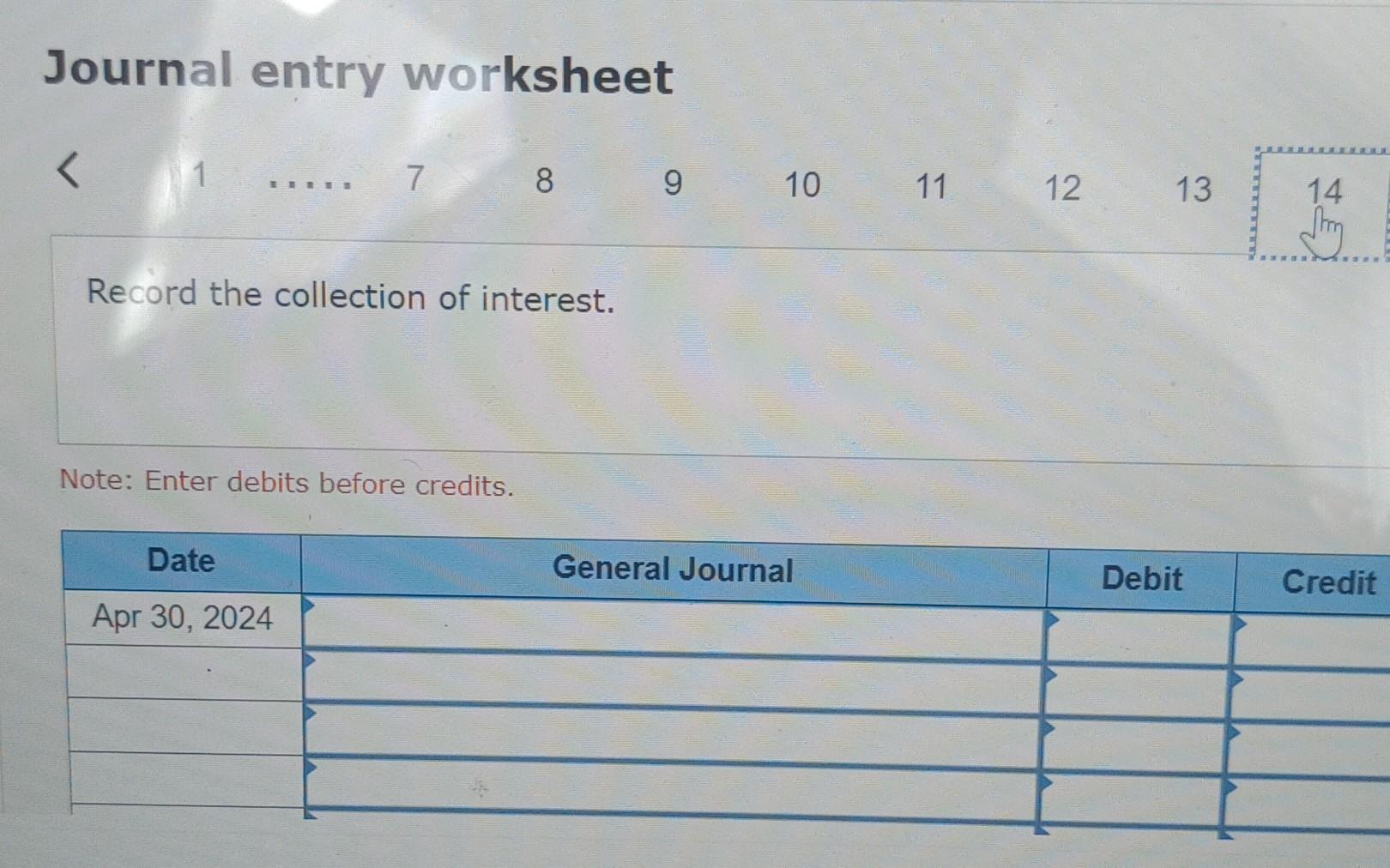

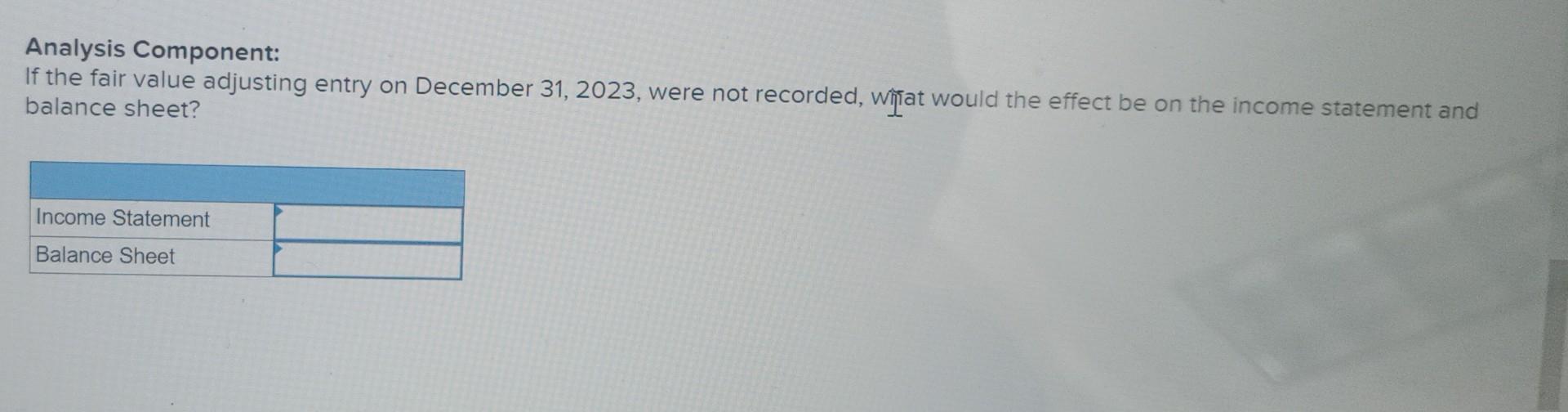

Prepare entries to record the following non-strategic investment transactions of Arrowhead Investment Corporation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) 2823 Mar. 1 Paid $69,980 to purchase a $69,000, two-year, 8.0% bond payable of Action Corporation dated March 1 . There was a $70 transaction fee included in the above-noted payment amount. Interest is paid quarterly beginning June 1. Management intends to actively trade bond purchases. Apr. 16 Bought 2,450 common shares of Brandon Motors at $30.00. There was a $70 transaction fee included in the above-noted payment amount. May 2 Paid $47,968 to purchase a five-year, 5.50\%, $49,000 bond payable of Collingwood Corporation. There was a $70 transaction fee included in the above-noted payment amount. Interest is paid annually each April 30. June 1 Received a cheque from Action Corporation regarding quarterly interest. Aug. 1 Brandon Motors' board of directors declared a dividend of $0.75 per share to shareholders of record on August 10 , payable August 15 . 15 Received the Brandon Motors dividend. Sept. 1 Received a cheque from Action Corporation regarding quarterly interest. 17 Purchased 25,900 Dauphin Inc. Common shares at $3.20. There tas a $70 transaction fee. Oct. 20 Sold the Brandon Motors shares at $31.90. Dec. 1 Received a cheque from Action Corporation regarding quarterly interest. 1 Sold the Action Corporation bond at 101 . 31 Accrued interest on the Collingwood bond. The fair value of the equity security on this date was Dauphin, $3.50. The carrying value equalled the fair value for the Collingwood bond. Apr. 30 Received a cheque from Collingwood Corporation regarding annual interest. Journal entry worksheet 814 Record the purchase of $69,000,2-year, 8.0% bond payable to be held as an investment. Note: Enter debits before credits. Journal en. y worksheet Record the purchase of investment. Note: Enter debits before credits. Record the purchase of 5 -year, 5.5%,$49,000 bond payable to be held as an investment. Note: Enter debits before credits. Journalentry worksheet Record the collection of interest. Note: Enter debits before credits. Journal entry worksheet 34 Record the declaration of dividend. Note: Enter debits before credits. Journai ntry worksheet 5 Record the collection of dividend income. Note: Enter debits before credits. Record the collection of interest income. Note: Enter debits before credits. ournal enury worksheet 4 Record the purchase of investment. Note: Enter debits before credits. Journal entry worksheet Record the sale of investment. Note: Enter debits before credits. Record the collection of interest. Note: Enter debits before credits. Record the sale of investment. Note: Enter debits before credits. Journal entry worksheet 1789 Record the accrual of interest. Note: Enter debits before credits. Record the fair value adjustment at year end. Note: Enter debits before credits. Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started