Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do all parts, they are relatively short, i would appreciate it :) You are the Finance Director of a small limited liability business, Alternative

Please do all parts, they are relatively short, i would appreciate it :)

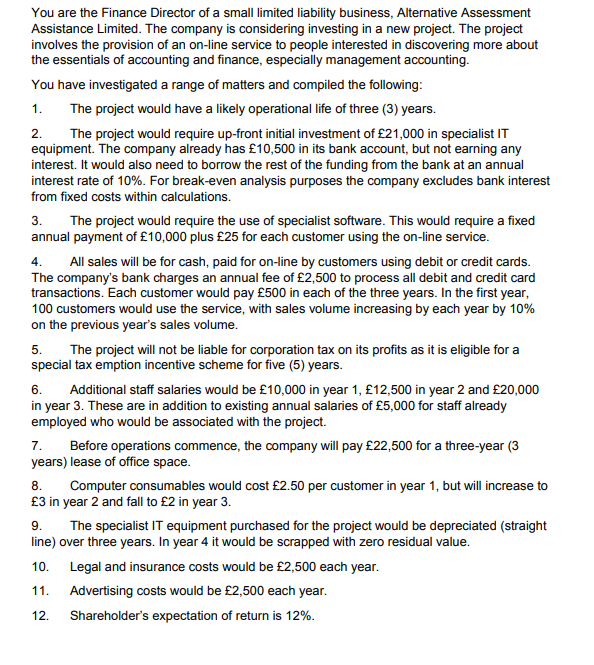

You are the Finance Director of a small limited liability business, Alternative Assessment Assistance Limited. The company is considering investing in a new project. The project involves the provision of an on-line service to people interested in discovering more about the essentials of accounting and finance, especially management accounting. You have investigated a range of matters and compiled the following: 1. The project would have a likely operational life of three (3) years. 2. The project would require up-front initial investment of 21,000 in specialist IT equipment. The company already has 10,500 in its bank account, but not earning any interest. It would also need to borrow the rest of the funding from the bank at an annual interest rate of 10%. For break-even analysis purposes the company excludes bank interest from fixed costs within calculations. 3. The project would require the use of specialist software. This would require a fixed annual payment of 10,000 plus 25 for each customer using the on-line service. 4. All sales will be for cash, paid for on-line by customers using debit or credit cards. The company's bank charges an annual fee of 2,500 to process all debit and credit card transactions. Each customer would pay 500 in each of the three years. In the first year, 100 customers would use the service, with sales volume increasing by each year by 10% on the previous year's sales volume. 5. The project will not be liable for corporation tax on its profits as it is eligible for a special tax emption incentive scheme for five (5) years. 6. Additional staff salaries would be 10,000 in year 1, 12,500 in year 2 and 20,000 in year 3. These are in addition to existing annual salaries of 5,000 for staff already employed who would be associated with the project. 7. Before operations commence, the company will pay 22,500 for a three-year (3 years) lease of office space. 8. Computer consumables would cost 2.50 per customer in year 1, but will increase to 3 in year 2 and fall to 2 in year 3. 9. The specialist IT equipment purchased for the project would be depreciated (straight line) over three years. In year 4 it would be scrapped with zero residual value. 10. Legal and insurance costs would be 2,500 each year. 11. Advertising costs would be 2,500 each year. 12. Shareholder's expectation of return is 12%. Using the details shown above: a) For each of the three years, calculate the Break-Even Point and Margin of Safety in terms of customer numbers and sales revenues. Round up as appropriate: Round up to the nearest whole figure; Round up to the nearest customer. (8 marks) b) Undertake an investment appraisal for the proposed project. For the purposes of the nent in the new equipment, and the purchase of the three-year lease, are made before the first year of operations. Calculate the non-discounted Payback period, and the Net Present Value. For Payback show your answer to two (2) decimal places. For Net Present Value use a discount factor of 11% and show your answer to the nearest whole figure. (10 marks) c) Assuming the company has an IRR hurdle rate of 20%, state whether or not the proposed project exceeds that hurdle rate. Show appropriate calculations to justify your statement. (4 marks) d) Looking back over your calculations for i), ii), and iii), provide appropriate advisory comments. (Maximum of 250 word) (8 marks) You are the Finance Director of a small limited liability business, Alternative Assessment Assistance Limited. The company is considering investing in a new project. The project involves the provision of an on-line service to people interested in discovering more about the essentials of accounting and finance, especially management accounting. You have investigated a range of matters and compiled the following: 1. The project would have a likely operational life of three (3) years. 2. The project would require up-front initial investment of 21,000 in specialist IT equipment. The company already has 10,500 in its bank account, but not earning any interest. It would also need to borrow the rest of the funding from the bank at an annual interest rate of 10%. For break-even analysis purposes the company excludes bank interest from fixed costs within calculations. 3. The project would require the use of specialist software. This would require a fixed annual payment of 10,000 plus 25 for each customer using the on-line service. 4. All sales will be for cash, paid for on-line by customers using debit or credit cards. The company's bank charges an annual fee of 2,500 to process all debit and credit card transactions. Each customer would pay 500 in each of the three years. In the first year, 100 customers would use the service, with sales volume increasing by each year by 10% on the previous year's sales volume. 5. The project will not be liable for corporation tax on its profits as it is eligible for a special tax emption incentive scheme for five (5) years. 6. Additional staff salaries would be 10,000 in year 1, 12,500 in year 2 and 20,000 in year 3. These are in addition to existing annual salaries of 5,000 for staff already employed who would be associated with the project. 7. Before operations commence, the company will pay 22,500 for a three-year (3 years) lease of office space. 8. Computer consumables would cost 2.50 per customer in year 1, but will increase to 3 in year 2 and fall to 2 in year 3. 9. The specialist IT equipment purchased for the project would be depreciated (straight line) over three years. In year 4 it would be scrapped with zero residual value. 10. Legal and insurance costs would be 2,500 each year. 11. Advertising costs would be 2,500 each year. 12. Shareholder's expectation of return is 12%. Using the details shown above: a) For each of the three years, calculate the Break-Even Point and Margin of Safety in terms of customer numbers and sales revenues. Round up as appropriate: Round up to the nearest whole figure; Round up to the nearest customer. (8 marks) b) Undertake an investment appraisal for the proposed project. For the purposes of the nent in the new equipment, and the purchase of the three-year lease, are made before the first year of operations. Calculate the non-discounted Payback period, and the Net Present Value. For Payback show your answer to two (2) decimal places. For Net Present Value use a discount factor of 11% and show your answer to the nearest whole figure. (10 marks) c) Assuming the company has an IRR hurdle rate of 20%, state whether or not the proposed project exceeds that hurdle rate. Show appropriate calculations to justify your statement. (4 marks) d) Looking back over your calculations for i), ii), and iii), provide appropriate advisory comments. (Maximum of 250 word) (8 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started