Answered step by step

Verified Expert Solution

Question

1 Approved Answer

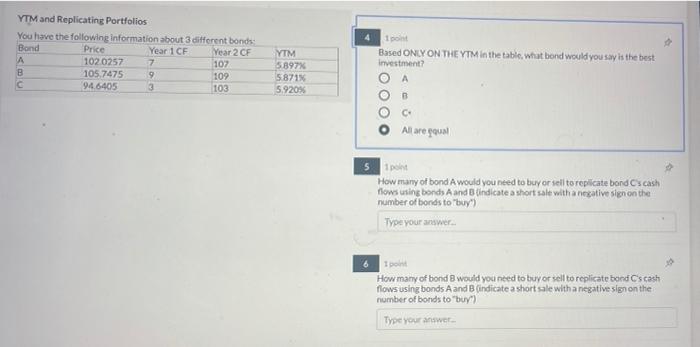

Please do all parts YTM and Replicating Portfolios You have the following information about 3 different bonds Bond Price Year 1 CF Year 2 CF

Please do all parts

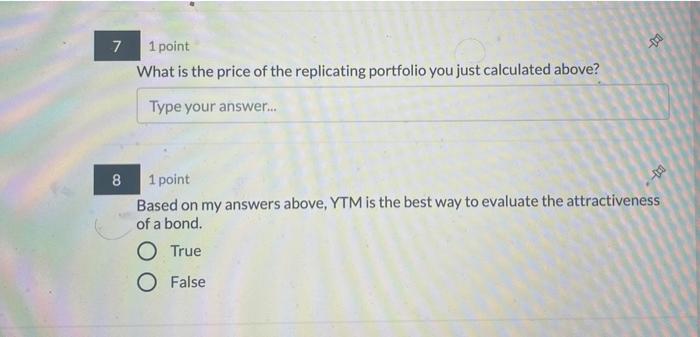

YTM and Replicating Portfolios You have the following information about 3 different bonds Bond Price Year 1 CF Year 2 CF 1020257 7 107 105.7475 9 109 94.6405 3 103 YTM 5897% 5871% 5.920% 4 point Based ONLY ON THE YTM in the table, what bond would you say is the best investment? A B C Al are goal 5 pont How many of bond A would you need to buy or sell to replicate bondscash flows using bonds and indicate a short sale with a negative sign on the number of bonds to buy Type your answer I pont How many of bond would you need to buy or sell to replicate bond Cs cash flows using bonds A and B (indicate a short sale with a negative sign on the number of bonds to buy Type your answer 7 1 point What is the price of the replicating portfolio you just calculated above? Type your answer. 8 1 point Based on my answers above, YTM is the best way to evaluate the attractiveness of a bond. O True O False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started