Answered step by step

Verified Expert Solution

Question

1 Approved Answer

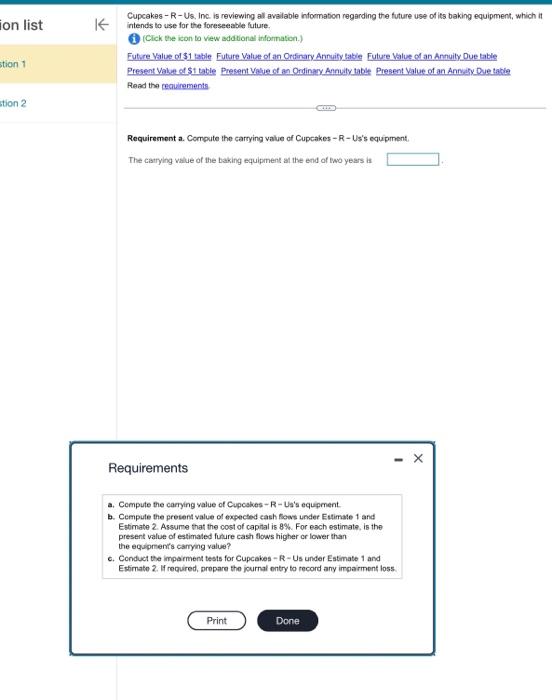

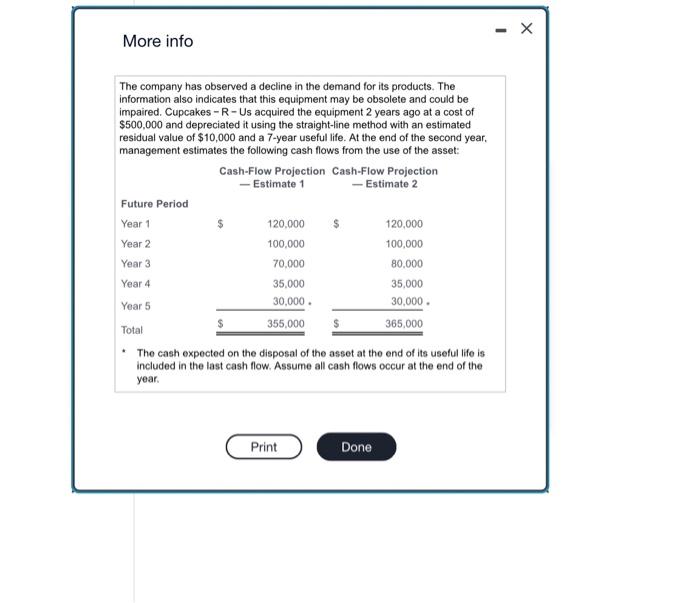

PLEASE DO ALL REQUIREMENTS Cupcakes - R -Us, Inc. is reviewing all avalable infocmation regarding the future use of its baking equipment, which it intends

PLEASE DO ALL REQUIREMENTS

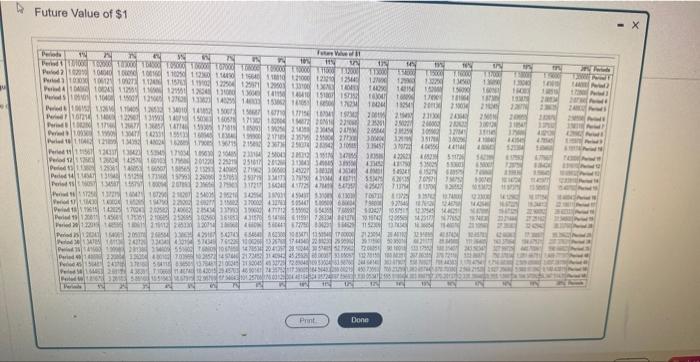

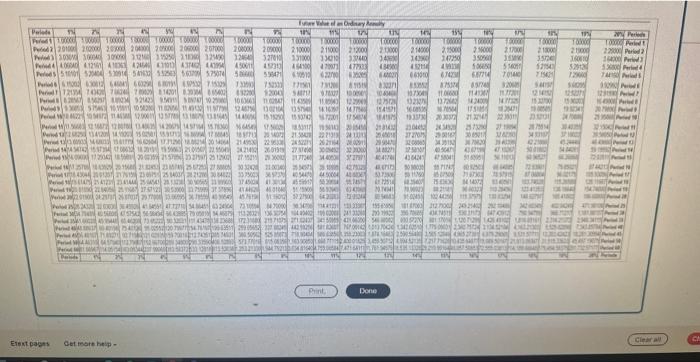

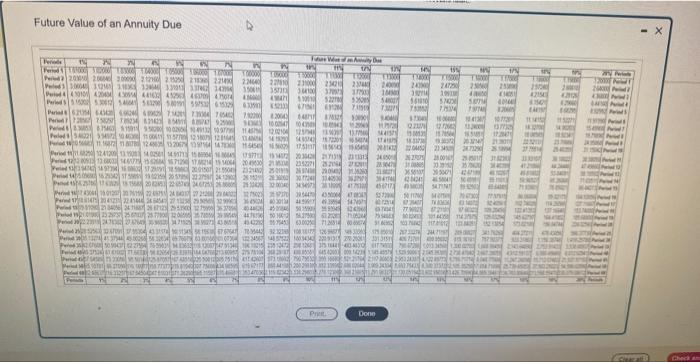

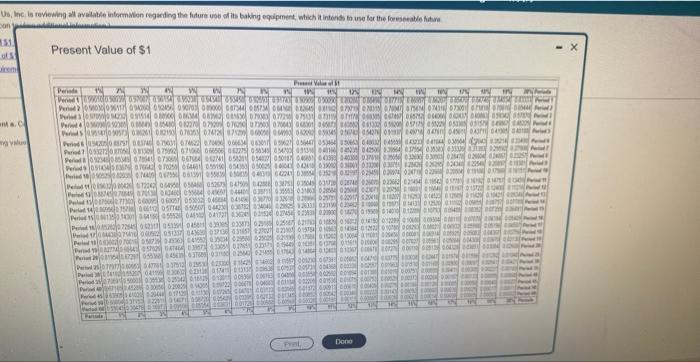

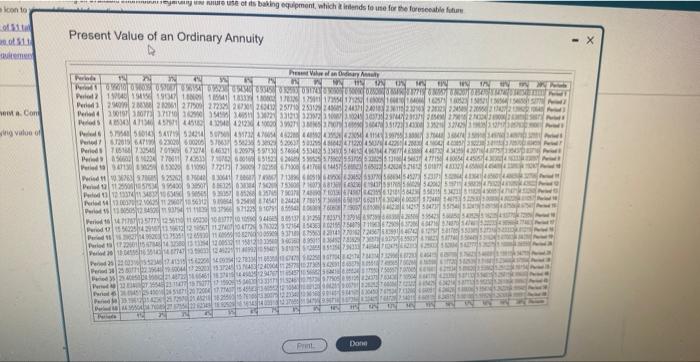

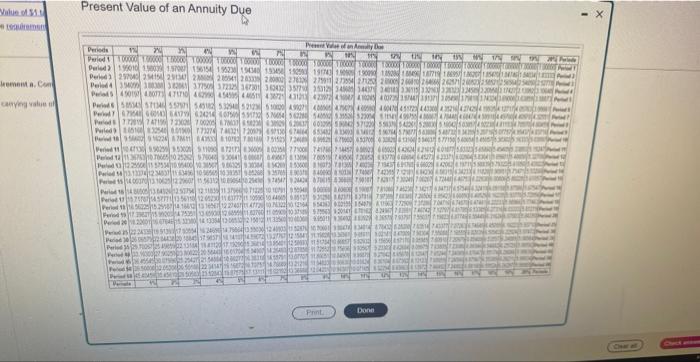

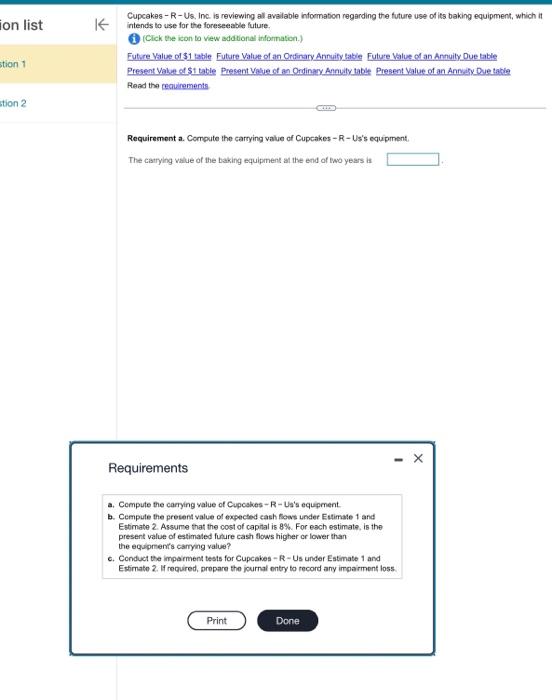

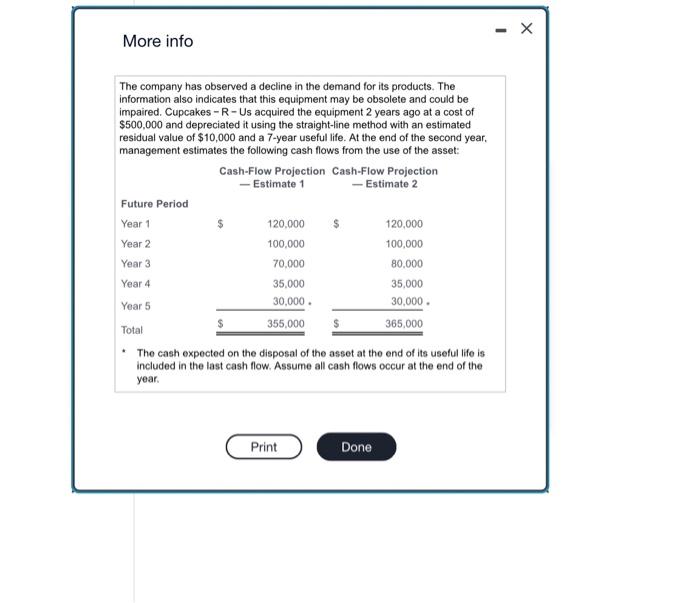

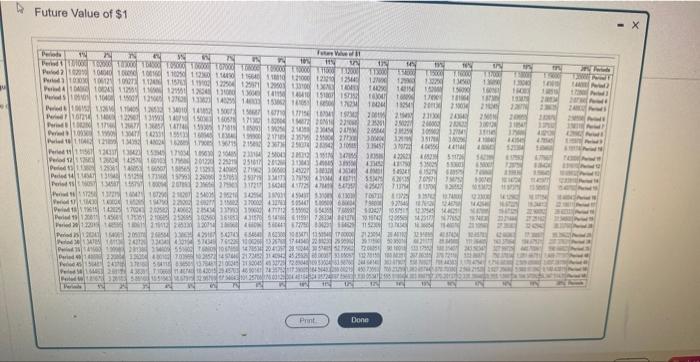

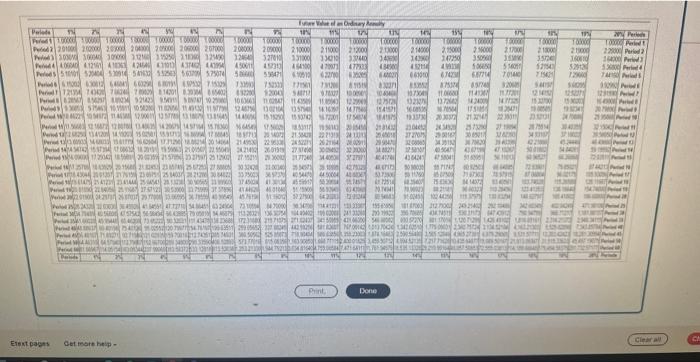

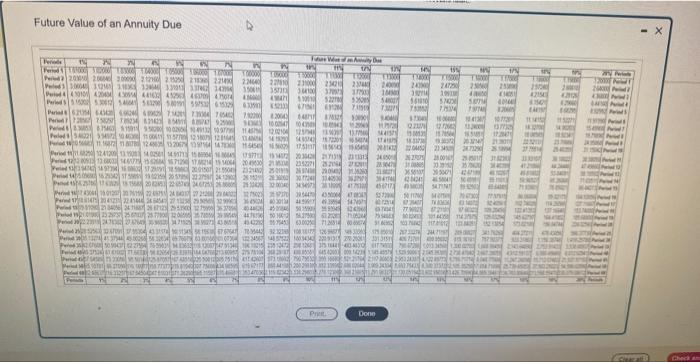

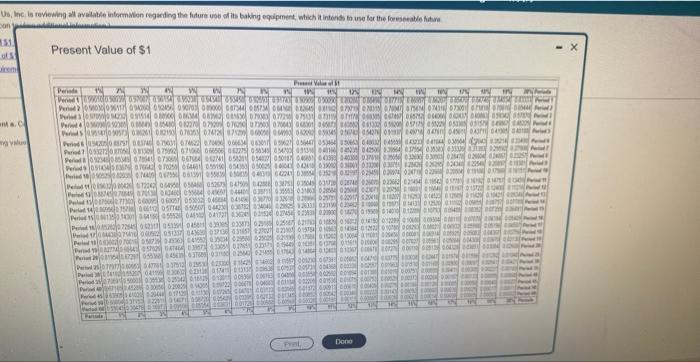

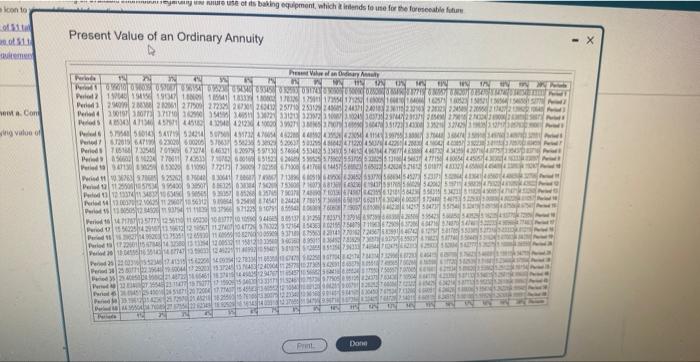

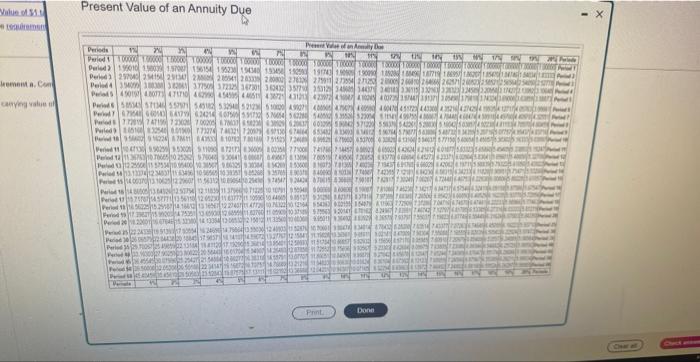

Cupcakes - R -Us, Inc. is reviewing all avalable infocmation regarding the future use of its baking equipment, which it intends to use for the foreseeable future. 6. (Cick the icon to vew addional infoumation.) Euture Yalue ofs1 bable. Eutare Value of an Orfinary Annuifilable Euture Value of an Annuiby Due table Present Yalee of 51 table Present value of an Ordinacy Arnily table Present Value of an Annidy Due table Flead tha cequirements Requirement a. Compute the carrying value of Cupcakes RU S's equpment. The catrying value of the baking equipment at the end of two years it Requirements a. Compute the carying value of Cupcakes - R - Ua's equpment. b. Cempute the presend value of expected cash fooss under Ettimale 1 and Estimate 2. Assume that the cost of capinal is 8%. For esch estimate, is the present value of estimaled fusure cash flows higher or lover than the equprent's camying value? c. Conduct the imparment tests for Cupcakes - R-Us under Eatimate 1 and Estimate 2. If reguired, prepare the joumal entry to record any impaiment loss More info The company has observed a decline in the demand for its products. The information also indicates that this equipment may be obsolete and could be impaired. Cupcakes - R-Us acquired the equipment 2 years ago at a cost of $500,000 and depreciated it using the straight-line method with an estimated residual value of $10,000 and a 7-year useful life. At the end of the second year. management estimates the following cash flows from the use of the asset: * The cash expected on the disposal of the asset at the end of its useful life is included in the last cash flow. Assume all cash flows occur at the end of the year. Future Value of $1 Future Value of an Annuity Due Present Value of $1 Present Value of an Ordinary Annuity Present Value of an Annuity Due Cupcakes - R -Us, Inc. is reviewing all avalable infocmation regarding the future use of its baking equipment, which it intends to use for the foreseeable future. 6. (Cick the icon to vew addional infoumation.) Euture Yalue ofs1 bable. Eutare Value of an Orfinary Annuifilable Euture Value of an Annuiby Due table Present Yalee of 51 table Present value of an Ordinacy Arnily table Present Value of an Annidy Due table Flead tha cequirements Requirement a. Compute the carrying value of Cupcakes RU S's equpment. The catrying value of the baking equipment at the end of two years it Requirements a. Compute the carying value of Cupcakes - R - Ua's equpment. b. Cempute the presend value of expected cash fooss under Ettimale 1 and Estimate 2. Assume that the cost of capinal is 8%. For esch estimate, is the present value of estimaled fusure cash flows higher or lover than the equprent's camying value? c. Conduct the imparment tests for Cupcakes - R-Us under Eatimate 1 and Estimate 2. If reguired, prepare the joumal entry to record any impaiment loss More info The company has observed a decline in the demand for its products. The information also indicates that this equipment may be obsolete and could be impaired. Cupcakes - R-Us acquired the equipment 2 years ago at a cost of $500,000 and depreciated it using the straight-line method with an estimated residual value of $10,000 and a 7-year useful life. At the end of the second year. management estimates the following cash flows from the use of the asset: * The cash expected on the disposal of the asset at the end of its useful life is included in the last cash flow. Assume all cash flows occur at the end of the year. Future Value of $1 Future Value of an Annuity Due Present Value of $1 Present Value of an Ordinary Annuity Present Value of an Annuity Due

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started