Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE DO ALL REQUIREMENTS PLEASE DO ALL REQUIREMENTS Pentucket Computer Company's payroll accountant has submitted her resignation and will be leaving the company in two

PLEASE DO ALL REQUIREMENTS

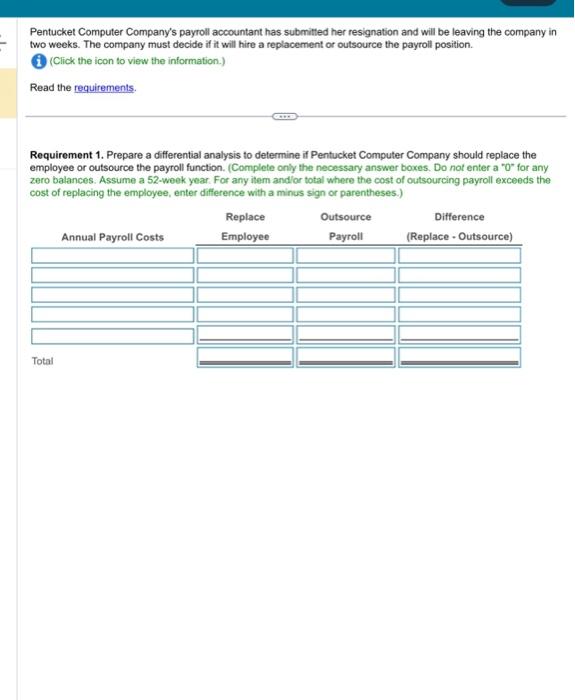

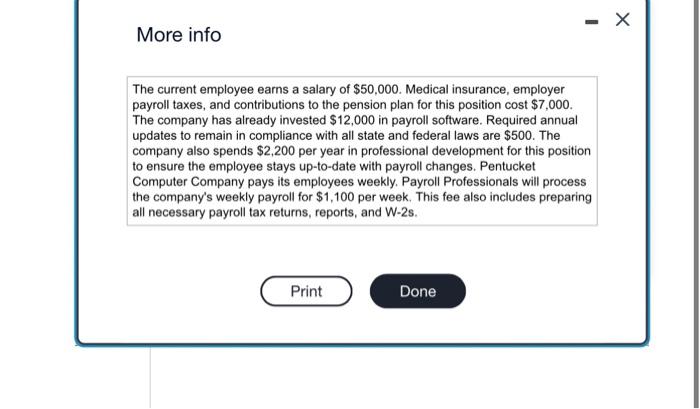

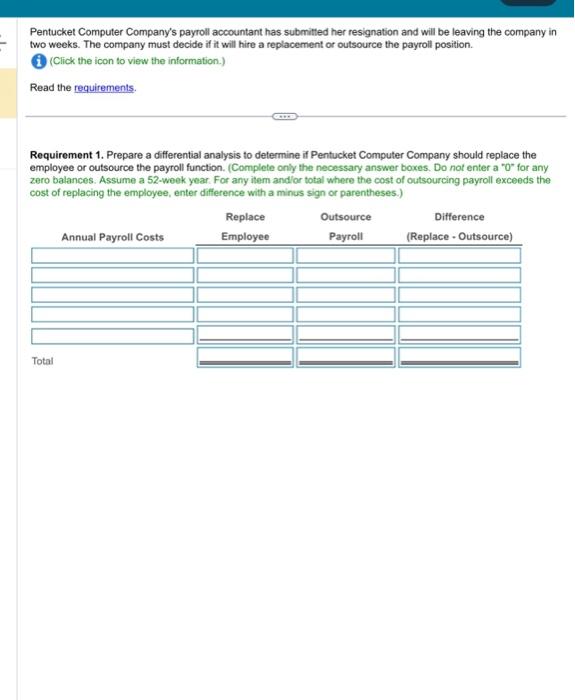

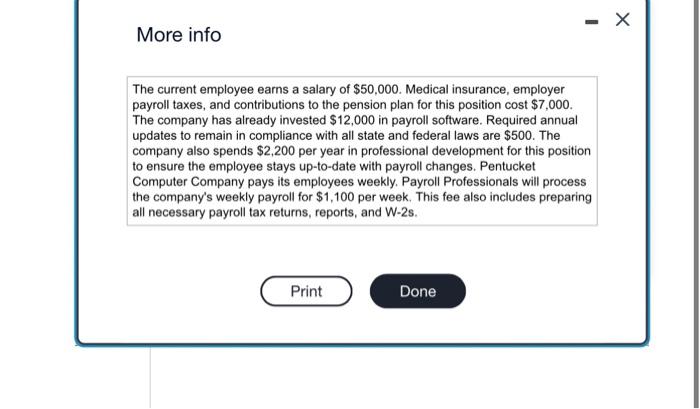

Pentucket Computer Company's payroll accountant has submitted her resignation and will be leaving the company in two weeks. The company must decide if it will hire a replacement or outsource the payroll position. (Click the icon to view the information.) Read the requirements. Requirement 1. Prepare a differential analysis to determine if Pentucket Computer Company should replace the employee or outsource the payroll function. (Complete only the necessary answer boxes. Do not enter a "O" for any zero balances. Assume a 52 -week year. For any item andior total where the cost of outsourcing payroll exceeds the cost of replacing the employee, enter difference with a minus sign or parentheses.) Requirements 1. Prepare a differential analysis to determine if Pentucket Computer Company should replace the employee or outsource the payroll function. 2. What other factors should Pentucket Computer Company consider in making this decision? More info The current employee earns a salary of $50,000. Medical insurance, employer payroll taxes, and contributions to the pension plan for this position cost $7,000. The company has already invested $12,000 in payroll software. Required annual updates to remain in compliance with all state and federal laws are $500. The company also spends $2,200 per year in professional development for this position to ensure the employee stays up-to-date with payroll changes. Pentucket Computer Company pays its employees weekly. Payroll Professionals will process the company's weekly payroll for $1,100 per week. This fee also includes preparing all necessary payroll tax returns, reports, and W2s

PLEASE DO ALL REQUIREMENTS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started