Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do all requirements! Thank you will give super good ratings! Hampton Auto Parts, Inc., completed the following selected transactions during 2018: (Click the icon

Please do all requirements! Thank you will give super good ratings!

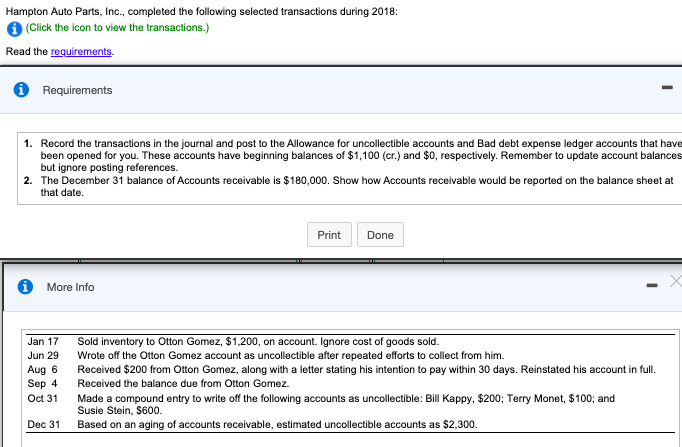

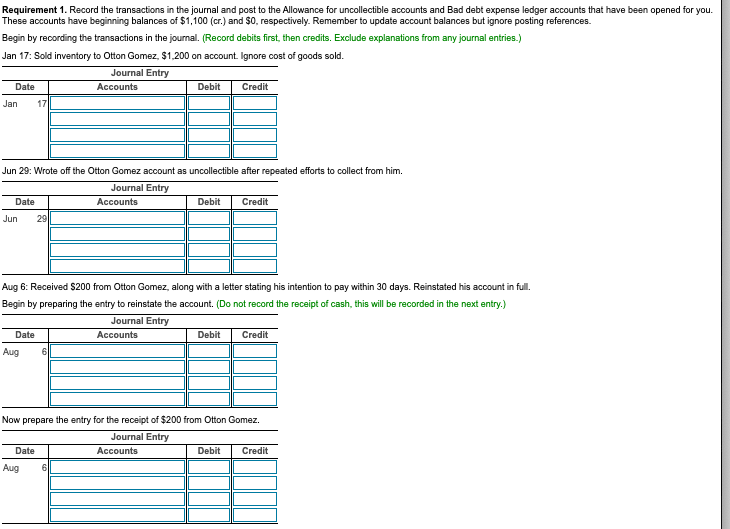

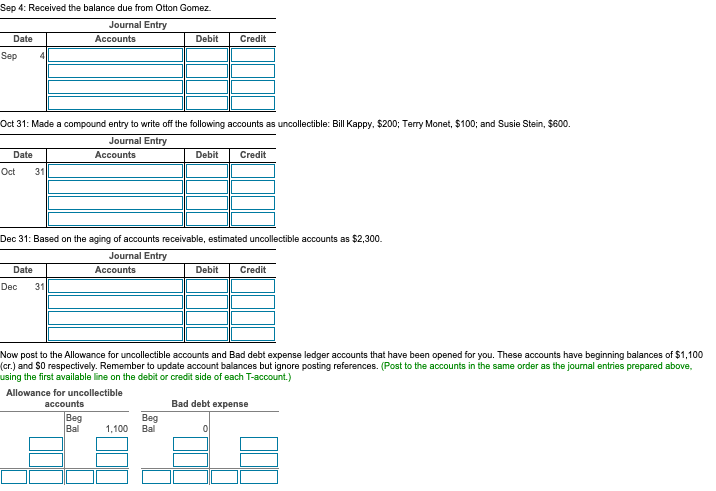

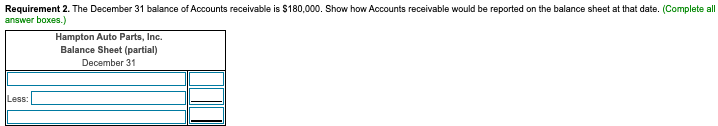

Hampton Auto Parts, Inc., completed the following selected transactions during 2018: (Click the icon to view the transactions.) Read the requirements i Requirements 1. Record the transactions in the journal and post to the Allowance for uncollectible accounts and Bad debt expense ledger accounts that have been opened for you. These accounts have beginning balances of $1,100 (cr.) and $0, respectively. Remember to update account balances but ignore posting references. 2. The December 31 balance of Accounts receivable is $180,000. Show how Accounts receivable would be reported on the balance sheet at that date. Print Done i More Info Jan 17 Jun 29 Aug 6 Sep 4 Oct 31 Sold inventory to Otton Gomez, $1,200, on account. Ignore cost of goods sold. Wrote off the Otton Gomez account as uncollectible after repeated efforts to collect from him. Received $200 from Otton Gomez, along with a letter stating his intention to pay within 30 days. Reinstated his account in full. Received the balance due from Otton Gomez. Made a compound entry to write off the following accounts as uncollectible: Bill Kappy, $200; Terry Monet, $100; and Susie Stein, $600 Based on an aging of accounts receivable, estimated uncollectible accounts as $2,300. Dec 31 Requirement 1. Record the transactions in the journal and post to the Allowance for uncollectible accounts and Bad debt expense ledger accounts that have been opened for you. These accounts have beginning balances of $1,100 (cr.) and $0, respectively. Remember to update account balances but ignore posting references. Begin by recording the transactions in the journal. (Record debits first, then credits. Exclude explanations from any journal entries.) Jan 17: Sold inventory to Otton Gomez, $1.200 on account. Ignore cost of goods sold. Journal Entry Date Accounts Debit Credit Jan 17 Jun 29: Wrote off the Otton Gomez account as uncollectible after repeated efforts to collect from him. Journal Entry Date Accounts Debit Credit Jun 29 Aug 6: Received $200 from Otton Gomez, along with a letter stating his intention to pay within 30 days. Reinstated his account in full. Begin by preparing the entry to reinstate the account. (Do not record the receipt of cash, this will be recorded in the next entry.) Journal Entry Date Accounts Debit Credit Aug 6 Now prepare the entry for the receipt of $200 from Otton Gomez. Journal Entry Date Accounts Debit Credit Aug 6 Sep 4: Received the balance due from Otton Gomez Journal Entry Date Accounts Debit Credit Sep 4 Oct 31: Made a compound entry to write off the following accounts as uncollectible: Bill Kappy, $200; Terry Monet, $100; and Susie Stein, $600. Journal Entry Date Accounts Debit Credit Oct 31 Dec 31: Based on the aging of accounts receivable, estimated uncollectible accounts as $2,300. Journal Entry Date Accounts Debit Credit 31 Dec Now post to the Allowance for uncollectible accounts and Bad debt expense ledger accounts that have been opened for you. These accounts have beginning balances of $1,100 (cr.) and $0 respectively. Remember to update account balances but ignore posting references. (Post to the accounts in the same order as the journal entries prepared above. using the first available line on the debitor credit side of each T-account.) Allowance for uncollectible accounts Bad debt expense Beg 1,100 Beg Bal Bal 0 Requirement 2. The December 31 balance of Accounts receivable is $180,000. Show how Accounts receivable would be reported on the balance sheet at that date. (Complete all answer boxes.) Hampton Auto Parts, Inc. Balance Sheet (partial) December 31 LessStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started