Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do all statement for abc and dplease double check the additional information. please provide clear and details working for understanding like w1&w2and working for

please do all statement for abc and dplease double check the additional information.

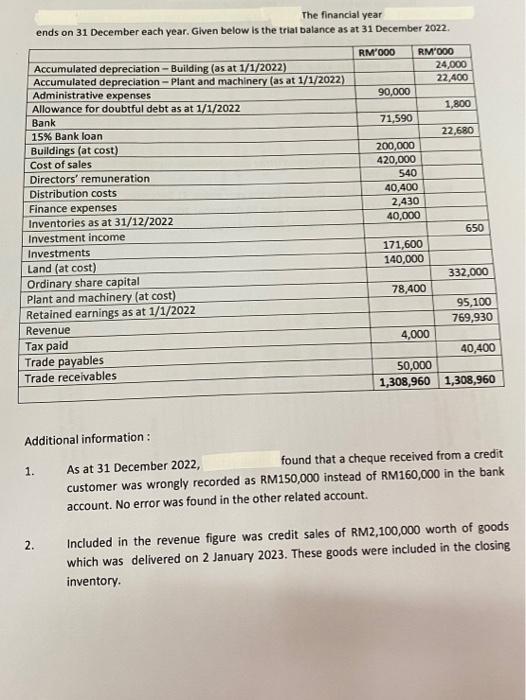

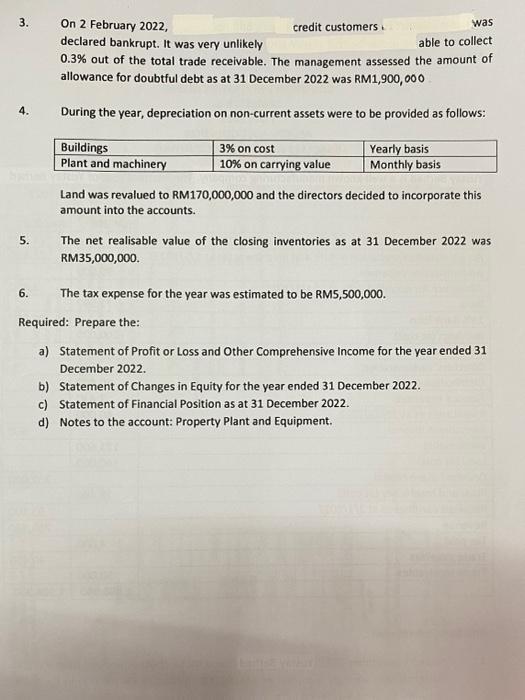

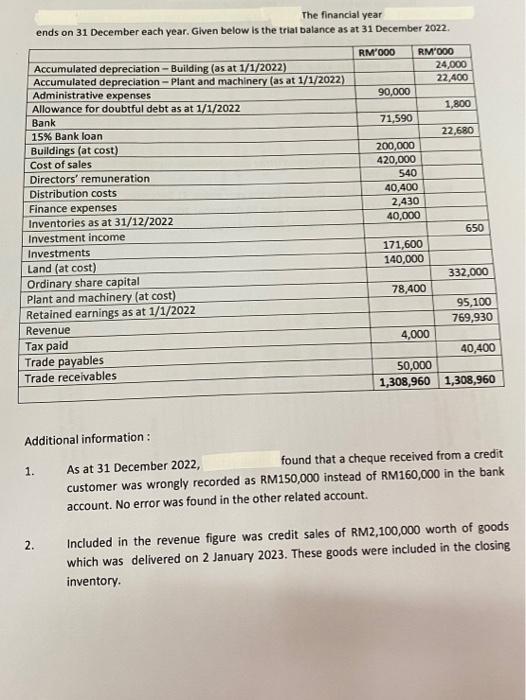

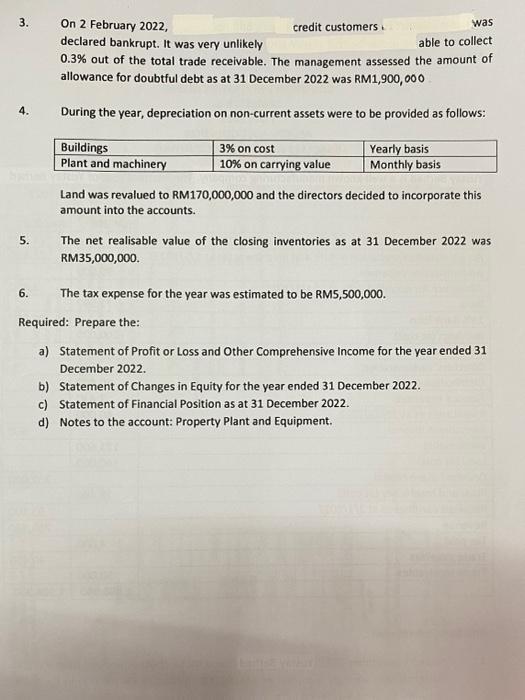

The financial year ends on 31 December each year. Given below is the triat balance as at 31 December 2022. Additional information : 1. As at 31 December 2022, found that a cheque received from a credit customer was wrongly recorded as RM150,000 instead of RM160,000 in the bank account. No error was found in the other related account. 2. Included in the revenue figure was credit sales of RM2,100,000 worth of goods which was delivered on 2 January 2023. These goods were included in the closing inventory. 3. On 2 February 2022, credit customers : was declared bankrupt. It was very unlikely able to collect 0.3% out of the total trade receivable. The management assessed the amount of allowance for doubtful debt as at 31 December 2022 was RM1,900,000 4. During the year, depreciation on non-current assets were to be provided as follows: Land was revalued to RM170,000,000 and the directors decided to incorporate this amount into the accounts. 5. The net realisable value of the closing inventories as at 31 December 2022 was RM35,000,000. 6. The tax expense for the year was estimated to be RM5,500,000. Required: Prepare the: a) Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2022. b) Statement of Changes in Equity for the year ended 31 December 2022. c) Statement of Financial Position as at 31 December 2022. d) Notes to the account: Property Plant and Equipment. The financial year ends on 31 December each year. Given below is the triat balance as at 31 December 2022. Additional information : 1. As at 31 December 2022, found that a cheque received from a credit customer was wrongly recorded as RM150,000 instead of RM160,000 in the bank account. No error was found in the other related account. 2. Included in the revenue figure was credit sales of RM2,100,000 worth of goods which was delivered on 2 January 2023. These goods were included in the closing inventory. 3. On 2 February 2022, credit customers : was declared bankrupt. It was very unlikely able to collect 0.3% out of the total trade receivable. The management assessed the amount of allowance for doubtful debt as at 31 December 2022 was RM1,900,000 4. During the year, depreciation on non-current assets were to be provided as follows: Land was revalued to RM170,000,000 and the directors decided to incorporate this amount into the accounts. 5. The net realisable value of the closing inventories as at 31 December 2022 was RM35,000,000. 6. The tax expense for the year was estimated to be RM5,500,000. Required: Prepare the: a) Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2022. b) Statement of Changes in Equity for the year ended 31 December 2022. c) Statement of Financial Position as at 31 December 2022. d) Notes to the account: Property Plant and Equipment

The financial year ends on 31 December each year. Given below is the triat balance as at 31 December 2022. Additional information : 1. As at 31 December 2022, found that a cheque received from a credit customer was wrongly recorded as RM150,000 instead of RM160,000 in the bank account. No error was found in the other related account. 2. Included in the revenue figure was credit sales of RM2,100,000 worth of goods which was delivered on 2 January 2023. These goods were included in the closing inventory. 3. On 2 February 2022, credit customers : was declared bankrupt. It was very unlikely able to collect 0.3% out of the total trade receivable. The management assessed the amount of allowance for doubtful debt as at 31 December 2022 was RM1,900,000 4. During the year, depreciation on non-current assets were to be provided as follows: Land was revalued to RM170,000,000 and the directors decided to incorporate this amount into the accounts. 5. The net realisable value of the closing inventories as at 31 December 2022 was RM35,000,000. 6. The tax expense for the year was estimated to be RM5,500,000. Required: Prepare the: a) Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2022. b) Statement of Changes in Equity for the year ended 31 December 2022. c) Statement of Financial Position as at 31 December 2022. d) Notes to the account: Property Plant and Equipment. The financial year ends on 31 December each year. Given below is the triat balance as at 31 December 2022. Additional information : 1. As at 31 December 2022, found that a cheque received from a credit customer was wrongly recorded as RM150,000 instead of RM160,000 in the bank account. No error was found in the other related account. 2. Included in the revenue figure was credit sales of RM2,100,000 worth of goods which was delivered on 2 January 2023. These goods were included in the closing inventory. 3. On 2 February 2022, credit customers : was declared bankrupt. It was very unlikely able to collect 0.3% out of the total trade receivable. The management assessed the amount of allowance for doubtful debt as at 31 December 2022 was RM1,900,000 4. During the year, depreciation on non-current assets were to be provided as follows: Land was revalued to RM170,000,000 and the directors decided to incorporate this amount into the accounts. 5. The net realisable value of the closing inventories as at 31 December 2022 was RM35,000,000. 6. The tax expense for the year was estimated to be RM5,500,000. Required: Prepare the: a) Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2022. b) Statement of Changes in Equity for the year ended 31 December 2022. c) Statement of Financial Position as at 31 December 2022. d) Notes to the account: Property Plant and Equipment

please provide clear and details working for understanding like w1&w2and working for clear details about the amount is from what cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started