Answered step by step

Verified Expert Solution

Question

1 Approved Answer

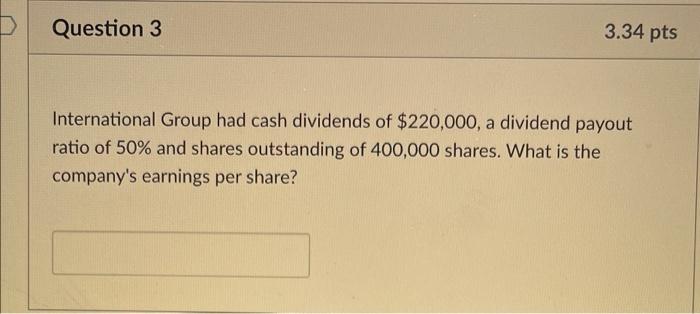

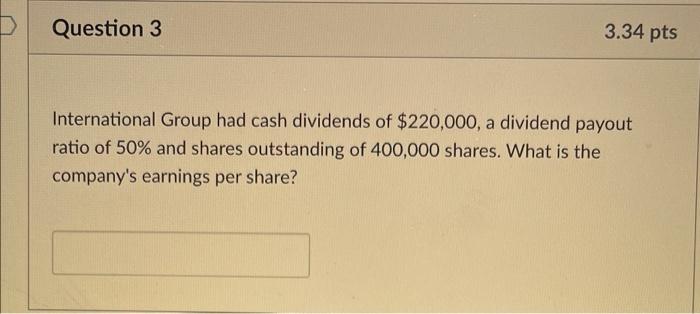

please do all thanks need help Question 3 3.34 pts International Group had cash dividends of $220,000, a dividend payout ratio of 50% and shares

please do all thanks need help

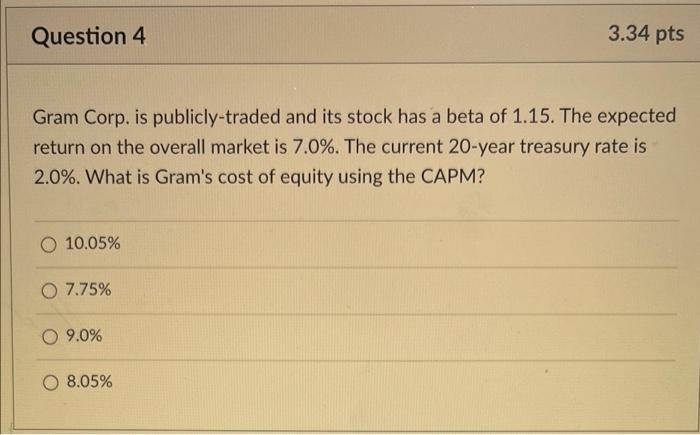

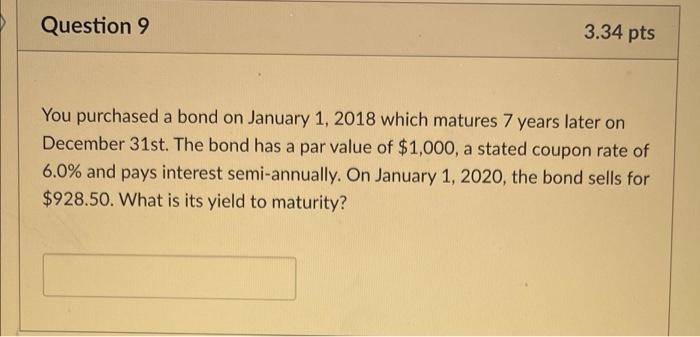

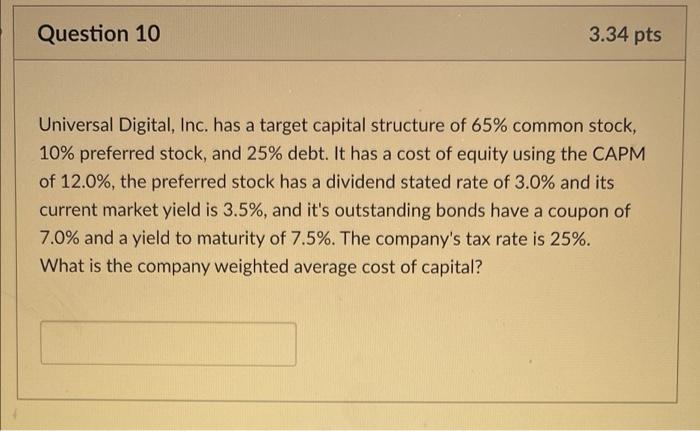

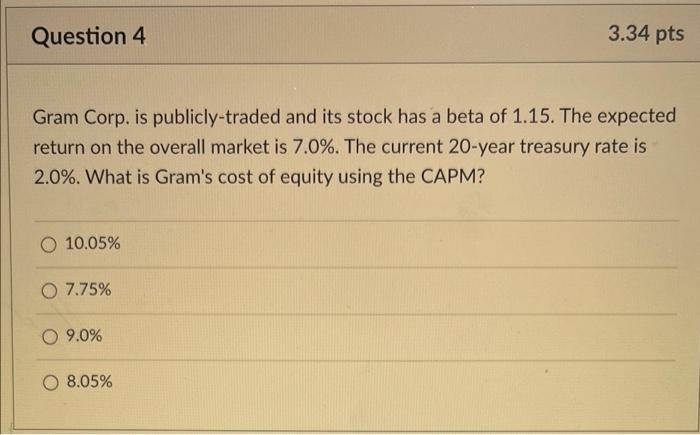

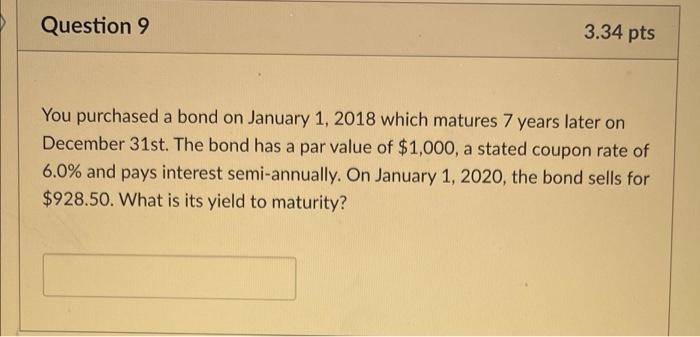

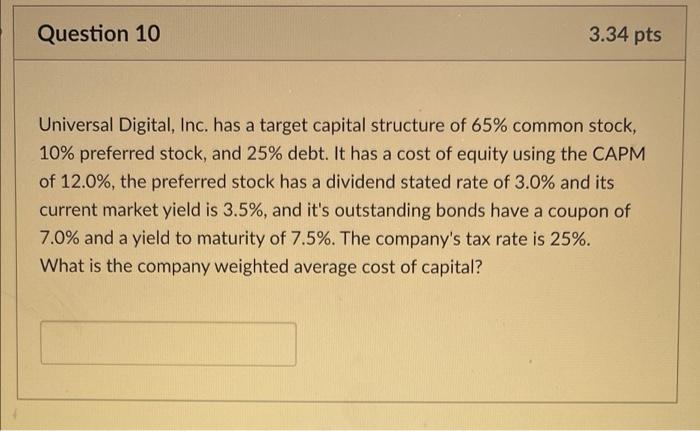

Question 3 3.34 pts International Group had cash dividends of $220,000, a dividend payout ratio of 50% and shares outstanding of 400,000 shares. What is the company's earnings per share? Question 4 3.34 pts Gram Corp. is publicly-traded and its stock has a beta of 1.15. The expected return on the overall market is 7.0%. The current 20-year treasury rate is 2.0%. What is Gram's cost of equity using the CAPM? O 10.05% 0 7.75% O 9.0% 8.05% Question 9 3.34 pts You purchased a bond on January 1, 2018 which matures 7 years later on December 31st. The bond has a par value of $1,000, a stated coupon rate of 6.0% and pays interest semi-annually. On January 1, 2020, the bond sells for $928.50. What is its yield to maturity? Question 10 3.34 pts a Universal Digital, Inc. has a target capital structure of 65% common stock, 10% preferred stock, and 25% debt. It has a cost of equity using the CAPM of 12.0%, the preferred stock has a dividend stated rate of 3.0% and its current market yield is 3.5%, and it's outstanding bonds have a coupon of 7.0% and a yield to maturity of 7.5%. The company's tax rate is 25%. What is the company weighted average cost of capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started