Answered step by step

Verified Expert Solution

Question

1 Approved Answer

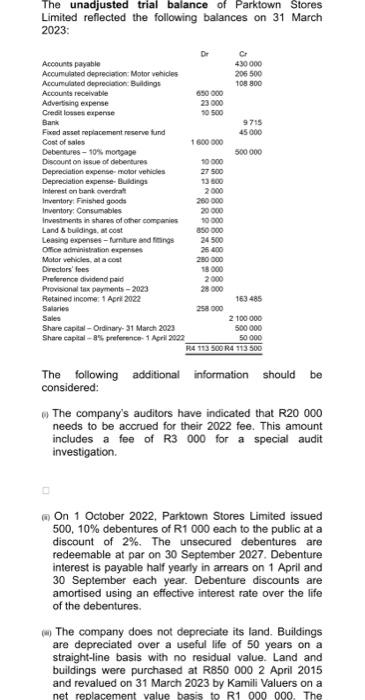

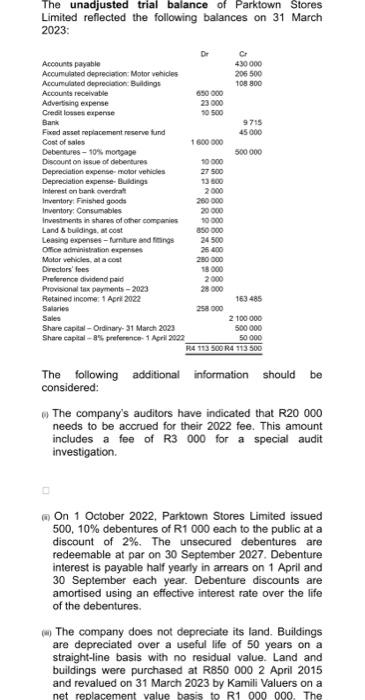

please do all the required The unadjusted trial balance of Parktown Stores Limited reflected the following balances on 31 March 2023: The following additional information

please do all the required

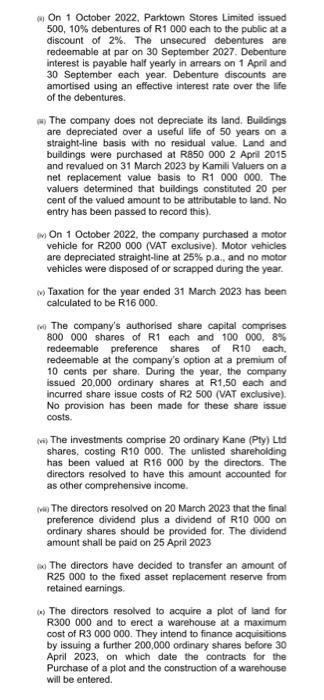

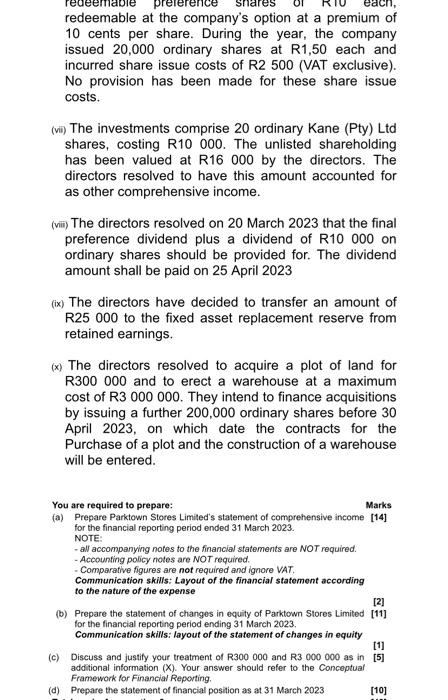

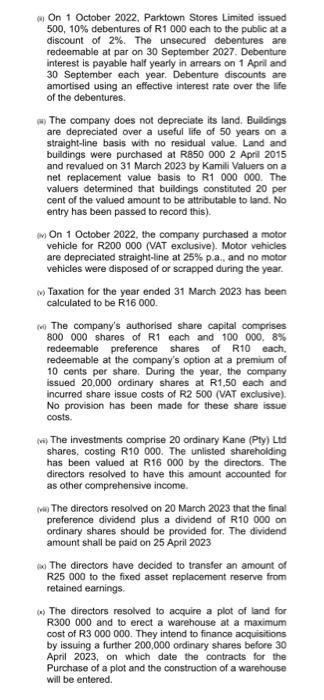

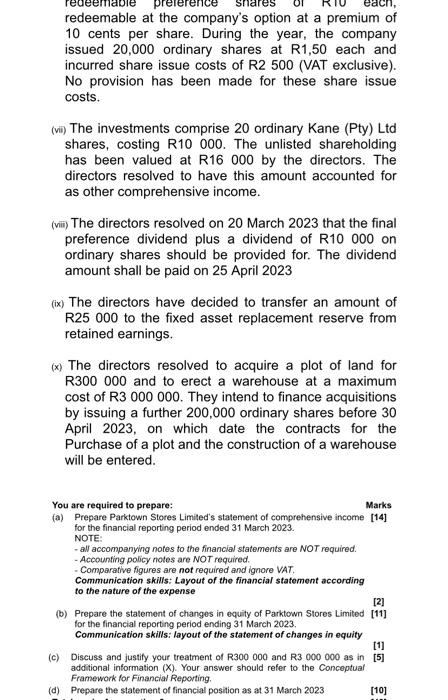

The unadjusted trial balance of Parktown Stores Limited reflected the following balances on 31 March 2023: The following additional information should be considered: (5) The company's auditors have indicated that R20 000 needs to be accrued for their 2022 fee. This amount includes a fee of R3 000 for a special audit investigation. (a) On 1 October 2022, Parktown Stores Limited issued 500,10% debentures of R1 000 each to the public at a discount of 2%. The unsecured debentures are redeemable at par on 30 September 2027. Debenture interest is payable half yearly in arrears on 1 April and 30 September each year. Debenture discounts are amortised using an effective interest rate over the life of the debentures. (ii) The company does not depreciate its land. Buildings are depreciated over a useful life of 50 years on a straight-line basis with no residual value. Land and buildings were purchased at R850 0002 April 2015 and revalued on 31 March 2023 by Kamili Valuers on a net replacement value basis to R1000000. The (i) On 1 October 2022, Parktown Stores Limited issued 500,10% debentures of R1 000 each to the public at a discount of 2%. The unsecured debentures are redeemable at par on 30 September 2027. Debenture interest is payable half yearly in arrears on 1 April and 30 September each year. Debenture discounts are amortised using an effective interest rate over the life of the debentures. (ii) The company does not depreciate its land. Bulldings are depreciated over a useful life of 50 years on a straight-line basis with no residual value. Land and buildings were purchased at R850 0002 April 2015 and revalued on 31 March 2023 by Kamili Valuers on a net replacement value basis to R1000000. The valuers determined that buildings constituted 20 per cent of the valued amount to be attributable to land. No entry has been passed to record this). (m) On 1 October 2022, the company purchased a motor vehicle for R200 000 (VAT exclusive). Motor vehicles are depreciated straight-line at 25% p.a., and no motor vehicles were disposed of or scrapped during the year. (m) Taxation for the year ended 31 March 2023 has been calculated to be R16 000 . (vi) The company's authorised share capital comprises 800000 shares of R1 each and 100000,8% redeemable preference shares of R10 each, redeemable at the company's option at a premium of 10 cents per share. During the year, the company issued 20,000 ordinary shares at R1,50 each and incurred share issue costs of R2 500 (VAT exclusive). No provision has been made for these share issue costs. (vi) The investments comprise 20 ordinary Kane (Pty) Ltd shares, costing R10 000. The unlisted shareholding has been valued at R16 000 by the directors. The directors resolved to have this amount accounted for as other comprehensive income. (vii) The directors resolved on 20 March 2023 that the final preference dividend plus a dividend of R10 000 on ordinary shares should be provided for. The dividend amount shall be paid on 25 April 2023 (b) The directors have decided to transfer an amount of R25 000 to the fixed asset replacement reserve from retained earnings. (4) The directors resolved to acquire a plot of land for R300000 and to erect a warehouse at a maximum cost of R3 000000 . They intend to finance acquisitions by issuing a further 200,000 ordinary shares before 30 April 2023, on which date the contracts for the Purchase of a plot and the construction of a warehouse will be entered. redeemable at the company's option at a premium of 10 cents per share. During the year, the company issued 20,000 ordinary shares at R1,50 each and incurred share issue costs of R2 500 (VAT exclusive). No provision has been made for these share issue costs. (vii) The investments comprise 20 ordinary Kane (Pty) Ltd shares, costing R10 000. The unlisted shareholding has been valued at R16 000 by the directors. The directors resolved to have this amount accounted for as other comprehensive income. (vii) The directors resolved on 20 March 2023 that the final preference dividend plus a dividend of R10 000 on ordinary shares should be provided for. The dividend amount shall be paid on 25 April 2023 (ix) The directors have decided to transfer an amount of R25 000 to the fixed asset replacement reserve from retained earnings. (x) The directors resolved to acquire a plot of land for R300 000 and to erect a warehouse at a maximum cost of R3 000000 . They intend to finance acquisitions by issuing a further 200,000 ordinary shares before 30 April 2023, on which date the contracts for the Purchase of a plot and the construction of a warehouse will be entered. You are required to prepare: Marks (a) Prepare Parktown Stores Limited's statement of comprehensive income [14] for the financial reporting period ended 31 March 2023. NOTE: - all accompanying notes to the financial statements are NOT required. - Accounting policy notes are NOT required. - Comparative figures are not required and ignore VAT. Communication skills: Layout of the financial statement according to the nature of the expense (b) Prepare the statement of changes in equity of Parktown Stores Limited for the financial reporting period ending 31 March 2023. Communication skills: layout of the statement of changes in equity (c) Discuss and justify your treatment of R300 000 and R3 000000 as in [2] [11] additional information (X). Your answer should refer to the Conceptual Framework for Financial Reporting. (d) Prepare the statement of financial position as at 31 March 2023 [1] [5] [10]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started