please do all the requirements

please do all the requirements

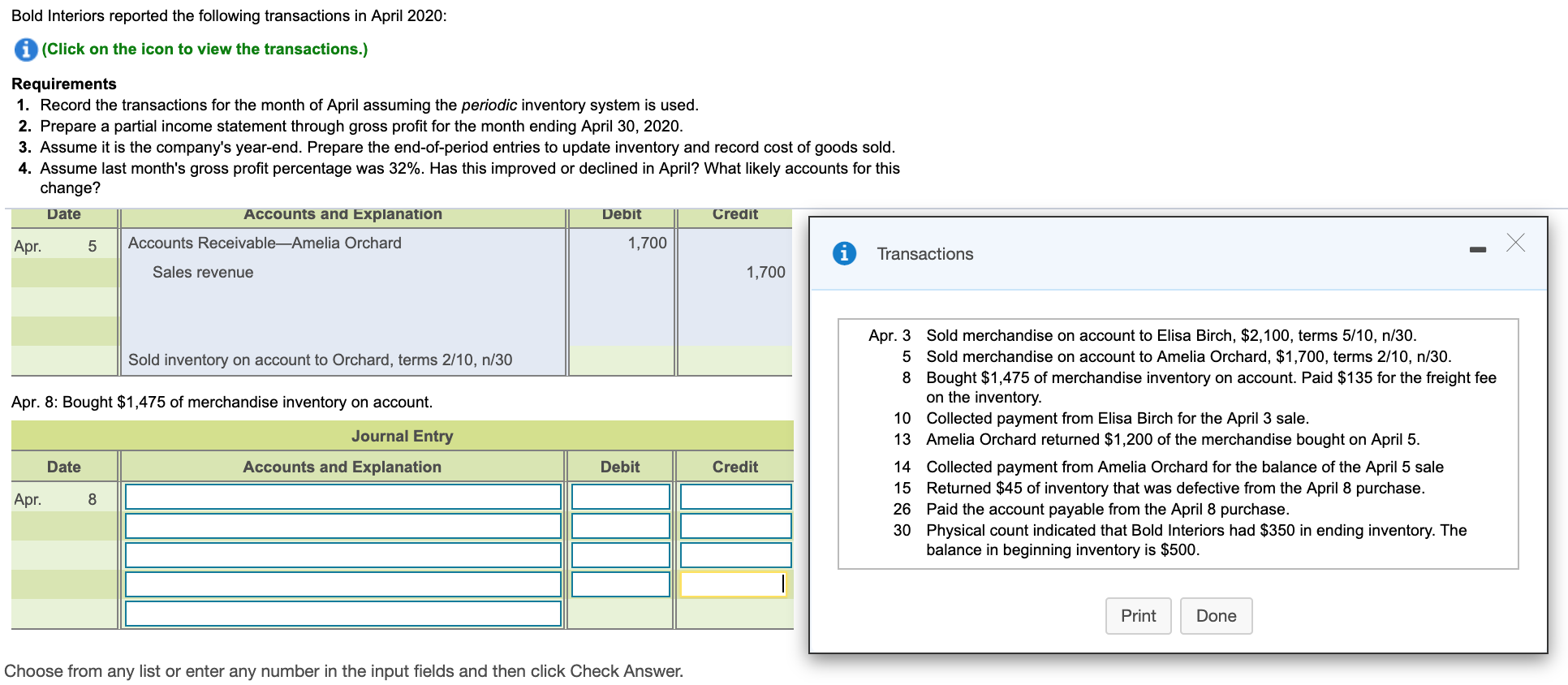

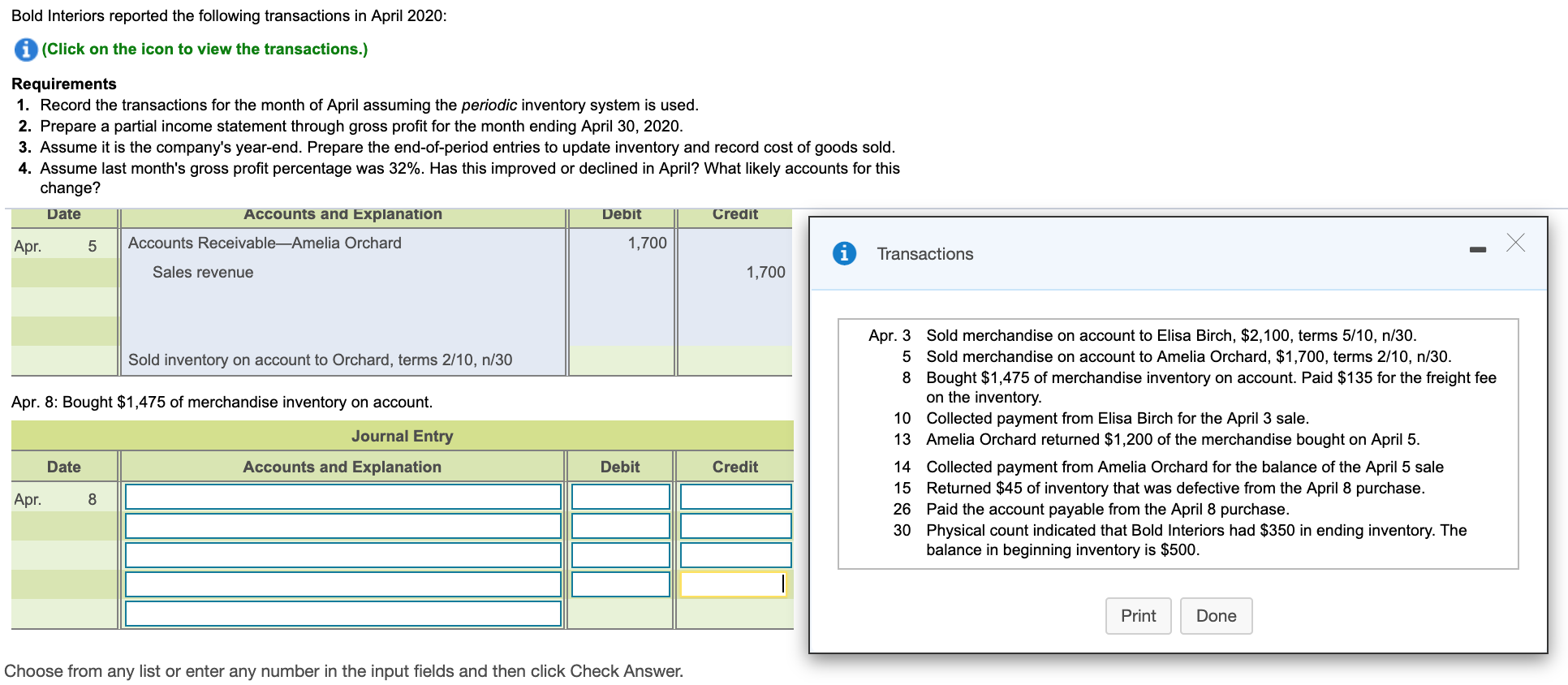

Bold Interiors reported the following transactions in April 2020: i (Click on the icon to view the transactions.) Requirements 1. Record the transactions for the month of April assuming the periodic inventory system is used. 2. Prepare a partial income statement through gross profit for the month ending April 30, 2020. 3. Assume it is the company's year-end. Prepare the end-of-period entries to update inventory and record cost of goods sold. 4. Assume last month's gross profit percentage was 32%. Has this improved or declined in April? What likely accounts for this change? Date Accounts and Explanation Debit Credit Apr. 5 Accounts ReceivableAmelia Orchard 1,700 Transactions Sales revenue 1,700 Sold inventory on account to Orchard, terms 2/10, n/30 Apr. 8: Bought $1,475 of merchandise inventory on account. Journal Entry Apr. 3 Sold merchandise on account to Elisa Birch, $2,100, terms 5/10, n/30. 5 Sold merchandise on account to Amelia Orchard, $1,700, terms 2/10, n/30. 8 Bought $1,475 of merchandise inventory on account. Paid $135 for the freight fee on the inventory. 10 Collected payment from Elisa Birch for the April 3 sale. 13 Amelia Orchard returned $1,200 of the merchandise bought on April 5. 14 Collected payment from Amelia Orchard for the balance of the April 5 sale 15 Returned $45 of inventory that was defective from the April 8 purchase. 26 Paid the account payable from the April 8 purchase. 30 Physical count indicated that Bold Interiors had $350 in ending inventory. The balance in beginning inventory is $500. Date Accounts and Explanation Debit Credit Apr. 8 1 Print Done Choose from any list or enter any number in the input fields and then click Check Answer. Bold Interiors reported the following transactions in April 2020: i (Click on the icon to view the transactions.) Requirements 1. Record the transactions for the month of April assuming the periodic inventory system is used. 2. Prepare a partial income statement through gross profit for the month ending April 30, 2020. 3. Assume it is the company's year-end. Prepare the end-of-period entries to update inventory and record cost of goods sold. 4. Assume last month's gross profit percentage was 32%. Has this improved or declined in April? What likely accounts for this change? Date Accounts and Explanation Debit Credit Apr. 5 Accounts ReceivableAmelia Orchard 1,700 Transactions Sales revenue 1,700 Sold inventory on account to Orchard, terms 2/10, n/30 Apr. 8: Bought $1,475 of merchandise inventory on account. Journal Entry Apr. 3 Sold merchandise on account to Elisa Birch, $2,100, terms 5/10, n/30. 5 Sold merchandise on account to Amelia Orchard, $1,700, terms 2/10, n/30. 8 Bought $1,475 of merchandise inventory on account. Paid $135 for the freight fee on the inventory. 10 Collected payment from Elisa Birch for the April 3 sale. 13 Amelia Orchard returned $1,200 of the merchandise bought on April 5. 14 Collected payment from Amelia Orchard for the balance of the April 5 sale 15 Returned $45 of inventory that was defective from the April 8 purchase. 26 Paid the account payable from the April 8 purchase. 30 Physical count indicated that Bold Interiors had $350 in ending inventory. The balance in beginning inventory is $500. Date Accounts and Explanation Debit Credit Apr. 8 1 Print Done Choose from any list or enter any number in the input fields and then click Check

please do all the requirements

please do all the requirements