Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do all When Resisto Systems, Inc., was formed, the company was authorized to issue 5,000 shares of $100 par value, 8 percent cumulative preferred

please do all

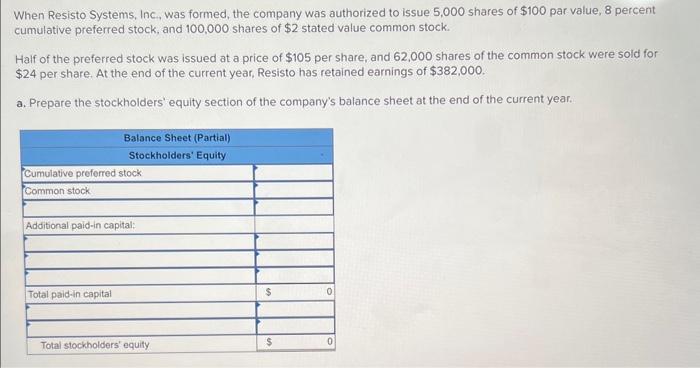

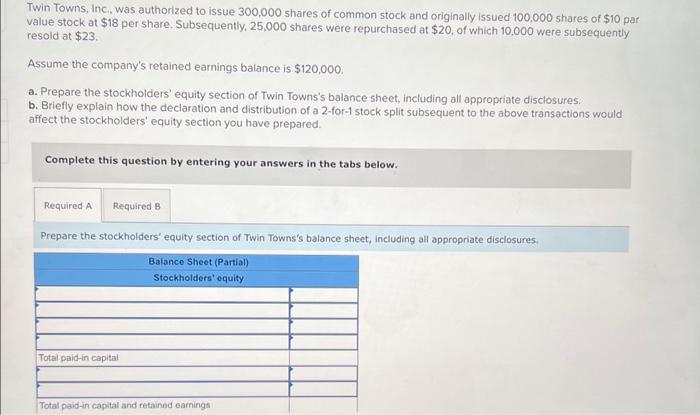

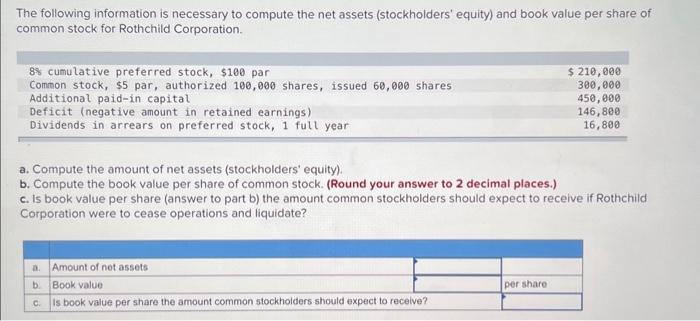

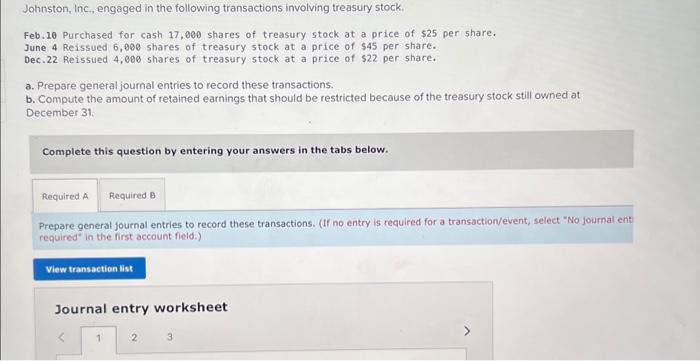

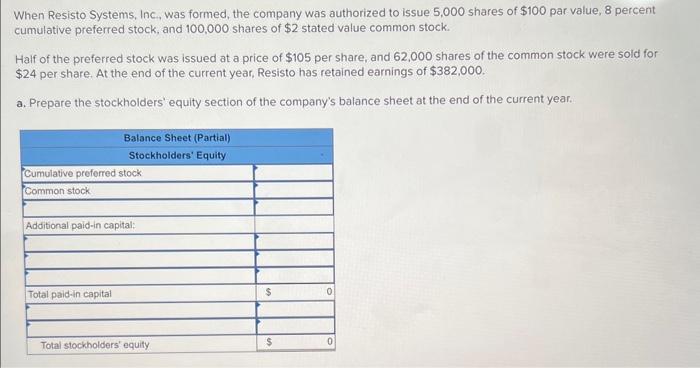

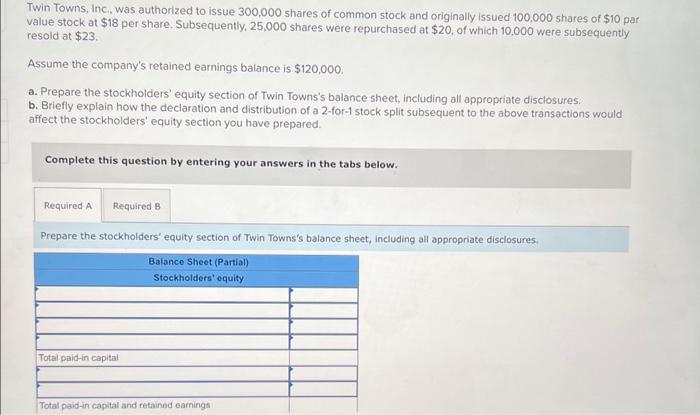

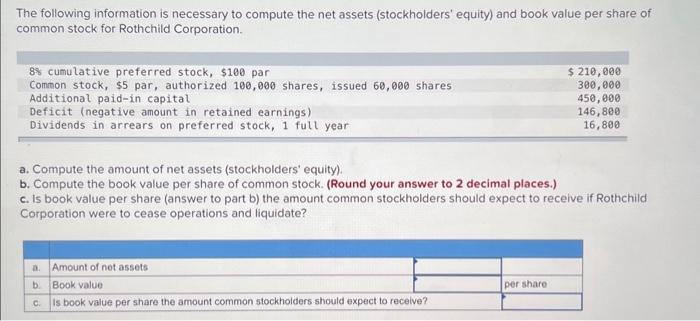

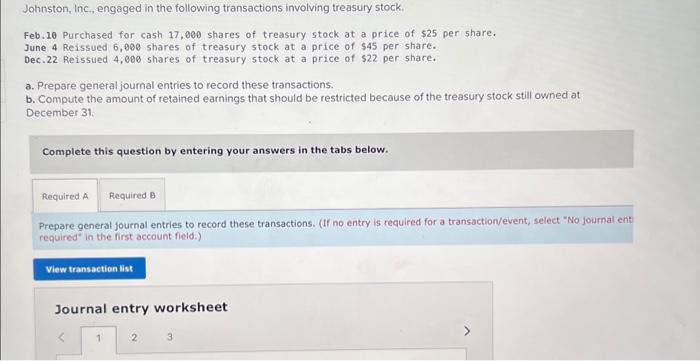

When Resisto Systems, Inc., was formed, the company was authorized to issue 5,000 shares of $100 par value, 8 percent cumulative preferred stock, and 100,000 shares of $2 stated value common stock. Half of the preferred stock was issued at a price of $105 per share, and 62,000 shares of the common stock were sold for $24 per share. At the end of the current year, Resisto has retained earnings of $382,000. a. Prepare the stockholders' equity section of the company's balance sheet at the end of the current year. Twin Towns, Inc, was authorized to issue 300,000 shares of common stock and originally issued 100,000 shares of $10 par value stock at $18 per share. Subsequently, 25,000 shares were repurchased at $20, of which 10,000 were subsequently resold at $23. Assume the company's retained earnings balance is $120,000. a. Prepare the stockholders' equity section of Twin Towns's balance sheet, including all appropriate disclosures. b. Briefly explain how the declaration and distribution of a 2 -for-1 stock split subsequent to the above transactions would affect the stockholders' equity section you have prepared. Complete this question by entering your answers in the tabs below. Prepare the stockholders' equity section of Twin Towns's balance sheet, including all appropriate disclosures. The following information is necessary to compute the net assets (stockholders' equity) and book value per share of common stock for Rothchild Corporation. a. Compute the amount of net assets (stockholders' equity). b. Compute the book value per share of common stock. (Round your answer to 2 decimal places.) c. Is book value per share (answer to part b) the amount common stockholders should expect to receive if Rothchild Corporation were to cease operations and liquidate? Johnston, Inc., engaged in the following transactions involving treasury stock. Feb.10 Purchased for cash 17,000 shares of treasury stock at a price of $25 per share. June 4 Reissued 6,008 shares of treasury stock at a price of $45 per share. Dec.22 Reissued 4,000 shares of treasury stock at a price of s22 per share. a. Prepare general journal entries to record these transactions. b. Compute the amount of retained earnings that should be restricted because of the treasury stock still owned at December 31. Complete this question by entering your answers in the tabs below. Prepare general journal entries to record these transactions. (If no entry is required for a transaction/event, select "No joumal ent required" in the first account field.) Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started