Please do both. I need help.

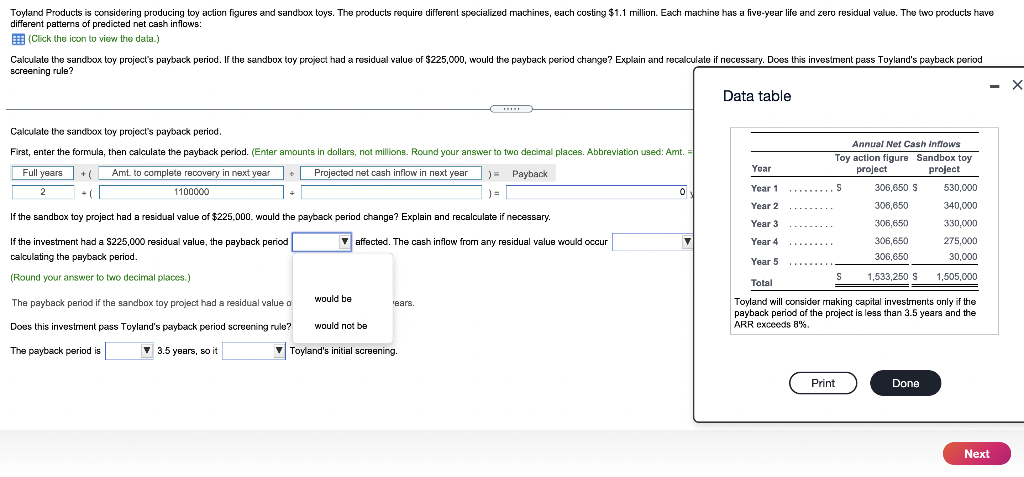

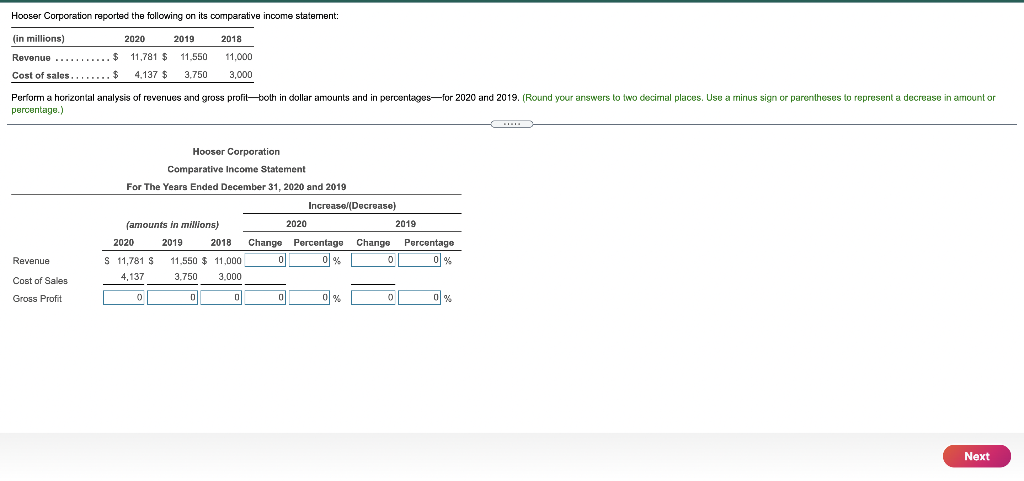

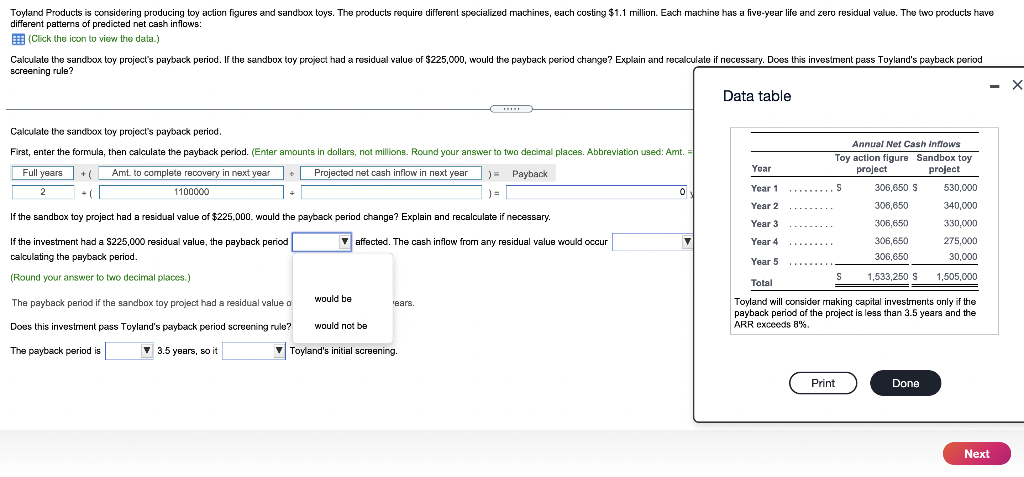

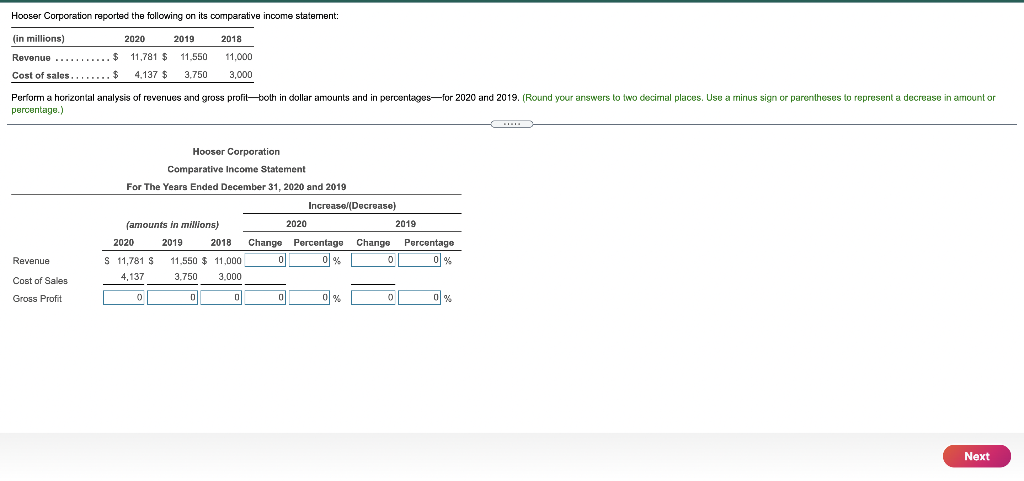

Toyland Products is considering producing toy action figures and sandbox toys. The products require different specialized machines, each costing $1.1 million. Each machine has a five-year life and zero residual value. The two products have different patterns of predicted net cash inflows: (Click the icon to view the data.) Calculate the sandbox toy project's payback period. If the sandbox toy project had a residual value of $225,000, would the payback period change? Explain and recalculate if necessary. Does this investment pass Toyland's payback period screening rule? - X Data table - Calculate the sandbox toy project's payback period. First, enter the formula, then calculate the payback period. (Enter amounts in dollars, not millions. Round your answer to two decimal places. Abbreviation used: Amt. = Full years +( Amt to complete recovery in next year . Projected net cash inflow in next year ) = Payback 2 1100000 ) = 0 + If the sandbox toy project had a residual value of $225,000. would the payback period change? Explain and recalculate if necessary. If the investment had a S225,000 residual value, the payback period affected. The cash inflow from any residual value would occur calculating the payback period. (Round your answer to two decimal places.) would be The payback period if the sandbox toy project had a residual value o 'ears. Does this investment pass Toyland's praytrack period screening rule? would not be The payback period is 3.5 years, so it , Toyland's initial screening. Annual Net Cash Inflows Toy action figure Sandbox toy Year project project Year 1 S 306,650 S 530,000 Year 2 308,650 340,000 Year 3 306,650 330.000 Year 4 306,650 275,000 306,650 30,000 Year 5 S 1533.250 S 1,505,000 Total Toyland will consider making capital investments only if the payback period of the project is less than 3.5 years and the ARR exceeds 8% Print Done Next Hooser Corporation reported the following on its comparative income statement: fin millions) 2020 2019 2018 Revenue ........... $ 11,781 $ 11,550 11,000 Cost of sales ........ $ $ 4.137 $ 3,750 3,000 Perform a horizontal analysis of revenues and gross profil both in dollar amounts and in percentages for 2020 and 2019. (Round your answers to two decimal places. Use a minus sign or parentheses to represent a decrease in amount or percentage.) Hooser Corporation Comparative Income Statement For The Years Ended December 31, 2020 and 2019 Increase/(Decrease) 2020 2019 Change famounts in millions) 2020 2019 2018 S 11,781 S 11,550 $ 11,000 4,137 3,750 3.000 Change Percentage 0 % Percentage 0% Revenue 0 Cost of Sales Gross Profit 0 D 0 0 0 % 0 0 % 0% Next