Answered step by step

Verified Expert Solution

Question

1 Approved Answer

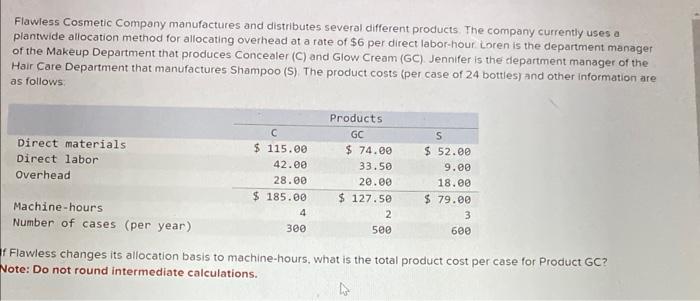

please do both parts Flawless Cosmetic Company manufactures and distributes several different products. The company currently uses a plantwide allocation method for allocating overhead at

please do both parts

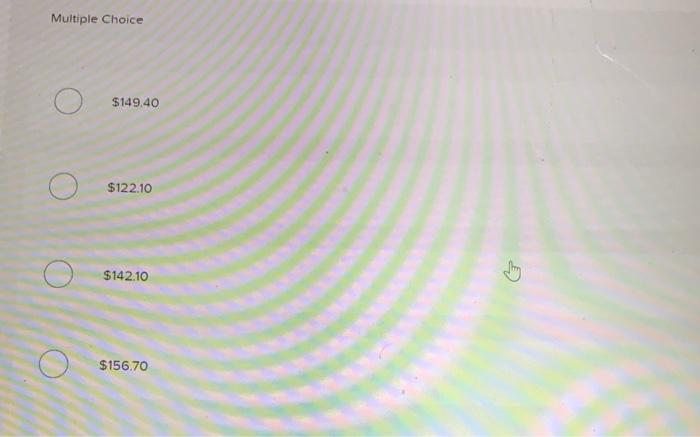

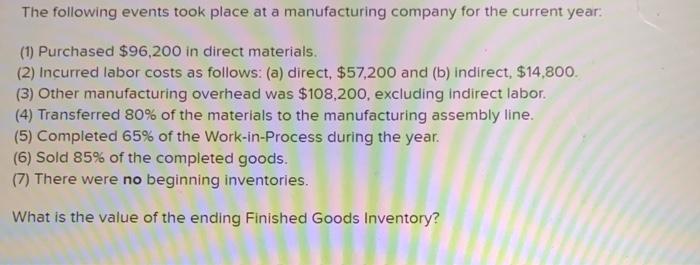

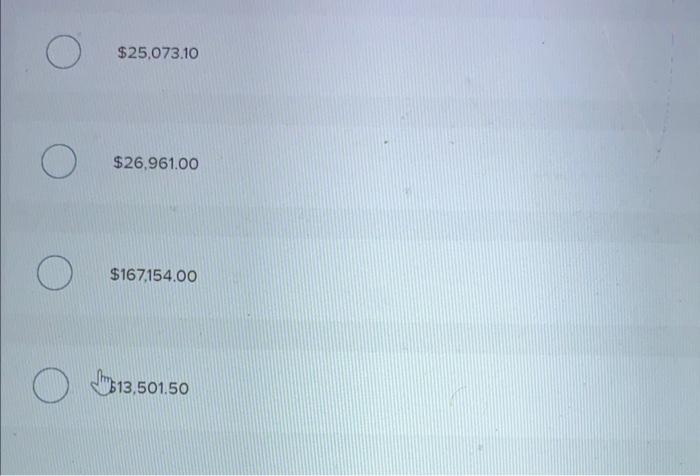

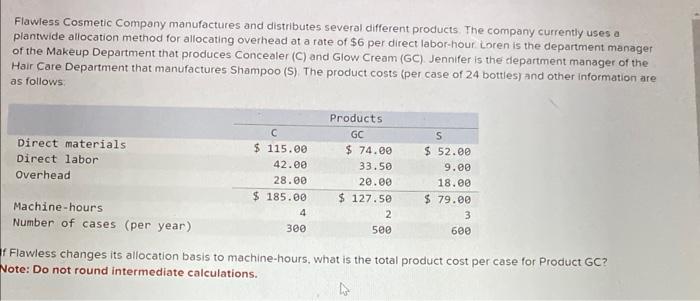

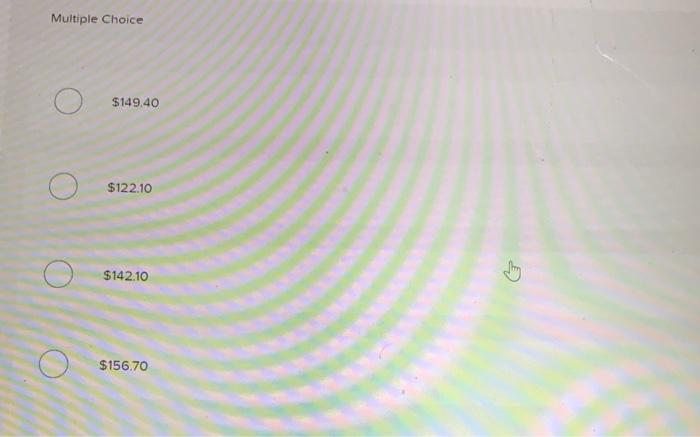

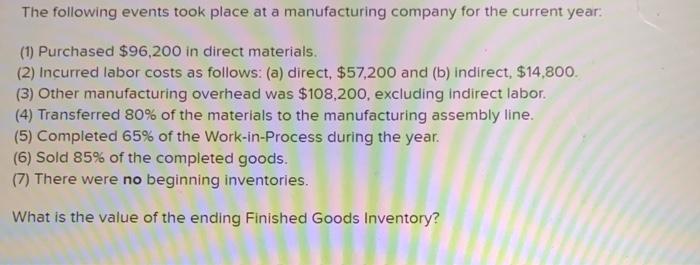

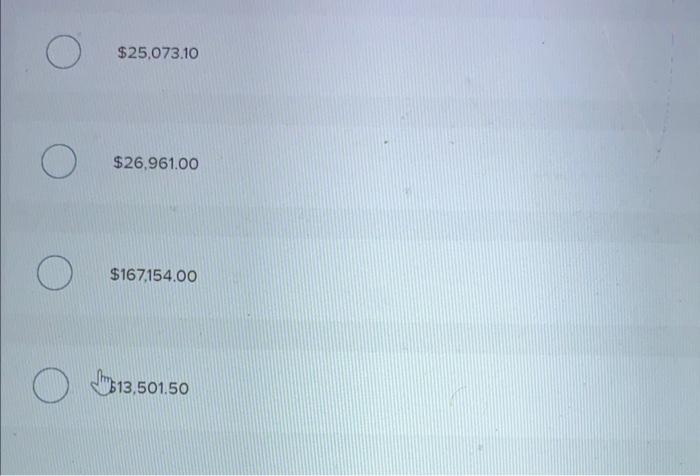

Flawless Cosmetic Company manufactures and distributes several different products. The company currently uses a plantwide allocation method for allocating overhead at a rate of $6 per direct labor-hour Loren is the department manager of the Makeup Department that produces Concealer (C) and Glow Cream (GC). Jennifer is the department manager of the Hair Care Department that manufactures Shampoo (S). The product costs (per case of 24 bottles) and other information are as follows: Flawless changes its allocation basis to machine-hours, what is the total product cost per case for Product GC? lote: Do not round intermediate calculations. Muitiple Choice $149.40 $122.10 $14210 $156.70 The following events took place at a manufacturing company for the current year: (1) Purchased $96,200 in direct materials. (2) Incurred labor costs as follows: (a) direct, $57,200 and (b) indirect, $14,800. (3) Other manufacturing overhead was $108,200, excluding indirect labor. (4) Transferred 80% of the materials to the manufacturing assembly line. (5) Completed 65% of the Work-in-Process during the year. (6) Sold 85% of the completed goods. (7) There were no beginning inventories. What is the value of the ending Finished Goods Inventory? $25.073.10 $26,961.00 $167,154.00 1713,501.50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started