Answered step by step

Verified Expert Solution

Question

1 Approved Answer

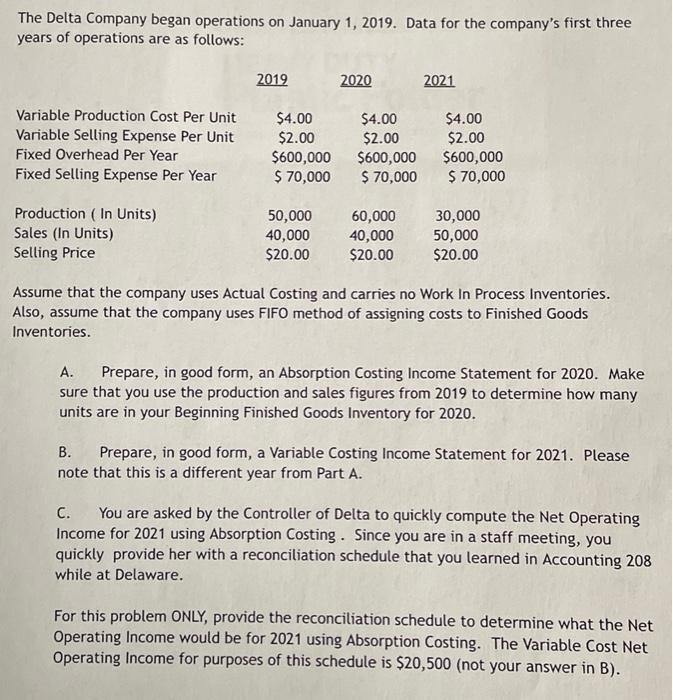

Please do both parts of C and explain it a little, thanks!! The Delta Company began operations on January 1, 2019. Data for the company's

Please do both parts of C and explain it a little, thanks!!

The Delta Company began operations on January 1, 2019. Data for the company's first three years of operations are as follows: Assume that the company uses Actual Costing and carries no Work In Process Inventories. Also, assume that the company uses FIFO method of assigning costs to Finished Goods Inventories. A. Prepare, in good form, an Absorption Costing Income Statement for 2020. Make sure that you use the production and sales figures from 2019 to determine how many units are in your Beginning Finished Goods Inventory for 2020. B. Prepare, in good form, a Variable Costing Income Statement for 2021. Please note that this is a different year from Part A. C. You are asked by the Controller of Delta to quickly compute the Net Operating Income for 2021 using Absorption Costing. Since you are in a staff meeting, you quickly provide her with a reconciliation schedule that you learned in Accounting 208 while at Delaware. For this problem ONLY, provide the reconciliation schedule to determine what the Net Operating Income would be for 2021 using Absorption Costing. The Variable Cost Net Operating Income for purposes of this schedule is $20,500 (not your answer in B)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started