Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do both questions please in 30 minutes will upvote 6 points McHan Company's common stock currently sells for $40 per share and the company

please do both questions please in 30 minutes will upvote

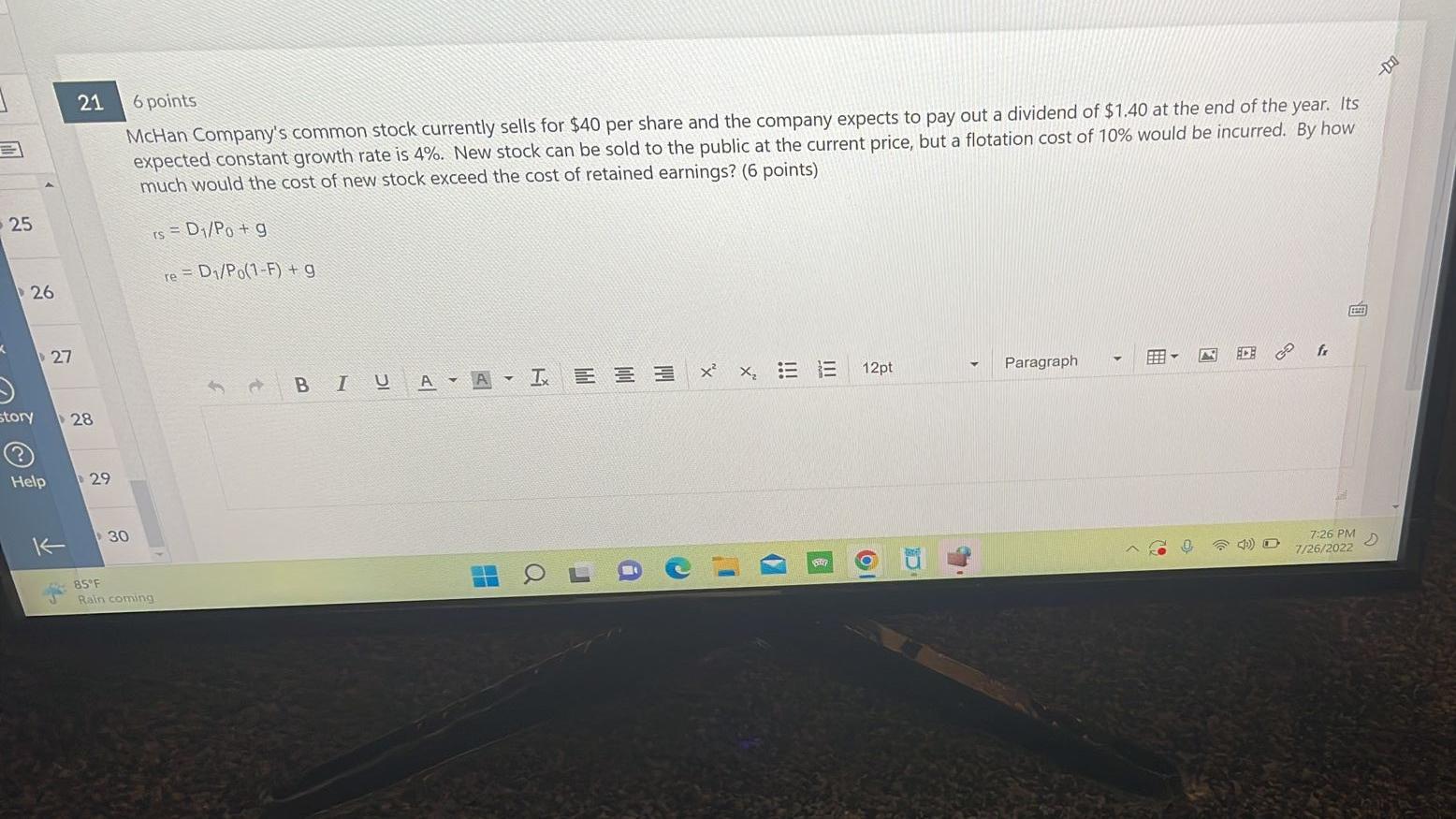

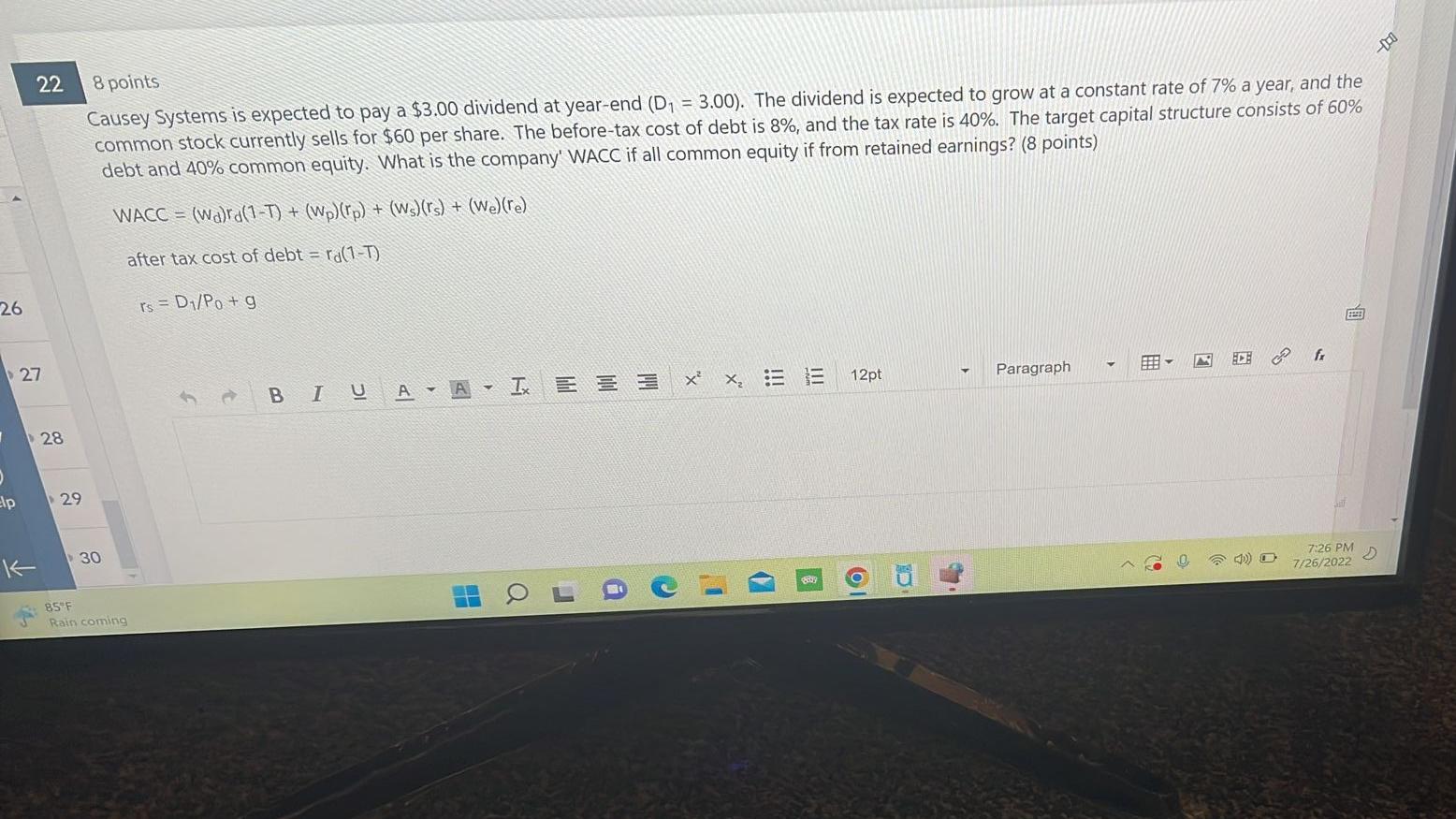

6 points McHan Company's common stock currently sells for $40 per share and the company expects to pay out a dividend of $1.40 at the end of the year. Its expected constant growth rate is 4%. New stock can be sold to the public at the current price, but a flotation cost of 10% would be incurred. By how much would the cost of new stock exceed the cost of retained earnings? ( 6 points) 8 points Causey Systems is expected to pay a $3.00 dividend at year-end (D1=3.00). The dividend is expected to grow at a constant rate of 7% a year, and the common stock currently sells for $60 per share. The before-tax cost of debt is 8%, and the tax rate is 40%. The target capits 60% debt and 40% common equity. What is the company' WACC if all common equity if from retained earnings? (8 points) WACC=(wd)rd(1T)+(wp)(rp)+(ws)(rs)+(we)(re) after tax cost of debt =rd(1T) rs=D1/P0+gStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started