Answered step by step

Verified Expert Solution

Question

1 Approved Answer

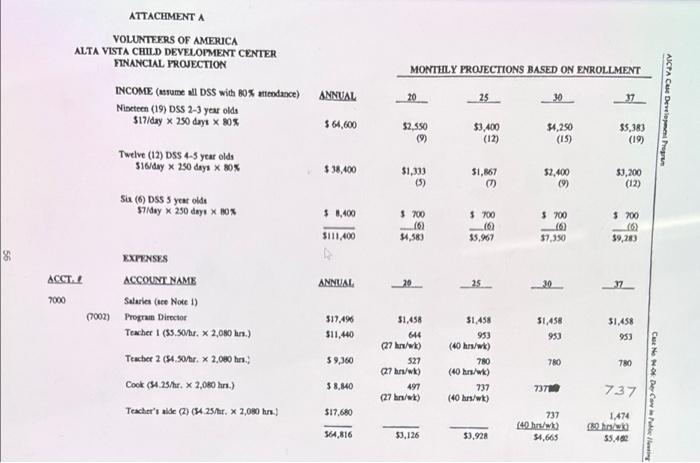

please do CVP analyses and assessment ATTACHMENTA VOLUNTEERS OF AMERICA ALTA VISTA CHILD DEVELOPMENT CENTER FINANCIAL PROJECTION INCOME (nume all DSS with 80% attendance) ANNUAL

please do CVP analyses and assessment

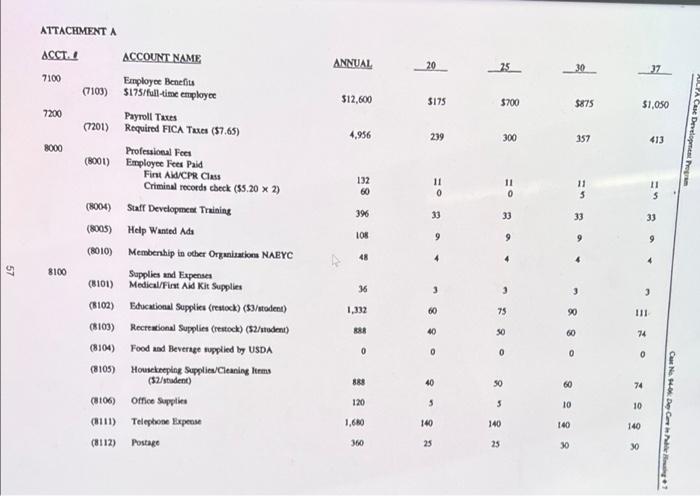

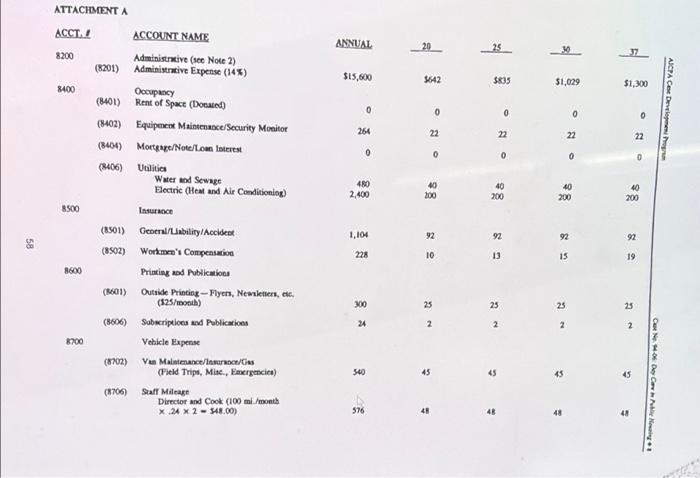

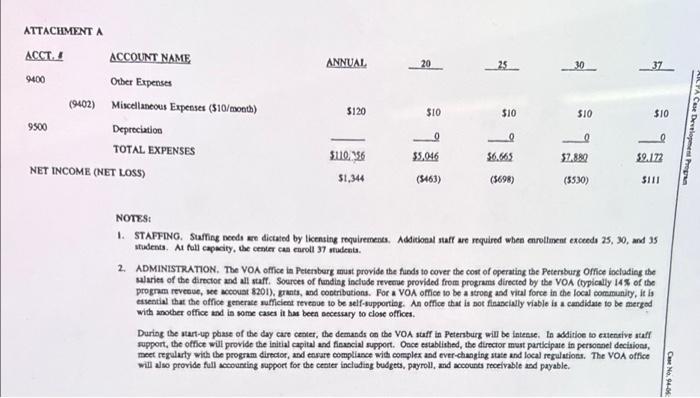

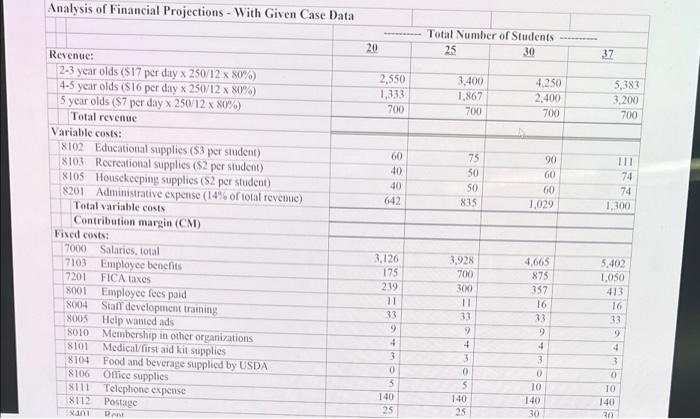

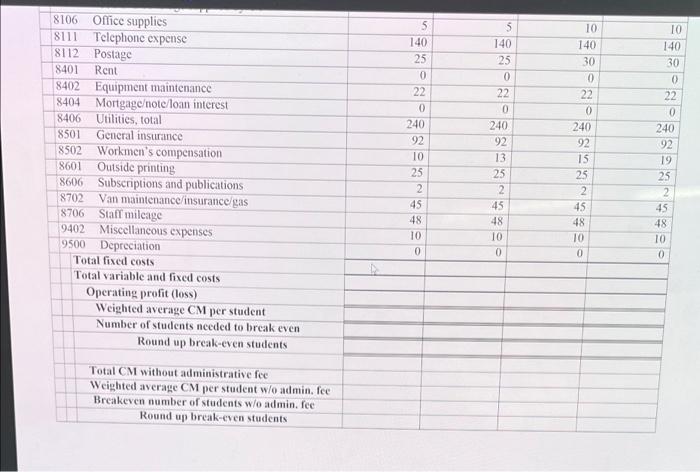

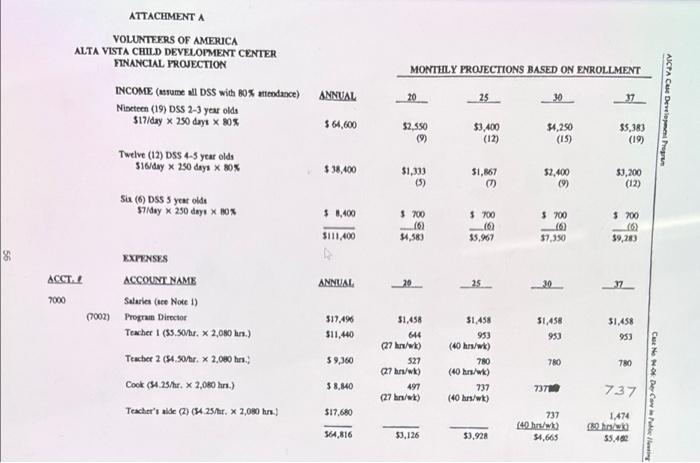

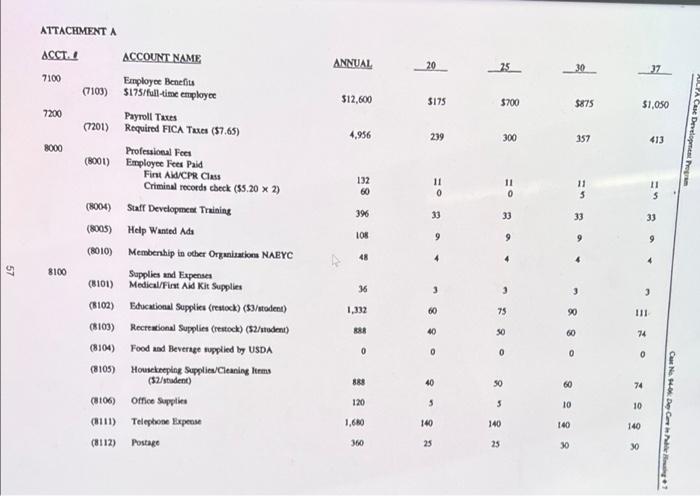

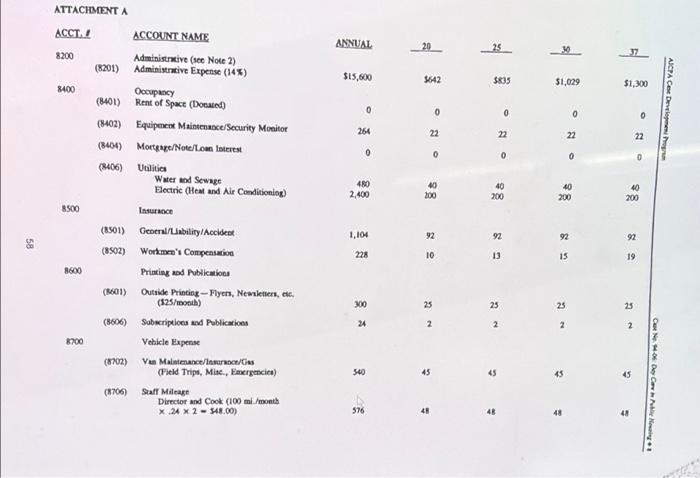

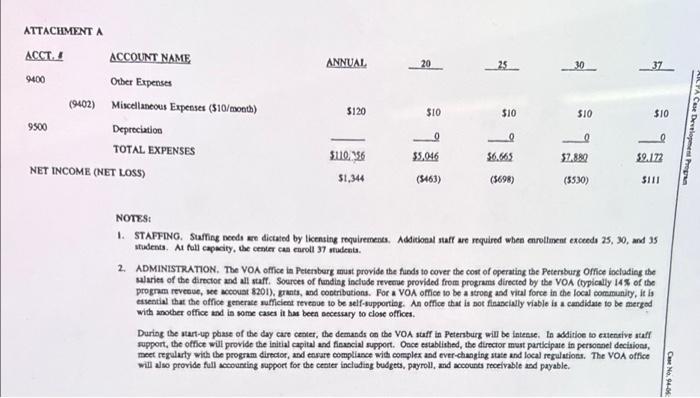

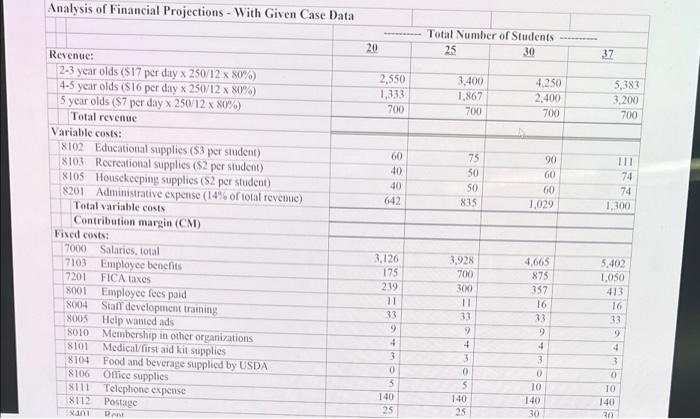

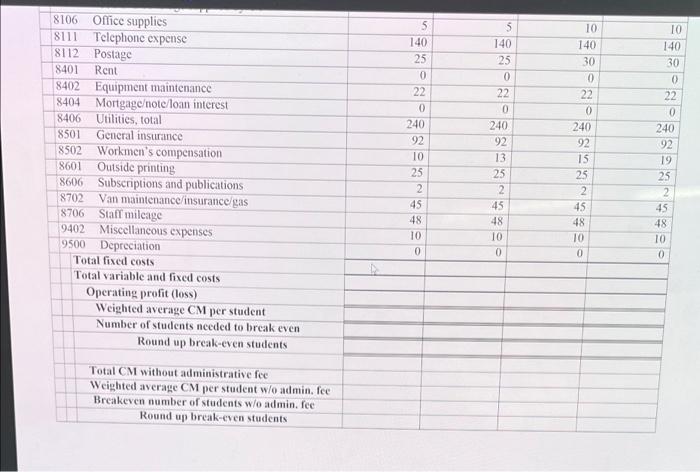

ATTACHMENTA VOLUNTEERS OF AMERICA ALTA VISTA CHILD DEVELOPMENT CENTER FINANCIAL PROJECTION INCOME (nume all DSS with 80% attendance) ANNUAL Nineteen (19) DSS 2-3 year olds 517/day x 250 dayt x 80% $ 64,600 MONTELY PROJECTIONS BASED ON ENROLLMENT 25 AICPA Case Devil $2,550 (9) $3,400 (12) $4,250 (15) $5,383 (19) Twelve (12) DSS 4-5 year olds 516/day 250 days X BOX $38,400 $1,333 (5) $1,867 (0) 52,400 (9) $3,200 (12) Six (6) DSS 5 year old 57/day 250 day! X 80% $ 8,400 $ 200 16 $ 700 16) $5,967 $ 700 (6) 57.350 3 700 (6 59,283 $111,400 14.589 18 ANNUAL ACCT 7000 25 30 37 EXPENSES ACCOUNT NAME Salaries (sce Note 1) (7002) Program Director Teacher I ($5.50/hr. x 2,080 hn.) Teacher 2 ($1.500r. * 2,080 hrs Cook (34.257r. * 2,080 hr.) Teacher's aide () (54.25/tur. * 2,080 hrs.) 317.4% 311,440 51,458 953 31,458 953 59,360 51.458 64 (27 hrs/wk) 527 (27 hr/wk) 497 (27 hr/) 31.458 953 (40 hrs/wk) 780 (40 hrs/wk) 737 (40 hrs/wk) 780 780 CN No De Can 58,840 737 737 $17.680 1,474 737 (40.hr/w) 54,665 564,816 53,126 53.928 55.462 ANNUAL 20 25_ 30 37 312,600 $175 5700 $875 $1,050 4.956 239 300 ALPA Case Daten en og 357 413 132 60 11 0 = 11 5 11 396 33 33 33 33 ATTACHMENT A ACCT. ACCOUNT NAME 7100 Employee Benefits (7105) $175/full-time employee 7200 Payroll Taxes (7201) Required FICA Taxe (57.65) 8000 Professional Fees (3001) Employee Fees Paid Fint A/CPR Class Criminal records check (35.20 x 2) (8000) Staff Development Training (8005) HelpWanted Ads (8010) Membership in other Organisations NAEYC 8100 Supplies and Expenses (101) Medical/First Aid Kit Supplies (8102) Educational Supplies (restock) (53/todent) (310) Recreational Supplies (restock) (52/madent) (3104) Food and Beverage supplied by USDA (8105) Housekeeping Supplies Cleaning kems (52/student) (3106) Office Supplies (11) Telephone Expete (8112) Postage 108 9 9 9 48 4 4 57 36 3 3 3 3 1,332 60 75 90 111 40 SO 60 74 0 0 0 0 0 0 C D 888 40 50 60 74 120 3 5 10 10 1.680 140 140 140 140 360 25 25 10 90 ANNUAL 20 _ 25 $15,600 5642 $635 $1,029 $1,300 AICPA Cer Devel 0 0 0 0 0 264 22 22 22 22 0 0 0 0 0 0 480 2,400 40 200 40 200 40 200 40 200 ATTACHMENTA ACCT. ACCOUNT NAME 8200 Administrative (se Note 2) (8201) Administrative Expense (14) 8400 Occupancy (8401) Rent of Space (Donated) (3402) Equipement Maintenance/ Security Monitor (404) Mortexpe/Note/Loan Interest (M406) Utilities Water and Sewage Electric (Heat and Air Conditioning) 8500 InCE (8501) General/Liability Accident (8502) Work's Compensation Printing and Publications (1601) Outside Printing -- Flyers, Newsletters, etc. (525) (8606) Saberiptions Rond Publications 8200 Vehicle Expense (8702) Van Maintenance/ IGR/Gas (Field Trips, Misc., Energia) (8706) Staff Mileage Director and Cook (100 ml./month x 24 x 2448.00) 1.104 92 92 92 92 58 228 10 13 15 19 8600 200 25 25 25 25 24 2 2 2 2 540 45 45 45 45 - Det 576 45 48 48 13 ATTACHMENT A ACCT ANNUAL - 20 25 30 37 9400 ACCOUNT NAME Other Expenses (9402) Miscellaneous Expenses (510/month) 9500 Depreciation TOTAL EXPENSES NET INCOME (NET LOSS) $120 $10 $10 $10 $10 ALPA Case Development pro 0 93 0 $9.172 $5.046 $6.65 2.880 $10.956 $1,344 (5463) (5698) (5530) $111 NOTES: 1. STAFFING. Suffing needs a dictated by licensing requirements. Additional staff are required when enrollment exceeds 25, 30, and 15 students. Al full capacity, the center can enroll 37 students 2. ADMINISTRATION. The VOA office in Petersburg must provide the funds to cover the cost of operating the Peterburg Office including the salaries of the director and all staff. Sources of funding include revenue provided from programs directed by the VOA (typically 14% of the program revenue, se account 8201), prants, and contributions. For a VOA office to be a strong and vital force in the local community, it is essential that the office generate sufficient revenue to be self-supporting An office that is not financially viable is a candidate to be merged with another office and in some cases it has been accessary to close offices. During the start-up phase of the day care center, the demands on the VOA staff in Petersburg will be intense. In additioe to extensive staff support the office will provide the initial capital and financial support. Once established, the director must participate in personnel decisions, meet regularly with the program director, and ensure compliance with complex and ever-changing state and local regulations. The VOA office will also provide full accounting support for the center including budgets, payroll and accounts receivable and payable. Case No. Analysis of Financial Projections - With Given Case Data 20 Total Number of Students 25 30 37 2,550 1,333 700 3,400 1,867 700 4.250 2,400 700 5,383 3.200 700 1 60 40 40 642 75 50 SO 835 90 60 60 1,029 111 74 74 1.300 Revenue: 2-3 year olds ($17 per day x 250/12 x 80%) 4-5 year olds (S16 per day x 250/12 x 80%) 5 year olds (87 per day x 250/12 x 80%) Total revenue Variable costs: 8102 Educational supplies (53 per student) 8103 Recreational supplies ($2 per student) 8105 Housekeeping supplies (52 per student) 8201 Administrative expense (14% of total revenue) Total variable costs Contribution margin (CM) Fixed costs: 7000 Salaries, total 7103 Employee benefits 7201 FICA taxes 800! Employee fees paid 8004 Staff development training 8005 Help wanted ads 8010 Membership in other organizations 8101 Medical first aid kit supplies 8104 Food and beverage supplied by USDA 8106 Office supplies 8111 Telephone expense 8112 Postage 3.928 700 300 11 33 5,402 1.050 413 16 33 3.126 175 219 11 33 9 4 3 0 5 140 25 4,663 875 357 16 33 2 4 31 0 10 140 30 9 4 4 3 0 5 3 0 10 140 30 140 D 25 8106 Office supplies 8111 Telephone expense 8112 Postage 8401 Rent 8402 Equipment maintenance 8404 Mortgageote/loan interest 8406 Utilities, total 8501 Gencral insurance 8502 Workmen's compensation 8601 Outside printing 8606 Subscriptions and publications 8702 Van maintenance/insurance/gas 8706 Staff milcage 9402 Miscellaneous expenses 9500 Depreciation Total fixed costs Total variable and fixed costs Operating profit (loss) Weighted average CM per student Number of students needed to break even Round up break-even students 5 140 25 0 22 0 240 92 10 25 2 45 48 10 0 5 140 25 0 22 0 240 92 13 25 2 45 48 10 0 10 140 30 0 22 0 240 92 15 25 2 45 48 10 0 10 140 30 0 22 0 240 92 19 25 2 45 48 10 0 Total CM without administrative fee Weighted average CM per student w/o admin, fee Breakeven number of students w/o admin. fee Round up break-even students ATTACHMENTA VOLUNTEERS OF AMERICA ALTA VISTA CHILD DEVELOPMENT CENTER FINANCIAL PROJECTION INCOME (nume all DSS with 80% attendance) ANNUAL Nineteen (19) DSS 2-3 year olds 517/day x 250 dayt x 80% $ 64,600 MONTELY PROJECTIONS BASED ON ENROLLMENT 25 AICPA Case Devil $2,550 (9) $3,400 (12) $4,250 (15) $5,383 (19) Twelve (12) DSS 4-5 year olds 516/day 250 days X BOX $38,400 $1,333 (5) $1,867 (0) 52,400 (9) $3,200 (12) Six (6) DSS 5 year old 57/day 250 day! X 80% $ 8,400 $ 200 16 $ 700 16) $5,967 $ 700 (6) 57.350 3 700 (6 59,283 $111,400 14.589 18 ANNUAL ACCT 7000 25 30 37 EXPENSES ACCOUNT NAME Salaries (sce Note 1) (7002) Program Director Teacher I ($5.50/hr. x 2,080 hn.) Teacher 2 ($1.500r. * 2,080 hrs Cook (34.257r. * 2,080 hr.) Teacher's aide () (54.25/tur. * 2,080 hrs.) 317.4% 311,440 51,458 953 31,458 953 59,360 51.458 64 (27 hrs/wk) 527 (27 hr/wk) 497 (27 hr/) 31.458 953 (40 hrs/wk) 780 (40 hrs/wk) 737 (40 hrs/wk) 780 780 CN No De Can 58,840 737 737 $17.680 1,474 737 (40.hr/w) 54,665 564,816 53,126 53.928 55.462 ANNUAL 20 25_ 30 37 312,600 $175 5700 $875 $1,050 4.956 239 300 ALPA Case Daten en og 357 413 132 60 11 0 = 11 5 11 396 33 33 33 33 ATTACHMENT A ACCT. ACCOUNT NAME 7100 Employee Benefits (7105) $175/full-time employee 7200 Payroll Taxes (7201) Required FICA Taxe (57.65) 8000 Professional Fees (3001) Employee Fees Paid Fint A/CPR Class Criminal records check (35.20 x 2) (8000) Staff Development Training (8005) HelpWanted Ads (8010) Membership in other Organisations NAEYC 8100 Supplies and Expenses (101) Medical/First Aid Kit Supplies (8102) Educational Supplies (restock) (53/todent) (310) Recreational Supplies (restock) (52/madent) (3104) Food and Beverage supplied by USDA (8105) Housekeeping Supplies Cleaning kems (52/student) (3106) Office Supplies (11) Telephone Expete (8112) Postage 108 9 9 9 48 4 4 57 36 3 3 3 3 1,332 60 75 90 111 40 SO 60 74 0 0 0 0 0 0 C D 888 40 50 60 74 120 3 5 10 10 1.680 140 140 140 140 360 25 25 10 90 ANNUAL 20 _ 25 $15,600 5642 $635 $1,029 $1,300 AICPA Cer Devel 0 0 0 0 0 264 22 22 22 22 0 0 0 0 0 0 480 2,400 40 200 40 200 40 200 40 200 ATTACHMENTA ACCT. ACCOUNT NAME 8200 Administrative (se Note 2) (8201) Administrative Expense (14) 8400 Occupancy (8401) Rent of Space (Donated) (3402) Equipement Maintenance/ Security Monitor (404) Mortexpe/Note/Loan Interest (M406) Utilities Water and Sewage Electric (Heat and Air Conditioning) 8500 InCE (8501) General/Liability Accident (8502) Work's Compensation Printing and Publications (1601) Outside Printing -- Flyers, Newsletters, etc. (525) (8606) Saberiptions Rond Publications 8200 Vehicle Expense (8702) Van Maintenance/ IGR/Gas (Field Trips, Misc., Energia) (8706) Staff Mileage Director and Cook (100 ml./month x 24 x 2448.00) 1.104 92 92 92 92 58 228 10 13 15 19 8600 200 25 25 25 25 24 2 2 2 2 540 45 45 45 45 - Det 576 45 48 48 13 ATTACHMENT A ACCT ANNUAL - 20 25 30 37 9400 ACCOUNT NAME Other Expenses (9402) Miscellaneous Expenses (510/month) 9500 Depreciation TOTAL EXPENSES NET INCOME (NET LOSS) $120 $10 $10 $10 $10 ALPA Case Development pro 0 93 0 $9.172 $5.046 $6.65 2.880 $10.956 $1,344 (5463) (5698) (5530) $111 NOTES: 1. STAFFING. Suffing needs a dictated by licensing requirements. Additional staff are required when enrollment exceeds 25, 30, and 15 students. Al full capacity, the center can enroll 37 students 2. ADMINISTRATION. The VOA office in Petersburg must provide the funds to cover the cost of operating the Peterburg Office including the salaries of the director and all staff. Sources of funding include revenue provided from programs directed by the VOA (typically 14% of the program revenue, se account 8201), prants, and contributions. For a VOA office to be a strong and vital force in the local community, it is essential that the office generate sufficient revenue to be self-supporting An office that is not financially viable is a candidate to be merged with another office and in some cases it has been accessary to close offices. During the start-up phase of the day care center, the demands on the VOA staff in Petersburg will be intense. In additioe to extensive staff support the office will provide the initial capital and financial support. Once established, the director must participate in personnel decisions, meet regularly with the program director, and ensure compliance with complex and ever-changing state and local regulations. The VOA office will also provide full accounting support for the center including budgets, payroll and accounts receivable and payable. Case No. Analysis of Financial Projections - With Given Case Data 20 Total Number of Students 25 30 37 2,550 1,333 700 3,400 1,867 700 4.250 2,400 700 5,383 3.200 700 1 60 40 40 642 75 50 SO 835 90 60 60 1,029 111 74 74 1.300 Revenue: 2-3 year olds ($17 per day x 250/12 x 80%) 4-5 year olds (S16 per day x 250/12 x 80%) 5 year olds (87 per day x 250/12 x 80%) Total revenue Variable costs: 8102 Educational supplies (53 per student) 8103 Recreational supplies ($2 per student) 8105 Housekeeping supplies (52 per student) 8201 Administrative expense (14% of total revenue) Total variable costs Contribution margin (CM) Fixed costs: 7000 Salaries, total 7103 Employee benefits 7201 FICA taxes 800! Employee fees paid 8004 Staff development training 8005 Help wanted ads 8010 Membership in other organizations 8101 Medical first aid kit supplies 8104 Food and beverage supplied by USDA 8106 Office supplies 8111 Telephone expense 8112 Postage 3.928 700 300 11 33 5,402 1.050 413 16 33 3.126 175 219 11 33 9 4 3 0 5 140 25 4,663 875 357 16 33 2 4 31 0 10 140 30 9 4 4 3 0 5 3 0 10 140 30 140 D 25 8106 Office supplies 8111 Telephone expense 8112 Postage 8401 Rent 8402 Equipment maintenance 8404 Mortgageote/loan interest 8406 Utilities, total 8501 Gencral insurance 8502 Workmen's compensation 8601 Outside printing 8606 Subscriptions and publications 8702 Van maintenance/insurance/gas 8706 Staff milcage 9402 Miscellaneous expenses 9500 Depreciation Total fixed costs Total variable and fixed costs Operating profit (loss) Weighted average CM per student Number of students needed to break even Round up break-even students 5 140 25 0 22 0 240 92 10 25 2 45 48 10 0 5 140 25 0 22 0 240 92 13 25 2 45 48 10 0 10 140 30 0 22 0 240 92 15 25 2 45 48 10 0 10 140 30 0 22 0 240 92 19 25 2 45 48 10 0 Total CM without administrative fee Weighted average CM per student w/o admin, fee Breakeven number of students w/o admin. fee Round up break-even students

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started