Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do d,e in one hour will be upvote Problem C3: Binomial Trees Consider a stock which currently sells for $105. Assume that during each

please do d,e in one hour will be upvote

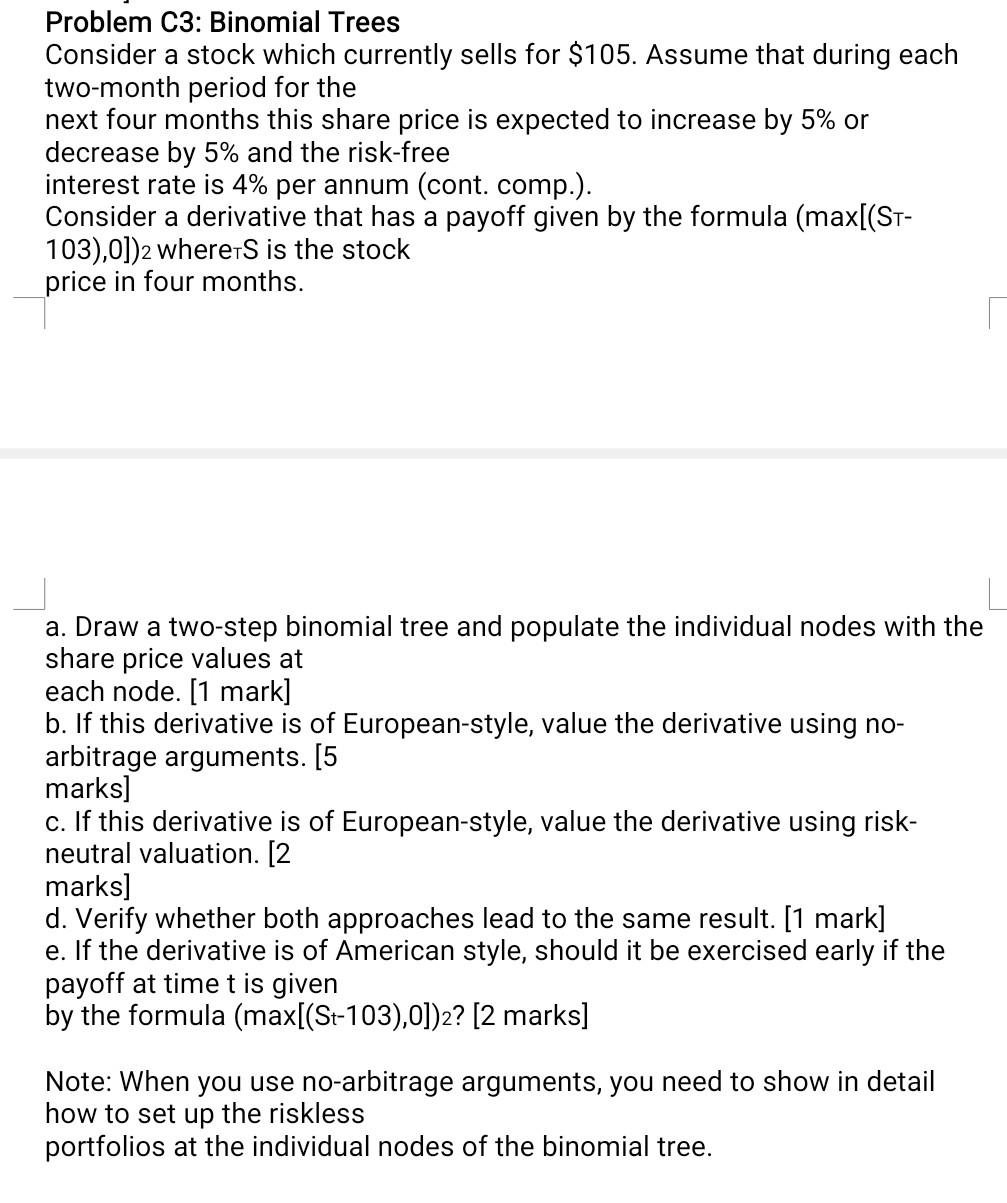

Problem C3: Binomial Trees Consider a stock which currently sells for $105. Assume that during each two-month period for the next four months this share price is expected to increase by 5% or decrease by 5% and the risk-free interest rate is 4% per annum (cont. comp.). Consider a derivative that has a payoff given by the formula (max[(ST103),0]) 2 where TS is the stock price in four months. a. Draw a two-step binomial tree and populate the individual nodes with the share price values at each node. [1 mark] b. If this derivative is of European-style, value the derivative using noarbitrage arguments. [5 marks] c. If this derivative is of European-style, value the derivative using riskneutral valuation. [2 marks] d. Verify whether both approaches lead to the same result. [1 mark] e. If the derivative is of American style, should it be exercised early if the payoff at time t is given by the formula (max[(St-103),0])2? [2 marks] Note: When you use no-arbitrage arguments, you need to show in detail how to set up the riskless portfolios at the individual nodes of the binomial treeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started