Please do E7-5, E7-10, and P7-1.

Please do E7-5, E7-10, and P7-1.

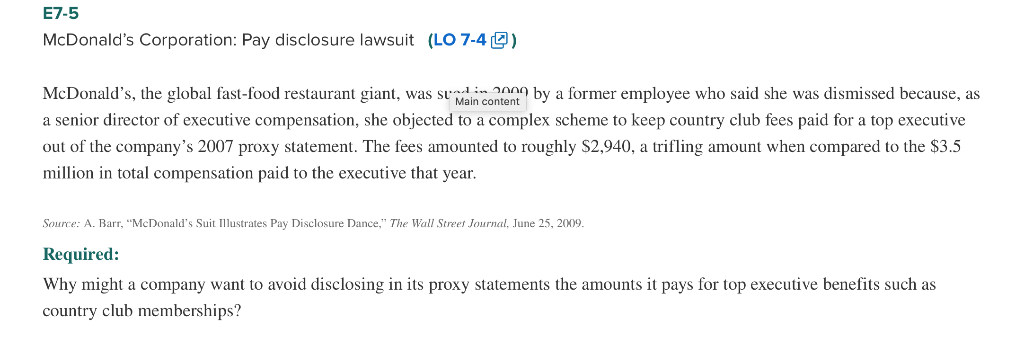

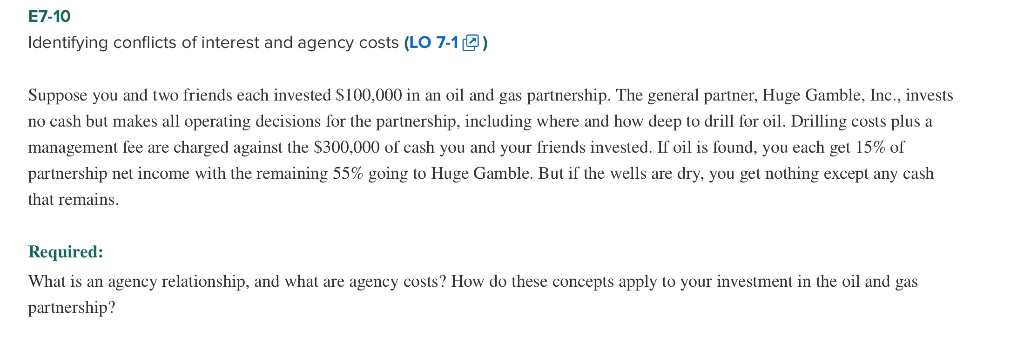

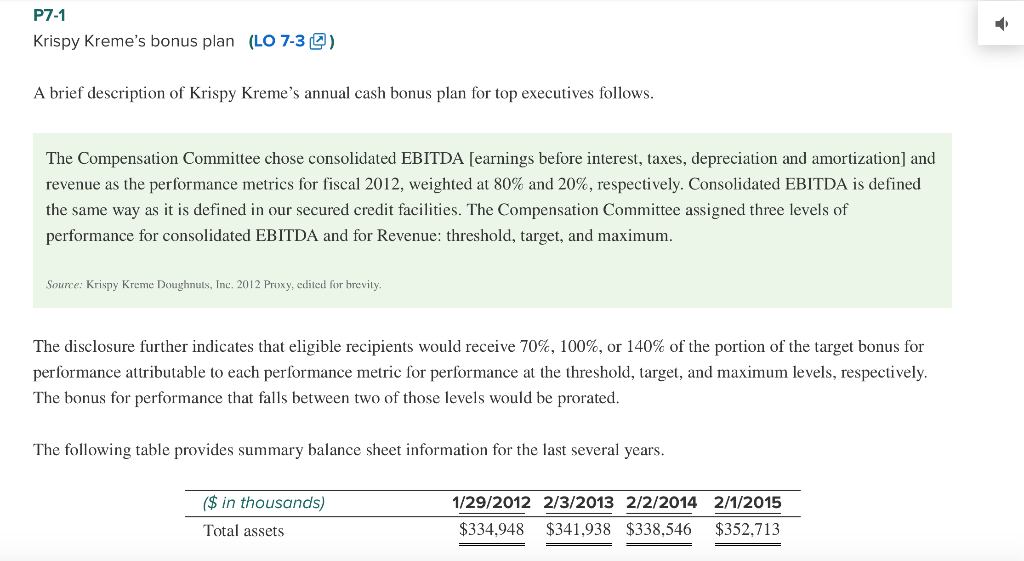

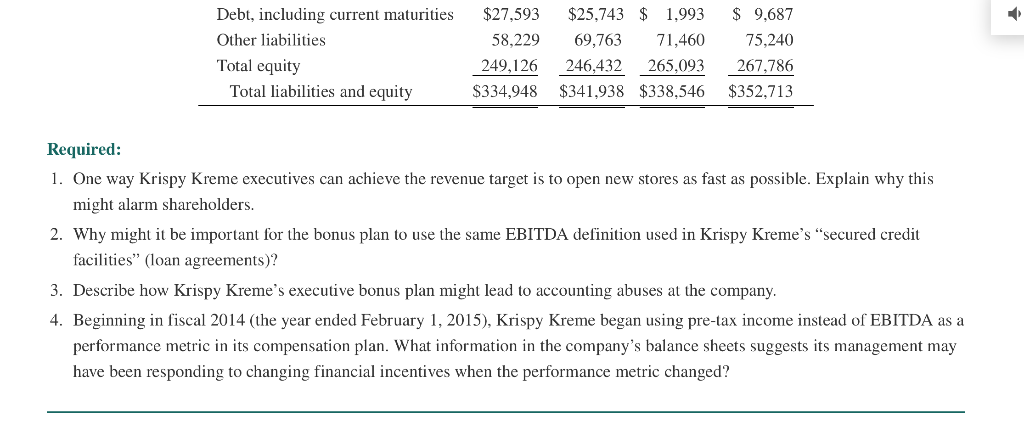

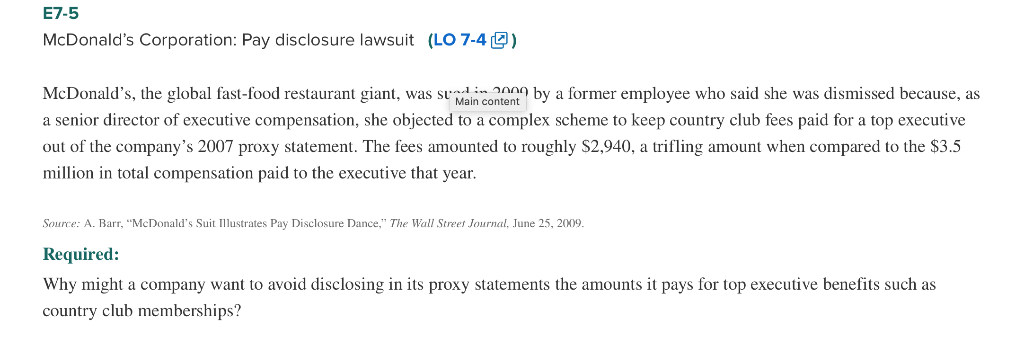

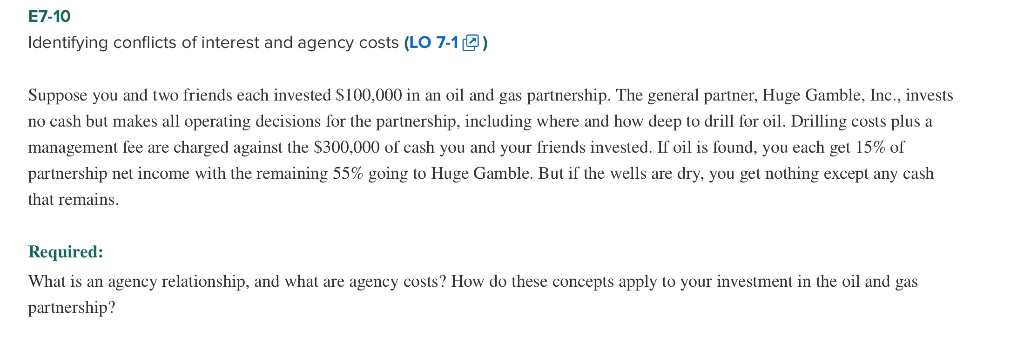

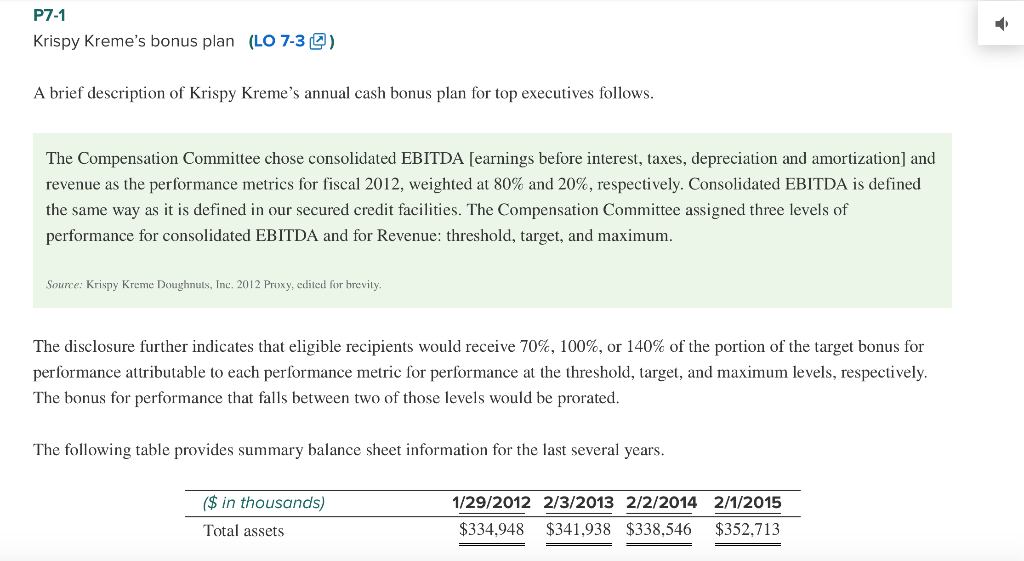

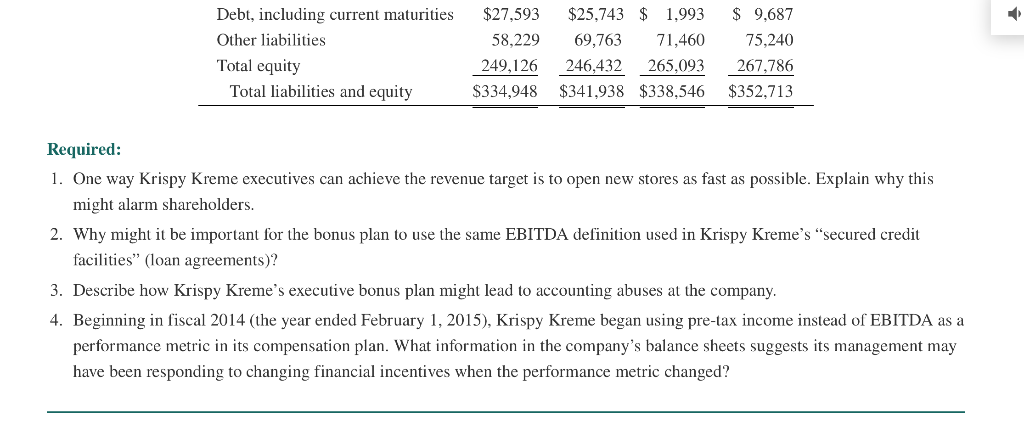

E7-5 McDonald's Corporation: Pay disclosure lawsuit (LO 7-42) McDonald's, the global fast-food restaurant giant, was sl Main cone? by a former employee who said she was dismissed because, as a senior director of executive compensation, she objected to a complex scheme to keep country club fees paid for a top executive out of the company's 2007 proxy statement. The fees amounted to roughly $2.,940, a trifling amount when compared to the S3.5 million in total compensation paid to the executive that year Source: A. Barr, "McDonald's Suit lustrates Pay Disclosure Dance," The Wall Street Journal, une 25, 2009 Required: Why might a company want to avoid disclosing in its proxy statements the amounts it pays for top executive benefits such as country club memberships? E7-10 dentifying conflicts of interest and agency costs (LO 7-1) Suppose you and two friends each invested S100,000 in an oil and gas partnership. The general partner, Huge Gamble, Inc., invests no cash but makes all operating decisions for the partnership, including where and how deep to drill for oil. Drilling costs plus a management fee are charged against the S300.000 of cash you and your friends invested. If oil is found, you each get 15% net income with the remaining 55% going to Huge Gamble. But if the wells are dry, you get nothing except any cash that remains. Required What is an agency relationship, and what are agency costs? How do these concepts apply to your investment in the oil and gas partnership? Debt, including current maturities $27,593 $25,743 $ 1,993 S 9,687 58,229 69,763 71,460 75,240 249.126 246.432 265,093 267.786 S334,948 $341,938 $338,546 $352,713 Other liabilities Total equity Total liabilities and equity Required: 1. One way Krispy Kreme executives can achieve the revenue target is to open new stores as fast as possible. Explain why this might alarm shareholders. 2. Why might it be important for the bonus plan to use the same EBITDA definition used in Krispy Kreme's "secured credit facilities" (loan agreements)? 3. Describe how Krispy Kreme's executive bonus plan might lead to accounting abuses at the company 4. Beginning in fiscal 2014 (the year ended February 1, 2015), Krispy Kreme began using pre-tax income instead of EBITDA as a performance metric in its compensation plan. What information in the company's balance sheets suggests its management may have been responding to changing financial incentives when the performance metric changed? E7-5 McDonald's Corporation: Pay disclosure lawsuit (LO 7-42) McDonald's, the global fast-food restaurant giant, was sl Main cone? by a former employee who said she was dismissed because, as a senior director of executive compensation, she objected to a complex scheme to keep country club fees paid for a top executive out of the company's 2007 proxy statement. The fees amounted to roughly $2.,940, a trifling amount when compared to the S3.5 million in total compensation paid to the executive that year Source: A. Barr, "McDonald's Suit lustrates Pay Disclosure Dance," The Wall Street Journal, une 25, 2009 Required: Why might a company want to avoid disclosing in its proxy statements the amounts it pays for top executive benefits such as country club memberships? E7-10 dentifying conflicts of interest and agency costs (LO 7-1) Suppose you and two friends each invested S100,000 in an oil and gas partnership. The general partner, Huge Gamble, Inc., invests no cash but makes all operating decisions for the partnership, including where and how deep to drill for oil. Drilling costs plus a management fee are charged against the S300.000 of cash you and your friends invested. If oil is found, you each get 15% net income with the remaining 55% going to Huge Gamble. But if the wells are dry, you get nothing except any cash that remains. Required What is an agency relationship, and what are agency costs? How do these concepts apply to your investment in the oil and gas partnership? Debt, including current maturities $27,593 $25,743 $ 1,993 S 9,687 58,229 69,763 71,460 75,240 249.126 246.432 265,093 267.786 S334,948 $341,938 $338,546 $352,713 Other liabilities Total equity Total liabilities and equity Required: 1. One way Krispy Kreme executives can achieve the revenue target is to open new stores as fast as possible. Explain why this might alarm shareholders. 2. Why might it be important for the bonus plan to use the same EBITDA definition used in Krispy Kreme's "secured credit facilities" (loan agreements)? 3. Describe how Krispy Kreme's executive bonus plan might lead to accounting abuses at the company 4. Beginning in fiscal 2014 (the year ended February 1, 2015), Krispy Kreme began using pre-tax income instead of EBITDA as a performance metric in its compensation plan. What information in the company's balance sheets suggests its management may have been responding to changing financial incentives when the performance metric changed

Please do E7-5, E7-10, and P7-1.

Please do E7-5, E7-10, and P7-1.