Answered step by step

Verified Expert Solution

Question

1 Approved Answer

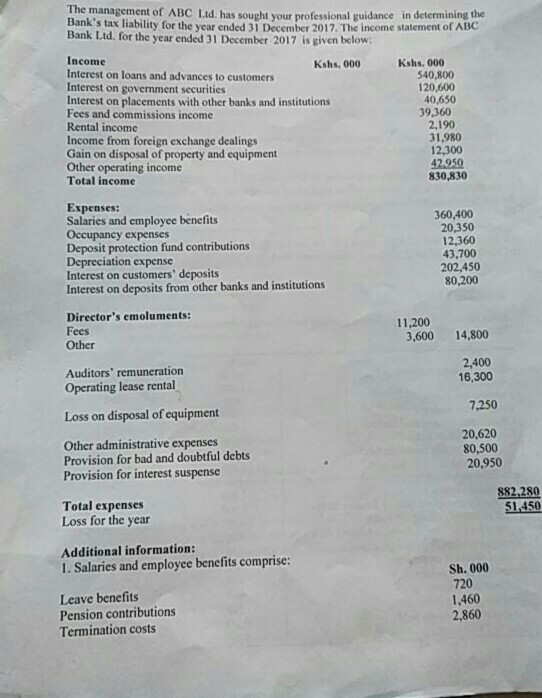

The management of ABC Ltd. has sought your professional guidance in determining the Bank's tax liability for the year ended 31 December 2017. The income

The management of ABC Ltd. has sought your professional guidance in determining the Bank's tax liability for the year ended 31 December 2017. The income statement of ABC Bank Ltd. for the year ended 31 December 2017 is given below Income Interest on loans and advances to customers Interest on government securities Interest on placements with other banks and institutions Kshs. 000 Kshs. 000 540,800 120,600 40,650 39,360 Fees and commissions income Rental income Income from foreign exchange dealings Gain on disposal of property and equipment Other operating income 2.190 31,980 12,300 42.950 830,830 Total income Expenses: Salaries and employee benefits Occupancy expenses Deposit protection fund contributions Depreciation expense Interest on customers' deposits Interest on deposits from other banks and institutions 360,400 20,350 12,360 43,700 202,450 80,200 Director's emoluments: Fees Other 11,200 3,600 14,800 Auditors' remuneration Operating lease rental 2,400 16,300 7.250 Loss on disposal of equipment Other administrative expenses Provision for bad and doubtful debts Provision for interest suspense 20,620 80,500 20,950 882.280 51450 Total expenses Loss for the year Additional information: 1. Salaries and employee benefits comprise: Sh. 000 720 1,460 2,860 Leave benefits Pension contributions Termination costs The management of ABC Ltd. has sought your professional guidance in determining the Bank's tax liability for the year ended 31 December 2017. The income statement of ABC Bank Ltd. for the year ended 31 December 2017 is given below Income Interest on loans and advances to customers Interest on government securities Interest on placements with other banks and institutions Kshs. 000 Kshs. 000 540,800 120,600 40,650 39,360 Fees and commissions income Rental income Income from foreign exchange dealings Gain on disposal of property and equipment Other operating income 2.190 31,980 12,300 42.950 830,830 Total income Expenses: Salaries and employee benefits Occupancy expenses Deposit protection fund contributions Depreciation expense Interest on customers' deposits Interest on deposits from other banks and institutions 360,400 20,350 12,360 43,700 202,450 80,200 Director's emoluments: Fees Other 11,200 3,600 14,800 Auditors' remuneration Operating lease rental 2,400 16,300 7.250 Loss on disposal of equipment Other administrative expenses Provision for bad and doubtful debts Provision for interest suspense 20,620 80,500 20,950 882.280 51450 Total expenses Loss for the year Additional information: 1. Salaries and employee benefits comprise: Sh. 000 720 1,460 2,860 Leave benefits Pension contributions Termination costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started