Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do e,f,g,hi in 10 minutes will upvote Question 4 Emperor Co. has issued 10,000 samurai bond with a 5.5% annual coupon rate, 25 years

please do e,f,g,hi in 10 minutes will upvote

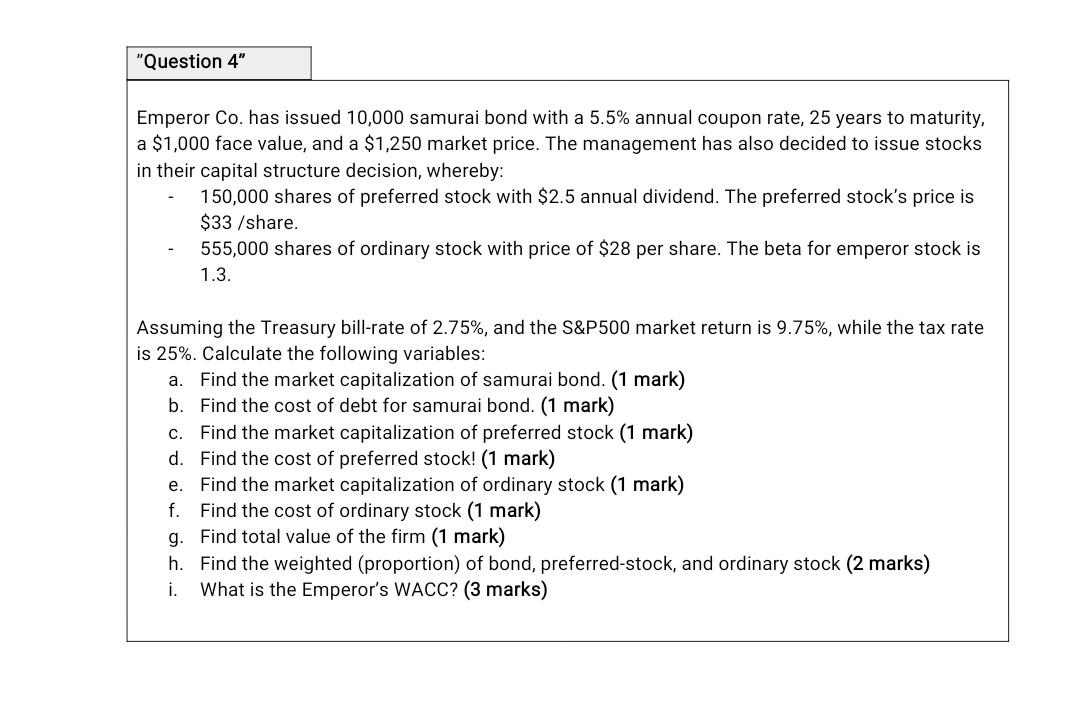

"Question 4" Emperor Co. has issued 10,000 samurai bond with a 5.5% annual coupon rate, 25 years to maturity, a $1,000 face value, and a $1,250 market price. The management has also decided to issue stocks in their capital structure decision, whereby: 150,000 shares of preferred stock with $2.5 annual dividend. The preferred stock's price is $33/share. 555,000 shares of ordinary stock with price of $28 per share. The beta for emperor stock is 1.3. Assuming the Treasury bill-rate of 2.75%, and the S&P500 market return is 9.75%, while the tax rate is 25%. Calculate the following variables: a. Find the market capitalization of samurai bond. (1 mark) b. Find the cost of debt for samurai bond. (1 mark) c. Find the market capitalization of preferred stock (1 mark) d. Find the cost of preferred stock! (1 mark) e. Find the market capitalization of ordinary stock (1 mark) f. Find the cost of ordinary stock (1 mark) g. Find total value of the firm (1 mark) h. Find the weighted (proportion) of bond, preferred-stock, and ordinary stock (2 marks) i. What is the Emperor's WACCStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started