Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do help me wuth taxation thank you Decedent is a citizen of the Philippines and a resident of Quezon City, died leaving the following:

Please do help me wuth taxation thank you

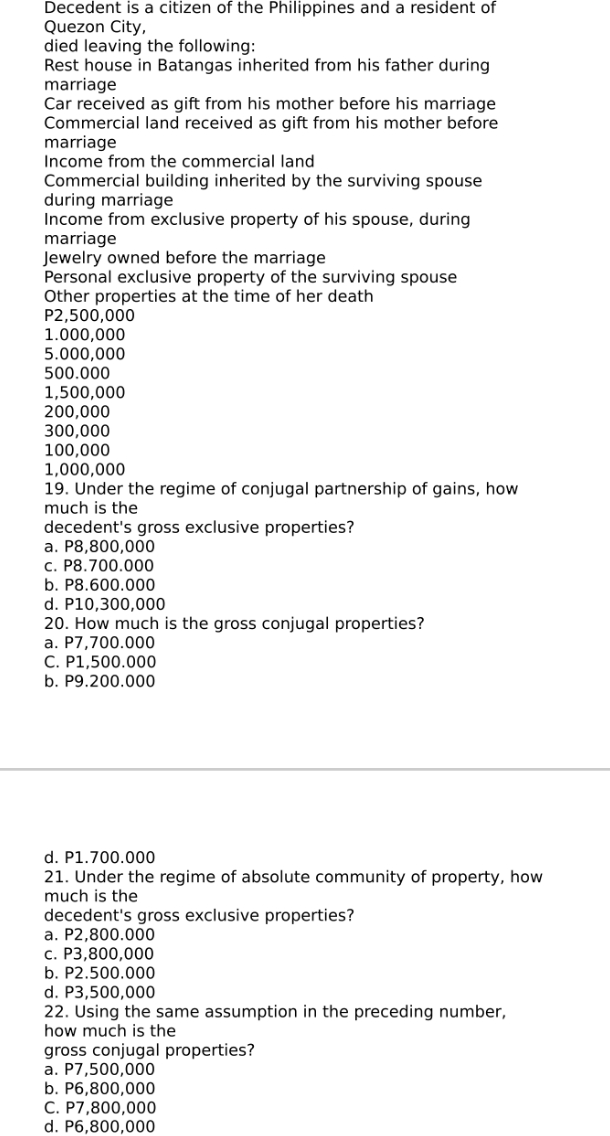

Decedent is a citizen of the Philippines and a resident of Quezon City, died leaving the following: Rest house in Batangas inherited from his father during marriage Car received as gift from his mother before his marriage Commercial land received as gift from his mother before marriage Income from the commercial land Commercial building inherited by the surviving spouse during marriage Income from exclusive property of his spouse, during marriage Jewelry owned before the marriage Personal exclusive property of the surviving spouse Other properties at the time of her death P2,500,000 1.000,000 5.000,000 500.000 1,500,000 200,000 300,000 100,000 1,000,000 19. Under the regime of conjugal partnership of gains, how much is the decedent's gross exclusive properties? a. P8,800,000 c. P8.700.000 b. P8.600.000 d. P10,300,000 20. How much is the gross conjugal properties? a. P7,700.000 C. P1,500.000 b. P9.200.000 d. P1.700.000 21. Under the regime of absolute community of property, how much is the decedent's gross exclusive properties? a. P2,800.000 c. P3,800,000 b. P2.500.000 d. P3,500,000 22. Using the same assumption in the preceding number, how much is the gross conjugal properties? a. P7,500,000 b. P6,800,000 C. P7,800,000 d. P6,800,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the gross exclusive properties and gross conjugal properties under different regimes le...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started