Please do in EXCEL, lowest digit is 1 and highest is 8. I only need 5,6,7 and 8

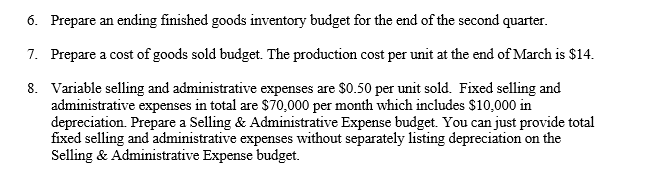

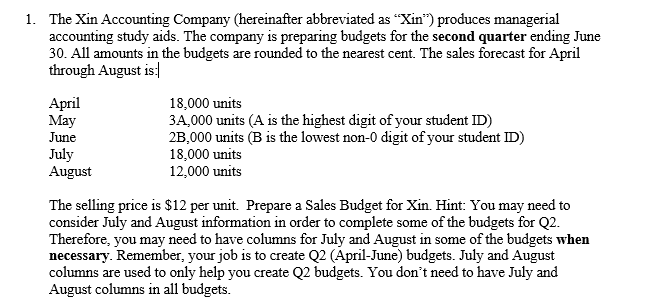

1. The Xin Accounting Company (hereinafter abbreviated as "Xin") produces managerial accounting study aids. The company is preparing budgets for the second quarter ending June 30. All amounts in the budgets are rounded to the nearest cent. The sales forecast for April through August is: April May June July August 18,000 units 3A,000 units (A is the highest digit of your student ID) 20,000 units (B is the lowest non- digit of your student ID) 18,000 units 12,000 units The selling price is $12 per unit. Prepare a Sales Budget for Xin. Hint: You may need to consider July and August information in order to complete some of the budgets for Q2. Therefore, you may need to have columns for July and August in some of the budgets when necessary. Remember, your job is to create Q2 (April-June) budgets. July and August columns are used to only help you create Q2 budgets. You don't need to have July and August columns in all budgets. 2. The company desires to have finished inventory on hand at the end of each month equal to 20 percent of the following month's budgeted unit sales. On March 31, there were 3,500 units on hand. Prepare a Production budget. 3. Five pounds of material are required per unit of product. Management desires to have materials on hand at the end of each month equal to 12 percent of the following month's production needs. This policy was met on March 31st. The material costs $0.40 per lb. Prepare a Direct Materials Purchases budget. 4. Each unit produced requires 0.06 hours of direct labor. Each hour of direct labor costs the company $20. Prepare a Direct Labor budget. 5. Variable manufacturing overhead is $20 per direct labor hour. Fixed manufacturing overhead in total is $50,500 per month. This includes $20,500 of depreciation. Prepare a Manufacturing Overhead budget. You can just provide total fixed manufacturing overhead without separately listing depreciation on the Manufacturing Overhead budget. 6. Prepare an ending finished goods inventory budget for the end of the second quarter. 7. Prepare a cost of goods sold budget. The production cost per unit at the end of March is $14. 8. Variable selling and administrative expenses are $0.50 per unit sold. Fixed selling and administrative expenses in total are $70,000 per month which includes $10,000 in depreciation. Prepare a Selling & Administrative Expense budget. You can just provide total fixed selling and administrative expenses without separately listing depreciation on the Selling & Administrative Expense budget. 1. The Xin Accounting Company (hereinafter abbreviated as "Xin") produces managerial accounting study aids. The company is preparing budgets for the second quarter ending June 30. All amounts in the budgets are rounded to the nearest cent. The sales forecast for April through August is: April May June July August 18,000 units 34,000 units (A is the highest digit of your student ID) 2B,000 units (B is the lowest non-0 digit of your student ID) 18,000 units 12,000 units The selling price is $12 per unit. Prepare a Sales Budget for Xin. Hint: You may need to consider July and August information in order to complete some of the budgets for Q2. Therefore, you may need to have columns for July and August in some of the budgets when necessary. Remember, your job is to create Q2 (April-June) budgets. July and August columns are used to only help you create Q2 budgets. You don't need to have July and August columns in all budgets. 1. The Xin Accounting Company (hereinafter abbreviated as "Xin") produces managerial accounting study aids. The company is preparing budgets for the second quarter ending June 30. All amounts in the budgets are rounded to the nearest cent. The sales forecast for April through August is: April May June July August 18,000 units 3A,000 units (A is the highest digit of your student ID) 20,000 units (B is the lowest non- digit of your student ID) 18,000 units 12,000 units The selling price is $12 per unit. Prepare a Sales Budget for Xin. Hint: You may need to consider July and August information in order to complete some of the budgets for Q2. Therefore, you may need to have columns for July and August in some of the budgets when necessary. Remember, your job is to create Q2 (April-June) budgets. July and August columns are used to only help you create Q2 budgets. You don't need to have July and August columns in all budgets. 2. The company desires to have finished inventory on hand at the end of each month equal to 20 percent of the following month's budgeted unit sales. On March 31, there were 3,500 units on hand. Prepare a Production budget. 3. Five pounds of material are required per unit of product. Management desires to have materials on hand at the end of each month equal to 12 percent of the following month's production needs. This policy was met on March 31st. The material costs $0.40 per lb. Prepare a Direct Materials Purchases budget. 4. Each unit produced requires 0.06 hours of direct labor. Each hour of direct labor costs the company $20. Prepare a Direct Labor budget. 5. Variable manufacturing overhead is $20 per direct labor hour. Fixed manufacturing overhead in total is $50,500 per month. This includes $20,500 of depreciation. Prepare a Manufacturing Overhead budget. You can just provide total fixed manufacturing overhead without separately listing depreciation on the Manufacturing Overhead budget. 6. Prepare an ending finished goods inventory budget for the end of the second quarter. 7. Prepare a cost of goods sold budget. The production cost per unit at the end of March is $14. 8. Variable selling and administrative expenses are $0.50 per unit sold. Fixed selling and administrative expenses in total are $70,000 per month which includes $10,000 in depreciation. Prepare a Selling & Administrative Expense budget. You can just provide total fixed selling and administrative expenses without separately listing depreciation on the Selling & Administrative Expense budget. 1. The Xin Accounting Company (hereinafter abbreviated as "Xin") produces managerial accounting study aids. The company is preparing budgets for the second quarter ending June 30. All amounts in the budgets are rounded to the nearest cent. The sales forecast for April through August is: April May June July August 18,000 units 34,000 units (A is the highest digit of your student ID) 2B,000 units (B is the lowest non-0 digit of your student ID) 18,000 units 12,000 units The selling price is $12 per unit. Prepare a Sales Budget for Xin. Hint: You may need to consider July and August information in order to complete some of the budgets for Q2. Therefore, you may need to have columns for July and August in some of the budgets when necessary. Remember, your job is to create Q2 (April-June) budgets. July and August columns are used to only help you create Q2 budgets. You don't need to have July and August columns in all budgets