Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do in GAAP principal project #2 July 2025 You and a partner, Santa Claus, started a kayak and canoe retail business in Brighton on

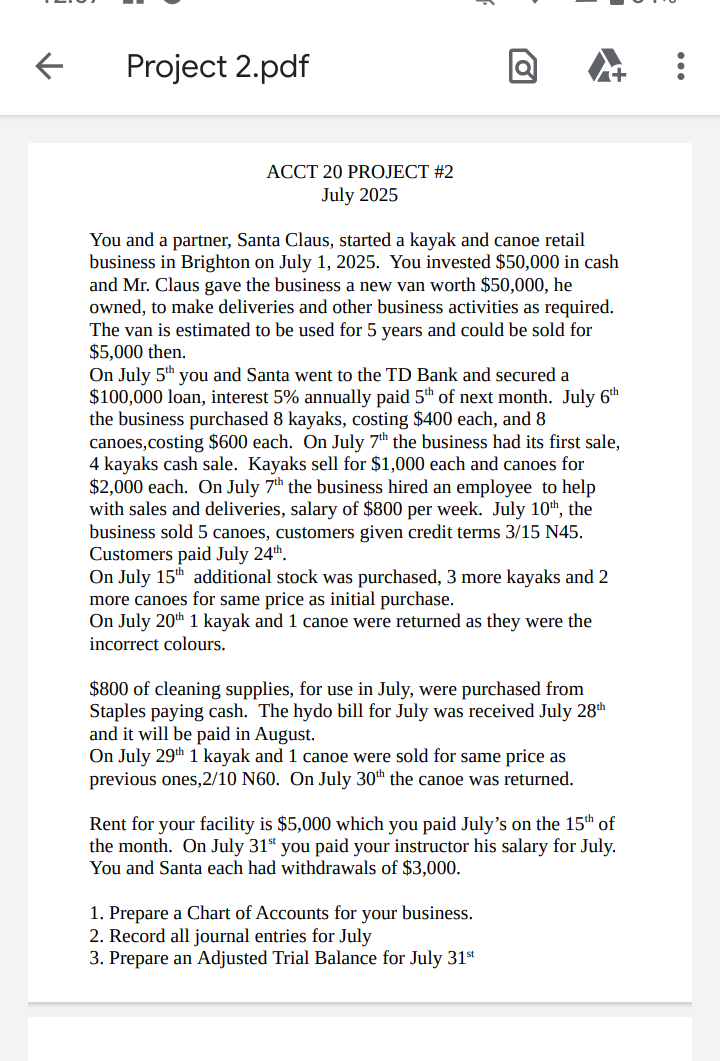

please do in GAAP principal project #2

July 2025 You and a partner, Santa Claus, started a kayak and canoe retail business in Brighton on July 1, 2025. You invested $50,000 in cash and Mr. Claus gave the business a new van worth $50,000, he owned, to make deliveries and other business activities as required. The van is estimated to be used for 5 years and could be sold for $5,000 then. On July 5th you and Santa went to the TD Bank and secured a $100,000 loan, interest 5% annually paid 5th of next month. July 6th the business purchased 8 kayaks, costing $400 each, and 8 canoes,costing $600 each. On July 7th the business had its first sale, 4 kayaks cash sale. Kayaks sell for $1,000 each and canoes for $2,000 each. On July 7th the business hired an employee to help with sales and deliveries, salary of $800 per week. July 10th, the business sold 5 canoes, customers given credit terms 3/15 N45. Customers paid July 24th. On July 15th additional stock was purchased, 3 more kayaks and 2 more canoes for same price as initial purchase. On July 20th1 kayak and 1 canoe were returned as they were the incorrect colours. $800 of cleaning supplies, for use in July, were purchased from Staples paying cash. The hydo bill for July was received July 28th and it will be paid in August. On July 29th1 kayak and 1 canoe were sold for same price as previous ones, 2/10N60. On July 30th the canoe was returned. Rent for your facility is $5,000 which you paid July's on the 15th of the month. On July 31st you paid your instructor his salary for July. You and Santa each had withdrawals of $3,000. 1. Prepare a Chart of Accounts for your business. 2. Record all journal entries for July 3. Prepare an Adjusted Trial Balance for July 31stStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started