Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it ASAP a) The credit score svstem for ABC Bank is below. Suppose you are a loan officer at ABC Bank. One of

please do it ASAP

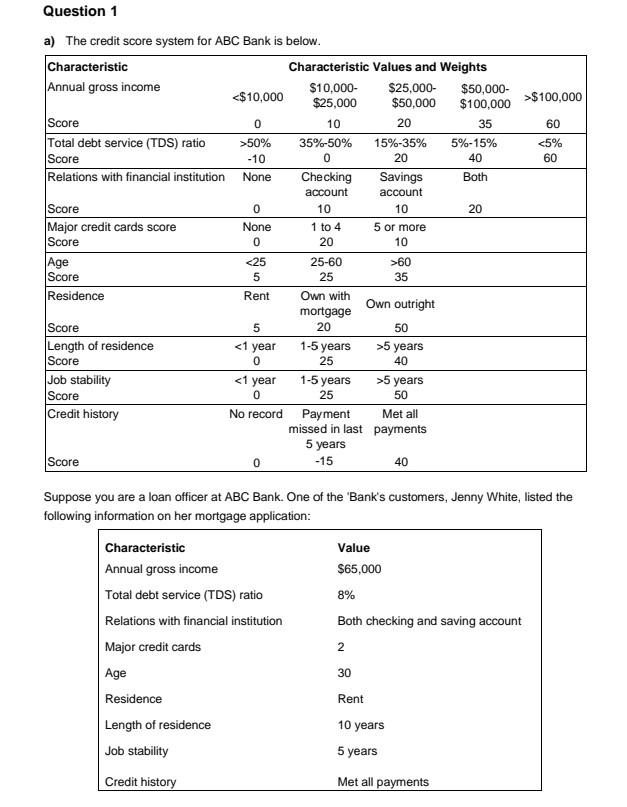

a) The credit score svstem for ABC Bank is below. Suppose you are a loan officer at ABC Bank. One of the 'Bank's customers, Jenny White, listed the following information on her mortgage application: The loan is automatically rejected if the applicant's total score is less than or equal to 120 . The loan is automatically approved if the total score is greater than or equal to 190 . A score between 120 and 190 (noninclusive) is reviewed by a loan committee for a final decision. Determine whether Jenny White should be approved for a mortgage from your bank. Please show each step of your calculation. [12 marks] b) What is the nature of an off-balance-sheet activity? How does a financial institution benefit from such activities? Identify the various risks that these activities generate for an financial institution, and explain how these risks can create varying degrees of financial stress for the financial institution at a later time. [7 marks] c) The following are Firm 'Beta's Balance Sheet (in millions): Also, the beginning retained earnings is $0, the market value of equity is equal to 70% of its book value and the company has a 40% dividend payout ratio. The sales are $1,250 million, the cost of goods sold is $700 million, the depreciation is $120 million and the net income is $350 million. Calculate the 'Altman's Z-score for Firm Beta. Then, based on your answer, decide whether you should approve Firm 'Beta's application to your bank for $8 million of a capital expansion loan. Please show each step of your calculation. Recall the following: Z=1.2X1+1.4X2+3.3X3+0.6X4+1.0X5X1=workingcapital/totalassetsX2=retainedearnings/totalassetsX3=EBIT/totalassetsX4=marketvalueofequity/long-termdebtX5=sales/totalassets Turn Over BUS201 (2023) Page 4 Net working capital = current assets current liabilities Current assets = cash + accounts receivable + inventory Current liabilities = accounts payable + accruals + notes payable EBIT= revenues cost of goods sold depreciation Net income = EBIT interest taxes Retained earnings = net income x(1 dividend payout ratio ) [12 marks] d) Discuss the shortcomings of using the 'Altman's Z-score model to evaluate the credit risk. a) The credit score svstem for ABC Bank is below. Suppose you are a loan officer at ABC Bank. One of the 'Bank's customers, Jenny White, listed the following information on her mortgage application: The loan is automatically rejected if the applicant's total score is less than or equal to 120 . The loan is automatically approved if the total score is greater than or equal to 190 . A score between 120 and 190 (noninclusive) is reviewed by a loan committee for a final decision. Determine whether Jenny White should be approved for a mortgage from your bank. Please show each step of your calculation. [12 marks] b) What is the nature of an off-balance-sheet activity? How does a financial institution benefit from such activities? Identify the various risks that these activities generate for an financial institution, and explain how these risks can create varying degrees of financial stress for the financial institution at a later time. [7 marks] c) The following are Firm 'Beta's Balance Sheet (in millions): Also, the beginning retained earnings is $0, the market value of equity is equal to 70% of its book value and the company has a 40% dividend payout ratio. The sales are $1,250 million, the cost of goods sold is $700 million, the depreciation is $120 million and the net income is $350 million. Calculate the 'Altman's Z-score for Firm Beta. Then, based on your answer, decide whether you should approve Firm 'Beta's application to your bank for $8 million of a capital expansion loan. Please show each step of your calculation. Recall the following: Z=1.2X1+1.4X2+3.3X3+0.6X4+1.0X5X1=workingcapital/totalassetsX2=retainedearnings/totalassetsX3=EBIT/totalassetsX4=marketvalueofequity/long-termdebtX5=sales/totalassets Turn Over BUS201 (2023) Page 4 Net working capital = current assets current liabilities Current assets = cash + accounts receivable + inventory Current liabilities = accounts payable + accruals + notes payable EBIT= revenues cost of goods sold depreciation Net income = EBIT interest taxes Retained earnings = net income x(1 dividend payout ratio ) [12 marks] d) Discuss the shortcomings of using the 'Altman's Z-score model to evaluate the credit risk

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started