Answered step by step

Verified Expert Solution

Question

1 Approved Answer

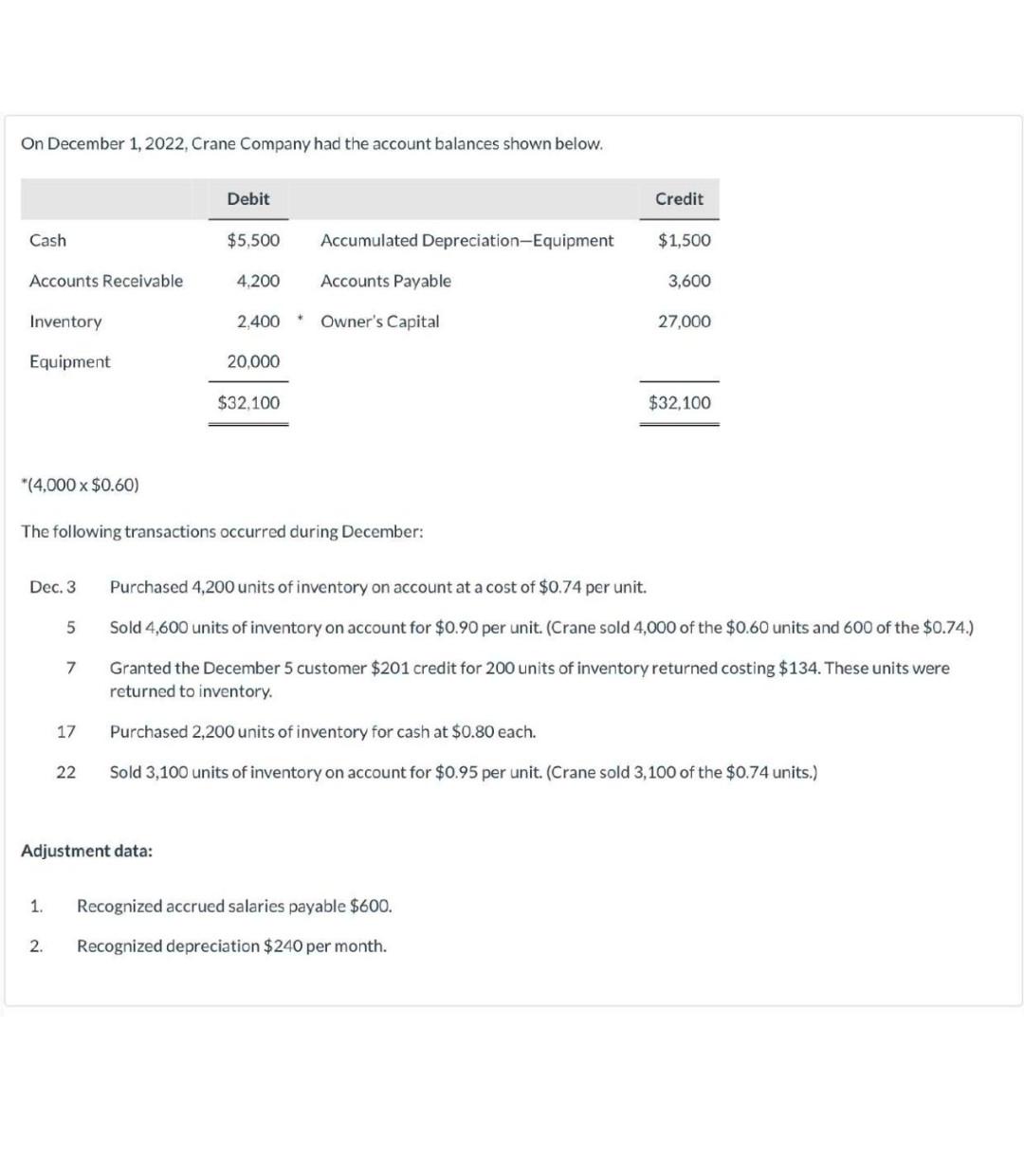

please do it correctly will upvote On December 1, 2022, Crane Company had the account balances shown below. (4,000$0.60) The following transactions occurred during December:

please do it correctly will upvote

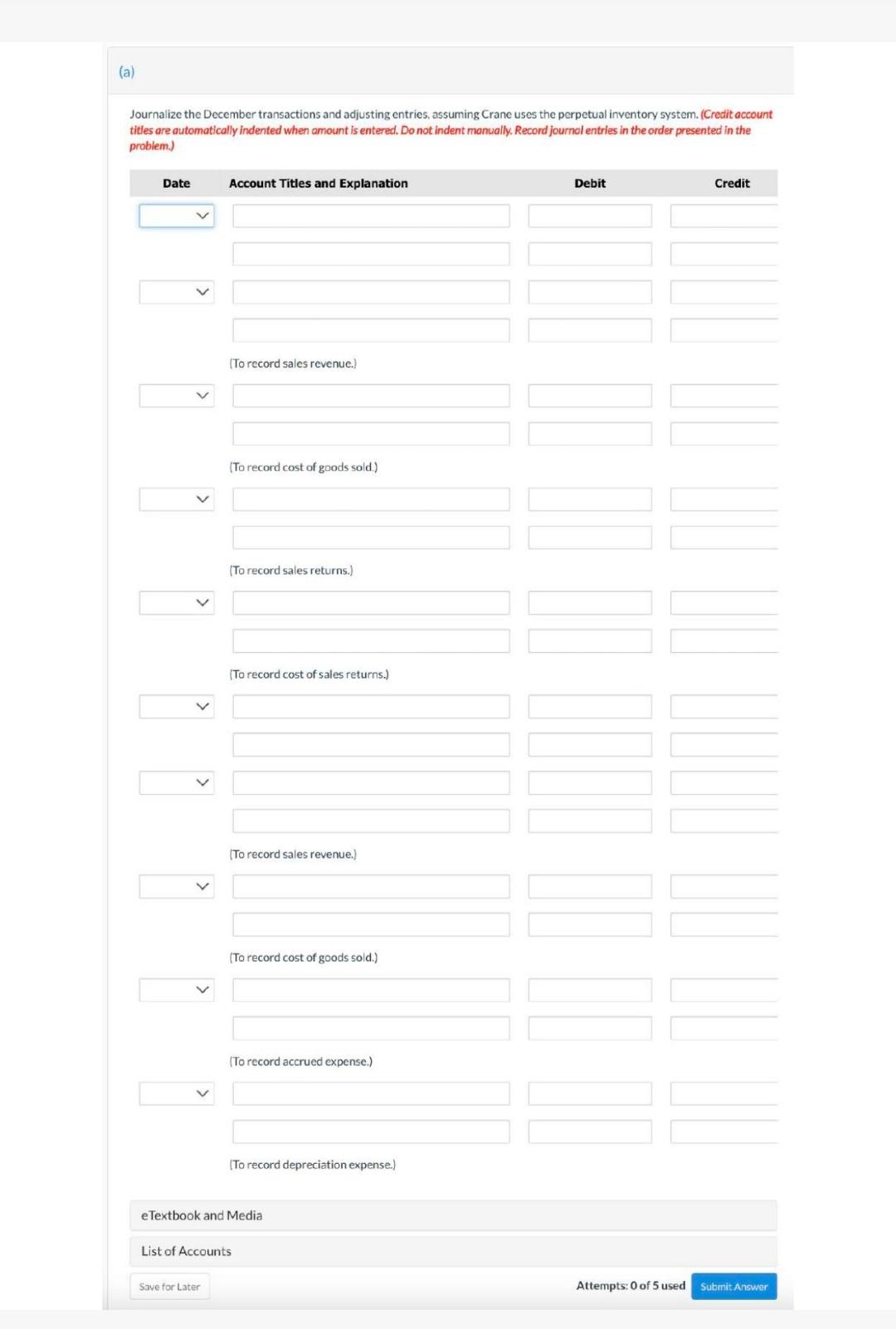

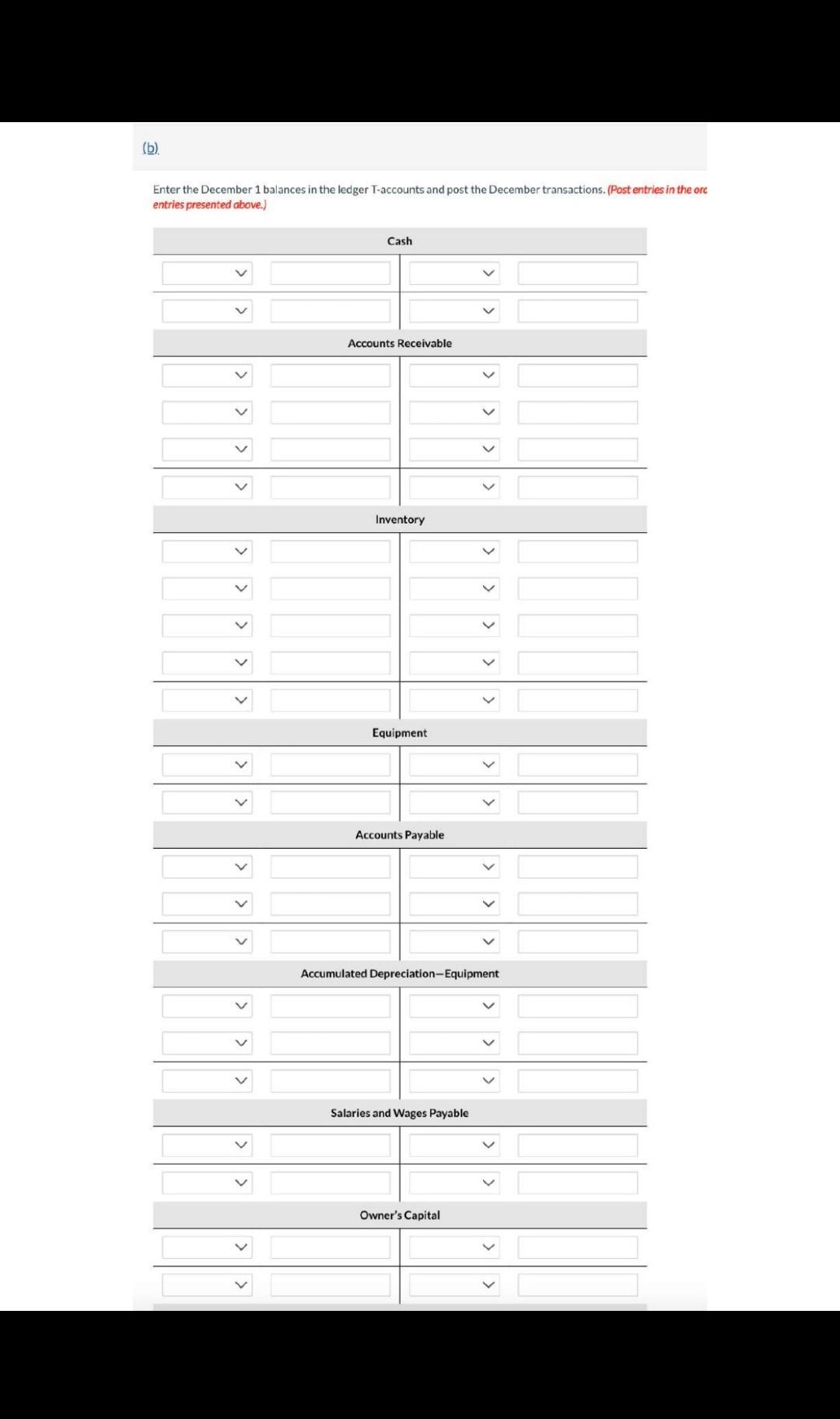

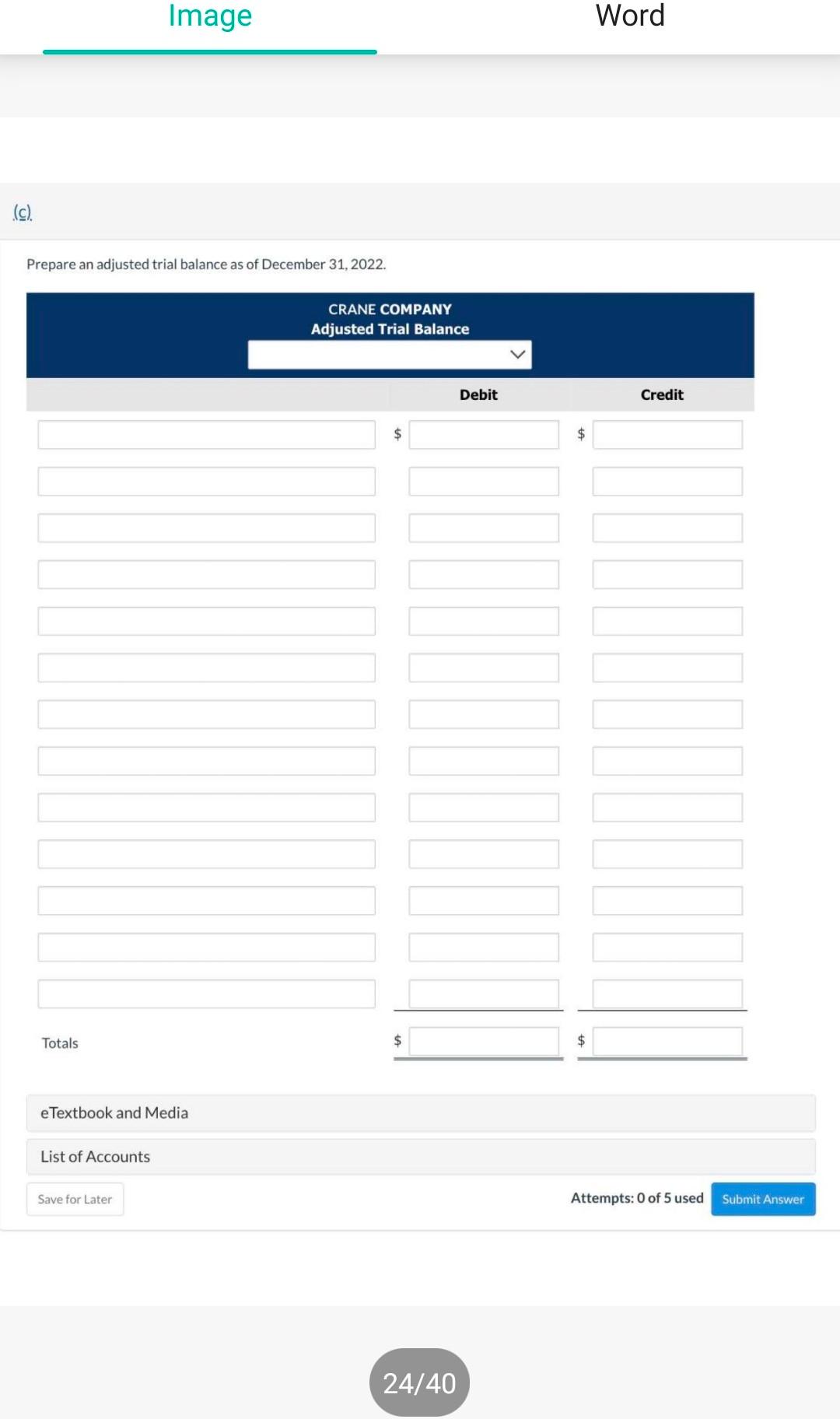

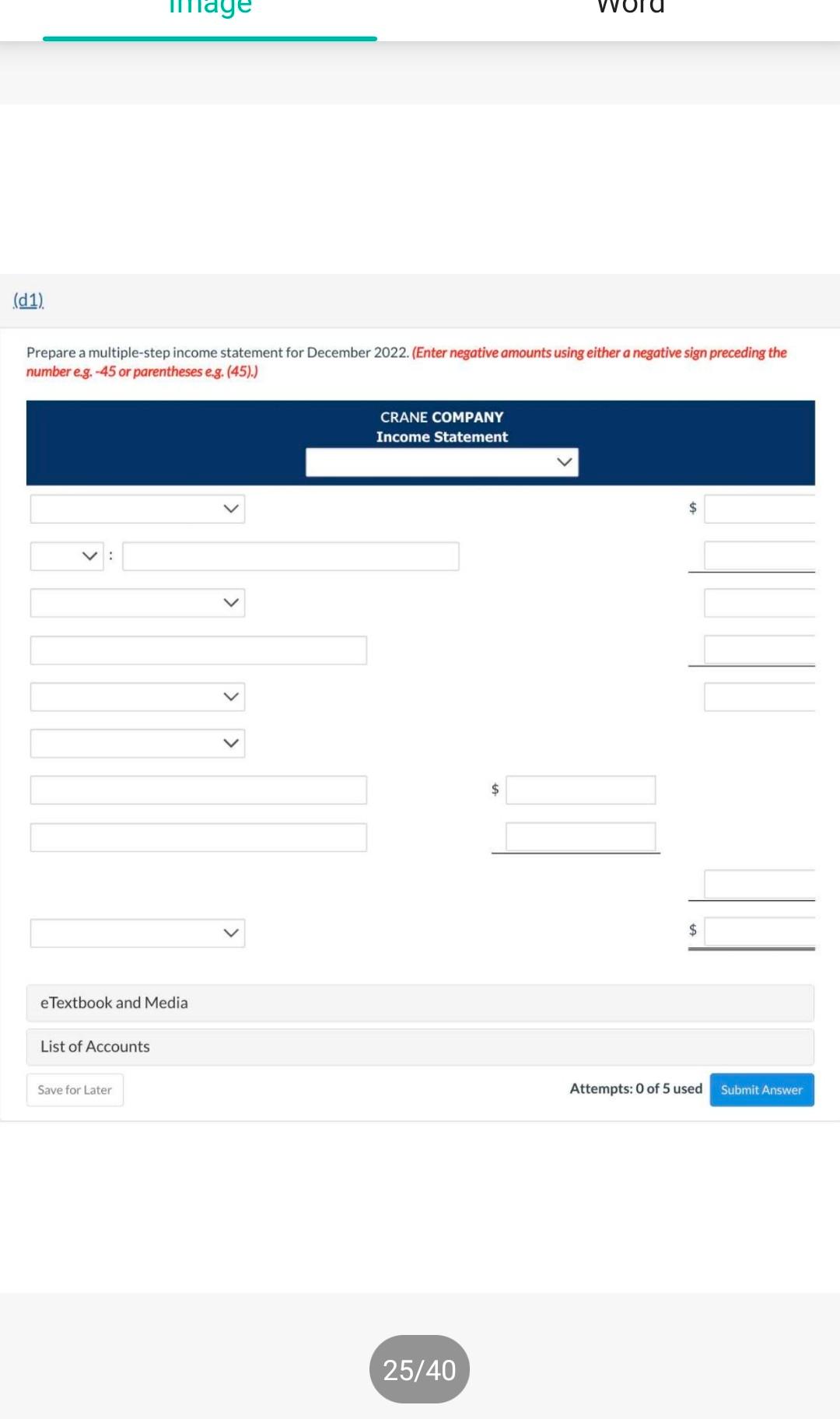

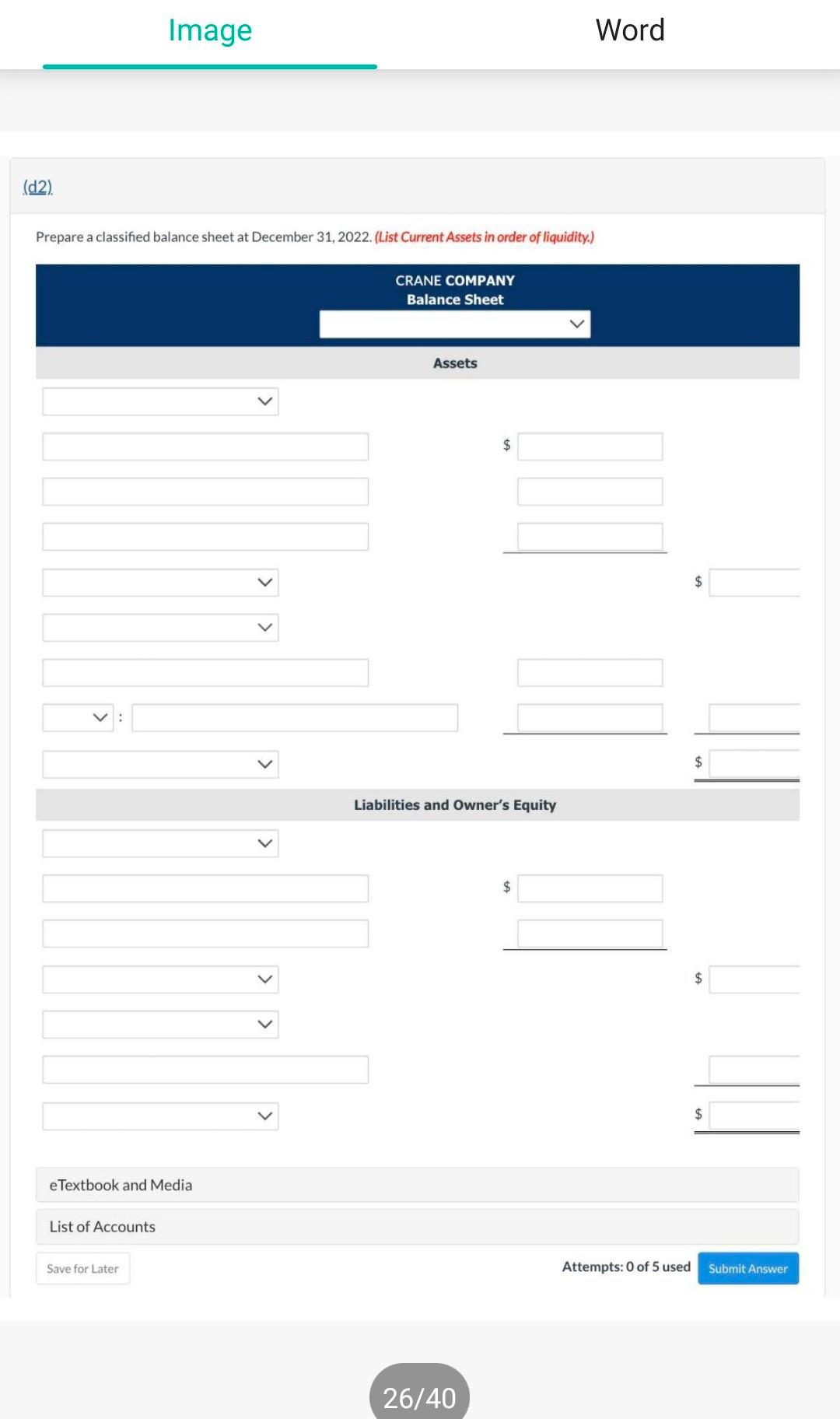

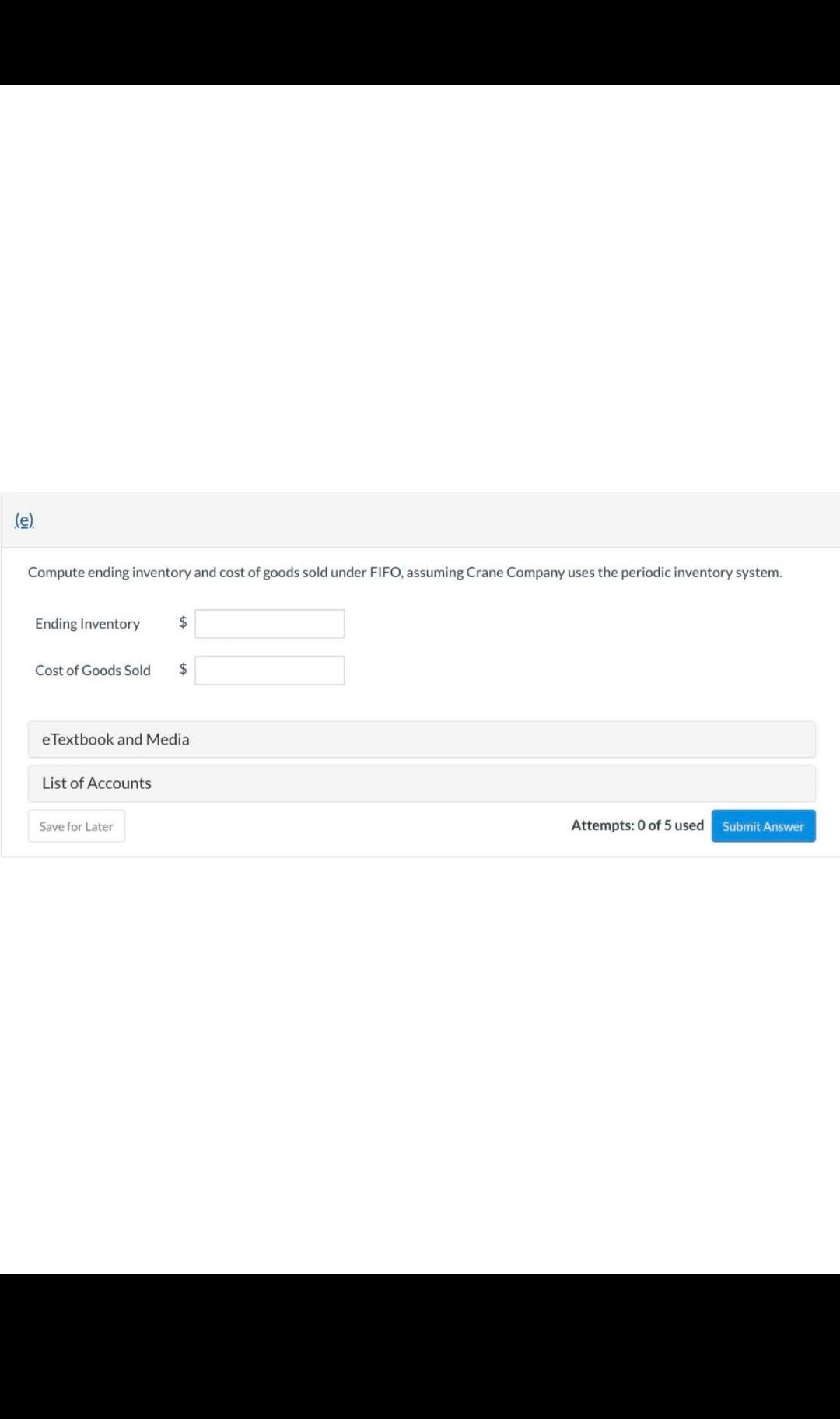

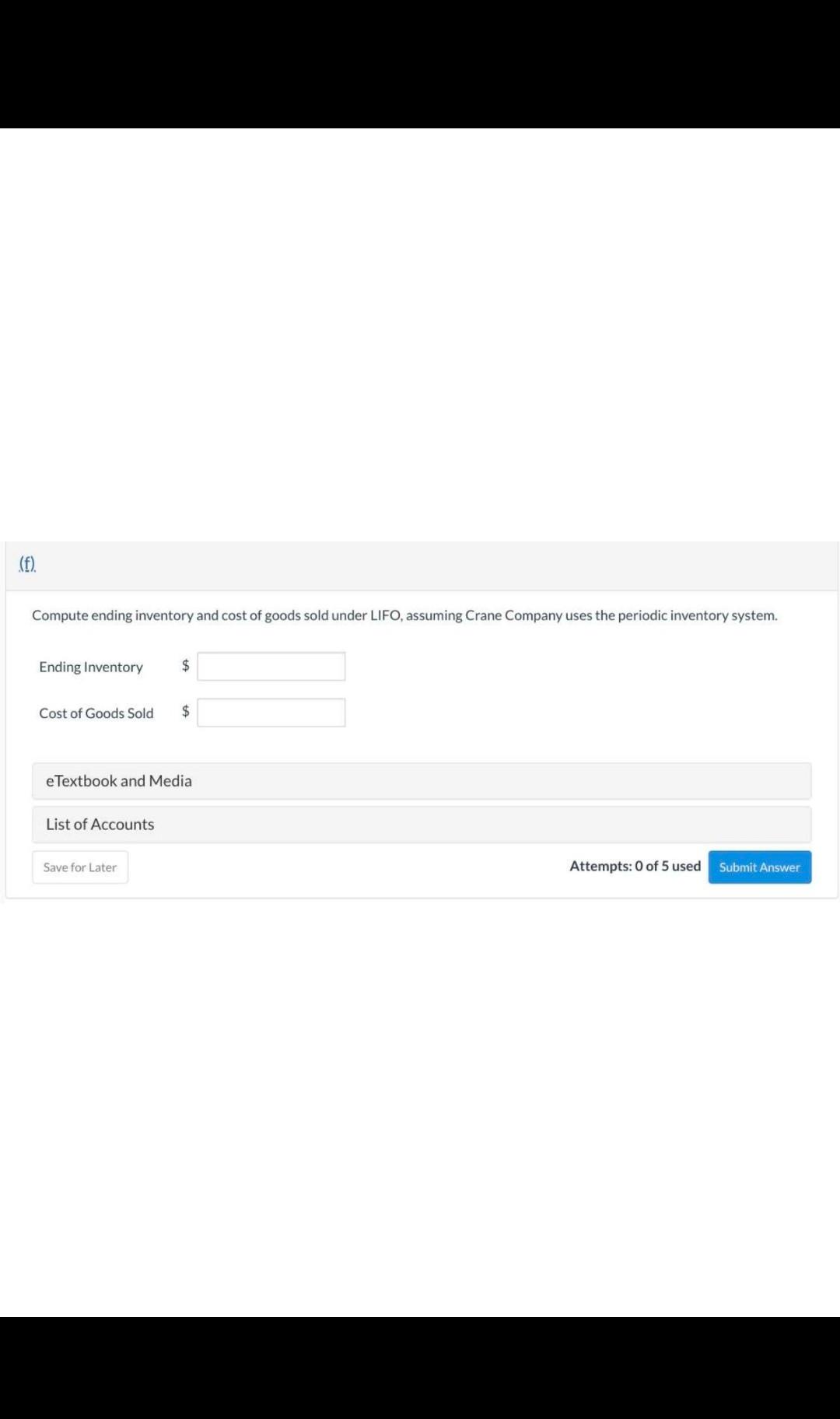

On December 1, 2022, Crane Company had the account balances shown below. (4,000$0.60) The following transactions occurred during December: Dec. 3 Purchased 4,200 units of inventory on account at a cost of $0.74 per unit. 5 Sold 4,600 units of inventory on account for $0.90 per unit. (Crane sold 4,000 of the $0.60 units and 600 of the $0.74.) 7 Granted the December 5 customer $201 credit for 200 units of inventory returned costing $134. These units were returned to inventory. 17 Purchased 2,200 units of inventory for cash at $0.80 each. 22 Sold 3,100 units of inventory on account for $0.95 per unit. (Crane sold 3,100 of the $0.74 units.) Journalize the December transactions and adjusting entries, assuming Crane uses the perpetual inventory system. (Credit account titles are automatically indented when amount is entered. Do not indent monually. Record journal entries in the order presented in the I Enter the December 1 balances in the ledger T-accounts and post the December transactions. (Post entries in the ore Prepare an adjusted trial balance as of December 31, 2022. Prepare a multiple-step income statement for December 2022 . (Enter negative amounts using either a negative sign preceding the Image Word (d2). Prepare a classified balance sheet at December 31, 2022. (List Current Assets in order of liquidity.) Liabilities and Owner's Equity $ eTextbook and Media List of Accounts $ $ List of Accounts Save for Later Attempts: 0 of 5 used Submit Answer 26/40 Compute ending inventory and cost of goods sold under FIFO, assuming Crane Company uses the periodic inventory system. Ending Inventory \$\$ Cost of Goods Sold \$ eTextbook and Media List of Accounts Attempts: 0 of 5 used Compute ending inventory and cost of goods sold under LIFO, assuming Crane Company uses the periodic inventory system. Ending Inventory \$ Cost of Goods Sold \$ eTextbook and Media List of Accounts Attempts: 0 of 5 usedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started