Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it correctly will upvote Problem 2: Big Dawg Donuts, LLC is a retail outlet that sells donuts and operates in a perfectly competitive

please do it correctly will upvote

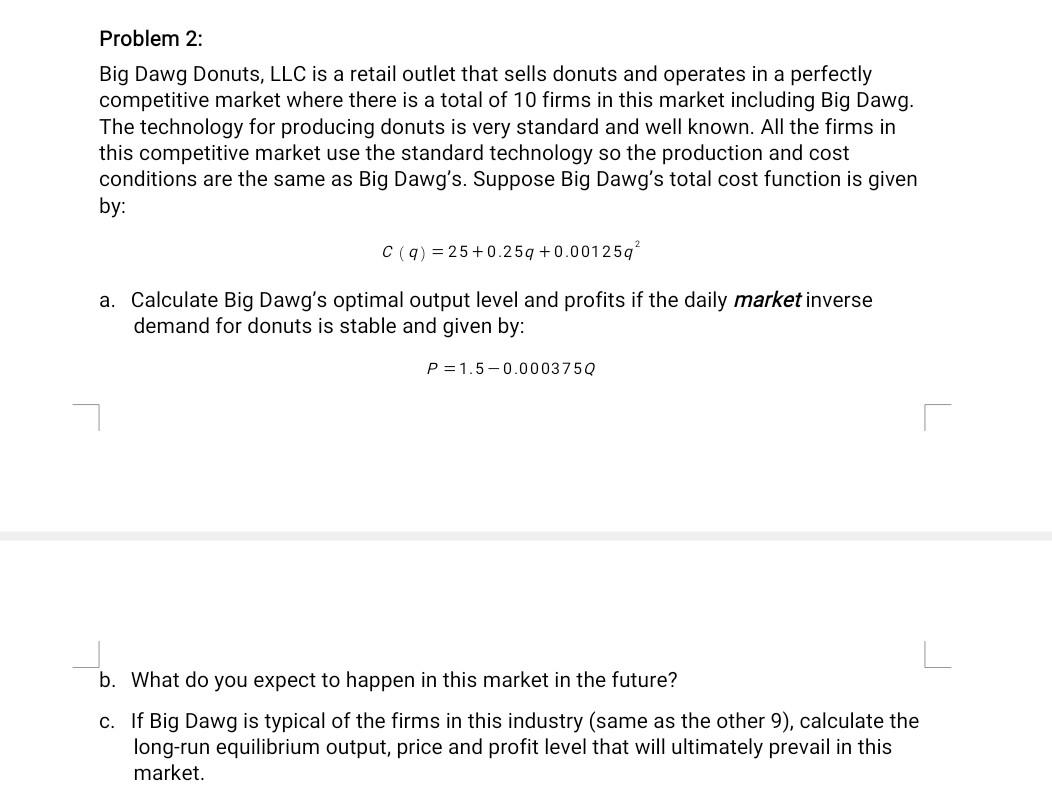

Problem 2: Big Dawg Donuts, LLC is a retail outlet that sells donuts and operates in a perfectly competitive market where there is a total of 10 firms in this market including Big Dawg. The technology for producing donuts is very standard and well known. All the firms in this competitive market use the standard technology so the production and cost conditions are the same as Big Dawg's. Suppose Big Dawg's total cost function is given by: C(q) = 25+0.259 +0.001259 a. Calculate Big Dawg's optimal output level and profits if the daily market inverse demand for donuts is stable and given by: P=1.5-0.000375Q b. What do you expect to happen in this market in the future? c. If Big Dawg is typical of the firms in this industry (same as the other 9), calculate the long-run equilibrium output, price and profit level that will ultimately prevail in this marketStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started