Answered step by step

Verified Expert Solution

Question

1 Approved Answer

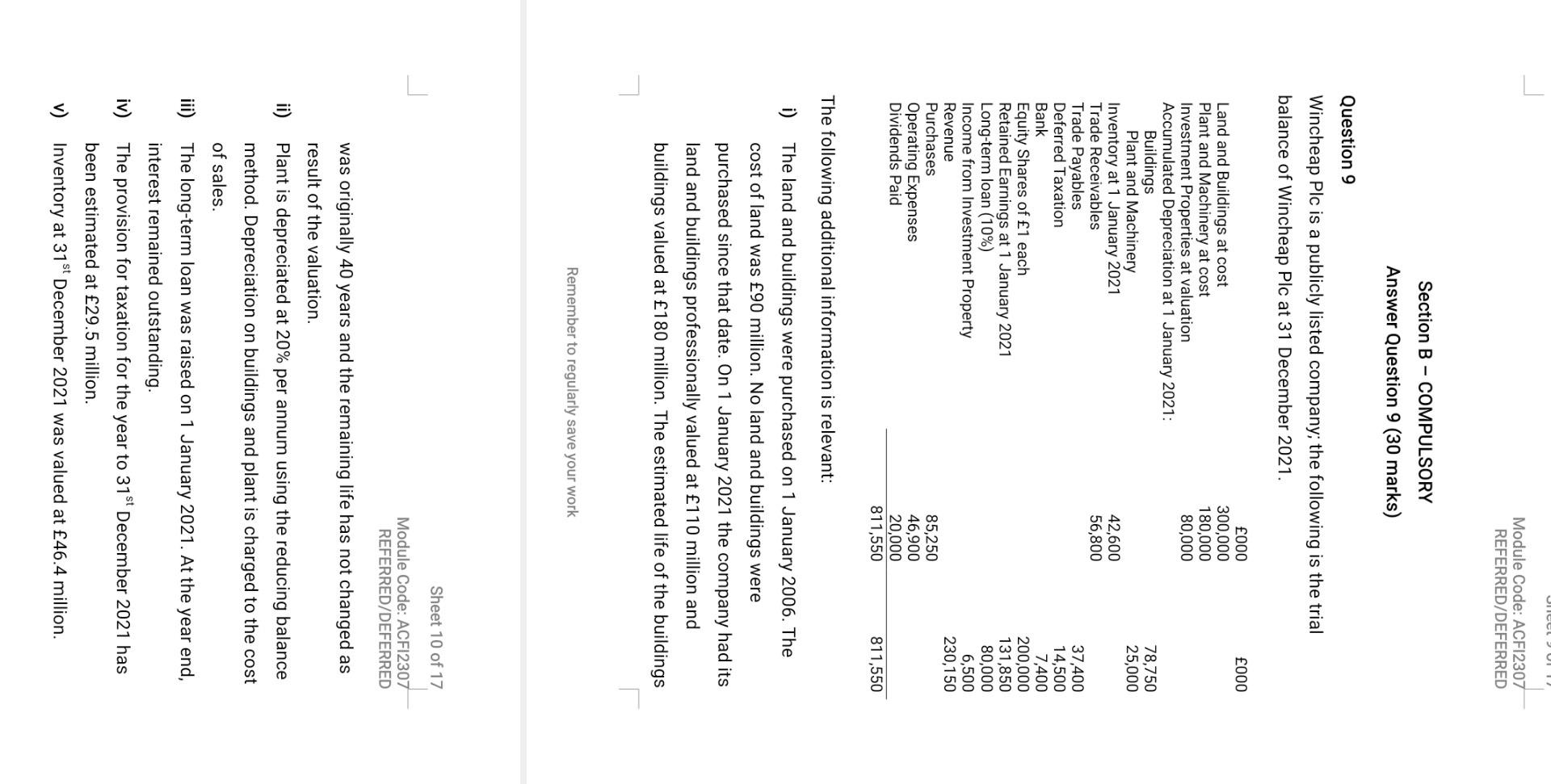

please do it correctly will upvote Section B - COMPULSORY Answer Question 9 (30 marks) Question 9 Wincheap Plc is a publicly listed company; the

please do it correctly will upvote

Section B - COMPULSORY Answer Question 9 (30 marks) Question 9 Wincheap Plc is a publicly listed company; the following is the trial balance of Wincheap Plc at 31 December 2021. The following additional information is relevant: i) The land and buildings were purchased on 1 January 2006. The cost of land was 90 million. No land and buildings were purchased since that date. On 1 January 2021 the company had its land and buildings professionally valued at 110 million and buildings valued at 180 million. The estimated life of the buildings Remember to regularly save your work Sheet 10 of 17 Module Code: ACFI2307 REFERRED/DEFERRED was originally 40 years and the remaining life has not changed as result of the valuation. ii) Plant is depreciated at 20% per annum using the reducing balance method. Depreciation on buildings and plant is charged to the cost of sales. iii) The long-term loan was raised on 1 January 2021. At the year end, interest remained outstanding. iv) The provision for taxation for the year to 31st December 2021 has been estimated at 29.5 million. v) Inventory at 31st December 2021 was valued at 46.4 million. REQUIRED: Prepare the following financial statements for the year ended 31st December 2021 in accordance with IAS 1. Show working notes where necessary. a) Statement of Profit and Loss and Other Comprehensive income. b) Statement of Changes in Equity. c) Statement of Financial Position. Section B - COMPULSORY Answer Question 9 (30 marks) Question 9 Wincheap Plc is a publicly listed company; the following is the trial balance of Wincheap Plc at 31 December 2021. The following additional information is relevant: i) The land and buildings were purchased on 1 January 2006. The cost of land was 90 million. No land and buildings were purchased since that date. On 1 January 2021 the company had its land and buildings professionally valued at 110 million and buildings valued at 180 million. The estimated life of the buildings Remember to regularly save your work Sheet 10 of 17 Module Code: ACFI2307 REFERRED/DEFERRED was originally 40 years and the remaining life has not changed as result of the valuation. ii) Plant is depreciated at 20% per annum using the reducing balance method. Depreciation on buildings and plant is charged to the cost of sales. iii) The long-term loan was raised on 1 January 2021. At the year end, interest remained outstanding. iv) The provision for taxation for the year to 31st December 2021 has been estimated at 29.5 million. v) Inventory at 31st December 2021 was valued at 46.4 million. REQUIRED: Prepare the following financial statements for the year ended 31st December 2021 in accordance with IAS 1. Show working notes where necessary. a) Statement of Profit and Loss and Other Comprehensive income. b) Statement of Changes in Equity. c) Statement of Financial PositionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started