please do it fast i meed it for exam amd i have only one hour 30 minutes it is one question

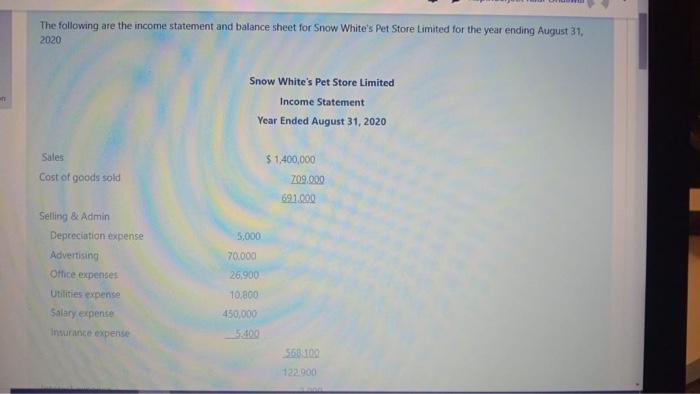

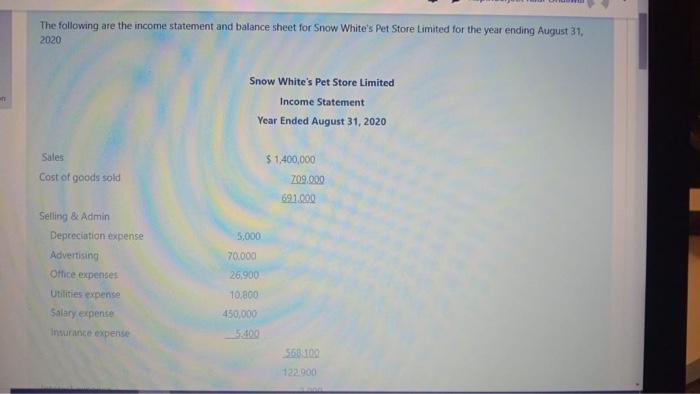

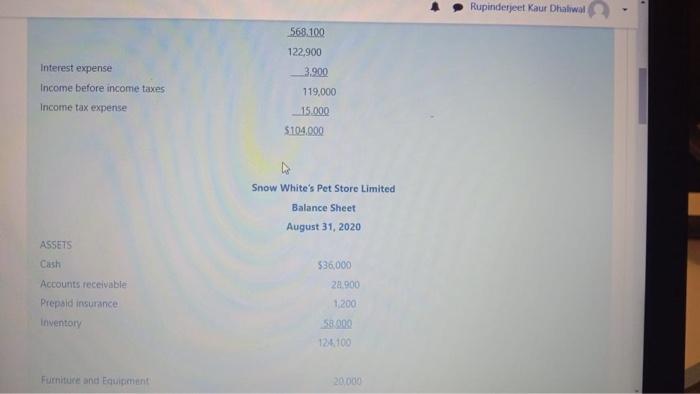

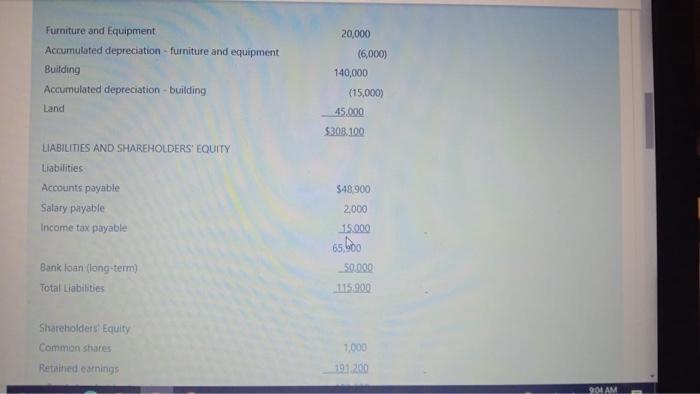

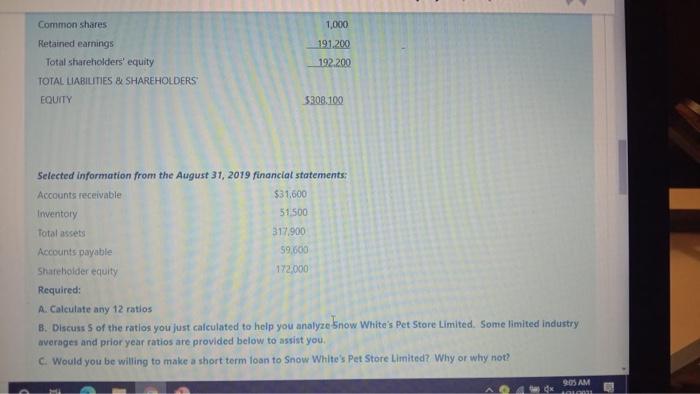

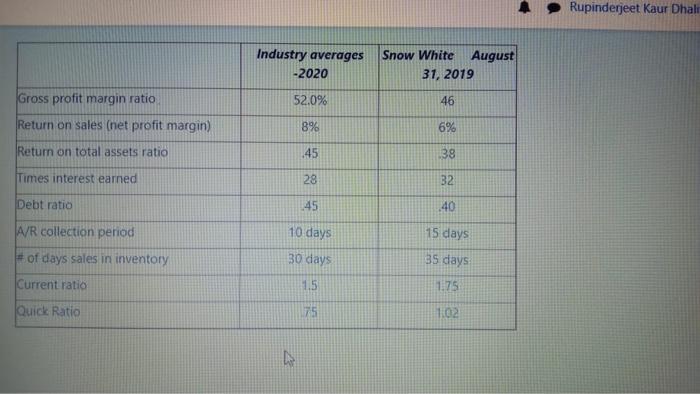

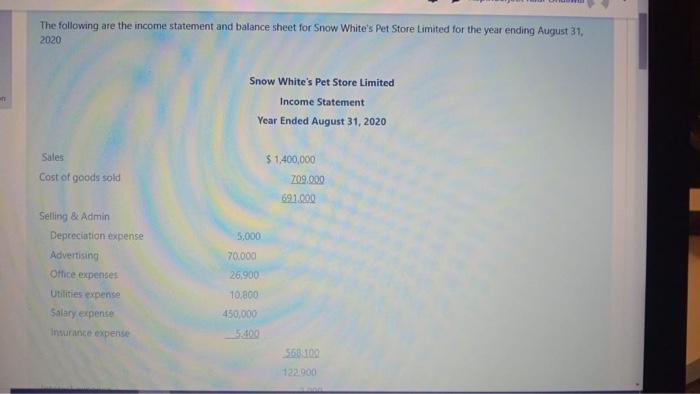

The following are the income statement and balance sheet for Snow White's Pet Store Limited for the year ending August 31, 2020 Snow White's Pet Store Limited Income Statement Year Ended August 31, 2020 Sales Cost of goods sold $ 1,400,000 209.000 691.000 Selling & Admin Depreciation expense Advertising Office expenses Utilities expense Salary expense Insurance expense 5,000 70.000 26.900 10.800 450,000 5.200 568100 Rupinderjeet Kaur Dhaliwal 568.100 122.900 3.900 Interest expense Income before income taxes Income tax expense 119,000 15.000 5104.000 Snow White's Pet Store Limited Balance Sheet August 31, 2020 ASSETS Cash 536.000 28.900 Accounts receivable Prepaid insurance Inventory 1,200 58.000 124.100 Furniture and Equipment 20.000 20,000 Furniture and Equipment Accumulated depreciation - furniture and equipment Building Accumulated depreciation - building Land (6,000) 140,000 (15,000) 45.000 $308.100 LIABILITIES AND SHAREHOLDERS' EQUITY Liabilities Accounts payable Salary payable Income tax payable $48.900 2,000 15.000 65.600 50.000 Bank loan (long-term) Total Liabilities 115.900 Shareholders' Equity Common shares 1.000 Retained earnings 191200 904 AM 1,000 191.200 Common shares Retained earnings Total shareholders' equity TOTAL LIABILITIES & SHAREHOLDERS EQUITY 192.200 5308.100 Selected information from the August 31, 2019 financial statements: Accounts receivable $31,600 Inventory 51500 Total assets 317.900 Accounts payable 59,600 Shareholder equity 172.000 Required: A. Calculate any 12 ratios B. Discuss 5 of the ratlos you just calculated to help you analyze Snow White's Pet Store Limited. Some limited industry averages and prior year ratios are provided below to assist you, Would you be willing to make a short term loan to Snow White's Pet Store Limited? Why or why not? 9:05 AM Rupinderjeet Kaur Dhali Industry averages -2020 Snow White August 31, 2019 Gross profit margin ratio 52.0% 46 Return on sales (net profit margin) 8% 6% Return on total assets ratio .45 38 Times interest earned 28 32 Debt ratio 45 40 A/R collection period 10 days 30 days 15 days 35 days # of days sales in inventory Current ratio 1.5 1.75 Quick Ratio 175 102 N