please do it for me this the full question for my revision.Thank you

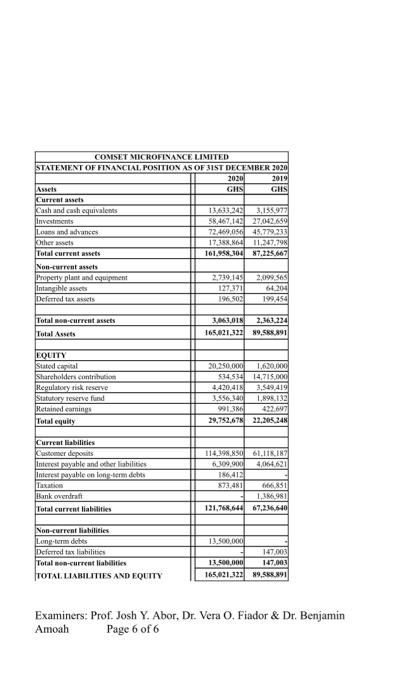

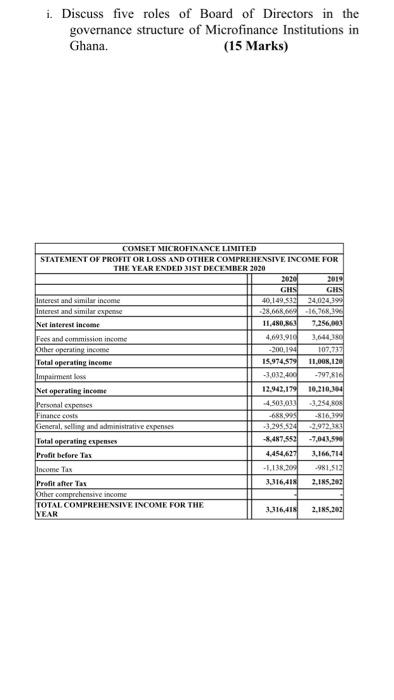

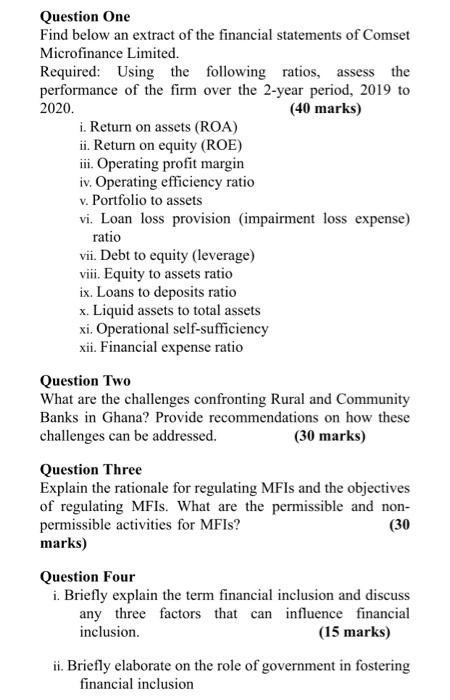

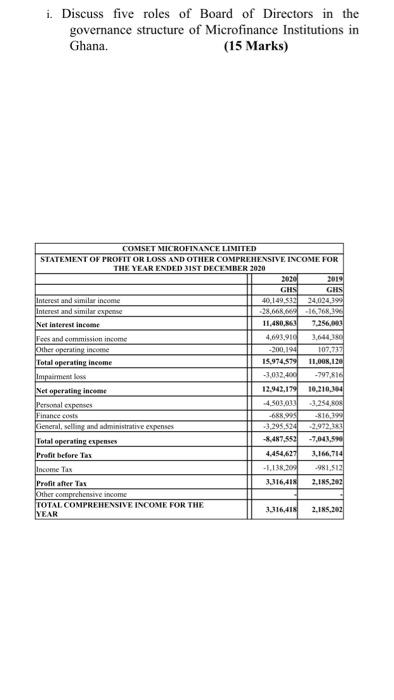

Question One Find below an extract of the financial statements of Comset Microfinance Limited Required: Using the following ratios, assess the performance of the firm over the 2-year period, 2019 to 2020. (40 marks) i. Return on assets (ROA) ii. Return on equity (ROE) iii. Operating profit margin iv. Operating efficiency ratio v. Portfolio to assets vi. Loan loss provision (impairment loss expense) ratio vii. Debt to equity (leverage) viii. Equity to assets ratio ix. Loans to deposits ratio x. Liquid assets to total assets xi. Operational self-sufficiency xii. Financial expense ratio Question Two What are the challenges confronting Rural and Community Banks in Ghana? Provide recommendations on how these challenges can be addressed. (30 marks) Question Three Explain the rationale for regulating MFIs and the objectives of regulating MFIs. What are the permissible and non- permissible activities for MFIs? (30 marks) Question Four i. Briefly explain the term financial inclusion and discuss any three factors that can influence financial inclusion (15 marks) ii. Briefly elaborate on the role of government in fostering financial inclusion (15 marks) Question Five i. Microfinance is the provision of financial services to the poor. A clear understanding of the characteristics of the poor is therefore key to the design and deployment of appropriate products and services. In no more than 1,000 words, discuss any four characteristics of the poor that necessitate a unique approach to designing financial products and services for them. (15 Marks) ii. In you were the Governor of the Central Bank of Ghana, would you limit the scope of microfinance to microcredit provision or you would expand the scope to include micro savings, microinsurance and other financial services to the poor? Justify your perspective in no more than 1,000 words. (15 Marks) Question Six a i. Analyze how the Group Lending and the Village Lending Models are used to manage the problem of Information Asymmetry in MFIs lending. (10 Marks) ii. Which of the two lending models in (i) is better at managing the problem of Information Asymmetry? (5 Marks) b. As part of the recent Banking and Specialized Deposit Taking Institutions clean up, the Bank of Ghana revoked the license of 347 Microfinance Institutions. From the press statement issued on the 31st of May 2019, the Bank of Ghana has put in place measures to ensure that the existing institutions remain safe and sound by complying with relevant prudential norms. The measures includes Introducing proportional corporate governance, fit and proper, and risk management directives; Increase the resources available for effective supervision of licensed microfinance companies. . i. Discuss five roles of Board of Directors in the governance structure of Microfinance Institutions in Ghana. (15 Marks) COMSET MICROFINANCE LIMITED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED BIST DECEMBER 2020 2020 2019 GHS GHS Interest and similar income 40,149,532 24,024.399 Interest and similar por 28,668.-1676819 Net interest income 11.480,863 7.256,003 Fees and commission income 4,693.910 3,644,30 Other operating income -200,194 107,737 Total operating income 15,974.579 11,008,120 Impairment loss -3,032,400 - 797.81 Net operating income 12.942.179 10.210.14 Personal expenses -4.303,013 3.254.80 Finance costs -688,995 -8161 Kieneral, selling and administrative expenses -3.295.524 -3.972.33 Total operating expenses -8,487,552 -7,043.50 Profit before Tas 4.454.627 3.166,714 Income Tax -5.138.209 -981 $12 Profit after Tax 3.316,41 2.185.282 Other comprehensive income TOTAL COMPREHENSIVE INCOME FOR THE 3316,418 YEAR 2.185.202 COMSET MICROFINANCE LIMITED STATEMENT OF FINANCIAL POSITION AS OF 31ST DECEMBER 2020 2020 2019 Assets GHS GHS Current assets Cash and cash equivalents 13,633.242 3.135.977 Investments 58,467.142 27.042.689 Les and advances 72.46205045,779233 Other assets 17,188,164 11,247.798 Total current 101.988_104 87.225.667 Non-currentes Property plant and equipment 2.739,149 2,099,565 Intangible assets 127,371 64204 Defend taxes 199.454 1 SOS 2,363.224 Total current assets Total Assets 3,063,01$ 165,621 322 89,58891 EQUITY Suated capital Shareholders contribution Regulatory risk Reserve Statutory reserve fund Retained caring Total equilty 20.250,000 1.620.000 534 534 14,715 4,420,418 3,549.419 3.556.340 1.898.132 43207 29,752.678 22.25.248 Current liabilities Customer deposits Interest payable and other liabilities Interest payable on long-term debts Taxati Bank overdraft Total current liabilities 114.398,850 61,118,187 309,900 4,064,621 16412 873,481 S1 1,386,981 121,768.64467.226,640 Non-current liabilities Long-term dobes Deferred tax liabilities Total concurrent liabilities TOTAL LIABILITIES AND EQUITY 13.500.000 147,003 13.500.000 147,003 165,021.322 9.58891 Examiners: Prof. Josh Y. Abor, Dr. Vera O Fiador & Dr. Benjamin Amoah Page 6 of 6 Question One Find below an extract of the financial statements of Comset Microfinance Limited Required: Using the following ratios, assess the performance of the firm over the 2-year period, 2019 to 2020. (40 marks) i. Return on assets (ROA) ii. Return on equity (ROE) iii. Operating profit margin iv. Operating efficiency ratio v. Portfolio to assets vi. Loan loss provision (impairment loss expense) ratio vii. Debt to equity (leverage) viii. Equity to assets ratio ix. Loans to deposits ratio x. Liquid assets to total assets xi. Operational self-sufficiency xii. Financial expense ratio Question Two What are the challenges confronting Rural and Community Banks in Ghana? Provide recommendations on how these challenges can be addressed. (30 marks) Question Three Explain the rationale for regulating MFIs and the objectives of regulating MFIs. What are the permissible and non- permissible activities for MFIs? (30 marks) Question Four i. Briefly explain the term financial inclusion and discuss any three factors that can influence financial inclusion (15 marks) ii. Briefly elaborate on the role of government in fostering financial inclusion (15 marks) Question Five i. Microfinance is the provision of financial services to the poor. A clear understanding of the characteristics of the poor is therefore key to the design and deployment of appropriate products and services. In no more than 1,000 words, discuss any four characteristics of the poor that necessitate a unique approach to designing financial products and services for them. (15 Marks) ii. In you were the Governor of the Central Bank of Ghana, would you limit the scope of microfinance to microcredit provision or you would expand the scope to include micro savings, microinsurance and other financial services to the poor? Justify your perspective in no more than 1,000 words. (15 Marks) Question Six a i. Analyze how the Group Lending and the Village Lending Models are used to manage the problem of Information Asymmetry in MFIs lending. (10 Marks) ii. Which of the two lending models in (i) is better at managing the problem of Information Asymmetry? (5 Marks) b. As part of the recent Banking and Specialized Deposit Taking Institutions clean up, the Bank of Ghana revoked the license of 347 Microfinance Institutions. From the press statement issued on the 31st of May 2019, the Bank of Ghana has put in place measures to ensure that the existing institutions remain safe and sound by complying with relevant prudential norms. The measures includes Introducing proportional corporate governance, fit and proper, and risk management directives; Increase the resources available for effective supervision of licensed microfinance companies. . i. Discuss five roles of Board of Directors in the governance structure of Microfinance Institutions in Ghana. (15 Marks) COMSET MICROFINANCE LIMITED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED BIST DECEMBER 2020 2020 2019 GHS GHS Interest and similar income 40,149,532 24,024.399 Interest and similar por 28,668.-1676819 Net interest income 11.480,863 7.256,003 Fees and commission income 4,693.910 3,644,30 Other operating income -200,194 107,737 Total operating income 15,974.579 11,008,120 Impairment loss -3,032,400 - 797.81 Net operating income 12.942.179 10.210.14 Personal expenses -4.303,013 3.254.80 Finance costs -688,995 -8161 Kieneral, selling and administrative expenses -3.295.524 -3.972.33 Total operating expenses -8,487,552 -7,043.50 Profit before Tas 4.454.627 3.166,714 Income Tax -5.138.209 -981 $12 Profit after Tax 3.316,41 2.185.282 Other comprehensive income TOTAL COMPREHENSIVE INCOME FOR THE 3316,418 YEAR 2.185.202 COMSET MICROFINANCE LIMITED STATEMENT OF FINANCIAL POSITION AS OF 31ST DECEMBER 2020 2020 2019 Assets GHS GHS Current assets Cash and cash equivalents 13,633.242 3.135.977 Investments 58,467.142 27.042.689 Les and advances 72.46205045,779233 Other assets 17,188,164 11,247.798 Total current 101.988_104 87.225.667 Non-currentes Property plant and equipment 2.739,149 2,099,565 Intangible assets 127,371 64204 Defend taxes 199.454 1 SOS 2,363.224 Total current assets Total Assets 3,063,01$ 165,621 322 89,58891 EQUITY Suated capital Shareholders contribution Regulatory risk Reserve Statutory reserve fund Retained caring Total equilty 20.250,000 1.620.000 534 534 14,715 4,420,418 3,549.419 3.556.340 1.898.132 43207 29,752.678 22.25.248 Current liabilities Customer deposits Interest payable and other liabilities Interest payable on long-term debts Taxati Bank overdraft Total current liabilities 114.398,850 61,118,187 309,900 4,064,621 16412 873,481 S1 1,386,981 121,768.64467.226,640 Non-current liabilities Long-term dobes Deferred tax liabilities Total concurrent liabilities TOTAL LIABILITIES AND EQUITY 13.500.000 147,003 13.500.000 147,003 165,021.322 9.58891 Examiners: Prof. Josh Y. Abor, Dr. Vera O Fiador & Dr. Benjamin Amoah Page 6 of 6

please do it for me this the full question for my revision.Thank you

please do it for me this the full question for my revision.Thank you