Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 10 minutes will upvote 1. Answer all parts of this question. (a) Explain how the clearing house operates to protect the

please do it in 10 minutes will upvote

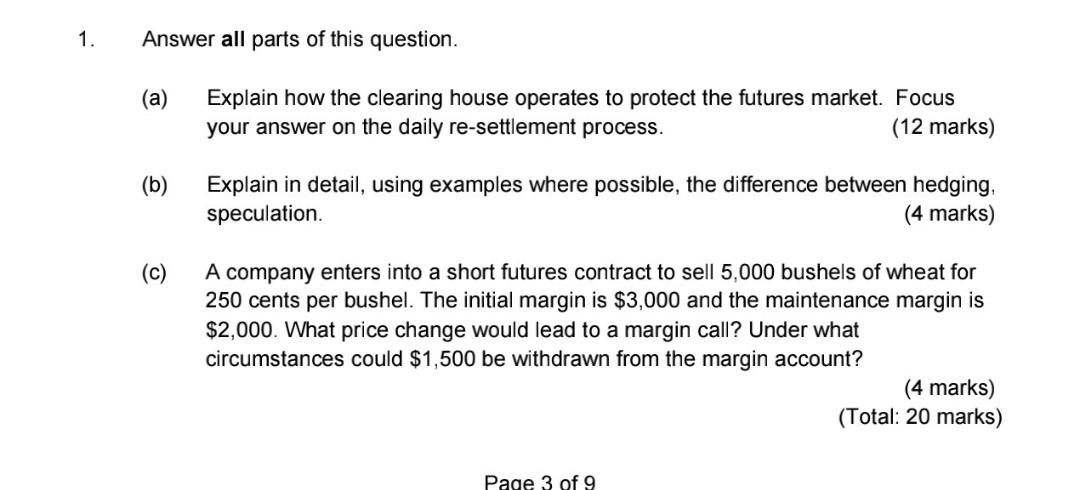

1. Answer all parts of this question. (a) Explain how the clearing house operates to protect the futures market. Focus your answer on the daily re-settlement process. (12 marks) (b) Explain in detail, using examples where possible, the difference between hedging, speculation. (4 marks) (c) A company enters into a short futures contract to sell 5,000 bushels of wheat for 250 cents per bushel. The initial margin is $3,000 and the maintenance margin is $2,000. What price change would lead to a margin call? Under what circumstances could $1,500 be withdrawn from the margin account? (4 marks) (Total: 20 marks) Page 3 of 9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started