Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 10 minutes will upvote 14. How much of a company's stock can a potential acquirer buy on the open market before

please do it in 10 minutes will upvote

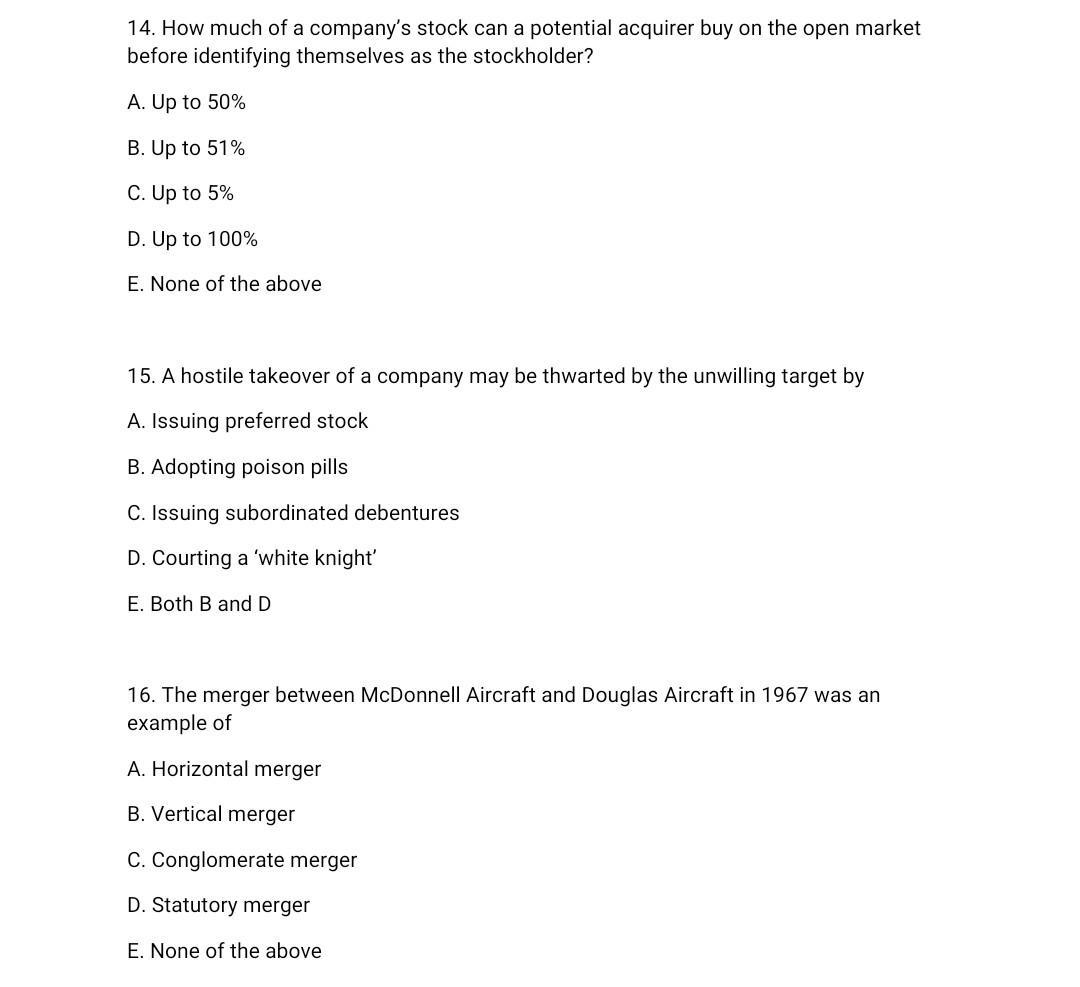

14. How much of a company's stock can a potential acquirer buy on the open market before identifying themselves as the stockholder? A. Up to 50% B. Up to 51% C. Up to 5% D. Up to 100% E. None of the above 15. A hostile takeover of a company may be thwarted by the unwilling target by A. Issuing preferred stock B. Adopting poison pills C. Issuing subordinated debentures D. Courting a 'white knight' E. Both B and D 16. The merger between McDonnell Aircraft and Douglas Aircraft in 1967 was an example of A. Horizontal merger B. Vertical merger C. Conglomerate merger D. Statutory merger E. None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started