Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 10 minutes will upvote Assume a project has normal cash flows. All else equal, which of the following statements is CORRECT?

please do it in 10 minutes will upvote

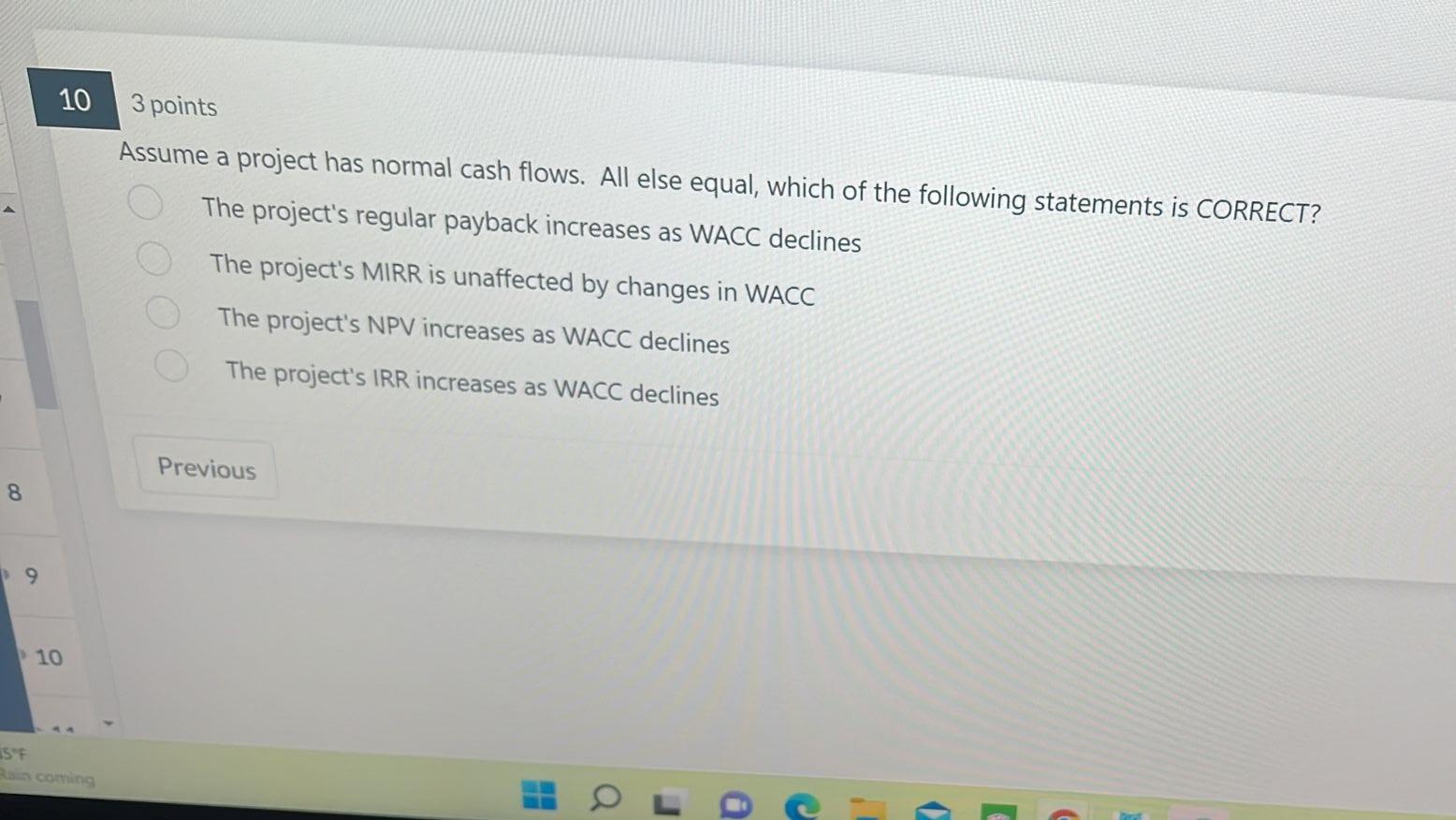

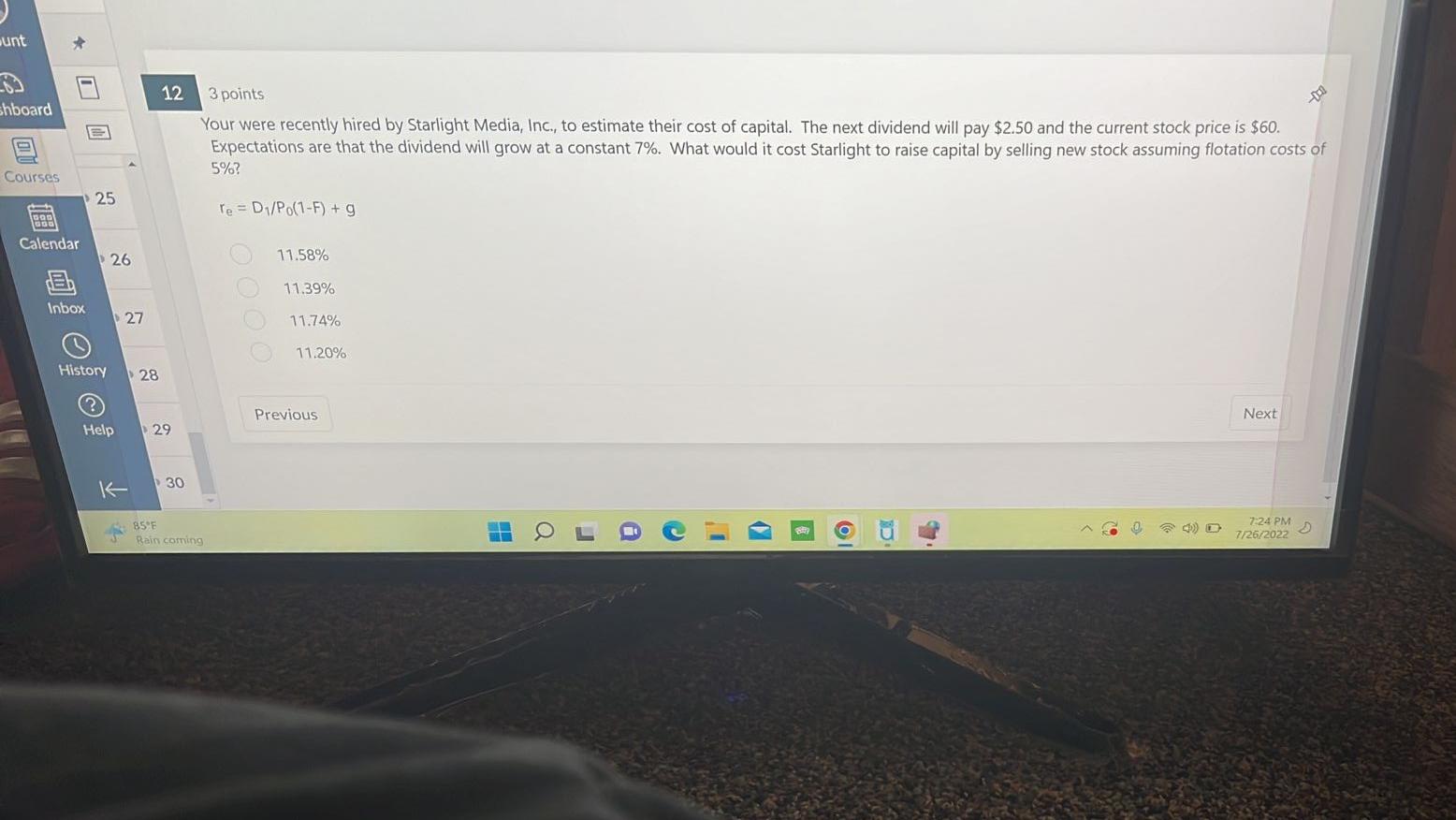

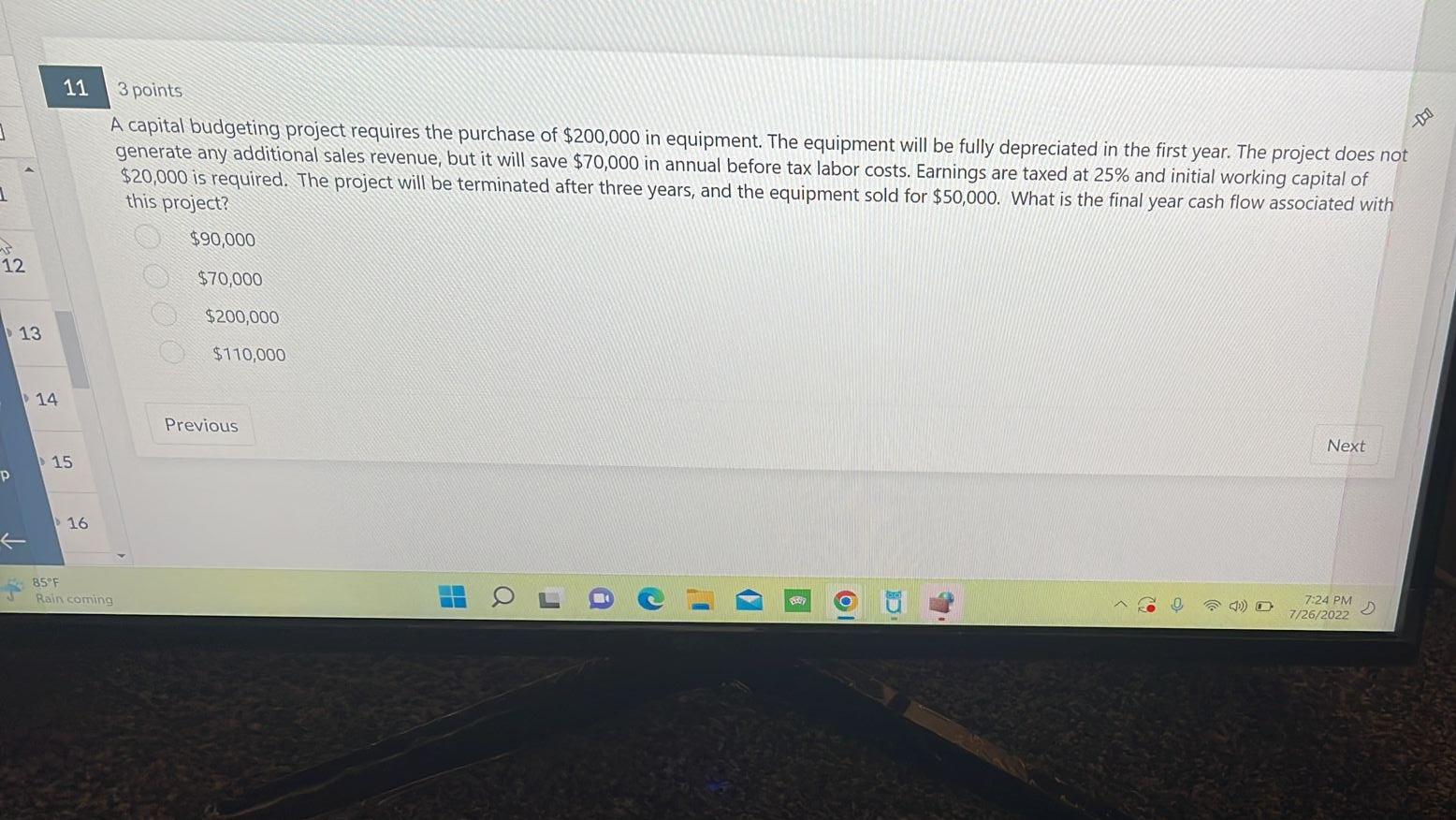

Assume a project has normal cash flows. All else equal, which of the following statements is CORRECT? The project's regular payback increases as WACC declines The project's MIRR is unaffected by changes in WACC The project's NPV increases as WACC declines The project's IRR increases as WACC declines Your were recently hired by Starlight Media, Inc., to estimate their cost of capital. The next dividend will pay $2.50 and the current stock price is $60. Expectations are that the dividend will grow at a constant 7%. What would it cost Starlight to raise capital by selling new stock assuming flotation costs of 5% ? re=D1/P0(1F)+g 11.58% 11.39% 11.74% 11.20% A capital budgeting project requires the purchase of $200,000 in equipment. The equipment will be fully depreciated in the first year. The project does not generate any additional sales revenue, but it will save $70,000 in annual before tax labor costs. Earnings are taxed at 25% and initial working capital of $20,000 is required. The project will be terminated after three years, and the equipment sold for $50,000. What is the final year cash flow associated with this project? $90,000 $70,000 $200,000 $110,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started