Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 10 minutes will upvote It is 1 August 2022. Bayes PLC (US), an American company, sold a 10-year-old Capesize vessel to

please do it in 10 minutes will upvote

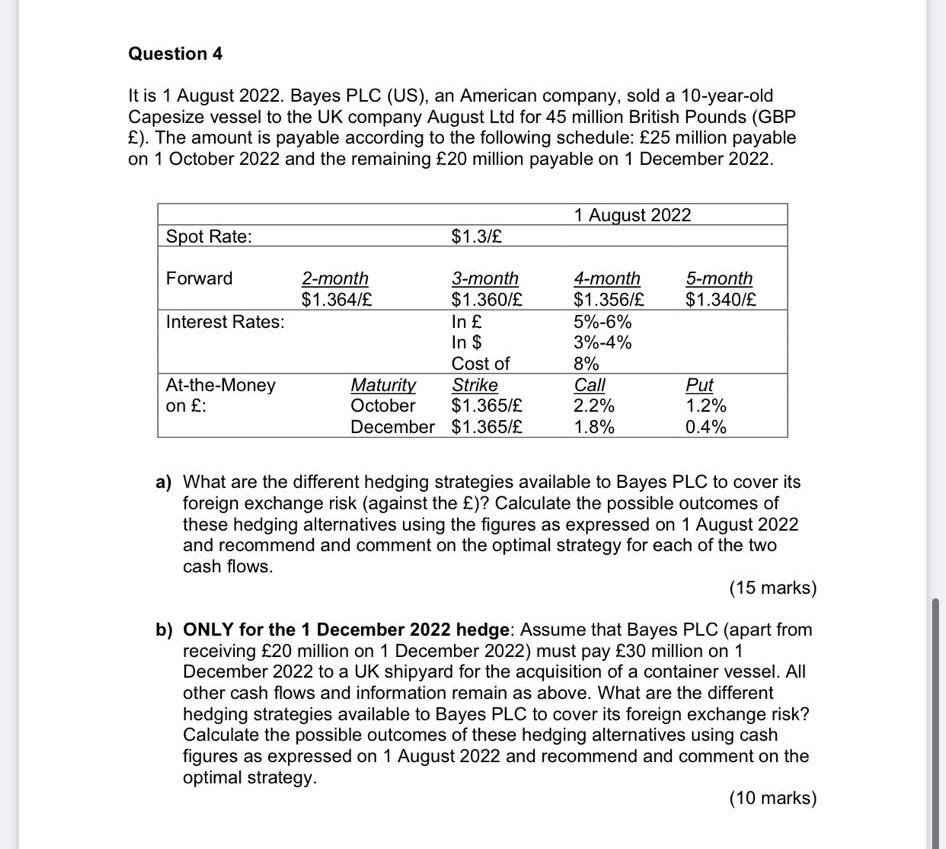

It is 1 August 2022. Bayes PLC (US), an American company, sold a 10-year-old Capesize vessel to the UK company August Ltd for 45 million British Pounds (GBP ). The amount is payable according to the following schedule: 25 million payable on 1 October 2022 and the remaining 20 million payable on 1 December 2022. a) What are the different hedging strategies available to Bayes PLC to cover its foreign exchange risk (against the )? Calculate the possible outcomes of these hedging alternatives using the figures as expressed on 1 August 2022 and recommend and comment on the optimal strategy for each of the two cash flows. (15 marks) b) ONLY for the 1 December 2022 hedge: Assume that Bayes PLC (apart from receiving 20 million on 1 December 2022) must pay 30 million on 1 December 2022 to a UK shipyard for the acquisition of a container vessel. All other cash flows and information remain as above. What are the different hedging strategies available to Bayes PLC to cover its foreign exchange risk? Calculate the possible outcomes of these hedging alternatives using cash figures as expressed on 1 August 2022 and recommend and comment on the optimal strategy. (10 marks) It is 1 August 2022. Bayes PLC (US), an American company, sold a 10-year-old Capesize vessel to the UK company August Ltd for 45 million British Pounds (GBP ). The amount is payable according to the following schedule: 25 million payable on 1 October 2022 and the remaining 20 million payable on 1 December 2022. a) What are the different hedging strategies available to Bayes PLC to cover its foreign exchange risk (against the )? Calculate the possible outcomes of these hedging alternatives using the figures as expressed on 1 August 2022 and recommend and comment on the optimal strategy for each of the two cash flows. (15 marks) b) ONLY for the 1 December 2022 hedge: Assume that Bayes PLC (apart from receiving 20 million on 1 December 2022) must pay 30 million on 1 December 2022 to a UK shipyard for the acquisition of a container vessel. All other cash flows and information remain as above. What are the different hedging strategies available to Bayes PLC to cover its foreign exchange risk? Calculate the possible outcomes of these hedging alternatives using cash figures as expressed on 1 August 2022 and recommend and comment on the optimal strategy. (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started