Answered step by step

Verified Expert Solution

Question

1 Approved Answer

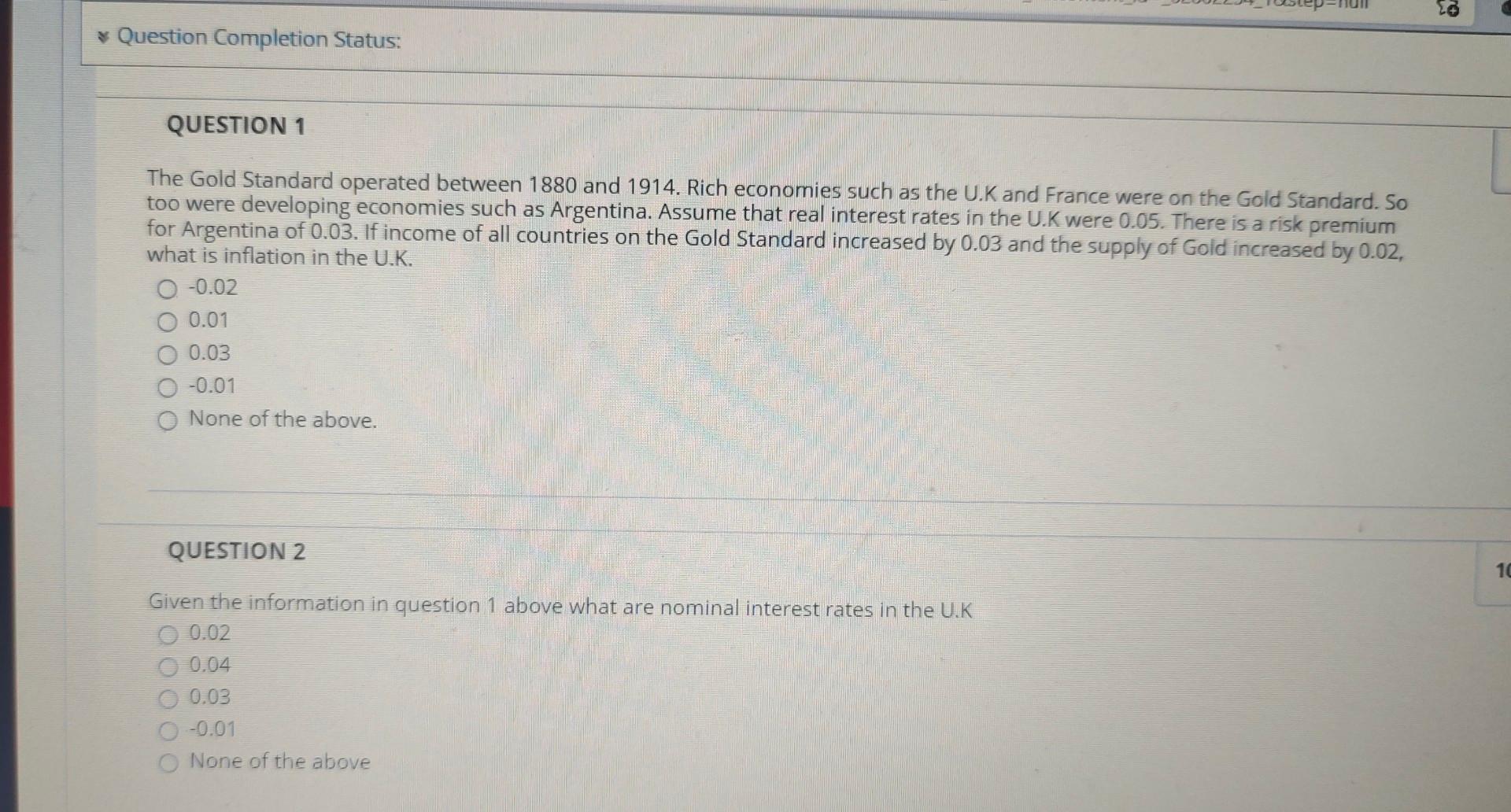

please do it in 10 minutes will upvote no * Question Completion Status: QUESTION 1 The Gold Standard operated between 1880 and 1914. Rich economies

please do it in 10 minutes will upvote

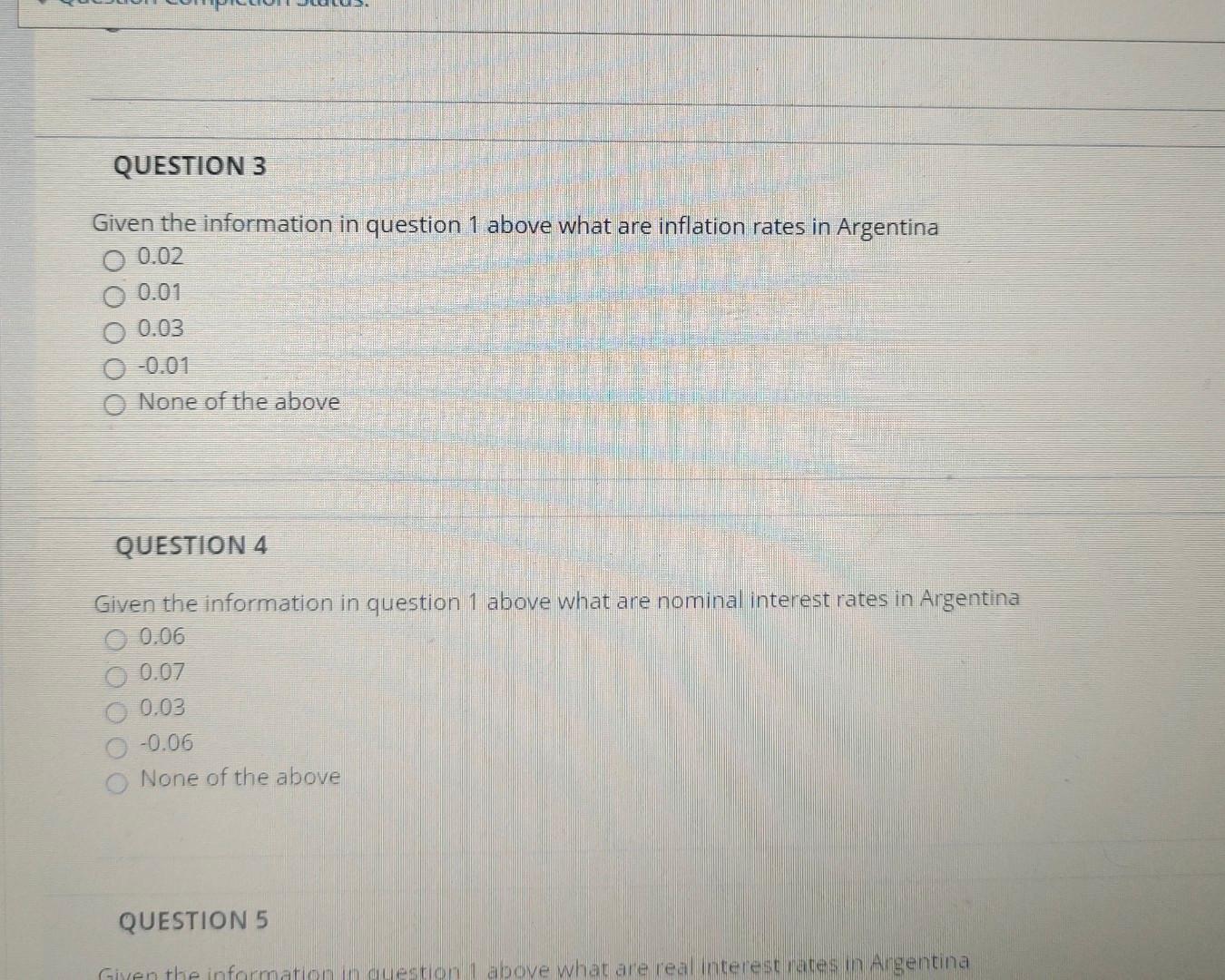

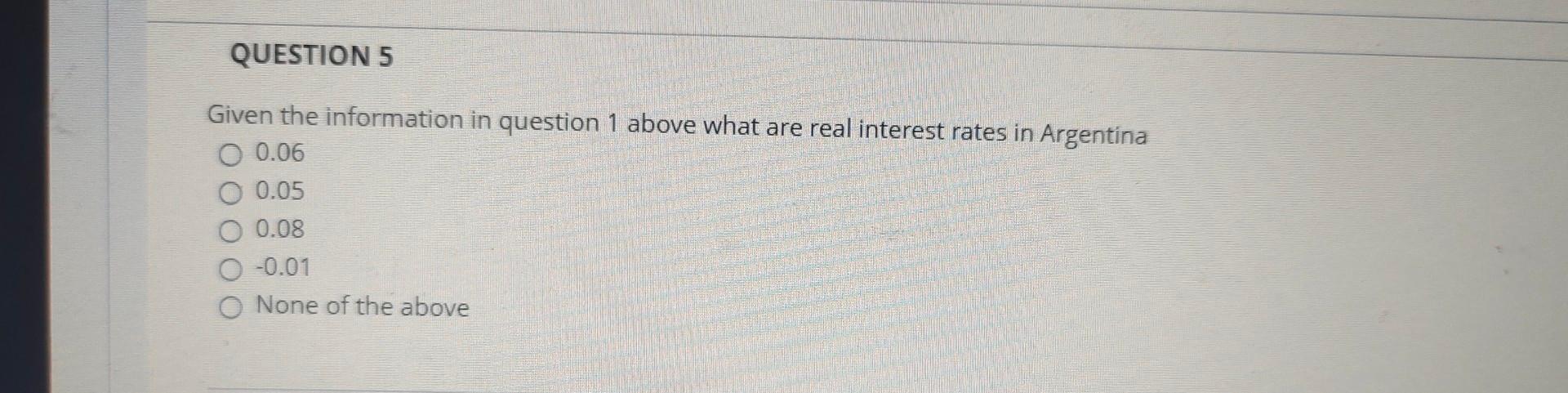

no * Question Completion Status: QUESTION 1 The Gold Standard operated between 1880 and 1914. Rich economies such as the UK and France were on the Gold Standard. So too were developing economies such as Argentina. Assume that real interest rates in the U.K were 0.05. There is a risk premium for Argentina of 0.03. If income of all countries on the Gold Standard increased by 0.03 and the supply of Gold increased by 0.02, what is inflation in the U.K. 0 -0.02 O 0.01 0.03 -0.01 O None of the above. QUESTION 2 10 Given the information in question 1 above what are nominal interest rates in the U.K 0.02 0.04 0.03 0 -0.01 None of the above QUESTION 3 Given the information in question 1 above what are inflation rates in Argentina 0 0.02 0 0.01 0 0.03 -0.01 None of the above QUESTION 4 Given the information in question 1 above what are nominal interest rates in Argentina 0 0.06 0.07 0.03 -0.06 None of the above QUESTION 5 Given the information in question above what are real interest rates in Argentina QUESTION 5 Given the information in question 1 above what are real interest rates in Argentina O 0.06 O 0.05 O 0.08 -0.01 O None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started