Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 10 minutes will upvote on Excell Scenario: A multi-national corporation is the sole tenant of a landmark CBD office building. The

please do it in 10 minutes will upvote on Excell

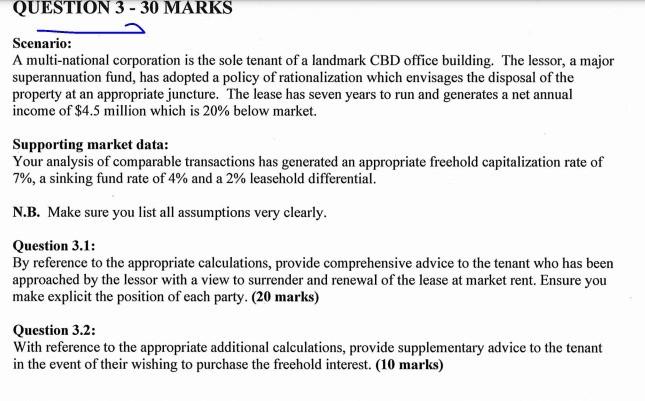

Scenario: A multi-national corporation is the sole tenant of a landmark CBD office building. The lessor, a major superannuation fund, has adopted a policy of rationalization which envisages the disposal of the property at an appropriate juncture. The lease has seven years to run and generates a net annual income of $4.5 million which is 20% below market. Supporting market data: Your analysis of comparable transactions has generated an appropriate freehold capitalization rate of 7%, a sinking fund rate of 4% and a 2% leasehold differential. N.B. Make sure you list all assumptions very clearly. Question 3.1: By reference to the appropriate calculations, provide comprehensive advice to the tenant who has been approached by the lessor with a view to surrender and renewal of the lease at market rent. Ensure you make explicit the position of each party. (20 marks) Question 3.2: With reference to the appropriate additional calculations, provide supplementary advice to the tenant in the event of their wishing to purchase the freehold interest. (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started