Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 10 minutes will upvote stion Completion Status: Consider the following after-tax cash flows for two mutually-exclusive projects. (Note: number in red

please do it in 10 minutes will upvote

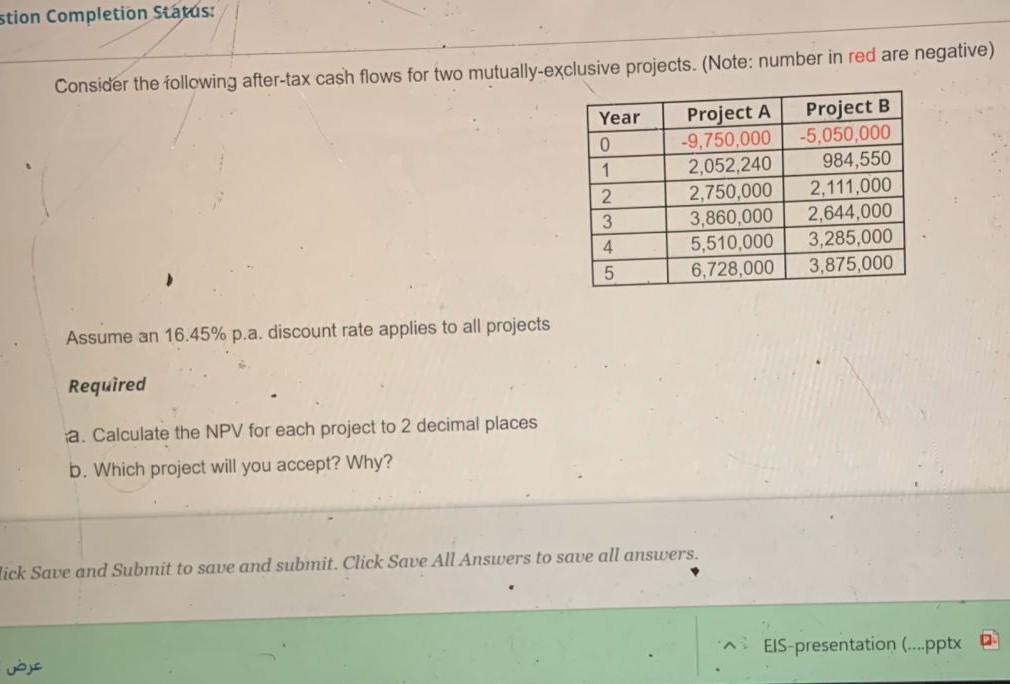

stion Completion Status: Consider the following after-tax cash flows for two mutually-exclusive projects. (Note: number in red are negative) Year 0 1 Project A -9,750,000 2,052,240 2,750,000 3,860,000 5,510,000 6,728,000 Project B -5,050,000 984,550 2,111,000 2,644,000 3,285,000 3,875,000 2. 3 4 5 Assume an 16.45% p.a. discount rate applies to all projects Required a. Calculate the NPV for each project to 2 decimal places b. Which project will you accept? Why? lick Save and Submit to save and submit. Click Save All Answers to save all answers. SEIS-presentation (....pptxStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started