Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 10 minutes will upvote The capital budgeting director of Sparrow Corporation is evaluating a project that costs $200,000, is expected to

please do it in 10 minutes will upvote

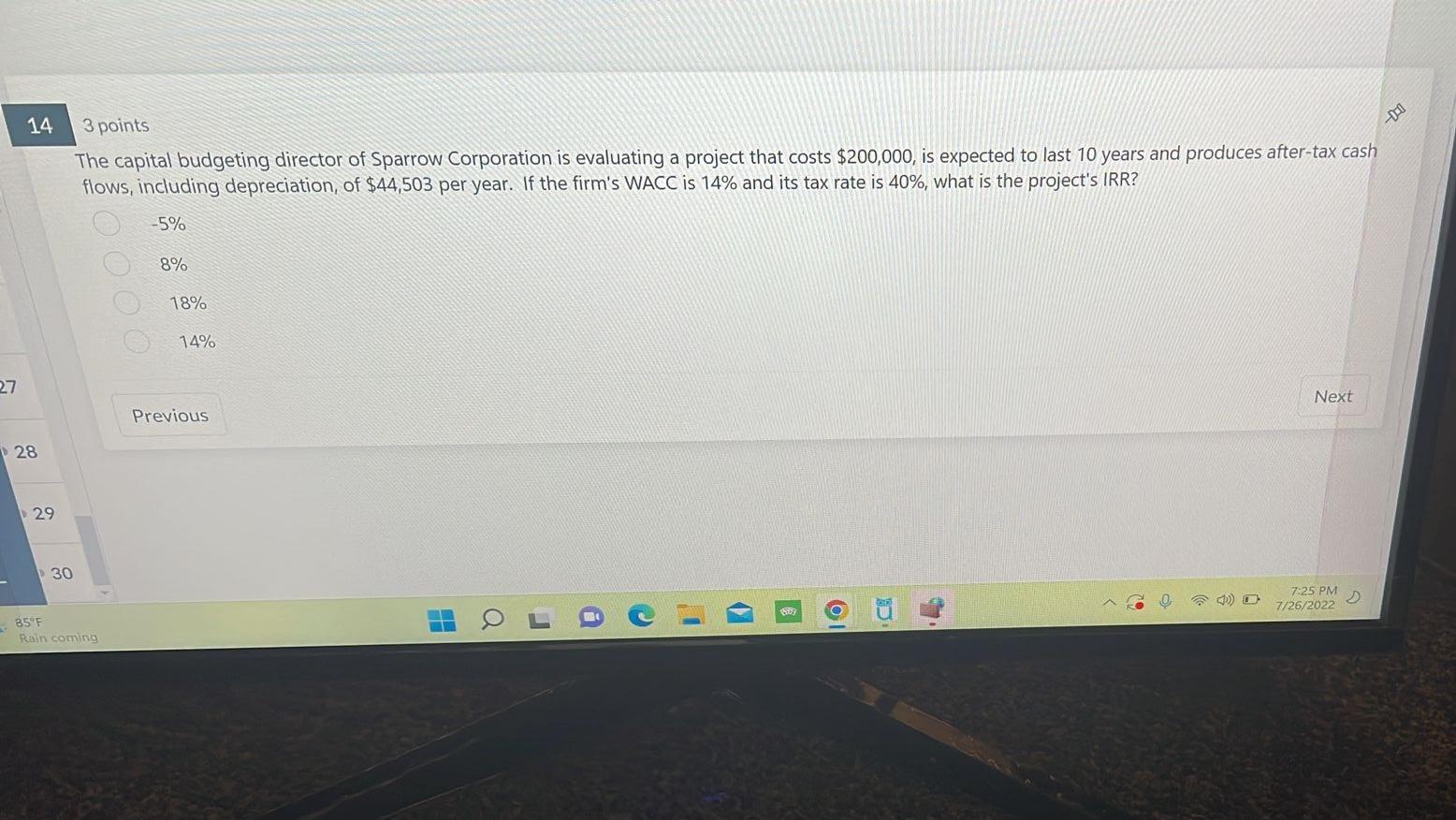

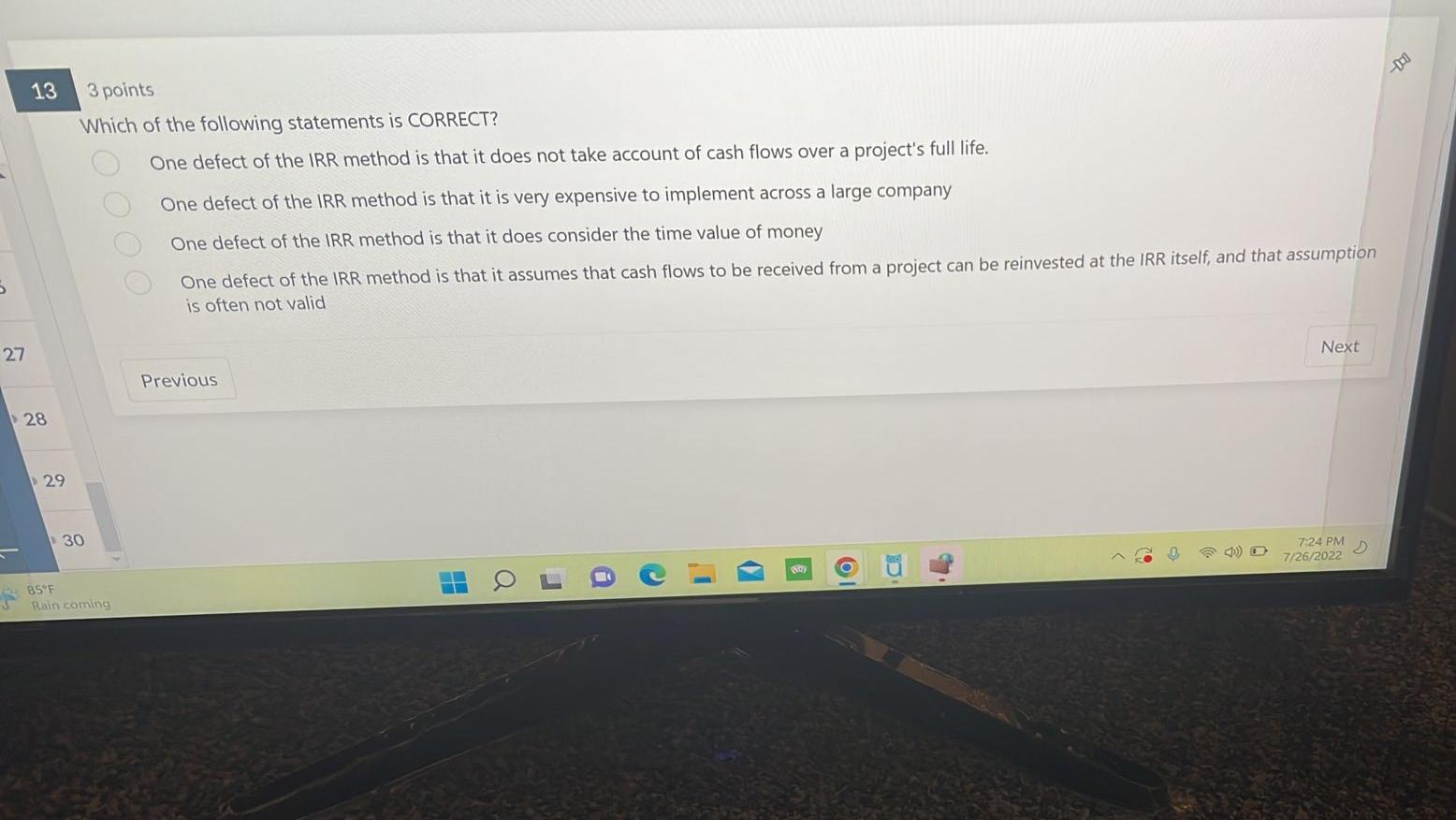

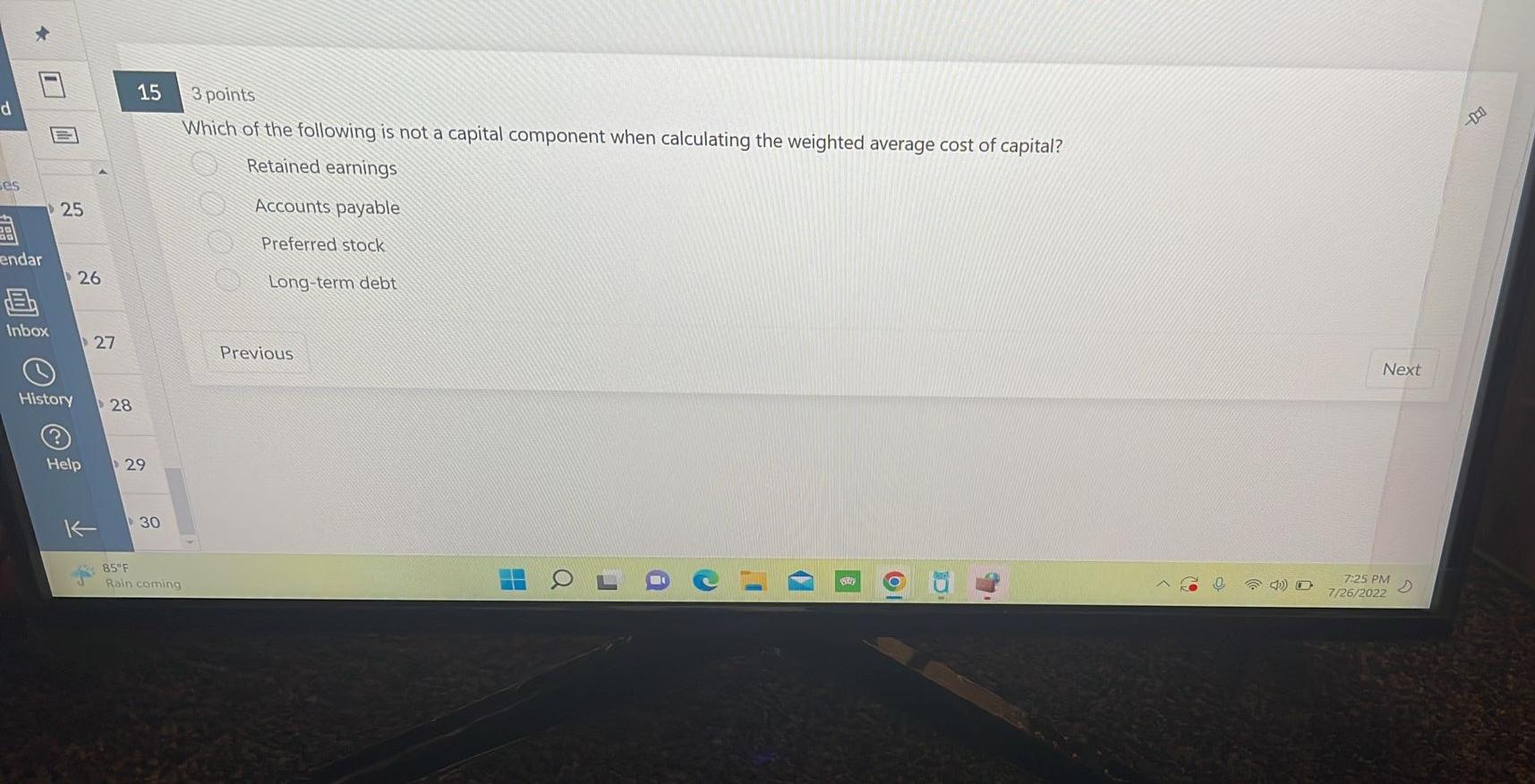

The capital budgeting director of Sparrow Corporation is evaluating a project that costs $200,000, is expected to last 10 years and produces after-tax cash flows, including depreciation, of $44,503 per year. If the firm's WACC is 14% and its tax rate is 40%, what is the project's IRR? 5% 8% 18% 14% 3 points Which of the following statements is CORRECT? One defect of the IRR method is that it does not take account of cash flows over a project's full life. One defect of the IRR method is that it is very expensive to implement across a large company One defect of the IRR method is that it does consider the time value of money One defect of the IRR method is that it assumes that cash flows to be received from an a project can beingest the is often not valid Which of the following is not a capital component when calculating the weighted average cost of capital? Retained earnings Accounts payable Preferred stock Long-term debtStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started