Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 20 minutes please urgently... I'll give you up thumb definitely Problem 16 You have until 9:00 PM to complete this assignment.

please do it in 20 minutes please urgently... I'll give you up thumb definitely

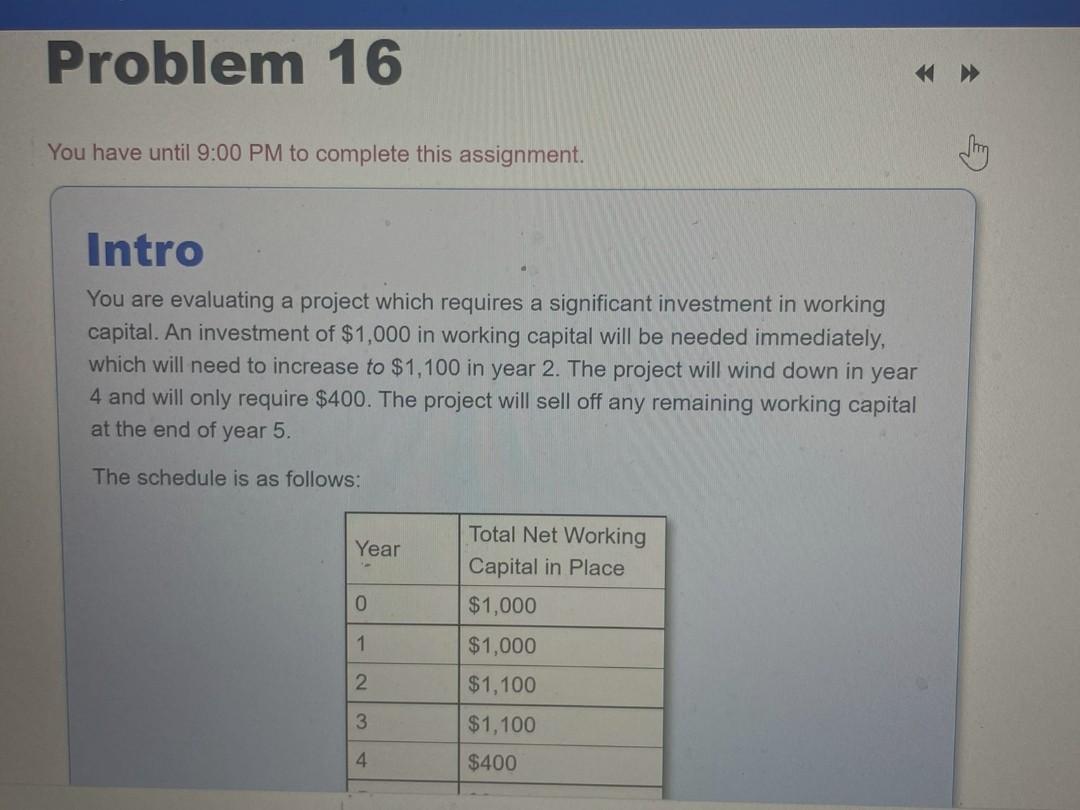

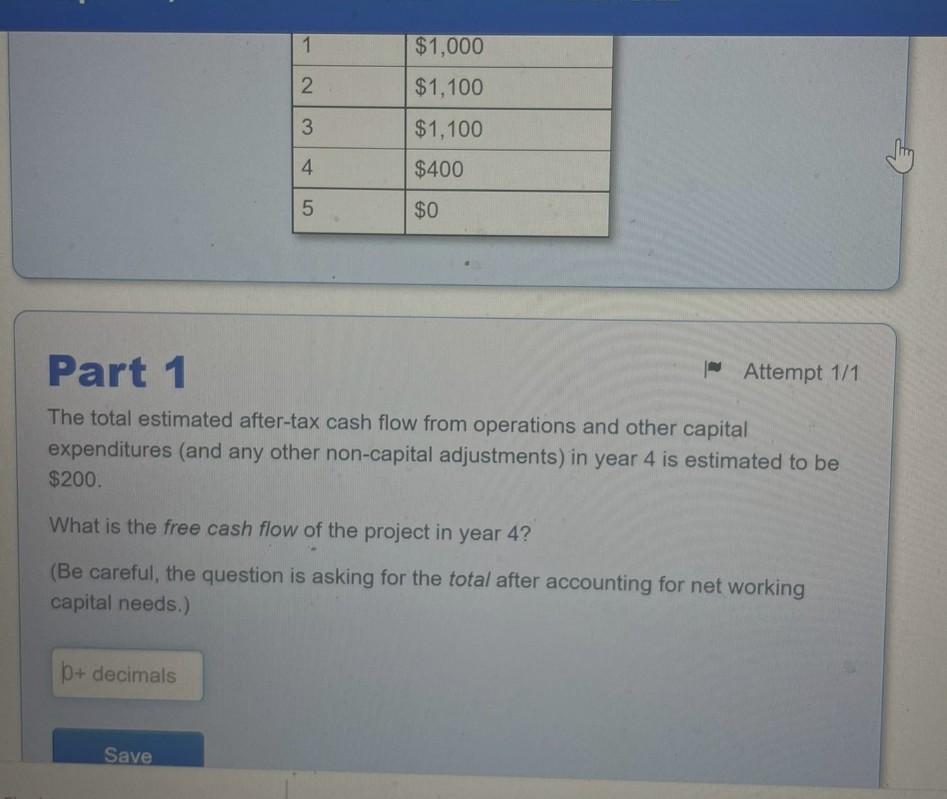

Problem 16 You have until 9:00 PM to complete this assignment. Intro You are evaluating a project which requires a significant investment in working capital. An investment of $1,000 in working capital will be needed immediately, which will need to increase to $1,100 in year 2. The project will wind down in year 4 and will only require $400. The project will sell off any remaining working capital at the end of year 5. The schedule is as follows: Year 0 1 234 >>> Total Net Working Capital in Place $1,000 $1,000 $1,100 $1,100 $400 0+ decimals 1 2 3 Save st 4 5 Part 1 The total estimated after-tax cash flow from operations and other capital expenditures (and any other non-capital adjustments) in year 4 is estimated to be $200. What is the free cash flow of the project in year 4? (Be careful, the question is asking for the total after accounting for net working capital needs.) $1,000 $1,100 $1,100 $400 $0 Attempt 1/1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started