Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 30 minutes please please please urgently... I'll give you up thumb definitely 3. Q3. Prepare the Cash flow statement of 'Win

please do it in 30 minutes please please please urgently... I'll give you up thumb definitely

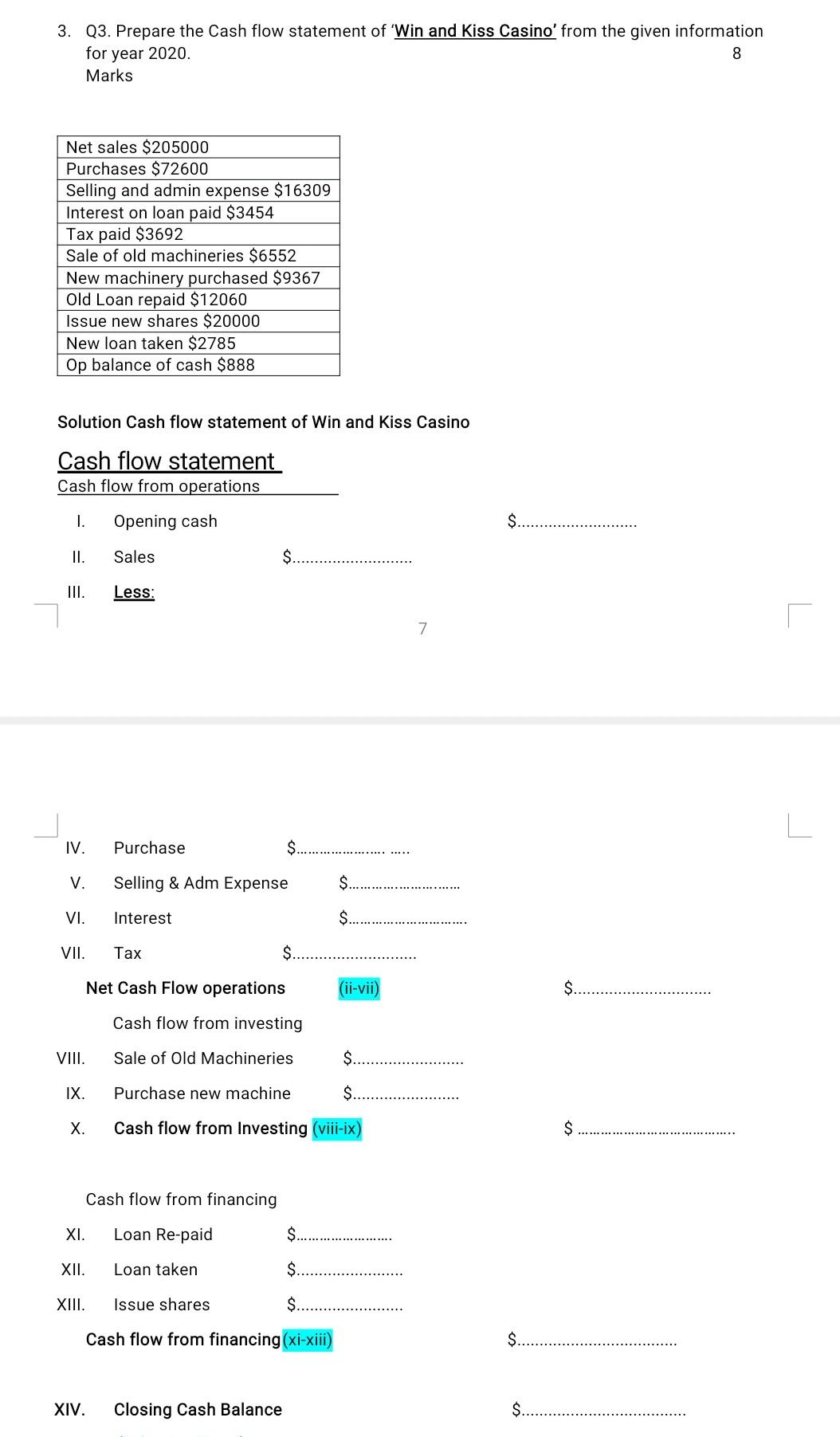

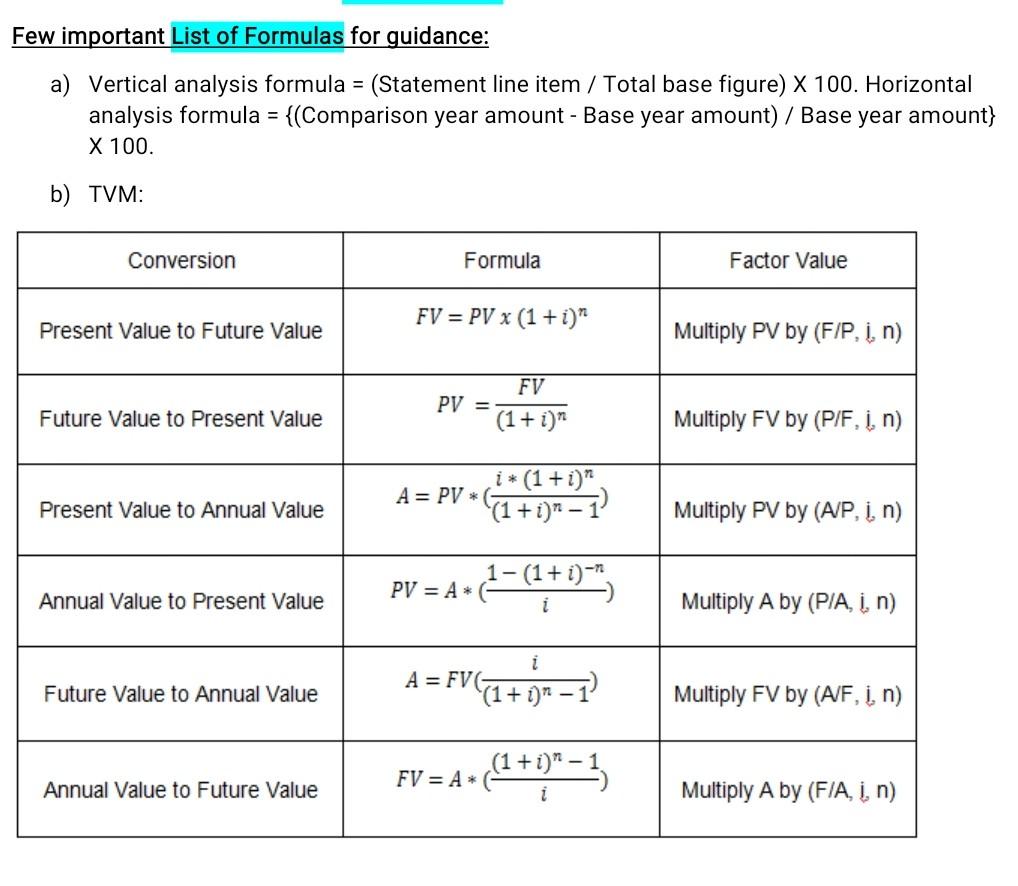

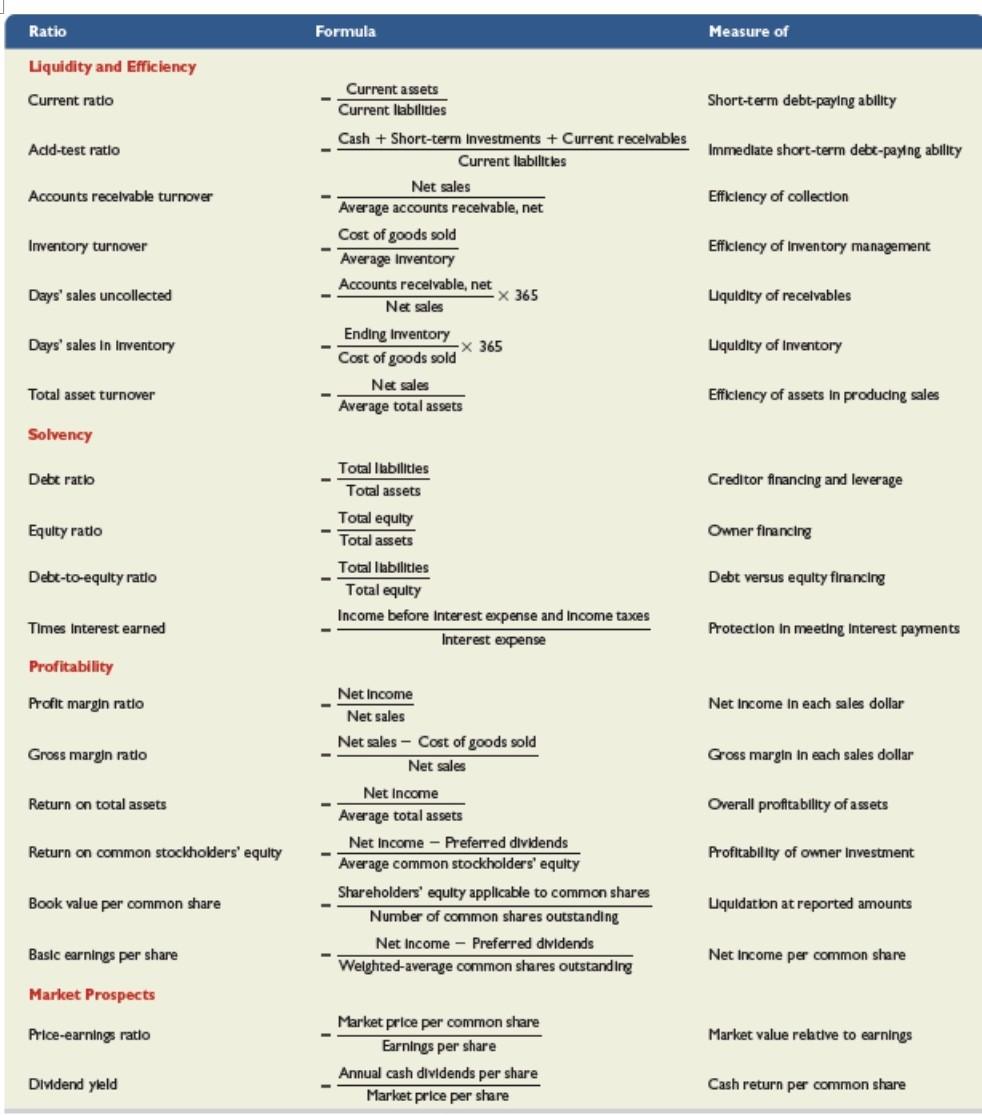

3. Q3. Prepare the Cash flow statement of 'Win and Kiss Casino' from the given information for year 2020. 8 Marks Net sales $205000 Purchases $72600 Selling and admin expense $16309 Interest on loan paid $3454 Tax paid $3692 Sale of old machineries $6552 New machinery purchased $9367 Old Loan repaid $12060 Issue new shares $20000 New loan taken $2785 Op balance of cash $888 Solution Cash flow statement of Win and Kiss Casino Cash flow statement Cash flow from operations 1. Opening cash $. II. Sales III. Less: 7 IV. Purchase $. V. Selling & Adm Expense $. VI. Interest $ VII. Tax Net Cash Flow operations (ii-vii) $ Cash flow from investing VIII. Sale of Old Machineries $. IX. Purchase new machine $ X. Cash flow from Investing (viii-ix) $ Cash flow from financing XI. Loan Re-paid $ XII. Loan taken $ XIII. Issue shares $ Cash flow from financing (xi-xiii) $ XIV. Closing Cash Balance Few important List of Formulas for guidance: a) Vertical analysis formula = (Statement line item / Total base figure) X 100. Horizontal analysis formula = {(Comparison year amount - Base year amount) / Base year amount} X 100. b) TVM: Conversion Formula Factor Value FV = PV x (1 + i)" Present Value to Future Value Multiply PV by (F/P, I, n) FV PV = (1 + i)" Future Value to Present Value Multiply FV by (P/F, I, n) i*(1+i)" A = PV * (1 + i)* - Present Value to Annual Value Multiply PV by (A/P, i, n) 1-(1+i)* PV = A* Annual Value to Present Value i Multiply A by (PIA, I, n) Future Value to Annual Value i A = FVG (1+1) - Multiply FV by (A/F, i, n) FV = A* (1+i)= -1 - Annual Value to Future Value i Multiply A by (FIA, i, n) Ratio Formula Measure of Liquidity and Efficiency Current ratio Current assets Current liabilities Short-term debt-paying ability Acid-test ratio Immediate short-term debt-paying ability Accounts receivable turnover Efficiency of collection Inventory turnover Efficiency of Inventory management Cash + Short-term Investments + Current receivables Current liabilitles Net sales Average accounts receivable, net Cost of goods sold Average Inventory Accounts receivable, net X 365 Net sales Ending Inventory X 365 Cost of goods sold Net sales Average total assets Days' sales uncollected Liquidity of recelvables Days' sales in Inventory Liquidity of Inventory Total asset turnover Efficiency of assets in producing sales Solvency Debt ratio Creditor financing and leverage Equity ratio Owner financing Total Ilabilities Total assets Total equity Total assets Total Itabilities Total equity Income before Interest expense and income taxes Interest expense Debt-to-equlty ratio Debt versus equity financing Times Interest earned Protection In meeting Interest payments Profitability Profit margin ratio Net Income in each sales dollar Gross margin ratio Gross margin in each sales dollar Return on total assets Overall profitability of assets Net Income Net sales Net sales - Cost of goods sold Net sales Net Income Average total assets Net Income - Preferred dividends Average common stockholders' equity Shareholders' equlty applicable to common shares Number of common shares outstanding Net Income - Preferred dividends Weighted average common shares outstanding Return on common stockholders' equity Profitability of owner Investment Book value per common share Liquidation at reported amounts Basic earnings per share Net Income per common share Market Prospects Price-earnings ratio Market value relative to earnings Market price per common share Earnings per share Annual cash dividends per share Market price per share Dividend yleld Cash return per common shareStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started