Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 30 minutes please please please urgently... I'll give you up thumb definitely 4. Using the information provided from 'KICK BOXER VS

please do it in 30 minutes please please please urgently... I'll give you up thumb definitely

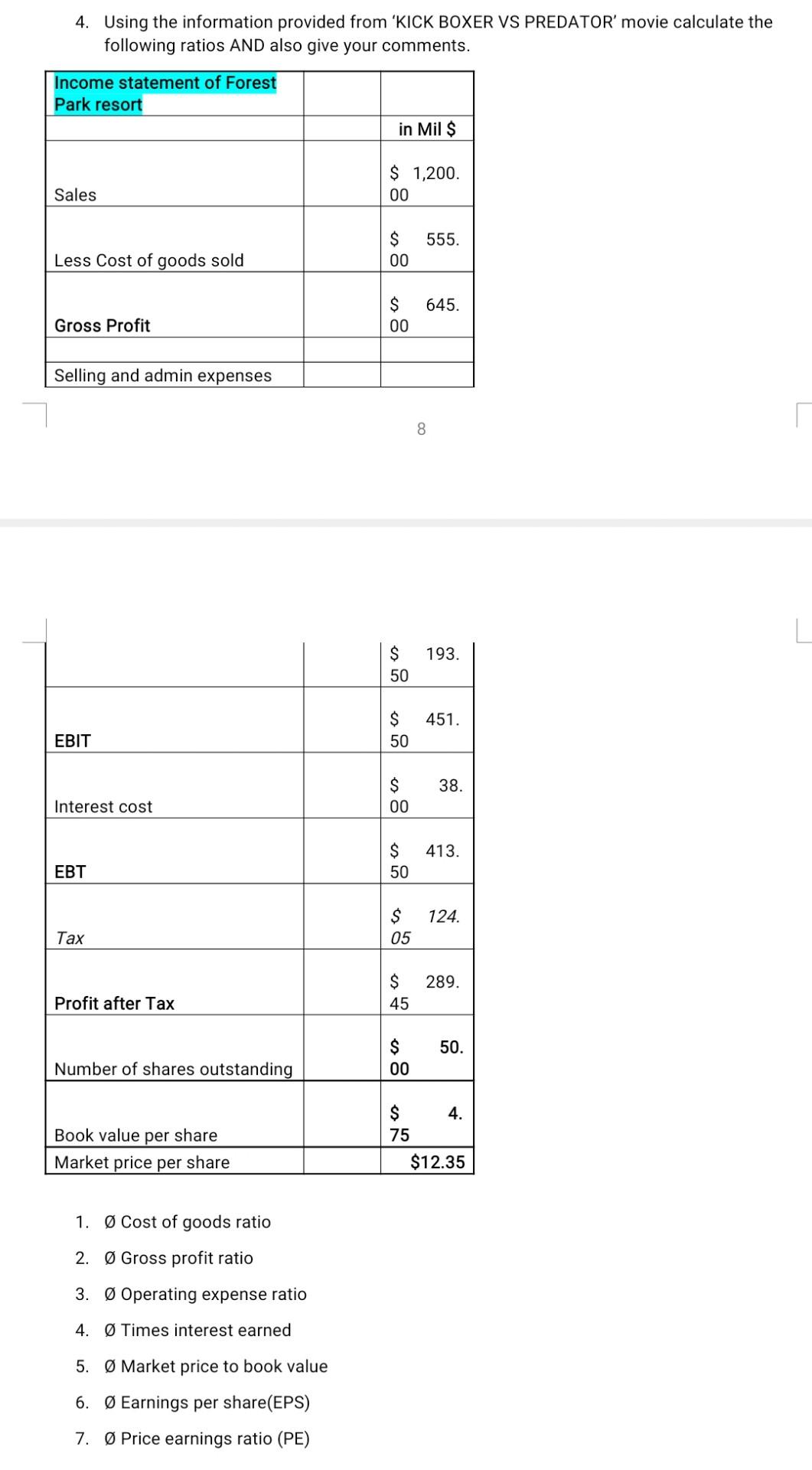

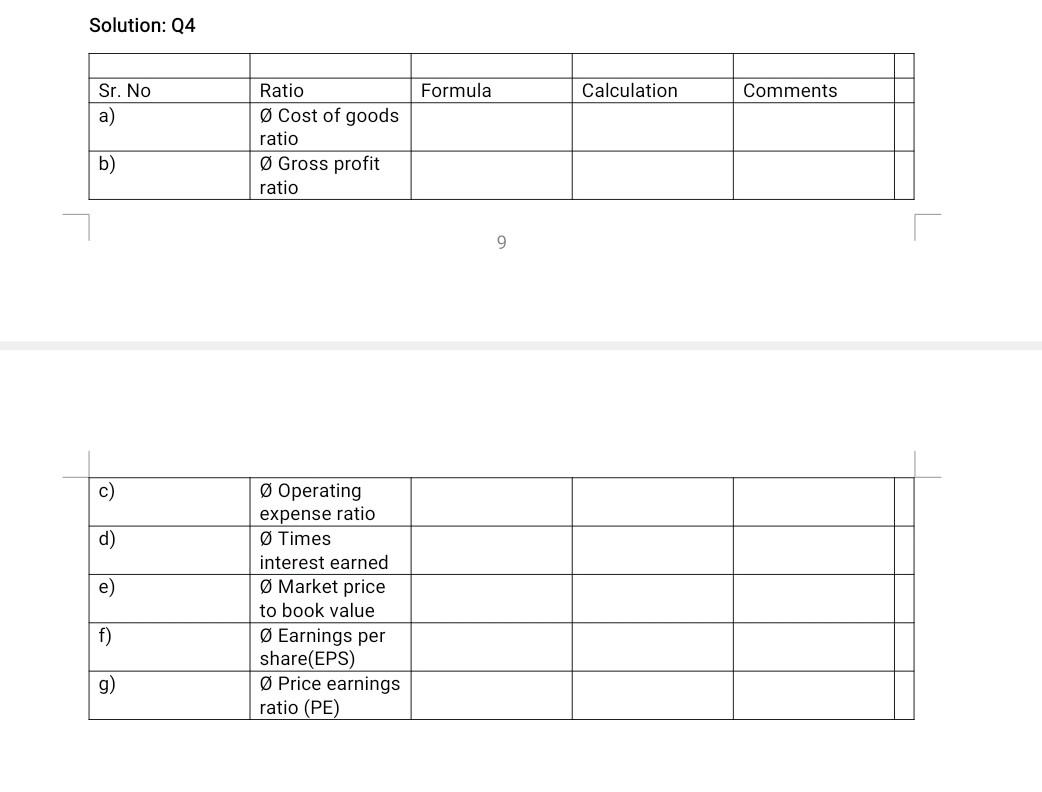

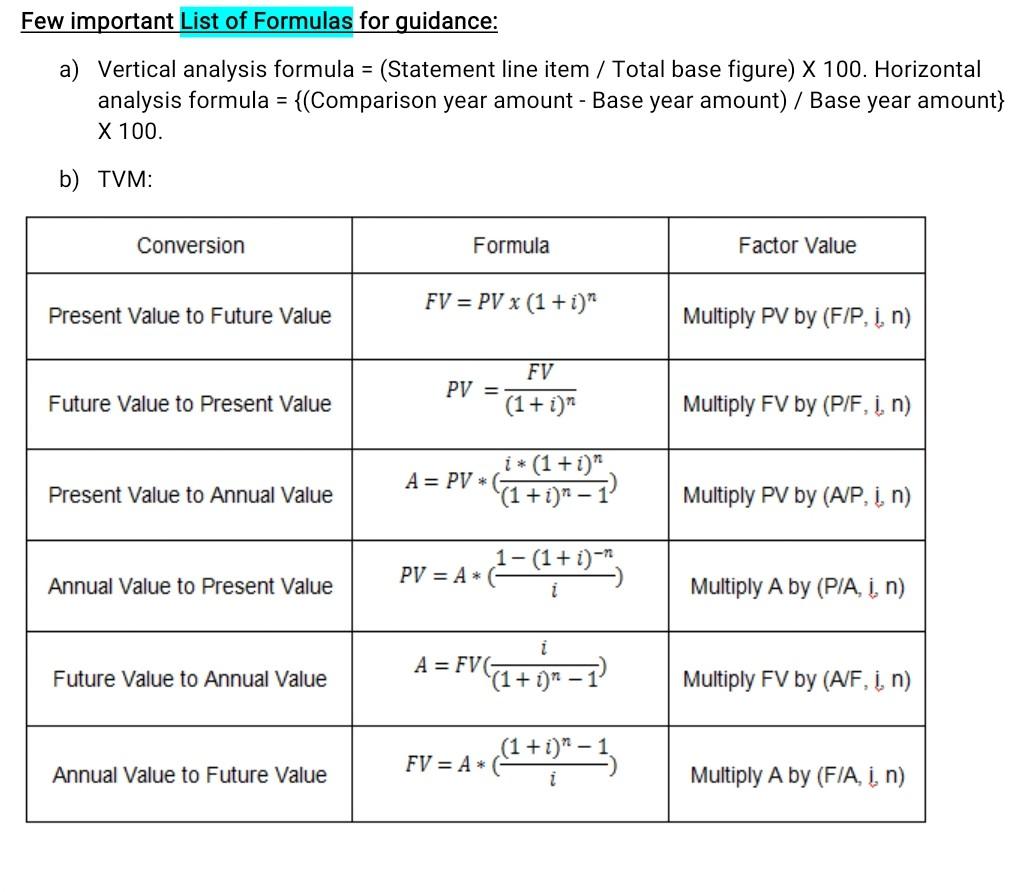

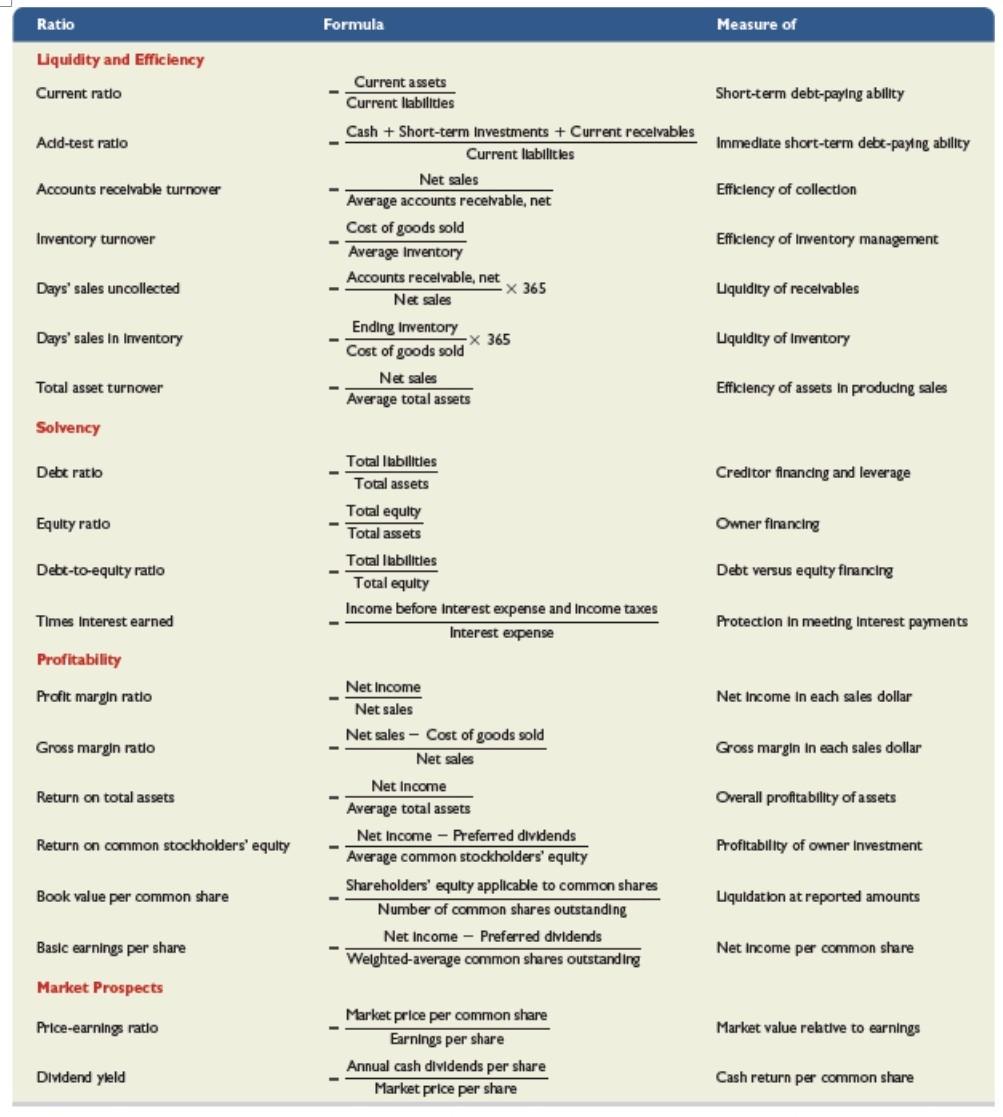

4. Using the information provided from 'KICK BOXER VS PREDATOR' movie calculate the following ratios AND also give your comments. Income statement of Forest Park resort in Mil $ $ 1,200. 00 Sales 555. $ 00 Less Cost of goods sold 645. $ 00 Gross Profit Selling and admin expenses 8 193. $ 50 451. $ 50 EBIT 38. $ 00 Interest cost 413. $ 50 EBT 124. $ 05 Tax 289. $ 45 Profit after Tax 50. $ 00 Number of shares outstanding 4. $ 75 Book value per share Market price per share $12.35 1. Cost of goods ratio 2. Gross profit ratio 3. Operating expense ratio 4. Times interest earned 5. Market price to book value 6. Earnings per share(EPS) 7. Price earnings ratio (PE) Solution: 04 Formula Calculation Comments Sr. No a) Ratio Cost of goods ratio Gross profit ratio b) 9 c) d) e) Operating expense ratio Times interest earned 0 Market price to book value Earnings per share(EPS) Price earnings ratio (PE) f) g) Few important List of Formulas for guidance: a) Vertical analysis formula = (Statement line item / Total base figure) X 100. Horizontal analysis formula = {(Comparison year amount - Base year amount) / Base year amount} X 100. b) TVM: Conversion Formula Factor Value FV = PV x (1 + i)" Present Value to Future Value Multiply PV by (F/P, , n) FV PV = (1+i)" Future Value to Present Value Multiply FV by (P/F, I, n) A= PV * i*(1+i)" (1+i)n-1 Present Value to Annual Value Multiply PV by (A/P, I, n) PV = A* 1-(1+i)= i Annual Value to Present Value Multiply A by (PIA, i, n) i A = FV( Future Value to Annual Value (1+i)n - 1 Multiply FV by (A/F, 1, n) FV = A=((2 +91-3 Annual Value to Future Value Multiply A by (FIA, i, n) Ratio Formula Measure of Liquidity and Efficiency Current ratio Current assets Current liabilities Short-term debt-paying ability Acid-test ratio Immediate short-term debt-paying ability Accounts recevable turnover Efficiency of collection Inventory turnover Efficiency of Inventory management Cash + Short-term Investments + Current receivables Current liabilities Net sales Average accounts receivable, net Cost of goods sold Average Inventory Accounts recelvable, net X 365 Net sales Ending Inventory -X 365 Cost of goods sold Net sales Average total assets Days' sales uncollected Liquidity of receivables Days' sales In Inventory Liquidity of Inventory Total asset turnover Efficiency of assets in producing sales Solvency Debt ratio Creditor financing and leverage Equity ratio Owner financing Total liabilities Total assets Total equity Total assets Total liabilities Total equity Income before Interest expense and income taxes Interest expense Debt-to-equity ratio Debt versus equity financing Times Interest earned Protection in meeting Interest payments Profitability Profit margin ratio Net Income in each sales dollar Gross margin ratio Gross margin in each sales dollar Return on total assets Overall profitability of assets Net Income Net sales Net sales - Cost of goods sold Net sales Net Income Average total assets Net Income - Preferred dividends Average common stockholders' equity Shareholders' equity applicable to common shares Number of common shares outstanding Net Income - Preferred dividends Weighted average common shares outstanding Return on common stockholders' equity Profitability of owner Investment Book value per common share Liquidation at reported amounts Basic earnings per share Net Income per common share Market Prospects Price-earnings ratio Market value relative to earnings Market price per common share Earnings per share Annual cash dividends per share Market price per share Dividend yield Cash return per common shareStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started