Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 30 minutes please urgently and kindly mention question number on top of the solution... I'll give you up thumb definitely =

please do it in 30 minutes please urgently and kindly mention question number on top of the solution... I'll give you up thumb definitely

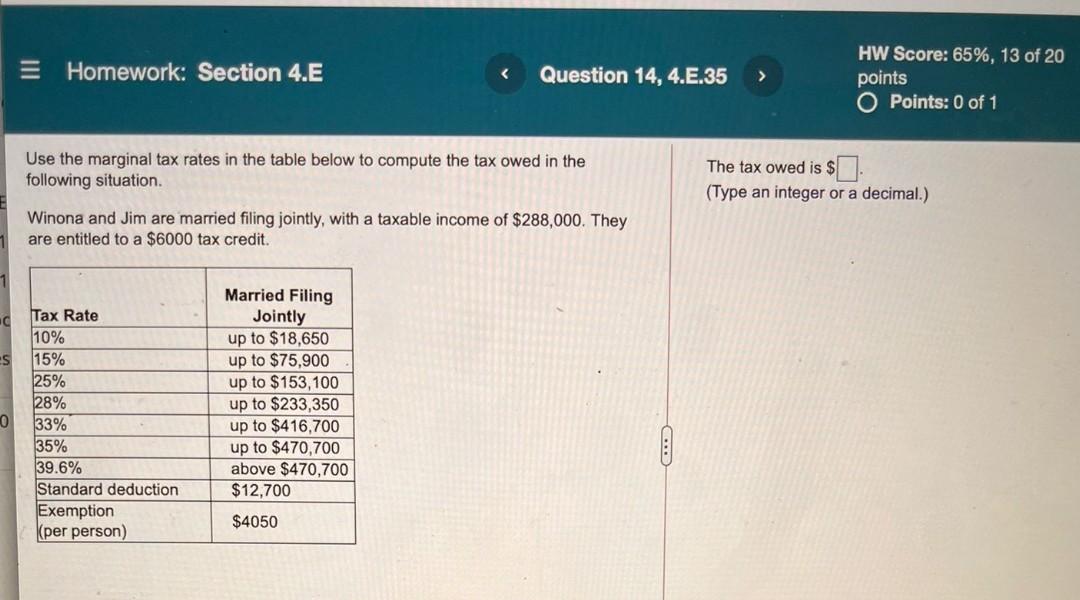

= Homework: Section 4.E HW Score: 65%, 13 of 20 points O Points: 0 of 1 Use the marginal tax rates in the table below to compute the tax owed in the following situation. The tax owed is $. (Type an integer or a decimal.) Winona and Jim are married filing jointly, with a taxable income of $288,000. They are entitled to a $6000 tax credit. . Married Filing Jointly up to $18,650 up to $75,900 up to $153,100 up to $233,350 up to $416,700 up to $470,700 above $470,700 $12,700 Tax Rate 10% 15% 25% 28% 33% 35% 39.6% Standard deduction Exemption (per person) 0 $4050Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started