Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please do it in 50 minutes please urgently... I'll give you up thumb definitely 5. (25 Marks) Sarah is the head Engineering manager at a

please do it in 50 minutes please urgently... I'll give you up thumb definitely

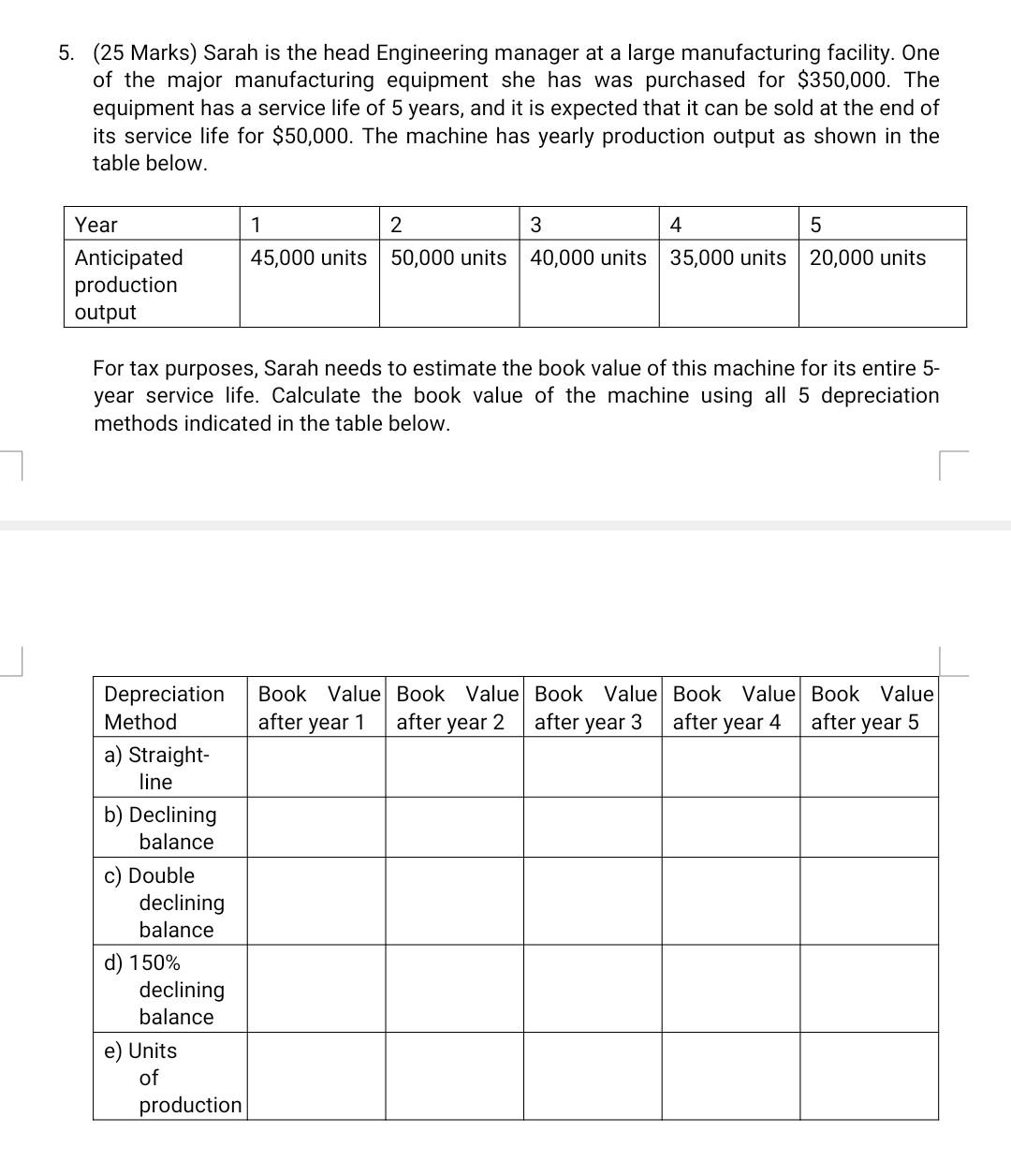

5. (25 Marks) Sarah is the head Engineering manager at a large manufacturing facility. One of the major manufacturing equipment she has was purchased for $350,000. The equipment has a service life of 5 years, and it is expected that it can be sold at the end of its service life for $50,000. The machine has yearly production output as shown in the table below. Year Anticipated production output 1 2 3 4 5 45,000 units 50,000 units 40,000 units 35,000 units 20,000 units For tax purposes, Sarah needs to estimate the book value of this machine for its entire 5- year service life. Calculate the book value of the machine using all 5 depreciation methods indicated in the table below. Book Value Book Value Book Value Book Value Book Value after year 1 after year 2 after year 3 after year 4 after year 5 Depreciation Method a) Straight- line b) Declining balance Double declining balance d) 150% declining balance e) Units of productionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started