Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please do it on Excel After that, you think dividends will grow at a constant 4% rate. a. Use the variable growth version of the

Please do it on Excel

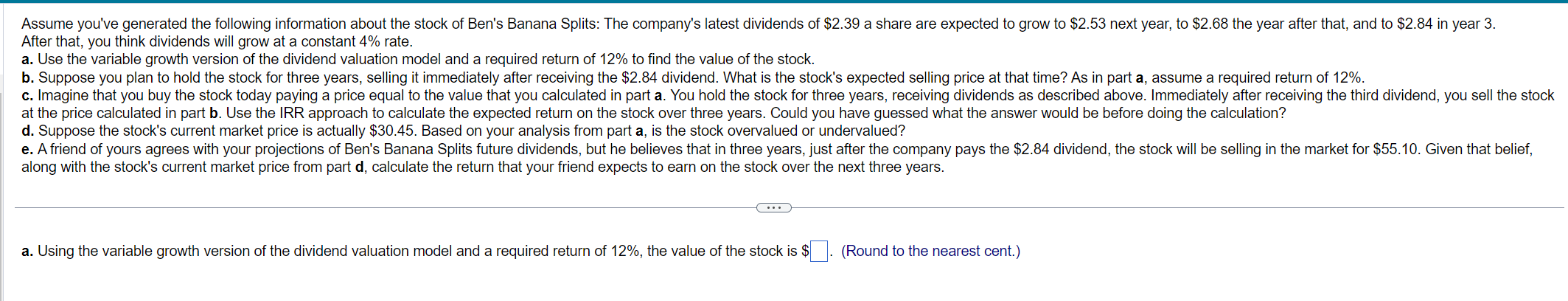

After that, you think dividends will grow at a constant 4% rate. a. Use the variable growth version of the dividend valuation model and a required return of 12% to find the value of the stock. at the price calculated in part b. Use the IRR approach to calculate the expected return on the stock over three years. Could you have guessed what the answer would be before doing the calculation? d. Suppose the stock's current market price is actually $30.45. Based on your analysis from part a, is the stock overvalued or undervalued? along with the stock's current market price from part d, calculate the return that your friend expects to earn on the stock over the next three years. a. Using the variable growth version of the dividend valuation model and a required return of 12%, the value of the stock is $. (Round to the nearest cent.)

After that, you think dividends will grow at a constant 4% rate. a. Use the variable growth version of the dividend valuation model and a required return of 12% to find the value of the stock. at the price calculated in part b. Use the IRR approach to calculate the expected return on the stock over three years. Could you have guessed what the answer would be before doing the calculation? d. Suppose the stock's current market price is actually $30.45. Based on your analysis from part a, is the stock overvalued or undervalued? along with the stock's current market price from part d, calculate the return that your friend expects to earn on the stock over the next three years. a. Using the variable growth version of the dividend valuation model and a required return of 12%, the value of the stock is $. (Round to the nearest cent.) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started