Answered step by step

Verified Expert Solution

Question

1 Approved Answer

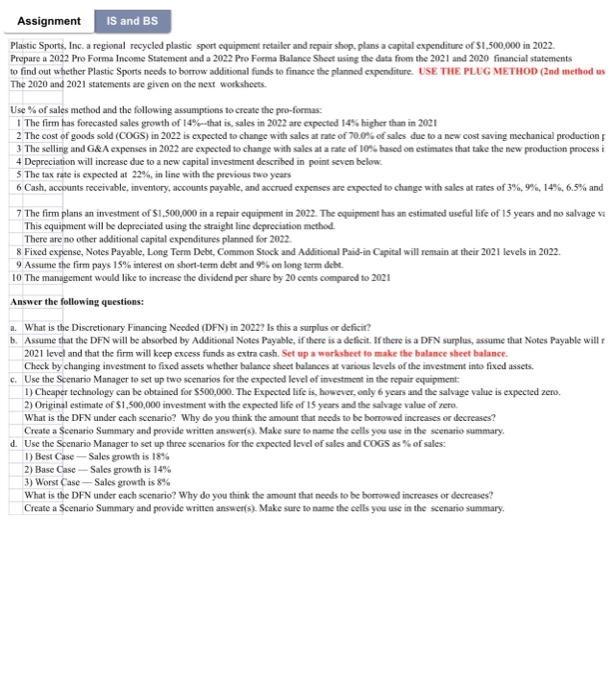

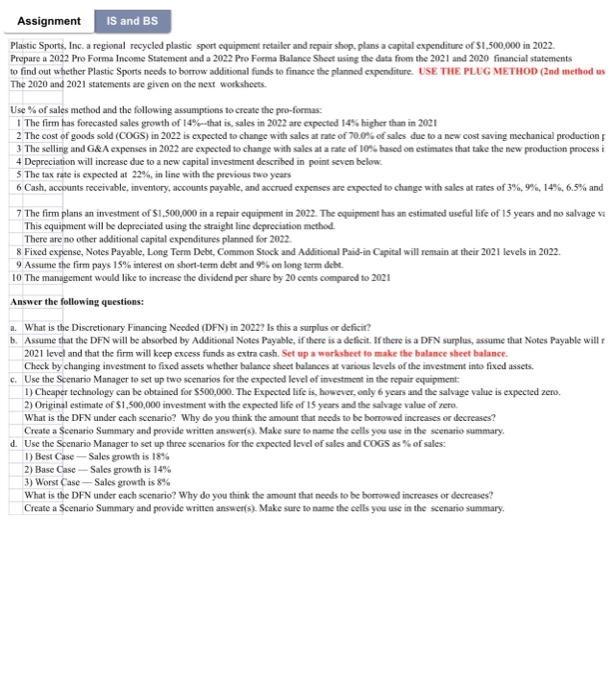

Please do it on excel with formula Answcr the following questions: a. What is the Discretionary Financing Needed (DFN) in 2022 ? Is this a

Please do it on excel with formula

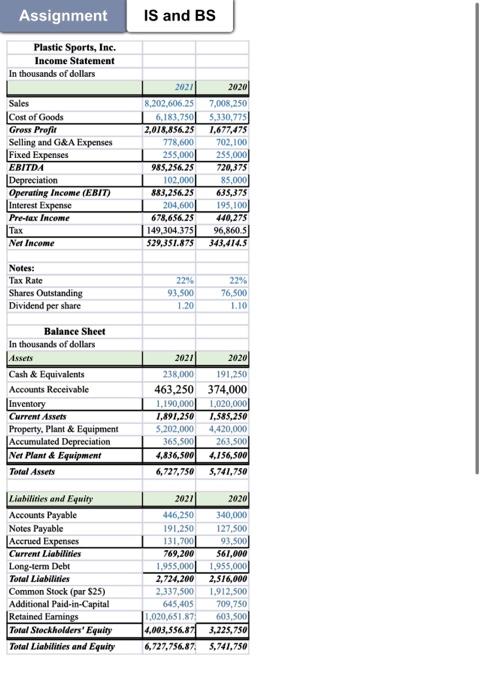

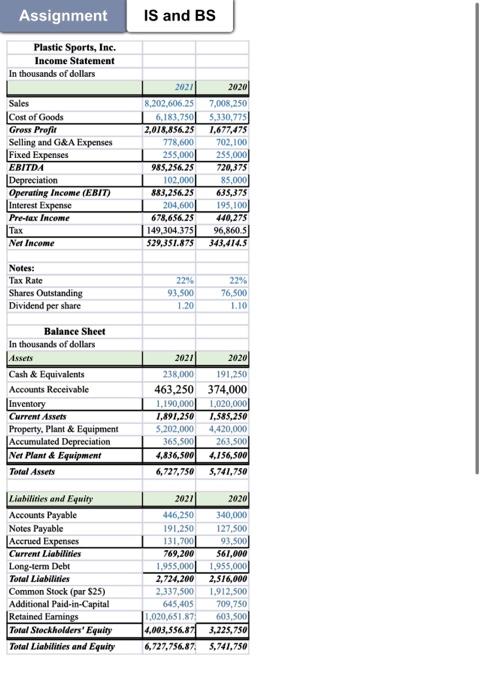

Answcr the following questions: a. What is the Discretionary Financing Needed (DFN) in 2022 ? Is this a surplus or deficit? b. Assume that the DFN will be abworbed by Additional Notes Payable, if there is a deficit. If there is a DFN surplus, assume that Notes Payable will r 2021 level and that the firm will keep excess funds as extra cash. Set up a worksteet to make the balance sheet balance. Check by changing investment to fixed assets whether balance sheet belanees at varivas levels of the investment into fixed assets. c. Use the Scenario Manager to set up two scenarios for the expected level of investment in the repuir equipment: 1) Cheaper technology can be obtained for $500,000. The Expectod life is, however, enly 6 years and the salvage value is expected zens. 2) Original estimate of $1,500,000 investment with the expected life of 15 years and the salvage value of zero. What is the DFN under each scenario? Why do you think the amount that needs to be bourowed increases or decreases? Create a Scenario Summary and provide written answer(s). Make sure to name the cells yee use in the scenarie summary. d. Use the Scenario Manager to set up three scenarios for the expected level of sales and COGS as \% of sales: 1) Best Case - Sales growth is 18% 2) Base Case - Sales growth is 14% 3) Worst Case - Sales growth is 8% What is the DFN under each seenario? Why do you think the amount that needs to be borrowed increases or decreases? Create a Scenario Summary and provide writed answer(s). Make sure to name the cells you use in the scenario summary. Plastic Sports, Inc. Income Statement In thousands of dollars Answcr the following questions: a. What is the Discretionary Financing Needed (DFN) in 2022 ? Is this a surplus or deficit? b. Assume that the DFN will be abworbed by Additional Notes Payable, if there is a deficit. If there is a DFN surplus, assume that Notes Payable will r 2021 level and that the firm will keep excess funds as extra cash. Set up a worksteet to make the balance sheet balance. Check by changing investment to fixed assets whether balance sheet belanees at varivas levels of the investment into fixed assets. c. Use the Scenario Manager to set up two scenarios for the expected level of investment in the repuir equipment: 1) Cheaper technology can be obtained for $500,000. The Expectod life is, however, enly 6 years and the salvage value is expected zens. 2) Original estimate of $1,500,000 investment with the expected life of 15 years and the salvage value of zero. What is the DFN under each scenario? Why do you think the amount that needs to be bourowed increases or decreases? Create a Scenario Summary and provide written answer(s). Make sure to name the cells yee use in the scenarie summary. d. Use the Scenario Manager to set up three scenarios for the expected level of sales and COGS as \% of sales: 1) Best Case - Sales growth is 18% 2) Base Case - Sales growth is 14% 3) Worst Case - Sales growth is 8% What is the DFN under each seenario? Why do you think the amount that needs to be borrowed increases or decreases? Create a Scenario Summary and provide writed answer(s). Make sure to name the cells you use in the scenario summary. Plastic Sports, Inc. Income Statement In thousands of dollars

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started